Who Are Gate ETF Leveraged Tokens For? A Practical Guide from Market Assessment to Capital Management

Image: https://www.gate.com/leveraged-etf

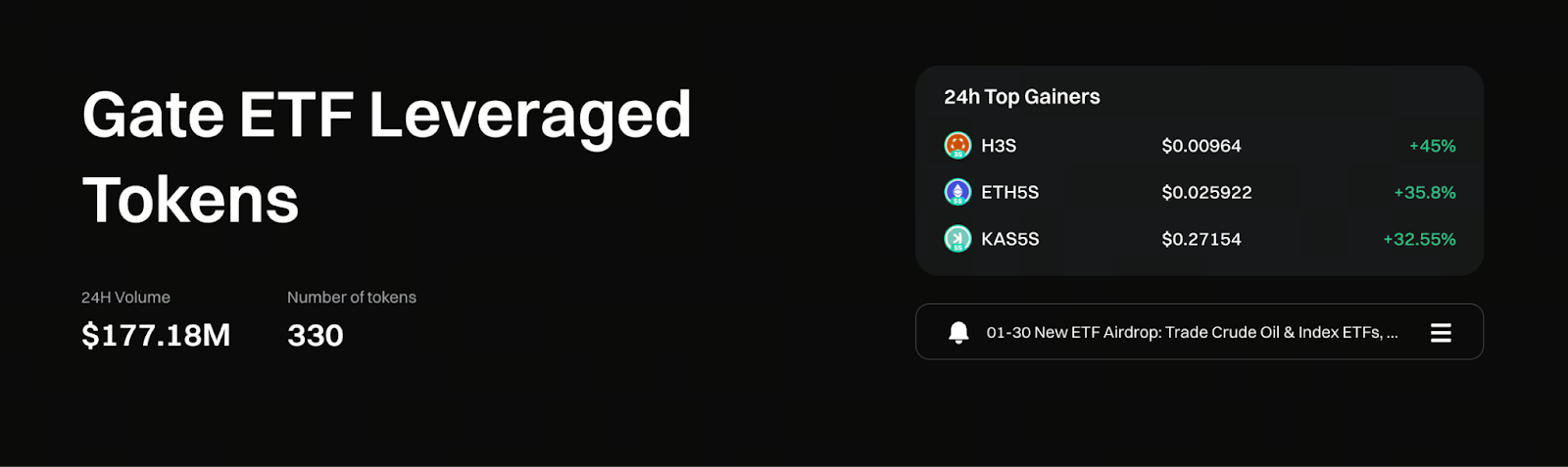

Gate ETF Leveraged Tokens: Product Positioning

Gate ETF leveraged tokens are purpose-built to offer streamlined leveraged exposure for trending markets. Unlike traditional contracts, which prioritize flexibility and higher risk, ETF leveraged tokens function as structured products. The system automatically adjusts leverage, making user operations significantly simpler.

On Gate, ETF leveraged tokens trade as spot instruments—there are no margin calls and no liquidation events. This positions them as leveraged tools with controlled risk, rather than high-frequency speculative vehicles.

Optimal Market Conditions for Gate ETF Leveraged Tokens

The deciding factor for using ETF leveraged tokens isn’t market volatility, but the presence of a sustained directional trend.

Gate ETF leveraged tokens excel when the market exhibits the following:

- Price breaks key ranges and enters a trend;

- Trading volume expands consistently in a single direction;

- Macro, policy, or fundamental drivers create a one-sided market.

In such scenarios, the auto-rebalancing mechanism reinforces prevailing trends, and the compounding effect becomes increasingly evident. Conversely, in markets without clear direction and frequent swings, the net asset value of ETF leveraged tokens may be repeatedly diminished—leading to divergent user experiences.

Core Differences: Gate ETF Leveraged Tokens vs. Contract Trading

Many investors compare ETF leveraged tokens to perpetual contracts, but their foundational logic differs.

Contract trading requires active management—monitoring margin ratios, liquidation prices, and funding rates. Gate ETF leveraged tokens, however, encapsulate risk within the product through system-level mechanisms.

As a result, ETF leveraged tokens are best suited for:

- Users who prefer not to monitor markets constantly;

- Investors seeking trend exposure while avoiding liquidation risk;

- Those favoring medium- to short-term holding over ultra-short-term trading.

Recognizing this distinction helps prevent the misuse of ETF leveraged tokens as contract substitutes.

Fund Management and Position Control Strategies

While liquidation risk is absent, Gate ETF leveraged tokens remain high-volatility instruments, making disciplined fund management essential.

Sound strategies include:

- Avoiding heavy, single-entry positions;

- Gradually building positions at the start of a trend rather than chasing highs;

- Reducing exposure or taking profits in stages when volatility spikes.

ETF leveraged tokens are designed to boost capital efficiency—not to promote aggressive trading. Treating them as an “enhancement module” within a portfolio is generally more prudent than taking an all-or-nothing approach.

A Rational Approach to ETF Leveraged Token Returns and Risks

Gate ETF leveraged tokens can deliver amplified returns in trending markets, but any tool that increases returns also increases volatility.

Rational investors should keep in mind:

- ETF leveraged tokens are not for long-term passive holding;

- Returns are driven by trends, not by time held;

- Understanding the product mechanism is more important than market prediction.

When product logic, market assessment, and risk awareness align, ETF leveraged tokens can enhance trading efficiency rather than magnify emotional trading.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B