What is M Coin Price?

What Is MemeCore?

MemeCore is a foundational public blockchain, or Layer 1 network (Layer 1), meaning it operates as an independent blockchain mainnet, directly processing transactions and smart contracts without relying on any external chains. MemeCore serves the concept of "Meme 2.0," aiming to transition meme coins from short-term speculation to a community-driven, sustainable cultural economy. Its core innovation is the "viral economy" model, which factors both content virality and on-chain activity into value distribution—enhancing the long-term sustainability of its ecosystem.

To clarify: Meme coins are tokens originating from internet culture, often centered around communities or cultural symbols. The viral economy refers to mechanisms designed to create positive feedback loops between content sharing and on-chain engagement, rewarding participants for contributing to both hype and network activity.

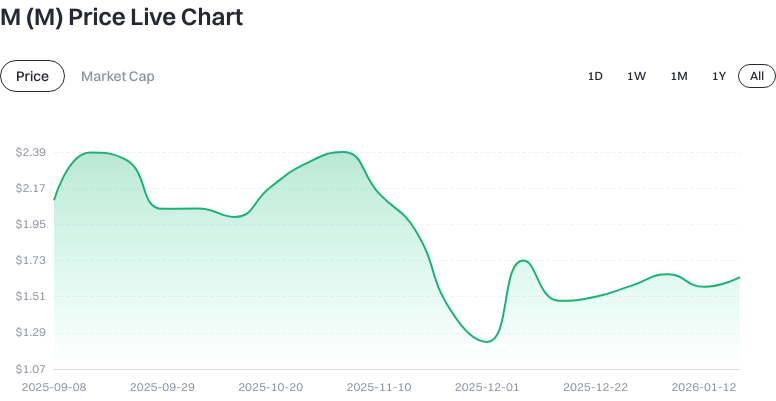

Current Price, Market Cap, and Circulating Supply of MemeCore (M)

As of 2026-01-21 (according to input data), key metrics for MemeCore (M) are as follows:

- Latest Price: $1.626900 per token.

- Circulating Supply: 1,677,276,215.823528 M, representing the number of tokens currently available in the market.

- Total and Max Supply: 5,000,000,000 M, indicating a fixed maximum issuance of 5 billion tokens.

- Circulating Market Cap: $8,134,500,000, calculated as price times circulating supply; measures the current market value in circulation.

- Fully Diluted Valuation (FDV): $8,134,500,000, representing the theoretical market cap if all tokens were released.

- Market Cap Share: 0.25%, showing its proportion relative to the overall crypto market.

- 24-Hour Trading Volume: $190,297.404030, indicating recent trading activity.

Click to view M/USDT Price

- Price Change: 1 hour +0.19%, 24 hours -3.72%, 7 days +0.71%, 30 days +13.18%.

Click to view Latest M Price Data

Note: The input data shows "Active Status: No," which may indicate low trading or network activity, or a difference in data reporting standards. Always verify with official announcements and on-chain explorers before investing.

Who Created MemeCore (M) and When?

MemeCore launched on 2025-07-06 (based on input data). It is positioned as a Layer 1 blockchain specifically built for the "Meme 2.0" era, focusing on deeply integrating community culture with on-chain economic activities.

For detailed information about the founding team, funding rounds, and advisory board, refer to official sources such as the website, whitepaper, and community updates. Keep an eye out for future announcements and audit reports.

How Does MemeCore (M) Work?

MemeCore’s operation can be understood across three primary layers:

-

Consensus & Execution Layer: As a Layer 1 network, MemeCore manages transaction ordering, block production, and smart contract (smart contract) execution. Its consensus mechanism allows network nodes to agree on block contents for enhanced security and decentralization. While the specific consensus algorithm has not been disclosed, it may be similar to popular models like Proof of Stake (PoS), but official documentation should be consulted.

-

Economic & Incentive Layer: The "viral economy" rewards two types of contributions—content virality and on-chain transactional activity. This model quantifies both social interactions (likes, shares, discussions) and blockchain operations (transfers, minting, trades) as measurable contributions that earn M rewards through contracts or incentive programs.

-

Application & Tools Layer: Designed for creators, communities, and project teams, this layer offers essential features for asset issuance, trading, and governance. Smart contracts enable programmable rules that execute automatically, reducing the need for trust between parties.

Example: A creator releases a meme that garners high engagement; community members actively trade related assets on-chain. Both forms of participation boost network activity and content virality, resulting in M token rewards according to set rules.

What Can MemeCore (M) Be Used For?

- Paying On-chain Transaction Fees (Gas): Like most public blockchains, all transactions or contract executions require gas fees—M serves as the network’s utility token.

- Participating in Ecosystem Incentives: If the viral economy program is open to creators and users, contributing to content virality or on-chain behavior earns M rewards, incentivizing participation and output.

- Issuing & Trading Meme-related Assets: Project teams or communities can issue tokens or NFTs on-chain for cultural engagement, fan privileges, or event access.

