What is AIT Coin?

What Is AIT Token?

AIT is an ERC-20 token issued by the AIT Protocol on Ethereum, designed for Web3 applications focused on artificial intelligence (AI) and big data. As an on-chain, transferable digital asset, AIT leverages the ERC-20 standard—the most widely adopted token protocol on Ethereum—enabling unified support across wallets and decentralized applications (DApps). Typical use cases for AIT include payments, incentivizing data contributions, and accessing ecosystem tools.

Public information indicates AIT launched in 2023 on the Ethereum network. Project tags link it to the Paal ecosystem, with a primary focus on AI and big data use cases.

Current Price, Market Cap, and Circulating Supply of AIT (AIT)

As of 2026-01-26T04:48:00Z (user-provided data):

- Latest price: approximately $0.000844, with a 24-hour price change of -5.3472%.

- Circulating supply: about 296,276,302.12 AIT; total supply: roughly 297,604,134.97 AIT.

- Circulating market cap: around $250,152.90; fully diluted market cap: approximately $251,274.02. Fully diluted market cap is a theoretical figure calculated by multiplying total supply by the current price.

- 24-hour trading volume: about $435.10, currently traded across 34 pairs; 1-hour price change +1.3945%, 7-day +0.6390%, 30-day -45.7143%.

Note: Circulating supply refers to tokens currently available for public trading; total supply is the overall number issued; trading volume reflects recent market activity. In highly volatile periods, prices can be sensitive to order book depth.

Who Created AIT (AIT) and When?

AIT was launched on December 22, 2023, operating on the Ethereum network. For details about the team and roadmap, refer to the official website and public resources (official site: https://aitprotocol.ai/). Project tags indicate links to the Paal ecosystem, with a strong emphasis on AI and big data.

Before participating, it is advisable to review the whitepaper or official statements to understand the token’s utility, issuance mechanism, and permission structure.

How Does AIT (AIT) Work?

AIT follows Ethereum’s ERC-20 standard and utilizes smart contracts to record balances and transfers. Smart contracts are self-executing code deployed on-chain that manage token issuance, transfers, and any reward logic.

On the supply side, the current total supply is approximately 297.6 million tokens. The project is marked as having a non-infinite supply, but no fixed maximum cap is disclosed in public data. Any future minting, burning, or unlocking arrangements are typically specified in the contract or official announcements.

For transactions, AIT transfers require paying gas fees on the Ethereum network. Gas fees compensate miners or validators for processing transactions. Users can send and receive AIT using compatible wallets with standard authorization flows.

What Can You Do With AIT (AIT)?

AIT’s main use cases include:

- Payments and access to ecosystem tools: For example, serving as a medium for unlocking features or settling usage fees within AI-related applications.

- Incentives and rewards: Community contributions such as data submission, labeling, or model participation may be rewarded in AIT, subject to project-specific rules.

- Trading and portfolio allocation: As a crypto asset, users can trade AIT on spot markets or include it in diversified portfolios.

Always refer to official documentation and smart contracts for specific use cases—avoid engaging in complex transactions based on assumptions.

Supported Wallets and Extensions for AIT (AIT)

As an ERC-20 token, AIT can be managed using mainstream Ethereum-compatible wallets:

- Software wallets like MetaMask, which offer browser integration and DApp connectivity.

- Hardware wallets such as Ledger or Trezor store private keys on secure chips, reducing theft risk.

- Multi-signature and access control tools enhance fund management security for teams or organizations.

When using wallets, always ensure you’re operating on Ethereum mainnet and verify the token contract address to avoid sending tokens to incorrect networks or phishing contracts.

Main Risks and Regulatory Considerations for AIT (AIT)

- Price volatility risk: Short-term price swings can be significant; robust capital management is advised.

