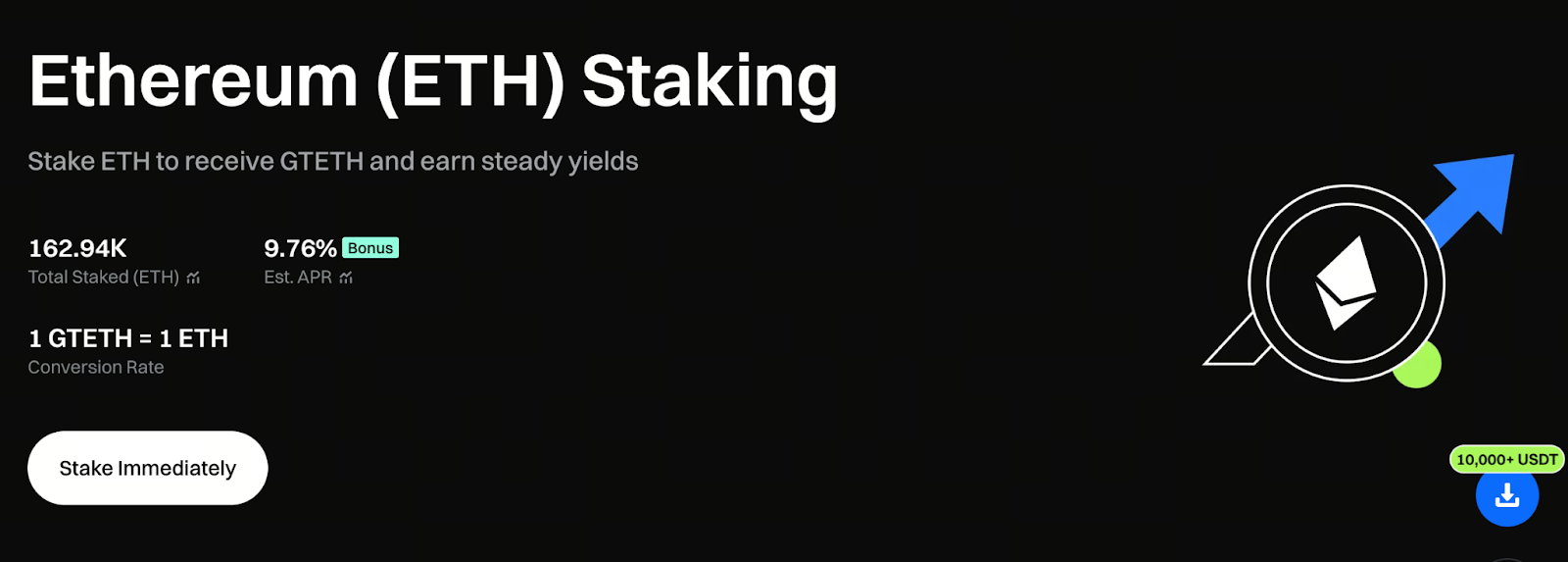

When Staking No Longer Means Lock-Up: How Gate GTETH Redefines ETH Allocation

Why Has Staking Yet to Become a Mainstream Allocation?

Following Ethereum’s PoS upgrade, staking became the backbone of network security and operation. Yet, ETH holders have not broadly adopted staking. This isn’t because the market overlooks potential returns, but rather due to a fundamental mismatch between traditional staking models and the pace of modern investing.

In the crypto market, where high volatility and frequent adjustments are the norm, instant asset allocation often outweighs the appeal of stated annualized returns. When staking means your funds are passively locked and can’t respond to market shifts in the short term, most traders naturally choose flexibility over stable but restricted rewards.

Liquidity: The Overlooked Cost

Whether running nodes independently or staking ETH through third parties, users typically face several hidden costs:

Uncertain fund unlock times, opaque yield calculations, and limited ability to adjust positions quickly in fast-moving markets.

As a result, staking feels more like a long-term commitment than a dynamic allocation tool. Over time, ETH staking mainly attracts long-term holders willing to give up liquidity, distancing itself from mainstream trading behaviors.

GTETH: Turning Staking into an Asset Option

GTETH is designed not to simplify PoS technology, but to streamline the user experience. For users, participation comes down to a single action: converting ETH to GTETH. Once converted, node operations, yield generation, and distribution are all handled automatically by the system. Staking becomes an asset choice—not a process to monitor and manage—making the entry threshold and daily asset operations consistent and straightforward.

Returns Directly Reflected in Value

Unlike traditional staking models that require periodic reward claims, GTETH uses a compounding return structure. Ethereum PoS staking yields, combined with additional GT incentives from Gate, are directly reflected in GTETH’s total value over time. Holders don’t need to take extra steps—just hold GTETH and its corresponding ETH value will naturally grow, with transparent, on-chain verification of all yield sources.

Liquidity as the Default, Not a Sacrifice

GTETH’s biggest departure from traditional staking is its elimination of the “locked position = lost flexibility” premise. While holding GTETH, users can redeem ETH or trade in the market at any time—no need to wait for a fixed unlock period. Yield and liquidity are no longer a trade-off; they coexist in a single asset, letting ETH staking finally match the pace of the market.

From Yield Tool to Strategic Allocation Node

With liquidity constraints removed, GTETH’s role shifts. It’s not just a staking alternative—it’s a flexible ETH allocation unit that can be adjusted as strategies change. Whether you’re reducing exposure in volatile markets or reallocating capital to seize new opportunities, GTETH lets you adjust while retaining staking yields, integrating staking into your portfolio rather than isolating it.

Transparent Yield Sources, Quantifiable Long-Term Efficiency

GTETH’s yield structure is straightforward, sourced from two main areas:

- Ethereum PoS staking yield: approximately 2.76% annualized

- Additional GT incentives from Gate: approximately 7% annualized

All accumulated returns are reflected in the final redemption value when converting back to ETH—making the process intuitive and transparent.

Start your Gate ETH staking journey and unlock on-chain mining rewards now: https://www.gate.com/staking/ETH?ch=ann46659

VIP Levels Shape Long-Term Compounding Performance

GTETH’s fee rate is linked to Gate VIP tiers, starting at a base rate of 6% with discounts by level:

- VIP 5–7: 20% fee discount

- VIP 8–11: 40% fee discount

- VIP 12–14: 60% fee discount

While short-term differences may be modest, over the long run and with compounding, fee structure becomes a major factor for final returns.

Distinct from Mainstream LSTs

Most liquid staking tokens are still certificates for locked positions, with limited flexibility. GTETH acts more like a daily asset management tool, with value that adjusts naturally with yields and allows free market entry and exit. In this setup, staking is no longer a static allocation—it’s a way to manage ETH that can adapt to your trading strategies.

Conclusion

GTETH’s value isn’t in technical complexity, but in redefining staking’s place within investment portfolios. It retains PoS yield potential while removing the capital and psychological constraints of lock-ups, enabling ETH staking to move in sync with market rhythms. With PoS now the norm for Ethereum, staking doesn’t have to be a rigid, long-term pledge—it can be a flexible allocation choice that balances liquidity and returns, in line with modern Web3 asset management logic.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks