What is AMP?

What Is Amp (AMP)? Definition and Key Features

Amp (AMP) is a digital collateral token designed to secure payments on the Flexa network. In blockchain payments, "collateral" refers to assets that guarantee transaction settlement. When a user pays with assets like Bitcoin and the transaction is pending on-chain confirmation, an equivalent amount of AMP is temporarily locked by a smart contract—an automated program on the blockchain—to protect the merchant. If the original payment fails, the locked AMP is used to compensate the merchant; if successful, the AMP is unlocked and returned. In addition to serving as payment collateral, AMP holders can stake their tokens (locking them in contracts to support the network and earn fees) and participate in governance voting.

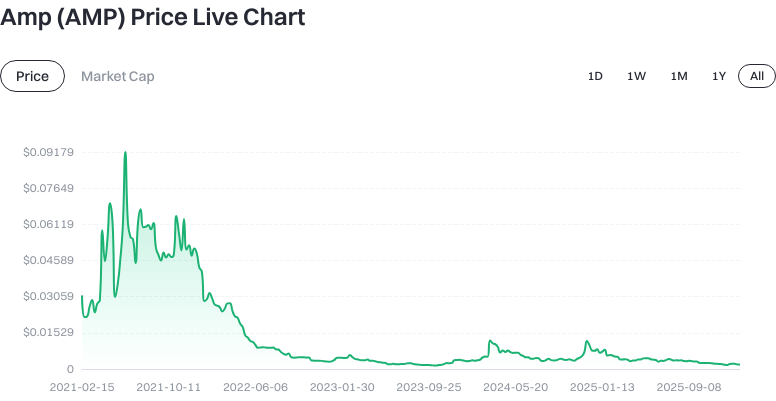

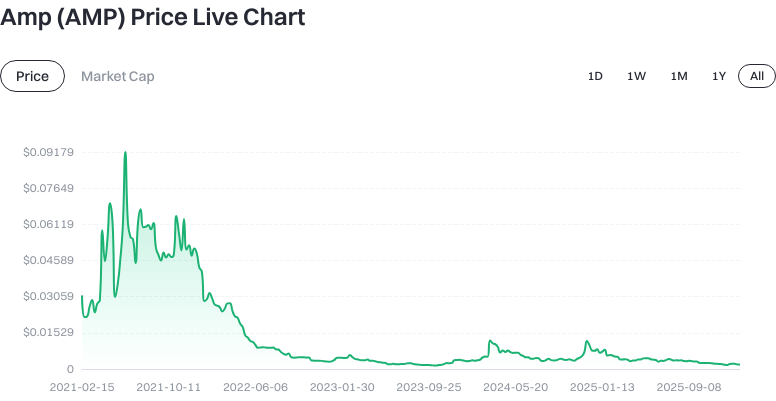

Current Price, Market Cap, and Supply of Amp (AMP)

As of 2026-01-26:

- Latest Price: $0.001933

- Circulating Supply: 84,282,147,058.408340 AMP (tokens available for public trading)

- Total Supply: 99,720,006,935.300125 AMP (all tokens issued, not necessarily in circulation)

- Maximum Supply: 100,000,000,000 AMP (the issuance cap)

- Circulating Market Cap: $192,758,773.405935 (price × circulating supply)

- Fully Diluted Market Cap: $192,758,773.405935 (price × maximum supply; reflects potential valuation if all tokens are released)

- 24-Hour Trading Volume: $17,831.132958 (total traded in last 24 hours)

- Price Change: 1 hour -0.16%, 24 hours -4.77%, 7 days -9.65%, 30 days 12.28%

View live AMP price data

This data is for informational purposes only.

Who Created Amp (AMP) and When?

Amp launched on October 29, 2020 as a 1:1 migration from Flexacoin (FXC), aiming to provide native collateral for Flexa’s crypto payment network. The project transitioned to community governance, allowing holders to vote on proposals such as grant recipients, partnerships, cross-chain integrations, and DeFi collaborations. This evolution enables AMP to serve both as a payment collateral asset and a governance token within the Flexa ecosystem.