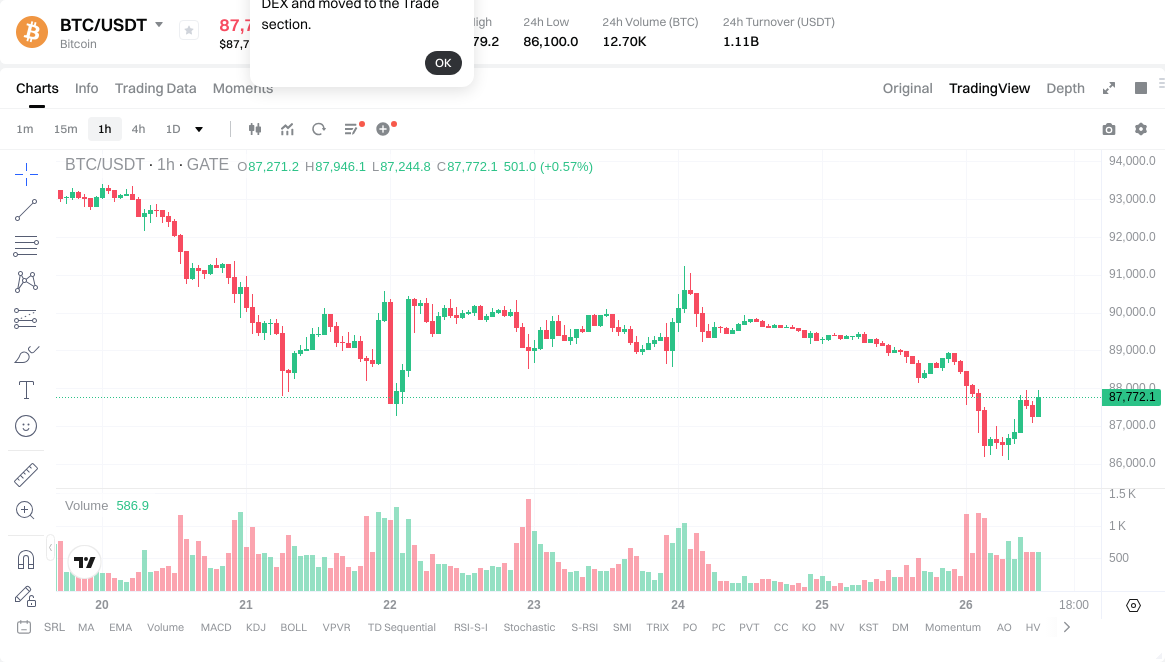

Click to view AIT USDT Price

- Liquidity risk: Low trading activity can result in slippage—the difference between expected and actual execution price.

- Smart contract and admin risk: Vulnerabilities or excessive admin privileges can introduce uncertainties.

- Regulatory compliance risk: Crypto regulations vary by region; ensure adherence to local laws including KYC (Know Your Customer) procedures and tax obligations.

- Custody and private key security: For assets stored on exchanges or hot wallets, enable two-factor authentication (2FA) and withdrawal whitelists; for self-custody, securely back up seed phrases and private keys.

How to Buy and Securely Store AIT (AIT) on Gate

Step 1: Registration & Security. Visit gate.com to create an account. Enable email or mobile verification plus 2FA and withdrawal whitelist for improved account security.

Step 2: Complete KYC. Submit identity information as required by the platform; completing KYC raises deposit and trading limits.

Step 3: Deposit funds. Choose fiat deposits or transfer in USDT/stablecoins. Always select the correct network/address for deposits—make a small test transaction before transferring larger sums.

Step 4: Spot trade AIT. In the spot section, search for relevant pairs (e.g., AIT/USDT) and place market or limit orders as needed. Market orders fill at current market price; limit orders execute at your set price.

Step 5: Withdraw & store securely. For long-term holding, transfer AIT to your personal Ethereum wallet. Verify ERC-20 compatibility and contract address; consider hardware wallets for medium/long-term storage. Diversify holdings and back up seed phrases.

Risk Tips: Check order book depth and volume before trading—avoid large market orders during low liquidity periods; test withdrawals with small amounts; protect private keys and seed phrases against phishing and fake customer service scams.

