What is AVA Coin?

What Is Travala.com?

Travala.com is an international travel booking platform that enables users to reserve hotels, flights, activities, and other travel-related services using both traditional payment methods and cryptocurrencies. The platform positions itself at the intersection of travel and digital assets, offering crypto-friendly settlement alongside loyalty-style incentives.

AVA is the native utility token of Travala.com. It is designed to function simultaneously as a payment instrument and a membership incentive mechanism. Users who pay for bookings using AVA may receive direct discounts at checkout, while holding or actively using AVA can unlock additional membership rewards, bonuses, and platform benefits.

AVA is issued under the BEP-2 standard, which is the native token format of Binance Chain. BEP-2 emphasizes fast transaction finality and low network fees, characteristics that align well with frequent, small-to-medium value payments such as travel bookings and in-platform reward distribution.

What Are the Current Price, Market Cap, and Circulating Supply of Travala.com (AVA)?

As of January 27, 2026, based on publicly available market data:

| Metric | Value | Explanation |

|---|---|---|

| Latest Price | $0.316700 | Most recent spot market price |

| Circulating Supply | 71,055,612 AVA | Tokens currently available for trading |

| Total Supply | 71,055,612 AVA | Tokens issued to date |

| Maximum Supply | 100,000,000 AVA | Hard cap on total issuance |

| Circulating Market Cap | $22,503,312.32 | Price × circulating supply |

| Fully Diluted Valuation (FDV) | $22,503,312.32 | Market cap assuming all tokens are released |

AVA represents approximately 0.000710% of the total global cryptocurrency market capitalization. The reported 24-hour trading volume is around $17,451.16, reflecting relatively modest liquidity compared with large-cap crypto assets.

Click to view the AVA/USDT price

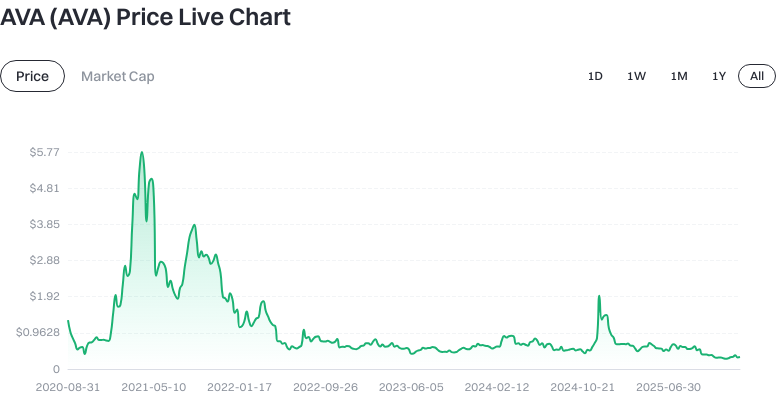

Recent short-term price movements show +0.35% over the past hour and +0.22% over the past 24 hours. Over longer intervals, AVA has declined by -10.99% over 7 days while recording a +9.21% gain over the past 30 days.

Click to view the latest AVA price chart

Fully diluted valuation (FDV) differs from market capitalization because FDV assumes all tokens up to the maximum supply are in circulation, while market cap reflects only currently circulating tokens.

Who Created Travala.com (AVA) and When?

AVA was launched on May 12, 2020 by the Travala.com team. The token was introduced to support crypto-native payments and to formalize a token-based membership and rewards system within the Travala.com booking ecosystem.

As Travala expanded its acceptance of digital assets, AVA became the platform’s core utility token, used for booking discounts, promotional rewards, and user incentive alignment.

How Does Travala.com (AVA) Work?

AVA operates as a BEP-2 token on Binance Chain. The BEP-2 network architecture prioritizes speed and low transaction costs, which makes it suitable for commerce-oriented use cases.

A critical operational detail is that BEP-2 transfers often require a Memo field. This Memo is used by exchanges and custodial platforms to route deposits to the correct internal account. Failing to include the correct Memo or using an incorrect one can result in permanent loss of funds.

Within Travala.com, AVA is used for:

- Order settlement when users choose AVA as a payment method.

- Membership reward distribution based on booking activity, promotional campaigns, or holding requirements.

- Discount application according to predefined platform rules.

From a supply perspective, AVA has a maximum issuance cap of 100 million tokens. As of January 2026, both total and circulating supply stand at 71,055,612 AVA, leaving a remaining allocation subject to future release schedules and official announcements.

What Can Travala.com (AVA) Be Used For?