- Community Governance: If governance mechanisms are implemented in the protocol, holding M may grant proposal and voting rights to help determine parameters or allocate funds.

What Is the Long-term Value Proposition of MemeCore (M)?

Long-term value depends on the interplay between supply and demand dynamics, network effects, and real-world ecosystem adoption:

- Supply Structure: With a fixed maximum supply of 5 billion tokens, MemeCore establishes a predictable scarcity boundary. Investors should also monitor vesting schedules and token distribution to assess potential sell pressure.

- Demand Drivers: If the viral economy effectively converts content hype into on-chain utility, MemeCore can establish a closed loop of content sharing and trading—driving real demand for transactions and content creation.

- Network Effects: More creators and communities increase content supply; more users interacting and trading drive up demand. Strengthening both sides can power an ecosystem flywheel—the key lies in transparent and verifiable mechanisms.

- Observable Metrics: Number of active addresses, daily transactions, gas fee revenue, contract interactions, content virality index, ecosystem project count, and retention rate.

Click to view M Contract Open Interest

These indicators help gauge real-world adoption.

Main Risks and Regulatory Considerations for MemeCore (M)

- Market Volatility Risk: Prices and volumes fluctuate significantly; short-term changes do not always indicate long-term trends.

- Technology & Network Stability: As a new blockchain network, risks include node failures, congestion, smart contract vulnerabilities, and possible outages. Follow audit results and emergency protocols.

- Mechanism Implementation Risk: If the viral economy’s measurement or distribution methods lack transparency or are vulnerable to manipulation (e.g., wash trading), incentive effectiveness and fairness may be compromised.

- Regulatory & Compliance Risk: Token issuance, trading activities, and taxation are regulated differently across jurisdictions—compliance with local laws is essential.

- Exchange & Account Security: Centralized platforms can be targets for attacks or withdrawal delays; personal accounts should enable two-factor authentication and beware of phishing links.

- Wallet & Private Key Security: Non-custodial wallets require secure storage of seed phrases and private keys—keep them offline to avoid cloud leaks.

How Can I Buy and Safely Store MemeCore (M) on Gate?

Step 1: Register & Complete KYC. Sign up at Gate (gate.com), complete identity verification for enhanced account security and withdrawal limits.

Step 2: Fund Your Account. Deposit fiat currency or stablecoins like USDT; double-check deposit networks and confirmations.

Step 3: Find the Trading Page. In the spot section, search “M” or “MemeCore.” Confirm contract address and project branding to avoid lookalike tokens.

Step 4: Select Trading Pair & Place an Order. Choose pairs like M/USDT based on listings. Use market orders for instant execution or limit orders to set buy prices; review fees and minimum order amounts before submitting.

Step 5: Risk Assessment. Analyze price trends as of “2026-01-21” alongside official announcements—evaluate liquidity, slippage risk, and consider dollar-cost averaging rather than going all-in during volatile periods.

Step 6: Withdraw & Confirm On-chain Transfer. For self-custody, navigate to withdrawals, enter your wallet address and select the correct network (must match your wallet’s supported networks). Perform a small test withdrawal first.

Step 7: Wallet Security Setup. Safeguard your seed phrase and private key—preferably write them down offline and store separately; enable two-factor authentication and withdrawal whitelist on your exchange account for added protection.

How Is MemeCore (M) Different from Solana?

- Purpose & Focus: MemeCore is built around a “viral economy,” merging content virality with on-chain transactions to serve meme culture; Solana targets general-purpose high-performance use cases in DeFi, NFTs, gaming, etc.

- Token Supply Model: M has a fixed max supply of 5 billion; Solana’s SOL has no maximum cap and uses a decreasing inflation model (according to public data). These different supply mechanisms impact long-term scarcity and issuance rates.

- Incentive Model: M emphasizes dual incentives—rewarding both virality and on-chain actions; Solana’s ecosystem does not have a native “viral economy” protocol—the incentive design is application-specific.

- Ecosystem Maturity: Solana already offers mature developer tools, infrastructure services, and major dApps; MemeCore’s ecosystem growth rate and developer retention remain to be observed as a newer chain.

- Technical Priorities: Solana is known for high throughput and low latency; details on MemeCore’s technical architecture and consensus mechanism have not been disclosed—refer to official docs for specifics.

In summary: MemeCore specializes in cultural economy features; Solana pursues general performance optimization. Choose based on your own goals and risk tolerance.

Summary of MemeCore (M)

MemeCore is positioned as a Layer 1 blockchain for the "Meme 2.0" era—aiming to create a sustainable value loop by linking content virality with on-chain transaction activity through its “viral economy” model. Its current metrics show transparent pricing, supply caps (5 billion max), and market boundaries. Long-term value will depend on transparent incentive mechanisms, real-world adoption of ecosystem projects, and genuine participation from both users and creators. For trading operations on Gate, follow step-by-step security protocols—use self-custody wallets where needed and safeguard private keys diligently. Looking ahead, keep tracking active addresses, transaction counts, fee revenues, content virality metrics, official announcements, audit results—and continually assess both technical soundness and regulatory developments.

