What is CTSI Coin?

What Is Cartesi?

Cartesi is a Layer 2 infrastructure protocol designed to enable complex and computationally intensive processes to be executed off-chain within a Linux environment. It leverages cryptographic proofs and dispute resolution mechanisms to ensure the correctness and security of results. As a Layer 2 solution, Cartesi extends the capabilities of the main blockchain by shifting heavy computation off-chain—meaning these operations are performed outside the main chain and only essential results are submitted back on-chain.

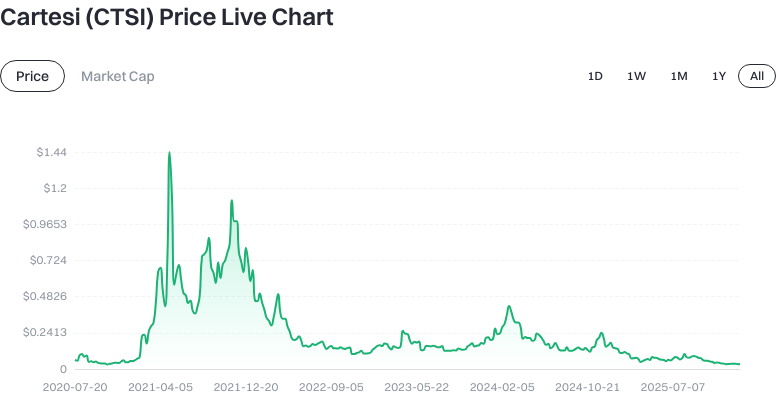

Cartesi (CTSI) Price, Market Cap, and Circulating Supply

As of 2026-01-27 (data based on provided market information): CTSI trades at $0.032620 with a circulating supply of 901,650,531.790014 tokens. Both total and maximum supply are capped at 1,000,000,000 tokens, confirming that CTSI has a fixed supply. Its circulating market cap stands at $32,620,000, with a fully diluted valuation of $32,620,000 and a market share of approximately 0.001%. Price changes: -0.03% over the past hour, +1.87% in 24 hours, -8.30% over 7 days, -4.10% over 30 days. The 24-hour trading volume is $24,731.25.

Check the latest CTSI price and market data

Key terms explained: Circulating supply is the number of tokens available for trading in the market; maximum supply is the absolute limit. Market cap equals price times circulating supply; fully diluted valuation estimates value using the max supply; trading volume reflects short-term liquidity and activity.

Who Created Cartesi (CTSI) and When?

Cartesi was developed by a team focused on scalable computing and blockchain engineering, with CTSI officially launching on 2020-04-22. The project’s vision is to build a “universal operating system” for decentralized applications (dApps), empowering developers to write sophisticated logic in familiar Linux environments while retaining blockchain’s decentralization and security. The launch date is sourced from official project materials and public documentation.

How Does Cartesi (CTSI) Work?

Cartesi boosts performance through a combination of off-chain computation and on-chain verification. Applications execute resource-intensive computations in a Linux environment off-chain, then submit the results to the blockchain. If disputes arise, an interactive verification process is triggered—narrowing down the scope for on-chain recalculation until the truth is established with minimal on-chain steps.

Temporary data for dApps can be stored on a sidechain governed by a Proof-of-Stake (PoS) consensus mechanism. A sidechain operates alongside the main chain to reduce interaction frequency and lower costs. PoS selects block producers based on staked tokens, incentivizing honest behavior.

This architecture allows complex applications to deliver performance and developer experience similar to traditional software, while preserving blockchain’s auditability and tamper-resistance.

What Can Cartesi (CTSI) Be Used For?

Cartesi is ideal for dApps requiring intensive computation or complex logic:

- On-chain games & simulations: Heavy calculations (physics, strategy) run off-chain, with only essential state updates recorded on-chain for smooth gameplay.

- Machine learning & scientific computing: Train or infer in a Linux environment; results and proofs are submitted on-chain for public verification.

- Data marketplaces & privacy-preserving computation: Temporary data stored on sidechains, with only proofs and settlements written to the main chain—balancing efficiency with compliance.

- Financial derivatives & batch settlement: High-frequency calculations and reconciliations occur off-chain; final settlements require minimal on-chain transactions.

CTSI tokens are used for staking, network governance, and as economic incentives within the ecosystem.

Wallets and Scalability Solutions in the Cartesi (CTSI) Ecosystem

Developers can build dApps using familiar Linux tools and mainstream programming languages, minimizing migration costs. The ecosystem typically includes SDKs, sample projects, and documentation to help bridge offchain computation with on-chain verification.

For asset management, users and developers can use self-custody wallets like MetaMask or TrustWallet to hold CTSI and interact with dApps; hardware wallets (Ledger, Trezor) are recommended for securing private keys and high-value holdings. Scalability is further enhanced through sidechain storage and dispute resolution processes. Security can be reinforced with address whitelists, risk-control scripts, or multisig schemes.

Main Risks and Regulatory Considerations for Cartesi (CTSI)

- Price volatility: Crypto assets are subject to significant short-term fluctuations due to market sentiment and liquidity.

- Technical and security assumptions: Dispute resolution and PoS sidechains depend on proper implementation and honest node behavior; vulnerabilities or inadequate staking can compromise security.

- Smart contract & integration risk: Bugs in dApp components or external dependencies could result in financial or data loss.

- Compliance & regulatory changes: Varying regional regulations around token trading and staking may impact usage and compliance costs.

