X A radical solution, the era of verbal masturbation comes to an end.

X has banned tweet mining.

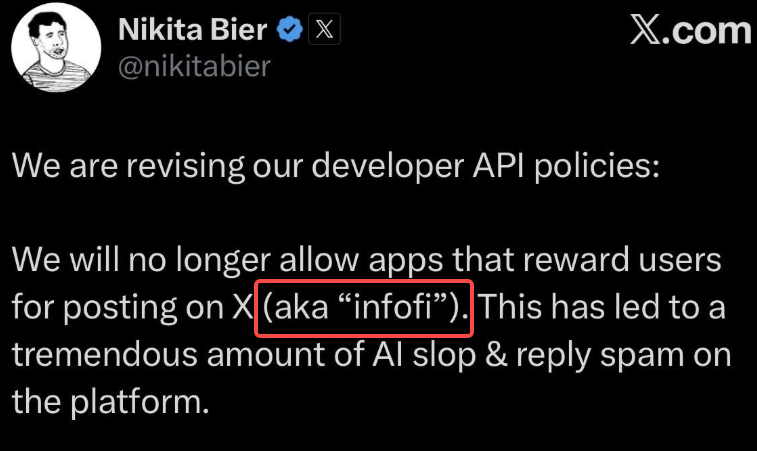

Yesterday, Product Lead Nikita Bier announced that all apps rewarding users for posting will have their API access revoked across the board.

He even added a thoughtful note: Developers whose access is blocked can contact us—we’ll help you migrate to Threads and Bluesky.

The landlord is evicting tenants—and even offering to call the movers.

As soon as the news broke, the InfoFi sector collapsed. KAITO dropped 20%, Cookie fell 20%, and the Kaito Yappers community of 157,000 members was immediately shut down.

But less than an hour later, Kaito founder Yu Hu published a lengthy statement.

The post didn’t apologize to the community or protest X’s policy. The core message was simple:

We’re moving.

Yaps is gone. The new product, Kaito Studio, will use a traditional marketing approach—brands and creators work one-on-one. The open model where anyone could farm points is over.

X is out. Next up: YouTube and TikTok. The crypto space is out; now it’s about finance, AI, and the entire creator economy—a $200 billion market.

The product is ready, the direction is clear, the data is there, and there’s a new story to tell.

But honestly, this doesn’t read like an emergency response written in an hour. It feels more like they saw this coming and had the statement ready, just waiting for X to make a move.

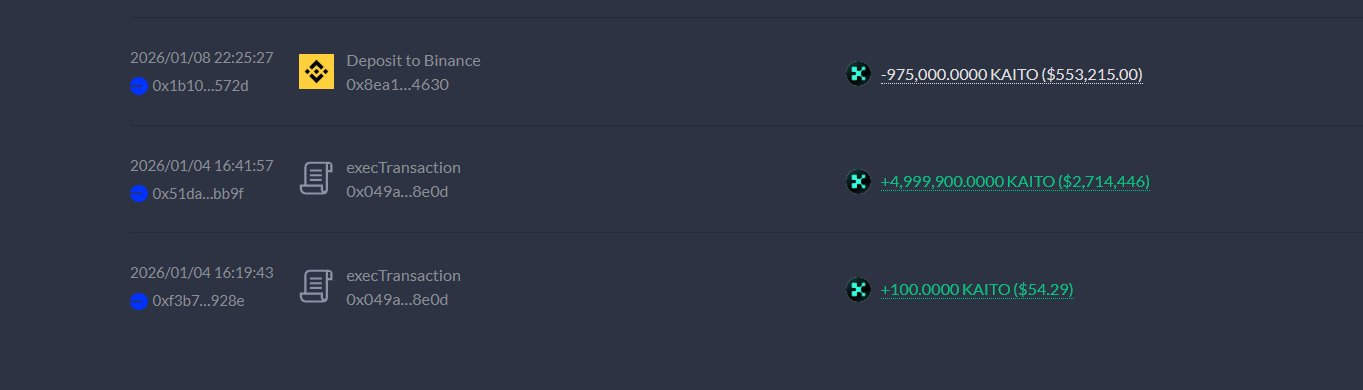

Meanwhile, there were even earlier signals on-chain.