AVA’s utility is primarily tied to the Travala.com platform:

- Payment for bookings: AVA can be used to pay for hotels, flights, and other travel services, often with built-in discounts.

- Membership rewards: Users may receive AVA as bonuses for qualifying activity or participation.

- Fee and promotion discounts: Certain campaigns offer additional benefits when AVA is used or held.

For example, paying for a hotel booking with AVA may unlock an immediate checkout discount, while seasonal promotions may distribute extra AVA rewards to active users.

What Are the Main Risks and Regulatory Considerations for Travala.com (AVA)?

- Market volatility risk: AVA’s price can fluctuate significantly due to market sentiment, liquidity conditions, and broader crypto cycles.

- Platform dependency risk: AVA’s utility and demand are closely linked to Travala.com’s operational performance and adoption.

- Regulatory compliance risk: Crypto payment regulations and travel-related compliance requirements vary across jurisdictions and may evolve.

- On-chain operational risk: Incorrect BEP-2 network usage or missing Memo information can result in irreversible fund loss.

- Security risk: Account security, private key management, and phishing prevention remain critical for both exchange and self-custody users.

What Is the Long-Term Value Proposition of Travala.com (AVA)?

AVA’s long-term value proposition depends largely on real-world platform usage rather than purely speculative demand:

- Utility-driven demand: Increased bookings and users translate into higher AVA usage.

- Incentive effectiveness: Discount structures and reward programs influence retention.

- Supply transparency: Clarity around remaining token issuance impacts market expectations.

- Industry conditions: Travel sector growth, competition, and macroeconomic cycles affect booking volume.

Key indicators to monitor include booking volume settled in AVA, active user growth on Travala.com, promotional campaign frequency, and on-platform token utilization metrics.

How Can I Buy and Safely Store Travala.com (AVA) on Gate?

Step 1: Register a Gate account and complete identity verification to unlock trading and withdrawal functionality.

Step 2: Deposit funds. Users typically deposit or acquire USDT via supported onramps.

Step 3: Navigate to spot trading and search for the AVA/USDT trading pair.

Step 4: Place a market or limit order, specifying price and quantity.

Step 5: Withdraw to a wallet if self-custody is preferred, ensuring correct BEP-2 address and Memo usage.

Step 6: Secure storage practices include enabling two-factor authentication, withdrawal whitelists, and properly backing up non-custodial wallets using offline storage of the mnemonic phrase.

How Does Travala.com (AVA) Differ from Bitcoin?

Purpose: AVA is a platform utility token, while Bitcoin functions primarily as a store of value and settlement asset.

Supply: AVA has a capped supply of 100 million tokens; Bitcoin’s supply is capped at 21 million coins.

Technology: AVA runs on Binance Chain via the BEP-2 standard; Bitcoin operates on its own independent blockchain.

Use cases: AVA is tied to travel bookings and rewards; Bitcoin has broader financial and macroeconomic applications.

Summary of Travala.com (AVA)

AVA is a utility-focused token designed specifically for the Travala.com travel ecosystem. It enables discounted payments, rewards participation, and membership incentives while operating on a fast, low-fee BEP-2 network. As of January 27, 2026, AVA remains a relatively small-cap asset with observable volatility. Its long-term outlook is primarily driven by platform adoption, booking volume, and sustained token utility rather than speculative narratives alone.

FAQ

Is AVA Related to Avalanche Blockchain?

No. AVA is the native token of Travala.com and is unrelated to the Avalanche blockchain. Despite name similarities, the two projects are entirely separate.

What Benefits Do I Get by Holding AVA?

Holding AVA may unlock booking discounts, membership tiers, participation rights, and ecosystem rewards depending on platform rules and promotions.

Where Can I Trade AVA Tokens?

AVA is listed on multiple exchanges, including Gate, where users can trade common pairs such as AVA/USDT.

What Is the Total Supply of AVA? Can It Be Inflated Limitlessly?

AVA has a fixed maximum supply of 100 million tokens. There is no mechanism for unlimited inflation.

Is AVA Price Volatile? Is It Suitable for Beginners?

AVA experiences price volatility typical of crypto assets. Beginners should approach cautiously, use proper risk management, and prioritize secure trading and storage practices.

Key Terms Related to AVA (AVA)

- Tokenomics: Token supply design and incentive structure.

- Circulating supply: Tokens currently available on the market.

- Fully diluted valuation: Market cap assuming all tokens are issued.

- Market cap dominance: Share of total crypto market value.

- 24-hour trading volume: Measure of liquidity and market activity.

Related Articles

What Are Altcoins?

What is Blum? All You Need to Know About BLUM in 2025