ICP Coin Price

What Is Internet Computer (ICP)?

Internet Computer (ICP) is a blockchain network designed to bring the concept of "cloud computing" onto a public blockchain. Its primary goal is to enable direct on-chain deployment of websites, applications, and data storage. This network utilizes smart contracts called "Canisters" to encapsulate code and state, with computational and storage fees paid in units called Cycles, based on actual usage.

The architecture prioritizes scalability and usability: nodes are organized into multiple "Subnets" that process transactions in parallel to boost throughput. "Chain-Key cryptography" allows Internet Computer to interact securely with other blockchains and traditional internet services without relying on external bridges. As a result, developers can use familiar programming languages to deploy decentralized applications (DApps) that directly serve end-users.

Current ICP Price, Market Cap, and Circulating Supply

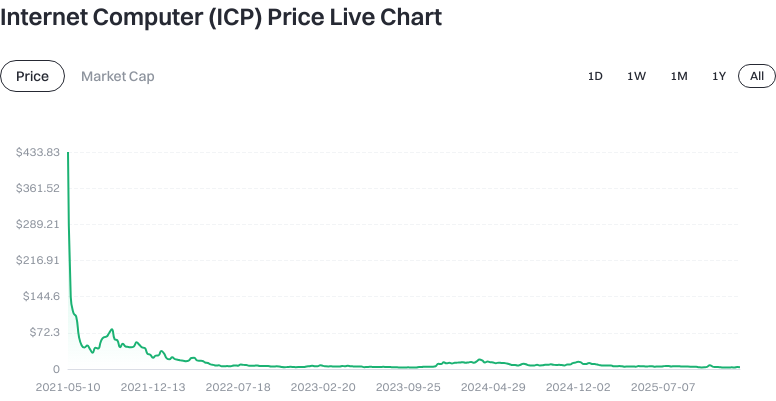

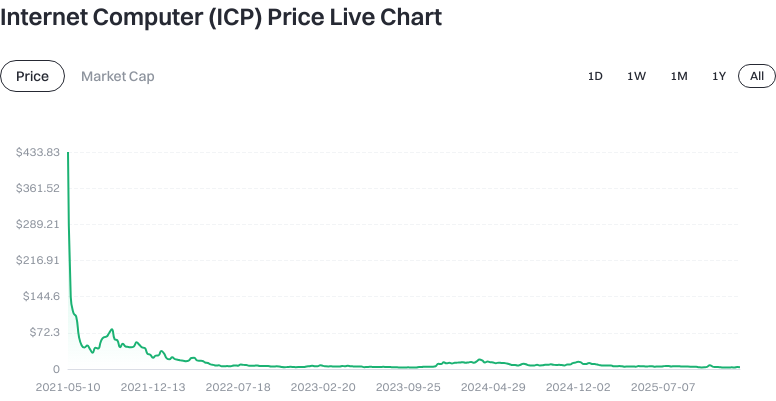

As of January 22, 2026 (source: aggregated market data), ICP is trading at approximately $3.699. The circulating market capitalization is around $2.025 billion (2,024,796,804.841092), with a 24-hour trading volume of about $3.79 million.

View the ICP/USDT Price

Recent price changes: +0.08% in the last hour, +1.70% over 24 hours, -16.14% over 7 days, and +24.09% in the past 30 days.

View the latest ICP price chart

In terms of supply, there are approximately 547,390,323.017327 ICP in circulation, which matches the current total supply. There is no fixed maximum supply (displayed as ∞), as issuance is governed by protocol and governance parameters. The market cap represents about 0.062% of the crypto market. These figures help contextualize ICP's price scale and volatility.

Who Created Internet Computer (ICP) and When?

Internet Computer was developed by the DFINITY Foundation, with Dominic Williams as the project’s chief architect. The project went through years of research and testing before entering broader deployment on June 30, 2019. The mainnet launch and token distribution occurred in 2021. Both the foundation and the community continue to advance protocol upgrades and ecosystem development collaboratively.

How Does Internet Computer (ICP) Work?

Internet Computer's architecture consists of three primary layers: Nodes, Subnets, and Canisters.

- Nodes & Subnets: Qualified node providers operate nodes that are allocated into Subnets—independent blockchain segments with their own consensus mechanisms. Parallel processing across Subnets increases network throughput, while inter-Subnet communication enables horizontal scaling.

- Canisters: These are smart contract containers that bundle code, persistent state, and interfaces—typically running in a WebAssembly environment. Developers can write Canisters in Motoko, Rust, and other supported languages.