Kaito’s multisig contract had previously distributed 24 million KAITO tokens to five addresses. One of these addresses transferred all 5 million KAITO tokens to Binance a week ago.

It looks more like a “cash out while you can” move.

They communicated in advance, drafted the statement ahead of time, and moved the tokens to the exchange before the announcement—every step was taken in advance.

Then, as soon as X made it official, the statement followed immediately. The transition was presented gracefully—proactive transformation, embracing change.

Yu Hu wrote in the statement: “After discussions with X, both parties agreed that a completely permissionless distribution system is no longer viable.”

Both parties agreed.

Getting kicked out is now described as reaching consensus. A product’s death sentence is rebranded as a strategic upgrade. The crypto world has seen this kind of spin far too often.

Project teams never say, “We failed.” They say they’re exploring new possibilities, that market conditions have changed, or that this is a planned transformation.

It sounds dignified, but it’s classic PR.

In truth, X’s ban was only the final blow. The “tweet mining” business was already on its last legs.

On paper, tweet mining sounds promising—tokenizing attention, giving creators fair rewards, building a decentralized information economy.

But in practice, we all know it got distorted.

If rewards are tied to posting, people spam more. If AI can generate content at scale, let AI do it. If there’s no limit on accounts, create as many sockpuppets as you want…

According to CryptoQuant, bots generated 7.75 million crypto-related tweets on X on January 9—a 1,224% year-over-year increase.

Last year, ZachXBT criticized these InfoFi platforms as the main culprits behind AI-generated junk content. He even offered a $5,000 bounty for user data to hunt down bots.

Legitimate discussions have been drowned out by endless “GM,” “LFG,” and “bullish” posts. It’s become nearly impossible to distinguish between real users and bots.

Last week, X’s Product Lead Nikita Bier tweeted: “CT is dying from suicide, not from the algorithm.”

Crypto Twitter is killing itself—not being killed by the algorithm.

At the time, the crypto community called him arrogant and responded with a barrage of “GM” memes.

Looking back now, doesn’t it feel like a warning before the crackdown on tweet mining?

On the issue of junk content, Kaito founder Yu Hu said they tried everything: raising the bar, adding filters, redesigning incentives.

But nothing worked.

Rewarding posts with tokens is just incentivizing noise. No matter how high the bar, profits will always drive behavior. Human nature is what it is. As long as incentives remain, spam won’t stop.

Even worse, their lifeline depended on someone else.

What business was Kaito in? Leveraging X’s traffic, incentivizing users with tokens to generate content, then selling the data to projects for marketing.

X was the foundation; Kaito was the house built on top.

If the owner of the foundation wants it back, the house collapses. No explanation or negotiation needed—a single announcement is enough.

To put it bluntly, InfoFi’s story is about a decentralized attention economy. But the attention was never really yours. The algorithm belongs to the platform, the API belongs to the platform, and the users belong to the platform.

You can put points on-chain and decentralize the tokens, but you can’t decentralize Twitter itself.

A parasite trying to overthrow its host. The host doesn’t need a revolution—just pull the plug.

In recent years, the Web3 startup playbook has been to leverage Web2’s traffic to build Web3 momentum. But the users are on Twitter, the data is on Twitter, the attention is on Twitter, and only the tokens and profits are their own.

It sounds clever—using leverage to achieve big results.

But someone else’s traffic is always someone else’s. The platform tolerates you only as long as you don’t get in the way. The moment you do, the vampire business model collapses for good.

This serves as a wake-up call for all Web3 projects built on borrowed platform traffic.

If your lifeline is in someone else’s hands, every dollar you earn is only yours until they decide to take it back.

Be clear whether you’re running a business or just renting. Renters shouldn’t have a landlord’s mentality—much less think the house is theirs.

Kaito says their next stop is YouTube and TikTok.

Are those landlords really any easier to deal with than Musk?

Statement:

- This article is republished from [TechFlow]. Copyright belongs to the original author [Kuli]. If you have any concerns about this republishing, please contact the Gate Learn team, and we will handle it promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Other language versions of this article are translated by the Gate Learn team. Without mentioning Gate, you may not copy, distribute, or plagiarize the translated article.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?