What is LDO Coin?

What Is LidoDAO?

LidoDAO is the decentralized governance organization behind Lido, a leading liquid staking protocol on Ethereum. The LDO token is used for governance voting, protocol parameter adjustment, and treasury allocation. Liquid staking allows users to delegate their ETH to vetted validator operators via smart contracts; in return, users receive transferable staking receipts (stETH) that can be used or traded on-chain while continuing to earn staking rewards. It’s important to note: LDO confers governance rights, not staking yield; stETH is the asset directly tied to ETH staking.

For clarity: DAO stands for Decentralized Autonomous Organization, which enables protocol rules and treasury spending to be determined by token-holder voting. Smart contracts are self-executing programs deployed on the blockchain, ensuring transparent, automated rule enforcement without manual intervention.

LidoDAO (LDO) Price, Market Cap, and Circulating Supply

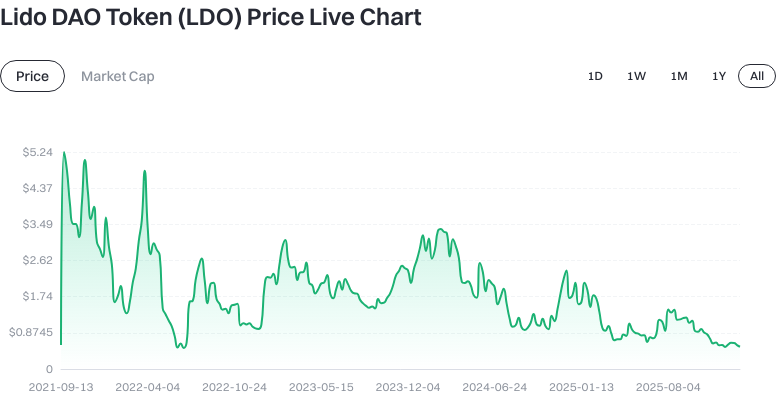

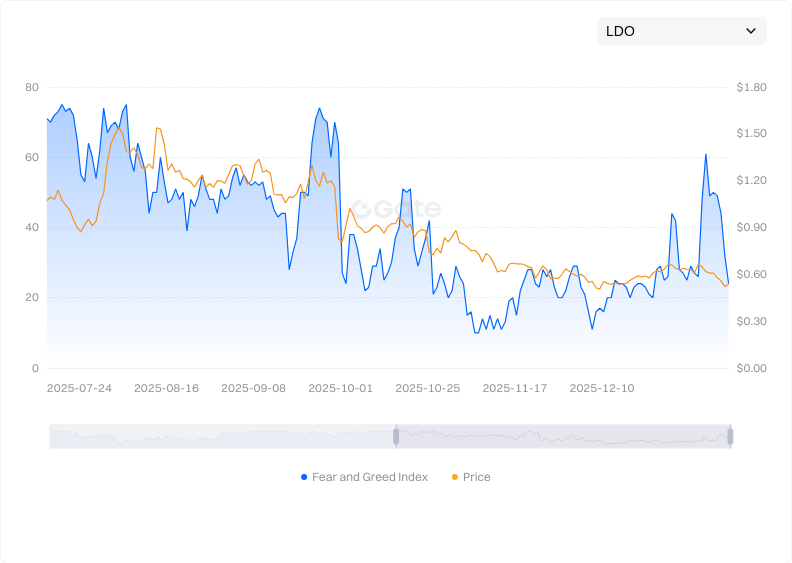

As of January 21, 2026:

- Latest Price: $0.537700

View LDO USDT Price

- Circulating Supply: 846,566,802.592789 LDO; Total Supply: 1,000,000,000; Max Supply: 1,000,000,000 (fixed cap).

- Circulating Market Cap: $537,700,000; Fully Diluted Market Cap: $537,700,000; Market Cap Share: 0.016%.

- 24h Trading Volume: $882,480.306372.

- Price Change: 1 hour +0.22%, 24 hours -3.11%, 7 days -19.59%, 30 days -2.23%.

Key Terms: Circulating supply refers to the quantity of tokens available for trading in the market; fully diluted market cap is calculated using the max supply; price change percentages reflect performance over various timeframes.

Who Founded LidoDAO (LDO) and When?

The Lido protocol was initiated by a group of early Ethereum staking service providers and developers around the transition to Ethereum PoS. Governance was subsequently transferred to LidoDAO. The LDO token was launched on January 4, 2021 (per provided data).