- Fee Model (Cycles): Users convert ICP tokens into Cycles to pay for computation, storage, and bandwidth—similar to a pay-as-you-go model in traditional cloud services.

- Governance (NNS): The Network Nervous System manages subnet configuration, upgrades, and economic parameters. Token holders can lock ICP to gain voting power and participate in protocol governance.

- Chain-Key Cryptography: This cryptographic framework uses a single public key to verify the network’s state and enables secure signatures for interoperability with external blockchains or internet services—minimizing reliance on third-party bridges.

Key Use Cases for Internet Computer (ICP)

Internet Computer aims for full end-to-end on-chain execution—including frontend hosting, backend logic, and data storage:

- Websites & Content Platforms: Host both static and dynamic content directly within Canisters, reducing dependency on traditional cloud providers.

- Social Networks, Gaming & Creator Economy: Manage user relationships and digital assets on-chain for improved composability and portability.

- Enterprise & Data Services: Deploy internal systems or API services with elastic scaling and pay-per-use billing in Cycles.

- Cross-chain & Internet Integration: Use Chain-Key cryptography to interact natively with Bitcoin and other blockchains or web services.

- Practical Examples: Explore products like caffeine.ai and icp.ninja built on ICP (ensure you use official links and observe security guidelines).

ICP Wallets and Extension Solutions

- NNS Wallet: Manage ICP tokens, participate in governance and staking, and convert ICP to Cycles for smart contract deployment via the Network Nervous System interface.

- Internet Identity: A passwordless identity system leveraging device security hardware, enabling seamless DApp logins while reducing credential leak risks.

- Third-party Wallets: Browser wallets like Plug and Stoic support DApp interaction, transaction signing, and asset management; some also offer hardware wallet integration for enhanced security.

- Developer Toolchain: Motoko/Rust SDKs and frontend tools help developers package apps as Canisters for easy subnet deployment.

A wallet is software that manages private keys—critical for signing transactions and proving asset ownership. Always back up your seed phrase offline; never store it unencrypted on internet-connected devices.

Major Risks and Regulatory Considerations for ICP

- Price & Liquidity Risk: Crypto assets are highly volatile; trading volumes can impact slippage and execution prices.

- Technical Complexity: Innovations like Subnets, Chain-Key cryptography, and Canisters carry risk—implementation flaws could impact security or usability.

- Governance & Inflation: With no hard supply cap, token issuance/burning depends on governance decisions and Cycles consumption; parameter changes may affect long-term dilution rates.

- Competitive Landscape: ICP competes with other general-purpose blockchains for developer adoption; ecosystem growth is critical for sustained demand.

- Compliance & Regulation: Token issuance, trading, and custody requirements vary by jurisdiction—always comply with local laws and monitor regulatory developments.

- Operational Risks: Errors in address selection or network choice—or private key exposure—can lead to irreversible loss; exchanges may have withdrawal delays or account restrictions.

How to Buy and Safely Store ICP on Gate

Step 1: Register & Complete KYC

Create an account on Gate’s website or app and complete identity verification to unlock higher limits and withdrawal access.

Step 2: Deposit Funds

Choose fiat deposit or crypto transfer from the assets page. For on-chain deposits, confirm the network type and minimum amount to avoid cross-chain errors.

Step 3: Search Trading Pair

Look up "ICP" on the trading page to find spot pairs—verify pair details and order book depth before trading.

Step 4: Place an Order

For instant execution, use a "market order." To buy at your target price, select a "limit order." Enter the amount, review fees, then submit your order.

Step 5: Withdraw to Self-custody Wallet

For long-term holding, withdraw ICP to a wallet where you control the private keys (such as NNS or compatible wallets). On the withdrawal page, paste your correct ICP mainnet address; double-check the network, tag/memo (if required), and minimum withdrawal amount before confirming.

Step 6: Secure Storage & Backup

Write down your seed phrase offline and store it separately; if using a hardware wallet, periodically test recovery procedures. Enable two-factor authentication (2FA) and withdrawal whitelisting for added security.

Tip: Test withdrawals with small amounts first to verify address accuracy before transferring larger sums; keep transaction IDs for reference.

How Does Internet Computer (ICP) Compare to Ethereum?

- Positioning & Architecture: Internet Computer focuses on on-chain cloud functionality—supporting direct hosting of frontend/backend—while Ethereum operates as a general-purpose L1 settlement/execution layer; most Ethereum frontends use traditional CDN or storage solutions.