- Custody & private key risk: Keeping assets on exchanges exposes users to platform risk; with self-custody, lost or leaked seed phrases mean unrecoverable assets. Always prioritize security and regular backups.

How to Buy and Securely Store Cartesi (CTSI) on Gate

Step 1: Register an account on Gate and complete identity verification. Enable two-factor authentication (2FA), set a strong password, and use withdrawal address whitelists for enhanced account security.

Step 2: Fund your account. Acquire USDT via supported deposit methods or fiat purchase channels on Gate—ensure you have enough balance for orders and fees.

Step 3: Find CTSI trading pairs. Search “CTSI” in the spot trading page and select your preferred pair (e.g., CTSI/USDT). Choose between market or limit orders as needed.

Step 4: Place your order. Market orders fill instantly at current prices; limit orders wait for matching at your set price. Confirm transactions in your order history and asset overview.

Step 5: Secure storage. For long-term holding, withdraw CTSI to a self-custody wallet, back up your seed phrase offline, and use hardware wallets for large amounts. If you keep CTSI on Gate temporarily, maintain 2FA, address whitelists, and perform regular security checks.

Note: Prices and order book depth fluctuate—refer to live data on Gate for actual execution.

How Is Cartesi (CTSI) Different from Polygon (MATIC)?

Technical approach: Polygon expands Ethereum throughput mainly via sidechains and various rollup solutions; Cartesi focuses on migrating complex computation off-chain into Linux environments while securing results and temporary data through dispute resolution and PoS sidechains.

Developer experience: Polygon targets EVM-compatible ecosystems for straightforward contract migration; Cartesi lets developers use traditional Linux tools and general-purpose languages—ideal for compute-intensive logic.

Security & data storage: Polygon’s different chains have varied security models; Cartesi stores temporary data on PoS sidechains, with critical results/disputes resolved by main chain verification.

Use cases: Polygon is suited for mass-market dApps and DeFi ecosystems; Cartesi is optimized for applications needing complex computation or verifiable results such as game simulations or ML proofs.

Ecosystem scale: Polygon currently has broader adoption and higher TVL; Cartesi positions itself in specialized compute-heavy scenarios. The two are not mutually exclusive—developers can choose or combine them as needed.

Summary of Cartesi (CTSI)

Cartesi aims to bring traditional software development capabilities to blockchain by combining off-chain Linux computation with on-chain dispute resolution—delivering higher performance and improved developer experience without sacrificing decentralization or security. CTSI functions as both the network’s utility/governance token and incentive mechanism for PoS sidechains. With moderate price, supply, and market cap figures, Cartesi’s value potential depends on its fit for specific use cases and technology adoption. Prospective users should start small, understand sidechain/dispute resolution security assumptions, prioritize safe trading/self-custody practices on Gate, back up private keys securely, and monitor both project development and regulatory updates.

FAQ

What Is the Relationship Between CTSI Token and Cartesi?

The CTSI token is the native utility token of the Cartesi project—they are essentially two sides of the same coin. Cartesi is a Linux-based Layer 2 scalability solution that uses CTSI for governance and incentive purposes within its ecosystem. Holding CTSI allows users to participate in network governance, stake for rewards, or trade it on exchanges like Gate.

What Are the Main Uses of CTSI Token?

CTSI has three primary functions: governance voting (holders influence project direction), staking/mining (validators earn rewards by securing the network), and utility in dApps built on Cartesi (for payments or interactions). In short, CTSI acts as the “fuel” of the Cartesi ecosystem.

Why Choose CTSI Over Other Layer 2 Tokens?

Cartesi’s distinctive advantage lies in its Linux virtual machine architecture—developers can build blockchain applications using conventional programming languages like C or Python, lowering the barrier to entry. While other Layer 2 solutions focus mainly on transaction throughput, Cartesi prioritizes computational capacity. If you believe in the future of advanced on-chain computation, CTSI is worth considering.

What Is CTSI’s Total Supply? Is There Unlimited Issuance?

CTSI has a capped total supply of 1 billion tokens—there will be no unlimited minting. Most tokens are already circulating or locked in staking pools. The protocol uses inflationary rewards to incentivize validators but with a decreasing issuance rate over time. Up-to-date supply figures can be checked live on Gate.

What Should Beginners Know About CTSI Risks?

Main risks include:

- Technical risk—Cartesi is innovative but still building adoption; its ecosystem is evolving.

- Market volatility—as a mid/small-cap token, price swings can be significant.

- Competitive risk—other Layer 2/computation scaling projects are also developing quickly. It’s best to start small—avoid going all-in on any single token.

Glossary of Key Cartesi (CTSI) Terms

- Layer 2 Solution: A scaling technology that processes transactions outside Ethereum’s main chain to boost throughput and lower gas fees.

- Off-chain computation: Performing complex calculations off blockchain to improve efficiency while verifying results on-chain.

- Optimistic Rollup: A Layer 2 scaling solution that assumes transactions are valid unless disputed—reducing on-chain costs.

- dApp development: Creating decentralized applications using smart contracts for various use cases.

- Gas fees: Fees paid in Gwei for executing transactions or deploying contracts on Ethereum.

- Validator: Network participant who validates off-chain transactions and submits proofs to the main chain when required.

Cartesi (CTSI): References & Further Reading

-

Official Site / Whitepaper:

-

Development / Documentation:

-

Media & Research:

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?