Background (as of October 2024): Before Ethereum’s Merge and Shanghai upgrade, Lido offered liquid staking receipts (stETH), allowing users to retain liquidity while earning staking rewards. Sources: Official Lido documentation and blog.

How Does LidoDAO (LDO) Work?

Operations can be summarized across three layers:

- User Layer: Users deposit ETH into Lido’s smart contract and receive stETH at a 1:1 ratio (less fees). stETH balances increase with staking rewards; users can utilize or trade stETH within DeFi ecosystems.

- Validator Layer: Validator operators selected through DAO governance run Ethereum validators, signing blocks and maintaining network security.

- Governance Layer: LDO holders vote on protocol parameters (such as fee rates, validator lists, treasury expenditures) and proposals (including upgrades and risk controls).

Glossary: Governance voting is the on-chain decision process for proposals; fee rate refers to the service fee charged by the protocol on staking rewards—funding node operations and treasury; treasury is the DAO-managed fund pool used for development, audits, and ecosystem incentives.

What Can You Do With LidoDAO (LDO)?

- Governance & Voting: Participate in voting on protocol parameters, validator operator changes, treasury budget allocation, risk management policies, and other proposals.

- Ecosystem Incentives & Engagement: In some cases, LDO can be used to join governance activities or earn community contribution rewards (subject to current governance arrangements).

- Risk Management Participation: Vote and oversee protocol audits, emergency responses, and upgrade pathways to enhance transparency.

Note: Staking rewards are earned by holding stETH and utilizing it within the ecosystem—not by holding LDO.

Key Risks and Regulatory Considerations of LidoDAO (LDO)

- Price Volatility: As a crypto asset, LDO may experience rapid price fluctuations; prudent position sizing and risk management are advised.

- Protocol & Smart Contract Risks: Even with audits, smart contracts may have undiscovered vulnerabilities or runtime exceptions that could affect stETH or governance operations.

- stETH/ETH Peg Risk: During extreme market conditions, stETH may deviate from ETH’s price, impacting liquidity expectations and capital usage.

- Governance Concentration & Voting Risk: If tokens are concentrated among few addresses, governance may skew toward specific interests; low voter participation can also degrade governance quality.

- Regulatory Uncertainty: Regulations around staking services, governance tokens, and yield distribution are evolving worldwide—potentially affecting protocol operation or token compliance.

- Exchange & Account Security: Enable platform security features when storing assets on exchanges; for self-custody wallets, securely store mnemonic phrases and private keys to avoid phishing and malicious links.

Long-Term Value Proposition of LidoDAO (LDO)

Long-term value is primarily driven by Ethereum staking demand, Lido’s market share, and protocol sustainability:

- Demand Side: ETH PoS staking rewards and network security needs fuel stETH use cases—indirectly boosting interest in the broader Lido ecosystem.

- Governance Value: LDO holders determine fee rates, validator governance, and treasury spending—making governance rights valuable for coordination and resource allocation.

- Ecosystem Synergy: As stETH’s utility in DeFi grows, network effects intensify and the strategic value of governance tokens increases.

Reference: As of October 2024, public sources indicate no direct protocol revenue distribution to LDO holders—the token’s value is more closely tied to governance expectations and ecosystem growth. Sources: Lido documentation and community governance discussions.

How to Buy and Safely Store LidoDAO (LDO) on Gate

Step 1: Register an account on gate.com and complete identity verification. Use accurate personal information to ensure compliance.

Step 2: Enable account security features. Activate two-factor authentication (2FA), set anti-phishing codes and withdrawal whitelists to strengthen login and withdrawal safety.

Step 3: Deposit funds. You can buy USDT via fiat gateways or transfer USDT/ETH from other wallets into your Gate account. Double-check network and address on the deposit page to avoid unrecoverable asset losses due to chain mismatch.

Step 4: Find the trading pair. Go to the spot trading section, search “LDO,” select the LDO/USDT pair; review order book depth and recent trades to assess slippage and fees.

Step 5: Place your order. Market orders execute quickly; limit orders let you set preferred prices. Consider splitting purchases over several orders according to your investment plan to avoid overexposure. Verify order details before confirming.

Step 6: Secure storage. For long-term holding, consider withdrawing to a self-custody wallet (supporting Ethereum ERC-20). Safeguard mnemonic phrases and private keys—do not photograph or screenshot them online; test small withdrawals before transferring large amounts.

Step 7: Ongoing management. Set price alerts and define take-profit/stop-loss strategies; monitor LidoDAO governance announcements and risk updates regularly. For on-chain governance participation, always verify official contract addresses and signature details to avoid phishing sites.