- Execution Environment: ICP centers around Wasm-based Canisters (supporting Motoko/Rust), while Ethereum uses the EVM (Solidity/Vyper).

- Fee Model: ICP tokens convert to Cycles for resource-based billing; Ethereum uses ETH directly for gas fees, which fluctuate with network congestion.

- Scalability Approaches: ICP leverages Subnets and Chain-Key cryptography for parallel scaling; Ethereum primarily relies on rollups (L2) for multi-layer scaling and data availability enhancements.

- Governance Model: ICP uses on-chain NNS governance for protocol upgrades; Ethereum upgrades are coordinated through client teams and community consensus.

- Ecosystem Maturity: Ethereum has a more established ecosystem with abundant tools and assets; ICP differentiates with native application hosting and direct multi-chain connectivity.

The two platforms are not mutually exclusive; developers can choose or combine them based on their specific use case needs.

Summary of Internet Computer (ICP)

Internet Computer (ICP) aims to evolve public blockchains into an "on-chain cloud," leveraging Canisters, parallel Subnets, and Chain-Key cryptography for scalable application/data hosting. Current price metrics show its market size and volatility profile; ICP already supports direct hosting of websites/services along with multi-chain interactions and AI-powered applications. For beginners, following a step-by-step process—registering on Gate, funding your account, placing orders, withdrawing funds to self-custody wallets—offers a secure approach. Going forward, long-term prospects will depend on developer growth, user retention, governance effectiveness, and sustainability of its economic model. Whether trading or building on ICP, always prioritize private key safety and regulatory compliance.

FAQ

What Factors Drive ICP Price Volatility?

ICP's price is mainly influenced by network development milestones, ecosystem growth, overall market sentiment, and broad crypto market trends. Launches of new features or ecosystem projects generally boost prices; stagnation or market downturns can cause declines. It’s best to monitor official announcements and ecosystem updates regularly rather than react impulsively to short-term price movements.

How Can Beginners Track Real-Time ICP Prices?

You can track real-time ICP price movements on platforms such as Gate, CoinMarketCap, CoinGecko, etc.

View the latest ICP price chart

Gate also provides candlestick charts, technical analysis tools, and price alert features for better market tracking. It’s recommended to cross-check data across multiple platforms for accuracy.

What Advantages Does ICP’s Price Offer Compared to Other Major Tokens?

As both a governance token and incentive within the Internet Computer ecosystem, ICP’s value is directly linked to network adoption rates and application innovation. Unlike legacy cryptocurrencies, ICP represents a new foundational layer for Web3 infrastructure—offering greater innovation potential but also higher risk. Newcomers should assess their risk tolerance carefully.

Is a Sharp Drop in ICP Price a Good Buying Opportunity?

A price dip might signal a buying opportunity but could also reflect fundamental issues. Analyze the reasons behind any drop—is it due to market panic or project-specific concerns? Avoid impulsive buying; instead, conduct thorough research or consider strategies like dollar-cost averaging for risk management. Remember: accurately timing the bottom is virtually impossible.

Why Do ICP Prices Differ Across Exchanges Like Gate?

ICP prices may vary slightly between exchanges due to differences in liquidity, trading depth, or regional factors—but discrepancies are usually minor. As a major exchange with high liquidity and diverse trading pairs, Gate offers relatively stable prices suitable for most users. When choosing an exchange, prioritize security and fees over minimal price differences.

Glossary of Key Internet Computer (ICP) Terms

- Canister: The fundamental smart contract unit on the ICP network; executes code and stores data—essential for building decentralized applications.

- Cycle: The computational unit on ICP used to measure/purchase canister execution and storage resources.

- Subnet: An independent blockchain segment composed of multiple nodes that collectively validate transactions and secure the ICP network.

- Neuron: Locked form of ICP tokens granting holders voting rights in protocol governance—and potential rewards.

- Internet Identity: Decentralized authentication system by ICP enabling secure app logins using biometrics or other advanced methods.

- Reverse Gas Model: Unique fee structure where developers prepay costs so end-users can access DApps without paying gas fees directly.

Further Reading & References for Internet Computer (ICP)

-

Official Website/Whitepaper

-

Development/Docs

-

Authoritative Media & Research

Related Articles

Gate Alpha Launches Points System: Trade On-Chain, Earn Points, Unlock Airdrops

Dogecoin Nears Critical Breakout Window as Market Tensions Build