Why Are More Traders Turning to Gate TradFi for Cross-Market Trading?

Market Context for Gate TradFi

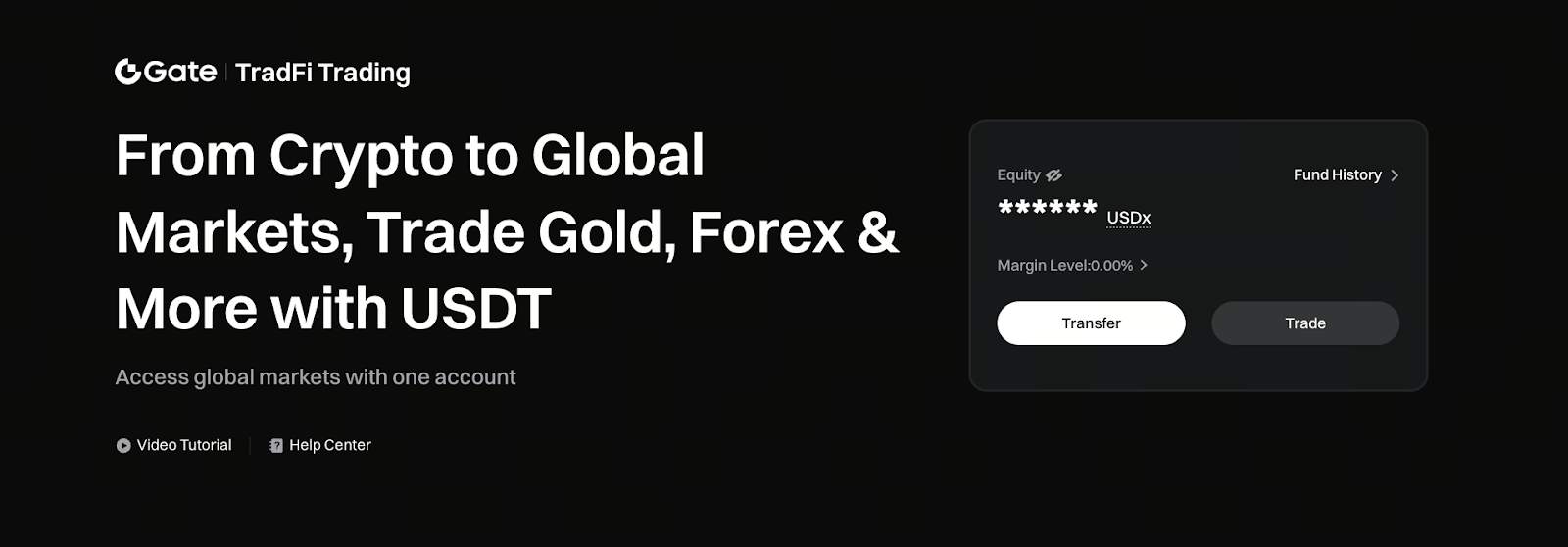

Image: https://www.gate.com/tradfi

Global financial markets have seen increased volatility in recent years, driving more frequent capital flows between crypto assets and traditional financial markets. Many traders now actively track opportunities in both digital assets and traditional finance.

Gate TradFi was launched in response to this environment, providing users with a unified gateway for trading traditional financial assets within a familiar platform.

Access Multiple Markets with a Single Account

Gate TradFi enables users to trade a variety of traditional assets using their existing accounts—no need for additional account setup. Supported asset classes include:

- Precious metals (e.g., gold)

- Major forex pairs

- Global indices

- Stock CFDs

- Commodity markets

This unified access streamlines trading and reduces the complexities associated with managing multiple platforms.

Why Are Traditional Financial Assets Attracting Renewed Interest?

During periods of heightened market uncertainty, assets like gold and indices often become the focus for capital allocation.

Some traders move funds to relatively stable asset classes when crypto markets experience significant volatility, helping to mitigate overall portfolio risk.

Gate TradFi streamlines cross-market adjustments, making them more accessible.

How TradFi Helps Traders Diversify Risk

Diversifying assets is central to robust trading strategies.

Gate TradFi allows users to flexibly allocate assets across multiple markets within a single account. This enables quick position adjustments as market conditions change, supporting risk hedging and new trading opportunities.

What Sets the Gate TradFi Trading Experience Apart?

Gate TradFi is designed to align with the operational habits of crypto users, distinguishing it from traditional trading platforms.

Users can transfer and trade directly with assets like USDT, avoiding complex currency conversions. Asset holdings and trading data are presented in a unified view for streamlined fund management.

Multi-Asset Trading: A Growing Trend

As global financial markets become increasingly integrated, demand for multi-asset trading continues to rise.

Gate TradFi offers traders a convenient way to engage with both crypto and traditional financial markets on a single platform.

Going forward, multi-market trading and unified asset management are likely to become the preferred approach for a growing number of traders.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Bitcoin's Future & TradFi (3,3)