What is SLP Coin?

What Is Smooth Love Potion (SLP)?

Smooth Love Potion (SLP) is a utility token used within the Axie Infinity blockchain game. Its primary function is to facilitate the breeding of Axie characters and to reward players for completing battles or missions. SLP operates on Ethereum’s ERC-20 standard, meaning its issuance, transfers, and balance management are governed by smart contracts. Smart contracts are self-executing programs deployed on the blockchain that operate according to preset rules, reducing the need for manual intervention.

Within the game’s ecosystem, SLP’s supply and consumption directly impact its price: increased player activity typically leads to more SLP being minted, while heightened breeding demand results in more SLP being burned. As such, SLP acts as a “functional voucher” closely tied to game engagement, freely traded on-chain yet influenced by game economic design.

SLP Token Price, Market Cap, and Circulation Overview

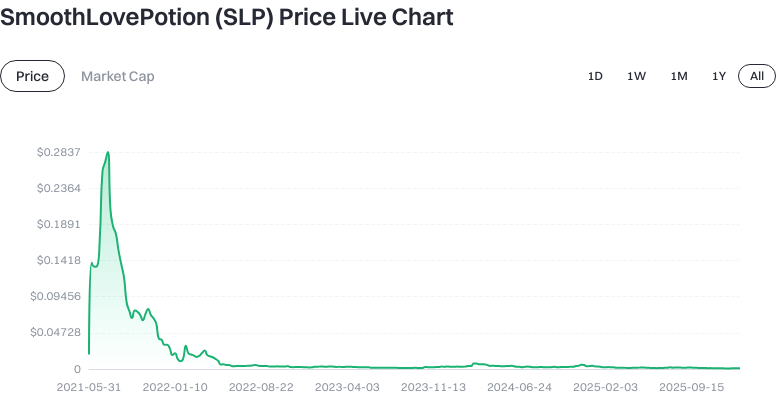

As of January 21, 2026, based on provided input data: the latest price is approximately $0.000911; circulating supply stands at about 36,445,941,616 tokens; total and max supply are both around 41,361,680,703 tokens; market cap is roughly $37,672,218.78; fully diluted market cap matches at $37,672,218.78; market cap dominance is approximately 0.0011%; and 24-hour trading volume is about $38,902.82.

Click to view SLP USDT Price

In terms of short-term price movements: the 1-hour change is about -0.85%, the 24-hour gain is approximately 2.27%, the 7-day increase is around 3.36%, and the 30-day gain is about 18.37%. (Source: User input, date: 2026-01-21)

Click to view Latest SLP Price Data

Glossary:

- Circulating supply refers to the number of tokens currently available for trading in the market.

- Total supply is the total amount of tokens issued, not all of which may be circulating.

- Max supply is the theoretical limit set by the project.

- Market cap equals price times circulating supply and measures relative size.

- Fully diluted market cap assumes all tokens are released (price times max supply).

- Trading volume reflects transaction activity within a set period.

Who Created Smooth Love Potion (SLP) and When?

SLP was developed alongside Axie Infinity by the Sky Mavis team, with its launch date recorded as March 18, 2021 (based on input data). During the rise of “Play-to-Earn,” players could earn SLP through battles and use it for breeding Axies or trading on exchanges—establishing a closed-loop GameFi economy. As game balance and economic models evolved, SLP’s issuance and burning strategies have undergone iterations.

How Does Smooth Love Potion (SLP) Work?

SLP adheres to the ERC-20 standard and leverages Ethereum smart contracts for recording and settlement. ERC-20 defines a set of common token interfaces, ensuring wallets and exchanges can universally recognize and manage tokens.

At the gameplay level, players “mint” new SLP through battle activities; breeding Axies requires “burning” SLP (token destruction). This dual-sided supply-and-demand mechanism links token quantity to game activity.

On the trading side, users buying or selling SLP on platforms must pay gas fees—the network fees for on-chain transactions—and verify contract addresses to avoid fake tokens. Some blockchain games use sidechains or dedicated expansion networks to boost speed and reduce costs; always follow official guides when transferring across networks.

What Can Smooth Love Potion (SLP) Be Used For?

-

Breeding Axie characters—the core use case for SLP—which directly determines new character output within the game.

-

Player rewards—users earn SLP by participating in battles or missions under specific rules, creating a “participation-reward-consumption” loop.

-

Market trading and asset management—players or investors can buy/sell SLP on exchanges or transfer it into personal wallets for safekeeping or future use.

In practice, if a season’s event increases breeding demand, SLP consumption rises and may temporarily impact price and supply. Conversely, a drop in active players or insufficient consumption may dampen market expectations.

What Are the Main Risks and Regulatory Considerations for Smooth Love Potion (SLP)?

- Price volatility risk: SLP’s price is closely tied to game activity as well as its minting and burning strategy—short-term fluctuations can be substantial.

- Economic model changes: Adjustments to rewards or breeding rules by developers can shift supply-demand dynamics and token outlook.

- Smart contract and cross-network risks: Contract vulnerabilities, fake addresses, and technical risks from cross-chain or sidechain bridges can lead to asset losses.

- Compliance and taxation: Crypto asset regulation varies by region; trading/transfers may require tax reporting or face restrictions.

- Platform/account security: Trading platforms carry market and operational risks—enable two-factor authentication for accounts; private key leaks result in irreversible asset loss. Input data indicates “Active: No,” meaning some tracking platforms may flag SLP as inactive—always verify contract addresses, trading pairs, and network status before transacting.