How Does Amp (AMP) Work? Mechanism and Collateral Management

Amp uses Ethereum smart contracts for programmable collateralization:

- Collateral Managers: These are contract or account configurations that define rules for locking/unlocking collateral (“when to lock”, “how much”, “when to unlock”) tailored for different use cases—for example, short-term locks and rapid releases for retail payments.

- Token Partitioning: Amp’s contracts allow tokens held by a single address to be split into “partitions” governed by different rules. This lets users mark tokens as “staked” in specific partitions without moving them—enhancing both security and flexibility.

- Settlement Guarantee Process: When users pay merchants with crypto assets, an equivalent value of AMP is locked in a contract as collateral. If the original payment is confirmed on-chain, the AMP is released; if it fails, the locked AMP compensates the merchant.

This system transforms blockchain confirmation delays into quantifiable collateral costs and risk management.

What Can Amp (AMP) Be Used For? Use Cases

- Payment Collateral: Enables merchants to receive instant settlement for crypto payments by using AMP as collateral during confirmation periods.

- Staking for Fees: Stake AMP in designated managers to support network capacity and collateralization—earn transaction fee rewards. Note: This staking is economic collateralization, not blockchain consensus.

- Governance Voting: Participate in decision-making regarding partnerships, cross-chain integrations, funding directions, and more—shaping the network’s evolution.

- Integration Scenarios: AMP can be integrated with wallets, merchant processors, and payment systems—embedding “collateral-first, settlement-later” workflows into existing solutions.

Main Risks and Regulatory Considerations for Amp (AMP)

- Price Volatility: Crypto assets can experience rapid price swings affecting both collateral costs and staking returns.

View live AMP price data

- Smart Contract Risk: Contracts may have bugs or misconfigured parameters; ongoing audits and upgrade governance are important.

- Liquidity & Adoption: If network usage falls short of expectations, staking rewards and token demand may decline.

- Reliance on External Networks: Collateral often covers assets from other chains; underlying chain congestion or rising gas fees can impact user experience.

- Compliance & Taxation: Some regions treat crypto payments as regulated activities; merchants and users should adhere to local KYC/AML rules and tax reporting requirements.

- Account Security: Enable two-factor authentication on exchange accounts; securely back up private keys/mnemonics for self-custody wallets—loss or exposure is irreversible.

Long-Term Value Proposition of Amp (AMP)

- Payment Network Effects: Wider merchant and wallet integration could expand collateral volume and fee income.

- Capital Efficiency: Partitioning and programmable collateral improve fund utilization and reduce merchant wait times.

- Cross-Chain & Integration Potential: More assets and blockchains can be added as collateral targets—increasing potential use cases.

- Supply Cap: With a max supply of 100 billion tokens, long-term value depends more on network usage and fee capture than scarcity.

- Governance Evolution: Community governance can optimize fee distribution and network parameters—affecting AMP’s tokenomics and incentives.

All factors are subject to uncertainty—continuous monitoring of network data and governance proposals is recommended.

How to Buy and Securely Store Amp (AMP) on Gate

Step 1: Register & Complete KYC. Sign up on Gate’s website or app, complete identity verification and withdrawal setup, enable two-factor authentication (2FA).

Step 2: Deposit or Buy USDT. Fund your account with fiat or crypto; if there is no direct fiat pair for AMP, buy USDT as an intermediary asset.

Step 3: Trade AMP Spot. Go to spot trading, search for “AMP,” select your pair (e.g., AMP/USDT), choose limit or market order as needed, enter the amount and submit your trade.

Step 4: Withdraw to Self-Custody Wallet (optional). For self-storage, prepare your Ethereum address (AMP typically runs on the ERC-20 network). When withdrawing, select the correct network/contract—test with a small transfer first before sending larger amounts.

