XRP Price Prediction: Ripple’s $1 Billion Treasury Move Could Spark a 1000x Surge in XRP Value

Ripple Commits $1 Billion to Expand Into the Corporate Treasury Sector

Ripple is once again in the spotlight, with multiple sources reporting that the company is acquiring a corporate treasury management firm for $1 billion. This move marks Ripple’s official entry into the corporate treasury services market, further solidifying its cross-border payments ecosystem and prompting renewed debate over the potential revaluation of XRP.

As news broke, some market educators and analysts began making more bullish price projections. Crypto researcher “X Finance Bull” models that if Ripple successfully integrates XRP into corporate treasury solutions, XRP’s price could start at $2–$3 in the short term, target $5–$10 in the medium term, and potentially reach the $20–$100 range in the long term.

(Source: Xfinancebull)

In the most optimistic scenario, if XRP secures a significant share of global corporate treasury flows, its price could theoretically surpass $1,000.

Corporate Treasury Integration

What makes this move a pivotal turning point? Treasury management sits at the heart of daily corporate operations, encompassing cash flow management, foreign exchange settlement, liquidity allocation, and cross-border fund transfers. If Ripple enables large enterprises to incorporate XRP into their treasury workflows, the resulting increase in on-chain liquidity demand would be transformative.

Industry observers note that capital flows at the enterprise level far exceed those in typical payment applications. If Ripple successfully enters this space, real-world use cases and demand for XRP could fundamentally shift. Experts caution that Ripple must address regulatory clarity, enterprise adoption rates, and transaction volume challenges for this scenario to materialize.

Multi-Stage Price Forecasts

According to the projections from “X Finance Bull,” XRP may follow three distinct upward phases:

- Short-term: $2–$3, reflecting the initial market reaction to Ripple’s treasury strategy;

- Medium-term: $5–$10, representing the gradual adoption of RippleNet technology and XRP settlement by large enterprises;

- Long-term: $20–$100+, assuming XRP becomes the standard liquid asset for multinational corporate treasury operations.

Some analysts consider the widely cited $1,000+ price prediction a “theoretical ceiling.” If XRP captures a substantial portion of global treasury settlements, such valuations could become feasible. However, achieving this would require significant changes, such as supply contraction, inflation control, or innovative economic models.

Regulatory and Integration Details Remain Key Variables

Shifts in regulatory policies will directly impact enterprise willingness to adopt XRP. Currently, regulatory positions in the United States, the European Union, and parts of Asia are becoming clearer, which bodes well for Ripple and XRP. Furthermore, integration details are critical, including:

- Whether enterprises will hold XRP long-term as a liquid asset;

- How Ripple’s treasury software will integrate with legacy ERP systems;

- How enterprises will evaluate XRP liquidity risks and custody strategies.

These factors will ultimately determine XRP’s role in corporate financial infrastructure. They will also influence its market performance.

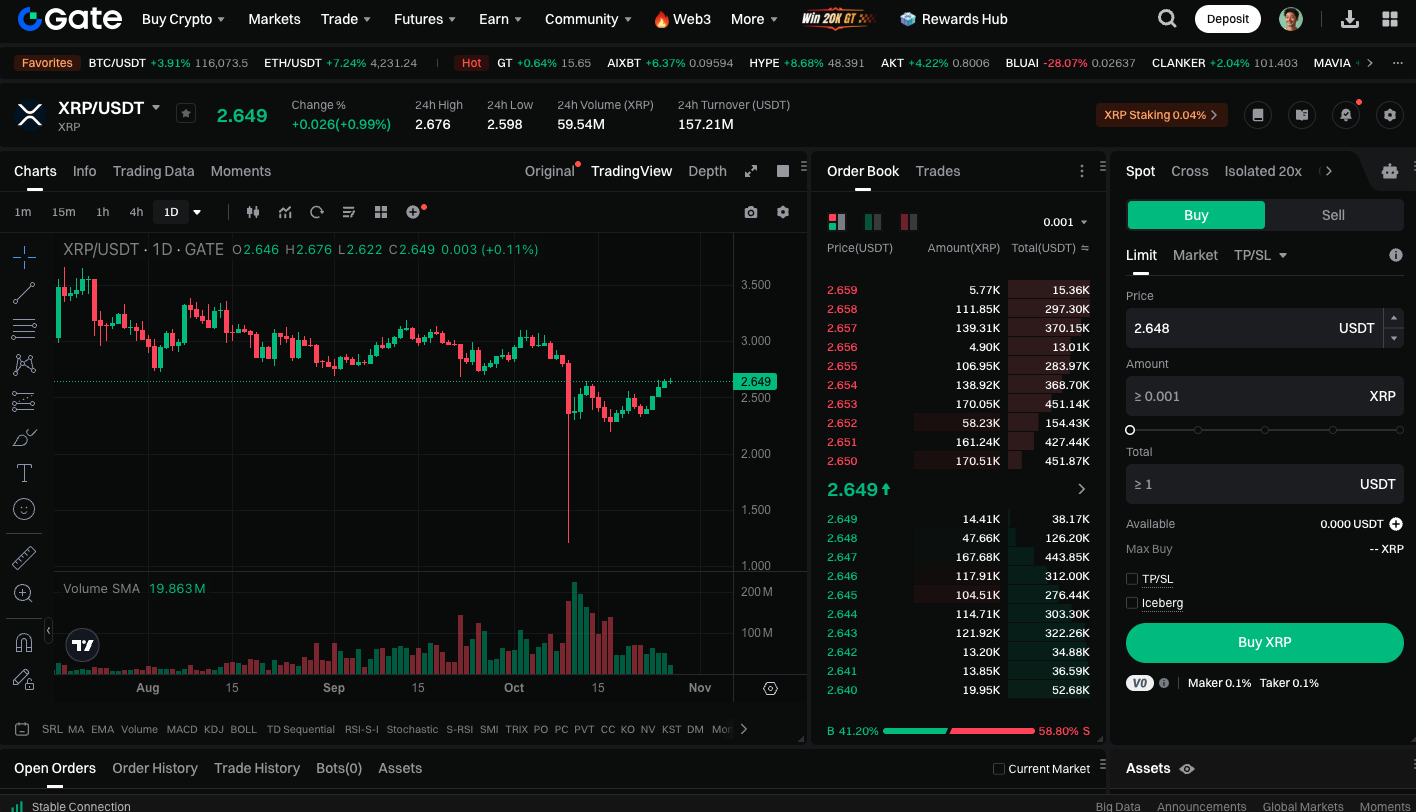

Ready to trade XRP spot? https://www.gate.com/trade/XRP_USDT

Summary

This $1 billion acquisition highlights Ripple’s long-term strategic ambition to transform XRP from a simple payment instrument into the core liquidity bridge for global corporate treasury operations. While the $1,000 price forecast for XRP remains theoretical, deepening enterprise adoption and regulatory improvements are steadily increasing the likelihood of a sustained upward trajectory. For investors, this corporate treasury transformation could be the catalyst for XRP’s next major growth phase.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About