Why Are More Users Starting to Trade On-Chain on Gate DEX?

Why On-Chain Trading Demand Keeps Growing

In recent years, the crypto market has evolved not only through expanding asset scale but also through changing trading methods. An increasing number of users are focusing on on-chain assets and decentralized trading, seeking direct participation in the on-chain ecosystem.

At the same time, new assets and projects often launch first in on-chain environments, prompting some traders to adopt on-chain trading to access market opportunities earlier.

Why Users Are Shifting to DEX Trading

Traditional centralized exchanges remain the main trading venue for most users. However, some users are seeking greater asset control and aiming to reduce operational costs associated with frequent asset transfers.

DEX trading enables users to trade directly from their wallets, eliminating the need to deposit assets into platform custody accounts. This approach is gaining wider acceptance, especially as demand for on-chain asset trading continues to increase.

What New Opportunities Does Gate DEX Offer?

Image: https://web3.gate.com/

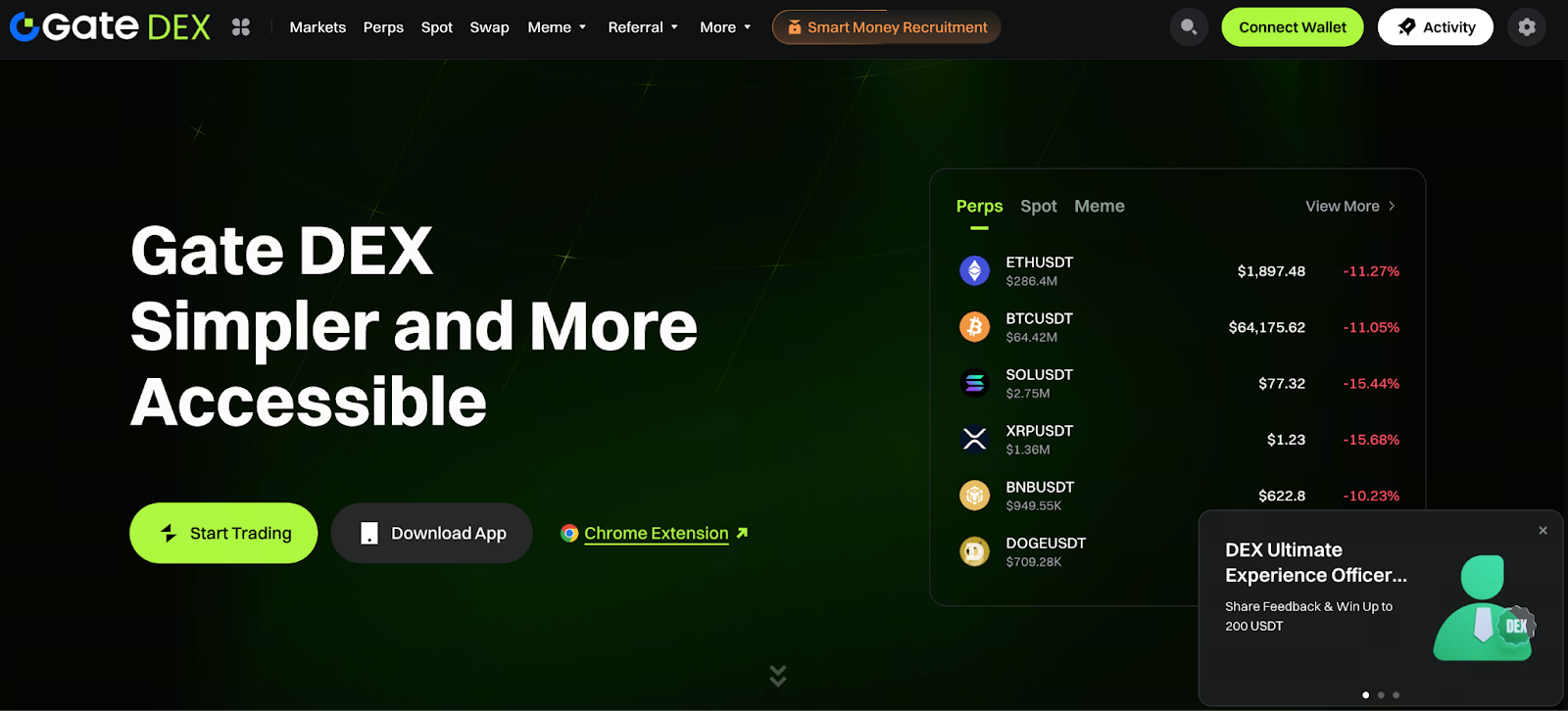

Gate DEX is more than just a Swap tool—it integrates on-chain spot trading, on-chain contract trading, and asset exchange within a single platform.

Users can convert and trade assets in one unified trading environment, eliminating the need to switch between multiple protocols. This integrated model streamlines the on-chain trading process, making it more focused and efficient.

What Does On-Chain Asset Control Mean for Users?

In an on-chain trading environment, users typically manage assets directly through their wallets. This grants them a higher degree of control and reduces risks associated with centralized storage.

For some users, this level of control offers greater flexibility, allowing for rapid asset allocation adjustments in response to market changes.

How Gate DEX Enhances Trading Efficiency

Traditional on-chain trading often involves multiple signature confirmations and cross-platform operations, which can slow down transactions. Gate DEX optimizes trading workflows, ensuring smoother asset swaps and trade execution.

The platform also supports trading methods familiar to exchange users, allowing them to maintain their usual trading rhythm even in an on-chain environment.

User Trading Habits Are Evolving

As the on-chain trading experience improves, some users are shifting parts of their trading activity to on-chain environments. This is especially true during periods of frequent new asset launches and trending projects, making on-chain trading a key channel for accessing market opportunities.

This trend is also driving DEX platforms to continuously refine their user experience and feature sets.

Potential Future Directions for On-Chain Trading Platforms

Looking ahead, on-chain trading platforms are likely to move beyond single-function trading tools, evolving into comprehensive on-chain financial service platforms.

Gate DEX’s development path illustrates how DEX products are transforming from simple trading tools into robust on-chain trading systems, providing users with more convenient and efficient on-chain trading options.

Related Articles

What is Fartcoin? All You Need to Know About FARTCOIN

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

2026 Silver Price Forecast: Bull Market Continuation or High-Level Pullback? In-Depth Analysis of Silver Candlestick Chart

Crypto Futures Calculator: Easily Estimate Your Profits & Risks