Step 5: Store Securely. Back up your mnemonic phrase and private key offline—avoid screenshots or cloud backups; consider hardware wallets for increased physical security; regularly check whitelist addresses; beware of phishing links and fake customer support.

Risk Reminder: Always verify contract address and withdrawal network before trading; check on-chain gas fees; review lock-up rules and potential loss scenarios before staking or participating in governance.

Comparison: Amp (AMP) vs Bitcoin (BTC)

- Purpose & Use Case: Bitcoin (BTC) is a decentralized store of value and settlement asset; Amp is a functional token for payment collateralization and network governance.

- Value Source: BTC derives value from scarcity and security; AMP’s value depends on demand for payment guarantees, fee distribution, and adoption.

- Settlement Experience: BTC has longer on-chain confirmation times; Amp provides instant merchant guarantees via collateral before confirmation.

- Supply Mechanism: BTC has a capped supply of 21 million with deflationary issuance; AMP’s cap is 100 billion tokens—economic design prioritizes payment coverage and incentive distribution.

- Risk Profile: BTC faces macroeconomic and regulatory risks; AMP has additional smart contract and adoption uncertainty alongside market risk.

These assets complement each other within payment ecosystems—they are not direct substitutes.

Summary of Amp (AMP)

Amp centers on “collateral-backed instant settlement,” leveraging Ethereum smart contracts, token partitioning, and collateral managers to deliver seamless crypto payment experiences for users and merchants. In the short term, performance depends on market volatility and adoption rates; over the longer term, merchant integration scale, transaction growth, cross-chain support, and governance effectiveness will drive fee capture and token demand. For investment or usage, prioritize operational security and compliance—trade via Gate with proper contract/network verification; safeguard your private keys if self-custodied; understand the risk-reward profile before staking; continuously monitor network metrics and governance developments.

FAQ

What is the main use of AMP token?

AMP is Flexa Network’s native token designed to collateralize payment transactions. When users pay with crypto via Flexa, AMP tokens are locked as collateral to ensure instant settlement and transaction security. In essence, AMP acts as “insurance” for merchants accepting crypto payments.

What practical applications does AMP offer?

AMP mainly supports instant payment settlement. Merchants can accept AMP or other cryptocurrencies through Flexa while benefiting from the safety provided by AMP-backed collateral. Regular users can hold AMP to participate in the network or trade it on supported exchanges like Gate—contributing to ecosystem growth.

Are there risks in holding AMP tokens?

Holding AMP involves several risks: market volatility (crypto prices fluctuate widely); adoption risk (if Flexa Network fails to gain traction, AMP’s value may drop); exposure to scams/phishing—trading via regulated platforms like Gate enhances safety. New users should learn thoroughly before investing.

How does AMP differ from other payment tokens?

AMP specializes in on-chain payment guarantees while other payment tokens may focus on different functionalities. Its key advantage is deep integration with Flexa’s payment rails—providing real-time collateral mechanisms. Other tokens might emphasize cross-chain transfers or DeFi utility; choose based on specific needs.

How should beginners get started with AMP?

Beginners should register accounts at regulated exchanges like Gate, complete identity verification, then purchase a small amount of AMP to try it out. Study AMP’s fundamentals and Flexa ecosystem first; increase exposure as understanding grows. After purchase, securely store tokens in wallets or keep them on Gate for flexible trading—but always safeguard private keys and account security.

Key Terms Related to Amp (AMP)

- Collateral: AMP tokens used as backing assets to guarantee liquidity and risk mitigation for payment transactions.

- Payment Rails: The infrastructure layer supporting various payment types and instant asset settlement enabled by AMP.

- Staking: Locking up AMP tokens to earn rewards while supporting network liquidity.

- Liquidity Pool: Pools where AMP accumulates to facilitate instant settlement across different payment transactions. See Liquidity Pools.

- Interoperability: AMP’s ability to operate across multiple blockchains and payment protocols—enabling asset compatibility and seamless payments.

Further Reading & References

-

Official Website / Whitepaper:

-

Development / Documentation:

-

Media & Research:

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?