Comparison Between LidoDAO (LDO) and RocketPool

- Token Functionality: LDO is primarily used for governance voting and parameter decisions; RocketPool’s RPL serves as collateral for node operators—integral to risk sharing and protocol security.

- Node Model: Lido relies on a curated group of validator operators selected through governance for professionalism and performance; RocketPool adopts an open decentralized node approach allowing regular users to run small-scale nodes.

- Staking Receipt Tokens: Lido issues stETH; RocketPool issues rETH. Both represent staking claims but differ in fee structures and re-staking strategies.

- Risk Profile: Lido faces risks from governance centralization and validator selection concentration; RocketPool’s open node system brings more decentralization but shifts risk considerations toward individual node requirements and collateral mechanisms.

- Use Cases: Both receipt tokens are integrated into DeFi protocols—their specific utility depends on protocol support and fee policies.

In summary, while both serve Ethereum staking needs, differences in token design and operational models lead to distinct approaches to value accrual and risk management.

Summary of LidoDAO (LDO)

LidoDAO empowers Ethereum users with transferable staking receipts (stETH) through liquid staking; its governance token (LDO) facilitates protocol parameter setting and fund allocation—not direct staking reward distribution. Current market data reflects dynamic price updates and supply structure; investors should focus on governance progress, fee policies, and stETH’s DeFi utility. For operations, follow Gate’s standard procedures—activate account security, verify contract addresses, and securely store private keys—to minimize trading and custody risks. Comparing RocketPool highlights differences in token utility and node architecture—driving distinct risk profiles and value drivers. Practical advice includes staged buying strategies, monitoring governance updates/audit reports, careful mnemonic/private key storage for self-custody wallets, and adapting strategies as regulations or markets evolve.

FAQ

What Is the Relationship Between LDO Token and Ethereum Staking?

LDO is the governance token of the Lido protocol. Lido enables users to participate in Ethereum staking without needing the full 32 ETH minimum. Holding LDO gives you voting power over major protocol decisions—such as fee adjustments or new feature launches. In short, LDO represents your voice in the Lido ecosystem’s governance—not direct staking rewards.

What Do I Receive When I Stake ETH with Lido?

You receive an equivalent amount of stETH—a receipt token representing your staked ETH position. stETH can be used across DeFi applications while continuing to earn Ethereum staking rewards—it’s essentially “dual-purpose.” When you wish to withdraw, you can exchange stETH back for ETH with full transparency throughout the process.

What Yields Do LDO Holders Receive?

LDO is strictly a governance token—its primary value lies in influencing protocol decisions rather than direct yield generation. However, by voting on proposals such as fee allocations or development initiatives, holders can indirectly benefit from protocol growth. For actual staking rewards, you should hold stETH instead of LDO.

How Can Beginners Quickly Start Using Lido?

Visit the official Lido website, connect your wallet (MetaMask and other major wallets supported), enter your desired ETH staking amount, then click stake. The system automatically assigns your funds to validator nodes—the whole process takes just a few minutes. After receiving stETH, you can immediately trade it on Gate or use it in DeFi applications like Aave for borrowing/lending.

Is It Worth Holding LDO Long-Term?

LDO’s value depends on Lido’s significance within the Ethereum ecosystem. As the largest liquid staking protocol—with over a third of all Ethereum staked—Lido’s governance carries considerable weight. However, remember that LDO itself does not produce direct income; its value is purely as a governance token whose long-term prospects hinge on Ethereum’s growth trajectory and market sentiment.

Essential Terms Related to Lido (LDO)

- Liquid Staking: A method enabling users to stake assets for rewards while retaining liquidity through transferable receipt tokens usable across DeFi.

- stETH: Receipt token issued by Lido for ETH staked—representing your share in Ethereum’s Beacon Chain.

- Beacon Chain: The proof-of-stake consensus layer of Ethereum 2.0 where users stake ETH for network validation/security.

- Staking Rewards: Incentives earned by validators participating in blockchain consensus—paid out as newly minted tokens or transaction fees.

- DAO Governance: Decentralized decision-making process via holding/voting with LDO tokens—shaping protocol direction through community proposals.

- Ethereum Ecosystem: The collective of applications/protocols built atop Ethereum; Lido leads liquid staking solutions within this ecosystem.

Reference & Further Reading on Lido DAO (LDO)

-

Official Website / Whitepaper:

-

Development / Documentation:

-

Authoritative Media / Research:

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?