What is GARI Token?

What Is Gari Network (GARI)?

Gari Network (GARI) is a social token designed for short-form video content creators and their audiences. Social tokens are digital assets that represent participation and rights within a platform or community, granting holders access to tipping, purchasing memberships or exclusive content, and voting on governance proposals. GARI is integrated with the Chingari app, enabling users to own and utilize assets on the blockchain, thereby enhancing creator rewards and community engagement.

What Are the Current Price, Market Cap, and Circulating Supply of Gari Network (GARI)?

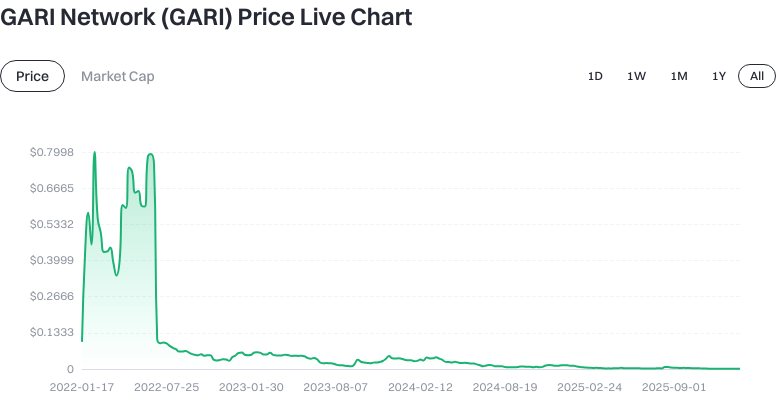

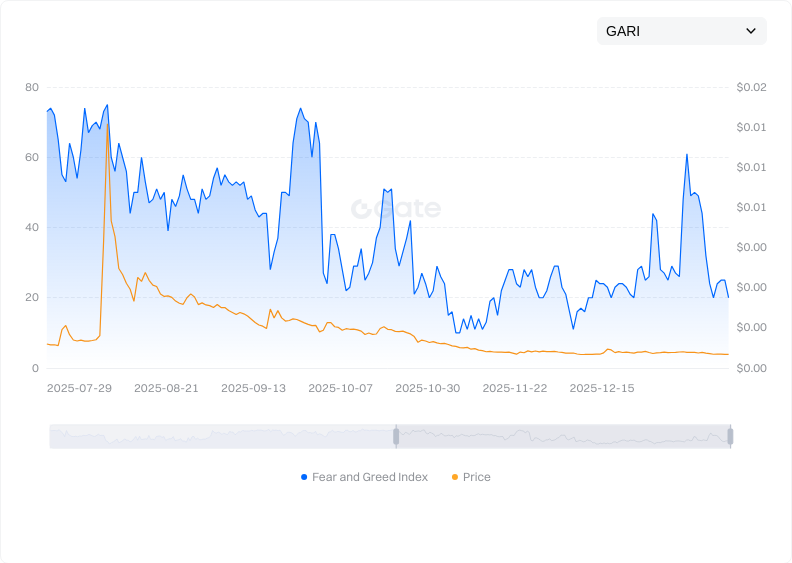

As of 2026-01-26, GARI is priced at approximately $0.001011. Its circulating market cap is around $1,008,372.18, with a 24-hour trading volume near $14,904.36. The current circulating supply stands at about 660,348,764.80 tokens, with a total supply of 997,400,772.79 and a max supply of 1,000,000,000. Recent price changes include -1.56% over the past hour, -6.64% in 24 hours, -12.01% in 7 days, and -25.77% in 30 days.

View GARI USDT Price

Market cap is calculated by multiplying the token price by its circulating supply, reflecting the total value of tokens actively traded in the market. Fully diluted market cap multiplies price by max supply, estimating potential total value once all tokens are released (subject to price and release schedule fluctuations). Data indicates high short-term volatility and low trading volume, highlighting liquidity and slippage risks.

Who Created Gari Network (GARI), and When?

GARI was launched by the Chingari short-video platform team on 2022-01-17. Its mission is to facilitate value exchange and governance between creators and viewers via blockchain technology. Previously, creators relied mainly on ad revenue or brand partnerships for monetization; GARI now provides direct tools for tipping, paid content, and community governance.

How Does Gari Network (GARI) Work?

GARI is issued and transacted on a public blockchain, allowing users to hold and transfer tokens via compatible wallets. Governance voting enables token holders to participate in decisions on platform policies such as incentive mechanisms or community fund allocation. Within the app, GARI can be used for tipping creators and unlocking exclusive content, while blockchain-based transactions ensure transparency and auditability.

Circulating supply refers to the number of tokens available for public trading; total supply is the total number issued; max supply is the protocol’s upper limit. As use cases within the ecosystem expand, demand and transaction frequency for GARI may increase—though these factors are also influenced by platform activity and incentive design.

What Can You Do With Gari Network (GARI)?

Within the Chingari app, viewers can use GARI to tip creators or purchase premium content, giving creators more direct income streams. Token holders also participate in governance votes, influencing incentive policies and community development.

For example: A creator uploads a members-only short video; viewers unlock it using GARI. Or the community initiates a vote on increasing rewards for new creators—GARI holders can join the decision process.

What Are the Main Risks and Regulatory Considerations for Gari Network (GARI)?