What Is the Long-Term Value of Smooth Love Potion (SLP)?

SLP’s long-term value depends on Axie Infinity’s player base size, breeding demand, reward mechanism stability, and ongoing content updates. If the ecosystem continues to attract new players and events drive up breeding consumption, SLP’s utility and demand will remain robust. On the other hand, declining engagement or excessive inflationary changes may pressure its value.

From a tokenomics perspective, clear burn pathways, predictable issuance schedules, and transparent governance communications help mitigate uncertainty. For beginners, monitor seasonal events, breeding costs, mint/burn statistics, community engagement levels, and development roadmaps.

How Do I Buy and Safely Store Smooth Love Potion (SLP) on Gate?

Step 1: Register a Gate account and complete KYC identity verification to unlock higher limits and security features.

Step 2: Deposit funds. Navigate to Gate’s “Deposit” page to purchase fiat currency or deposit USDT for SLP trading.

Step 3: Search for trading pairs. In Gate’s spot market, search “SLP,” confirm token name and contract details, then select an appropriate pair (e.g., SLP/USDT).

Step 4: Place an order. Choose limit or market orders based on price and quantity; after execution, check your SLP holdings under account assets.

Step 5: Secure storage. For short-term trading, keep assets in your Gate account with fund password and two-factor authentication enabled; for long-term holding, transfer to a self-custody wallet (such as an Ethereum-compatible wallet), securely storing your seed phrase and private key.

Step 6: Network and contract verification. When withdrawing funds, confirm the network (e.g., Ethereum mainnet) and target address—test with small amounts before larger transfers to avoid errors.

Step 7: Risk management settings. Enable login/withdrawal protections and price alerts for your account; routinely review security settings and stay updated with project announcements or maintenance notices.

How Is Smooth Love Potion (SLP) Different from AXS?

- Use case distinction: SLP is a utility token mainly used for breeding and player rewards; AXS serves as a governance token for voting on project decisions and capturing ecosystem value.

- Value drivers: SLP’s demand responds directly to breeding/game activity; AXS value is more linked to governance rights, staking, and ecosystem growth.

- Supply mechanisms: SLP minting/burning adapts flexibly to game rule changes; AXS typically has clearer release schedules and vesting arrangements. Their prices may react differently to events—newcomers should assess each separately.

- Participation modes: Players interact with SLP directly for breeding or rewards; governance participation or long-term support generally uses AXS.

Summary of Smooth Love Potion (SLP)

SLP is Axie Infinity’s utility token built on Ethereum ERC-20; its supply-demand loop is shaped by breeding consumption and player rewards. Current data places its price, supply, and market cap in mid-small scale ranges, with some trackers marking it as inactive—thorough verification is essential before transacting. Long-term value hinges on game engagement and economic model stability; short-term volatility is driven by issuance/burning cycles, events, and market sentiment. For newcomers buying via Gate: always verify contract/network details, activate account security features, securely store private keys, track game-related needs and information transparency—and manage positions/diversification prudently.

FAQ

What Is the Main Use of SLP Tokens?

SLP is Axie Infinity’s in-game utility token—players earn it through battles or breeding activities. SLP enables breeding of new Axie NFT characters and can be traded for other cryptocurrencies or fiat on exchanges. In essence, SLP serves as “proof of work” within the game—transforming gameplay into real-world earnings.

How Can Beginners Start Using SLP?

First install a crypto wallet such as MetaMask. Purchase SLP tokens on Gate or similar exchanges and transfer them into your wallet. To earn SLP through Axie Infinity gameplay, you’ll need three starter Axie NFT characters (which can be costly). Beginners should first buy SLP on exchanges to understand its features before deciding whether to enter the gaming ecosystem.

Why Is SLP Price So Volatile?

SLP’s price fluctuates due to several factors: shifts in game popularity, new player influxes, broader market trends, and large holder sell-offs. When game appeal drops or new player growth slows while SLP output remains high, prices tend to fall—a typical GameFi token trait with high volatility; invest cautiously.

How Should I Choose Between SLP and AXS Tokens?

SLP and AXS are two distinct tokens within the same ecosystem. AXS is a governance token representing project ownership/voting rights with limited supply; SLP is a high-volume utility token used for in-game rewards with greater price volatility. If you’re bullish on long-term project growth consider AXS; for short-term play-to-earn opportunities SLP offers direct access. Both can complement investment strategies.

What Security Precautions Should I Take When Holding SLP?

Private key management and wallet security are critical. Use hardware wallets (such as Ledger) for storing large amounts of SLP—avoid keeping tokens on exchanges long term. Beware of phishing sites and malicious contracts—only transact via official channels. Regularly back up your private key/seed phrase in an offline environment to prevent theft or loss.

Smooth Love Potion (SLP) Glossary

- Game token: Crypto asset used for in-game rewards/trading earned via gameplay.

- Axie Infinity: The blockchain gaming platform where players earn SLP through battling/breeding virtual pets.

- Play-to-Earn: A model where players receive crypto asset rewards with real-world value for gameplay.

- Tokenomics: Design of token supply/distribution/use cases to maintain ecosystem health/stability.

- Liquidity mining: Users provide liquidity to trading pairs for transaction fees/additional token incentives.

- Blockchain game: Game built on blockchain technology where player assets are on-chain with true ownership/tradeable value.

Smooth Love Potion (SLP) References & Further Reading

-

Official Website / Whitepaper:

-

Development / Documentation:

-

Trusted Media / Research:

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?