Comparison: AIT (AIT) vs Fetch.ai (FET)

- Technical positioning: AIT targets Web3 token applications in AI and big data as an ERC-20 token on Ethereum; Fetch.ai is focused on autonomous agents and computational networks for building agent-based infrastructure.

- Use case focus: AIT primarily serves as an incentive/value medium within its ecosystem; Fetch.ai emphasizes developer tools and intelligent agent frameworks.

- Ecosystem maturity & trading activity: FET has higher market adoption and trading activity; AIT currently has lower scale/liquidity—be mindful of slippage and depth when participating.

- Supply & market cap: According to current data, AIT’s market cap and trading volume are smaller; FET has a larger overall footprint. Risk-return profiles differ accordingly.

These tokens serve distinct purposes and are not direct substitutes—evaluate based on your needs and risk tolerance.

Summary of AIT (AIT)

AIT is an ERC-20 token on Ethereum aimed at AI and big data Web3 applications, with ties to the Paal ecosystem. Current data shows a relatively small scale with notable volatility. Prospective participants should understand supply dynamics, permission structures, and actual use cases before engaging. If buying via Gate, complete registration, KYC, trading procedures, and implement security best practices such as address/network verification, 2FA, and hardware wallets. For long-term value evaluation, monitor official updates, ecosystem growth, and liquidity trends—start small, diversify allocation, and incrementally build your understanding of project risks.

FAQ

What Is the Difference Between AIT Token and ALT Token?

AIT is an ERC-20 token associated with the AIT Protocol. AIT Protocol (AIT) is a specialized token focused on AI data annotation (Train-to-Earn), It is not affiliated with the Humanode network, which uses a separate token (HMND). ALT token generally refers to various altcoins—a generic term for alternative cryptocurrencies beyond major ones like BTC or ETH. The two differ entirely in issuers, technical application, and ecosystem positioning. AIT has a clear project background with specific use cases; beginners should research individual projects instead of making decisions based solely on token categories.

What Benefits Do You Get From Holding AIT Token?

Holding AIT offers governance rights and ecosystem participation—holders can vote on major project decisions and receive ecosystem incentives. Some exchanges or DeFi protocols may offer staking rewards; however, these involve risks. Always consult official resources like Gate for up-to-date information on AIT utilities and reward mechanisms.

How Can You Evaluate Whether AIT Token Is Worth Investing In?

Assessing any crypto asset requires reviewing team credentials, technical innovation, ecosystem growth progress, and market liquidity. As a token for AI-powered identity verification within the Humanode ecosystem, AIT’s value depends directly on adoption rates within its ecosystem. Beginners should thoroughly study the whitepaper and official updates before investing—avoid following trends or unverified recommendations.

On Which Exchanges Is AIT Token Tradable?

AIT is listed on leading exchanges including Gate, Binance, Huobi, etc. Gate offers both spot and contract trading pairs for AIT. Choosing reputable exchanges ensures fund safety and sufficient liquidity—always confirm current listings through official channels.

What Is the Total Supply of AIT Token? Is There a Risk of Unlimited Issuance?

Public information does not clearly disclose a fixed maximum supply for AIT; users should review official tokenomics and smart contracts for confirmation. This helps prevent inflation from unlimited issuance; however, check official documentation for unlock schedules or release plans before investing to assess long-term scarcity.

Quick Reference Glossary for AIT (AIT)

- Circulating Supply: The quantity of tokens currently available in the market used to calculate real-time market cap.

- Fully Diluted Market Cap: The theoretical total market value if all tokens were in circulation—indicates long-term value potential.

- Trading Pair: The asset combinations (e.g., USDT, ETH) available for trading with this token—key for liquidity and trading flexibility.

- 24-Hour Trading Volume: Total value traded over the past 24 hours—measures market activity and liquidity.

- Price Volatility: The magnitude of short-term price changes—reflects both risk level and investment opportunity.

Related Articles

What Are Altcoins?

What is Blum? All You Need to Know About BLUM in 2025