The primary risks are price volatility and liquidity. Data shows low 24-hour trading volume and significant short-term price swings, potentially causing large slippage during trades.

There are also smart contract and technical risks—vulnerabilities or attacks could compromise token security or functionality.

Regulatory compliance is another concern: Different countries impose specific rules on token usage and platform incentives; changing policies may impact adoption and circulation.

Finally, account and private key security are critical. Private keys control digital assets—if leaked or lost, recovery is impossible. Always enable 2FA and securely back up seed phrases offline.

What Is the Long-Term Value Proposition of Gari Network (GARI)?

Long-term value depends on growth in creator economy and Chingari platform activity. If tipping, paid content, and governance votes see increasing adoption, demand for GARI becomes more stable.

Key metrics to watch: monthly active users, creator revenue share, paid content penetration rate, governance participation levels, and token settlement volume within the app. Transparent incentives, solid user experience, and robust compliance also support long-term value.

How Can I Buy and Safely Store Gari Network (GARI) on Gate?

Step 1: Register a Gate account and complete identity verification. Visit gate.com, follow prompts to submit ID documents for KYC, and enable SMS or app-based two-factor authentication (2FA). Step 2: Fund your account. Use the “Buy Crypto” page to purchase USDT with fiat currency or deposit digital assets from another wallet into Gate, then transfer to your spot account. Step 3: Trade on the spot market. Search for GARI pairs under “spot trading,” place limit or market orders, then check your holdings and trade history once filled. Step 4: Secure storage. For long-term holding, withdraw to a self-custody wallet and back up your seed phrase offline; for short-term trading, keep funds on-platform but enable fund password, anti-phishing code, and login protection. Step 5: Ongoing risk management. Set price alerts, monitor announcements and project updates, manage position size carefully, avoid excessive leverage or emotional trading.

How Does Gari Network (GARI) Compare to Audius (AUDIO)?

Focus: GARI targets short video content and social interaction within the Chingari ecosystem; Audius specializes in music streaming for artists and listeners.

Token utility: GARI is primarily for tipping creators, unlocking premium content, and platform governance; AUDIO supports governance but also underpins node staking and network security—requiring higher technical involvement.

Adoption: GARI’s success hinges on Chingari’s user base and paid content adoption; Audius emphasizes decentralized distribution and music hosting. Both are part of the creator economy but differ in user scenarios and technical participation.

Summary of Gari Network (GARI)

Gari Network (GARI) is positioned as a social token powering the short-video creator economy—connecting tipping, paid content access, and governance voting within the Chingari app. Current data shows low price and trading volume with significant volatility; users should carefully consider liquidity risks before investing or using the token. For optimal security: register on Gate with KYC, conduct spot trading, use self-custody wallets with 2FA where possible. Long-term value will be determined by platform engagement levels, governance activity, and regulatory developments.

FAQ

How Is GARI Token Different from Standard Tokens?

GARI serves as both a governance and incentive token for the Gari Network platform—mainly rewarding creative content producers. Unlike generic tokens, GARI offers concrete utility: creators earn rewards for publishing videos while holders participate in platform decisions. This dual role drives practical value and ecosystem growth.

How Can I Obtain GARI Tokens?

There are three primary ways: buy directly from exchanges like Gate; earn as rewards by creating video content on the Gari Network platform; or receive airdrops/incentives through ecosystem activities. Beginners typically find purchasing via Gate easiest—afterwards transferring to their own wallet for safekeeping.

What Risks Should I Consider When Holding GARI Tokens?

As an emerging token, GARI’s main risks include high price volatility, potentially limited liquidity, and uncertainty around platform development. Users should also beware of market manipulation or fraudulent schemes. Only invest what you can afford to lose; always use official channels like Gate for purchases; securely store your private key and seed phrase.

What Is the Safest Way to Store GARI Tokens in a Wallet?

Storage security ranks as follows: hardware wallets (like Ledger) offer maximum safety—ideal for large amounts and long-term holding; mobile wallets are convenient but need regular updates/backups; exchange custody is most convenient but riskiest. For large holdings use hardware wallets; for small amounts or daily operations use mobile wallets—and always back up your private key and seed phrase securely.

What Is the Outlook for GARI Token’s Future Development?

GARI’s prospects depend on user growth and content ecosystem development within the Gari Network platform. If more creators and users join, demand—and therefore value—for GARI should rise accordingly. However, as a new project there are uncertainties; evaluate team strength, community engagement, and market adoption before investing—avoid chasing hype blindly.

Glossary of Key Terms Related to GARI (GARI)

- Social token: Digital asset issued by content creators or communities to incentivize user participation and interaction.

- Tokenomics model: The system governing token supply, distribution, burning mechanisms—balancing incentives with scarcity.

- Liquidity mining: The process where users provide liquidity to trading pairs in exchange for trading fees or extra token rewards.

- Governance token: A token granting holders voting rights over project decisions—enabling decentralized governance.

- Staking mechanism: Incentive structure where users lock tokens to earn rewards or participate in network validation.

References & Further Reading on GARI (GARI)

-

Official Site / Whitepaper:

-

Development / Documentation:

-

Authoritative Media / Research:

Related Articles

What Are Altcoins?

What is Blum? All You Need to Know About BLUM in 2025