FAQ

What Factors Influence M Token Price Fluctuations?

The price of M tokens is primarily driven by supply-demand dynamics in the market, overall crypto sector trends, project developments, and community sentiment.

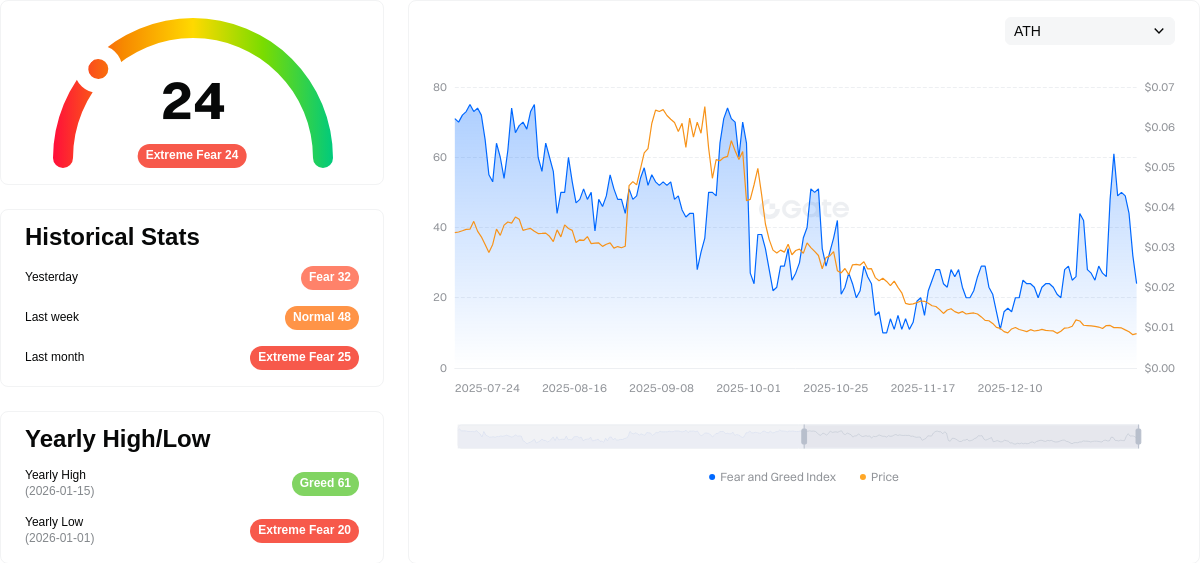

Click to view Crypto Market Fear & Greed Index

When Bitcoin or other leading cryptocurrencies rise in price, M typically follows suit; conversely when they decline. Key project announcements or ecosystem updates can also create short-term price impacts—newcomers should avoid chasing pumps or panic selling during dips.

How Can I Track Real-time Prices for M Token?

You can monitor real-time prices via platforms such as Gate, CoinMarketCap, or CoinGecko. Gate provides updated charts and order book depth; CoinMarketCap and CoinGecko aggregate prices across global exchanges for comparison. It’s best practice to check multiple sources for more accurate pricing references.

What’s the Difference Between M Token Price and Market Cap?

The token price reflects the current trading value of a single M token. Market cap is the total value of all circulating M tokens (price × circulating supply). Market cap offers a clearer picture of a project’s scale and market acceptance—while price can be volatile day-to-day, market cap tends to be more stable over time. Investors should focus more on market cap rankings rather than just absolute price levels.

Can M Token Price Drop to Zero?

All digital assets face some risk of becoming worthless—including M tokens. Major price crashes often result from team issues, severe security incidents, or extremely negative market sentiment. However, MemeCore benefits from a clear technical vision and an active community base—which helps manage risk better than many speculative projects. Only invest funds you can afford to lose; avoid leverage.

When Should Beginners Buy M Tokens?

There is no universally “optimal” entry price—this falls under investment advice territory. A more disciplined approach is dollar-cost averaging (DCA): accumulate small amounts periodically rather than making large lump-sum purchases. Learn how to read candlestick charts on Gate first—understand support/resistance concepts—and align your strategy with your risk tolerance and financial plan.

Glossary of Key Terms Related to M Token (M)

- Circulating Supply: The number of tokens that have been issued and are actively trading in the market—used in real-time market cap calculations.

- Fully Diluted Valuation (FDV): The projected market capitalization if all tokens were in circulation—reflects maximum theoretical value.

- Market Cap Share: The percentage that this token’s market cap represents out of the entire cryptocurrency sector—indicates its overall importance.

- Price Change Percentage: The percent change in token price over specified timeframes—captures short-term or long-term price trends.

- Trading Volume: The total value traded within a 24-hour period—signals market activity level and liquidity.

Further Reading & References for M Coin (M)

-

Official Website / Whitepaper:

-

Development / Documentation:

-

Trusted Media / Research:

Related Articles

What Are Altcoins?

What is Blum? All You Need to Know About BLUM in 2025