What is Tfuel?

What Is Theta Fuel (TFUEL)?

Theta Fuel (TFUEL) is the utility token of the Theta Network, designed to facilitate payments for on-chain transaction fees (commonly known as gas fees), bandwidth, and storage costs needed for video and content distribution. TFUEL also serves as a reward for nodes contributing resources to the network. The mainnet refers to the live blockchain environment, where TFUEL acts as the "fuel" for transaction execution and settlement. It works in tandem with Theta (THETA), which focuses on governance and staking functionalities.

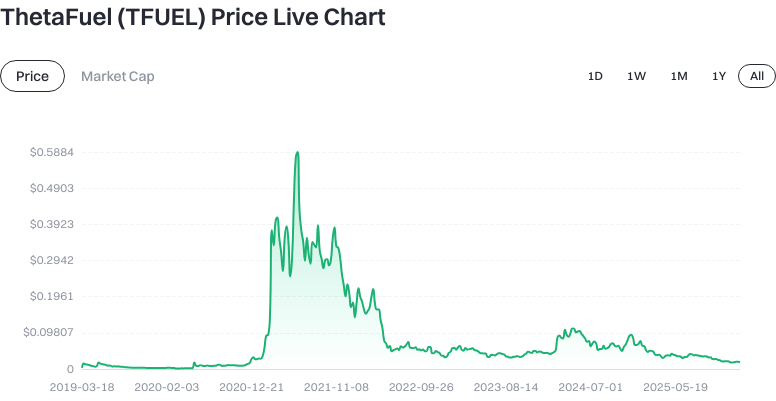

Current TFUEL Price, Market Cap, and Circulating Supply

As of January 21, 2026, TFUEL is priced at approximately $0.018290. The circulating supply stands at 7,201,460,230 tokens, with a total supply of 7,201,546,072 tokens. The market capitalization is about $131,716,277.66, with a fully diluted valuation of roughly $131,716,277.66 and a market share of approximately 0.0041%.

View TFUEL USDT Price

Short-term price movements: +0.16% (1 hour), -3.38% (24 hours), -8.23% (7 days), +4.68% (30 days); 24-hour trading volume is around $17,000.08.

The circulating supply represents tokens currently available for trading; the total supply is the overall number of tokens issued. Fully diluted market cap is calculated by multiplying current price by total supply. In this case, the fully diluted and circulating market caps are close, indicating most tokens are already in circulation. The maximum supply is shown as “∞”, meaning there is no hard cap and supply may adjust according to network mechanisms. All figures may fluctuate with market conditions.

Who Created Theta Fuel (TFUEL) and When?

TFUEL was launched by the Theta Labs team alongside the Theta mainnet as part of Theta’s dual-token system. The early version of the mainnet went public around 2019, and TFUEL was airdropped to THETA holders at a ratio of 1 THETA:5 TFUEL to support initial network usage and incentivize participation (Source: Theta Labs public documentation; official release dates apply).

How Does Theta Fuel (TFUEL) Work?

TFUEL powers transaction execution and content distribution fee settlement. Users pay TFUEL for on-chain transfers, smart contract calls, or for bandwidth and storage consumed in decentralized video distribution. Gas fees refer to the cost required to process actions on-chain, incentivizing nodes to handle data.

Theta Network utilizes a dual-token model: THETA handles staking and governance to ensure network security and consensus, while TFUEL is used for payments and settlements as operational fuel. Nodes—devices or programs that contribute computing power, bandwidth, or storage—are rewarded with TFUEL for relaying and caching data. A portion of network fees is burned (destroyed), permanently removing tokens from circulation to offset inflation caused by new issuance. Inflation occurs when token supply grows over time, potentially reducing purchasing power; burning helps balance supply and demand.

What Can You Do with Theta Fuel (TFUEL)?

TFUEL can be used to pay transaction fees and smart contract execution costs on-chain, ensuring smooth interactions. In decentralized video and content distribution scenarios, TFUEL settles bandwidth and storage expenses—for example, micro-payments during high-quality livestream viewing. Creators and platforms use TFUEL for tipping and settlements, lowering barriers for cross-border payments. Node operators earn TFUEL rewards by caching and relaying content, aligning resource contribution with compensation.

Wallets and Ecosystem Extensions for Theta Fuel (TFUEL)

Theta offers official web-based and mobile wallets for standard users to send/receive TFUEL and manage assets. Users can also run EdgeNodes or participate in content caching/distribution to enhance ecosystem utility and earn rewards. Blockchain explorers allow users to check wallet balances, transaction hashes, and block data for tracking funds and transaction status. Wallets provide mnemonic phrases or private keys; a mnemonic phrase is a sequence of words used to recover a wallet and should be securely stored offline to prevent leakage.

Key Risks and Regulatory Considerations for Theta Fuel (TFUEL)

Price volatility risk: Crypto asset prices are influenced by liquidity and market sentiment, often resulting in significant short-term fluctuations.

Technical & contract risk: Vulnerabilities in smart contracts or node software may impact fund security or service availability. Supply mechanism risk: The lack of a hard cap on maximum supply introduces inflation risk; users should monitor burn rates and network usage. Regulatory uncertainty: Compliance requirements vary across regions; always adhere to local laws regarding ownership and reporting. Platform & counterparty risk: Centralized custody or weak account security may lead to asset loss; enable two-factor authentication, diversify holdings, and back up your private key promptly.

How to Buy and Safely Store Theta Fuel (TFUEL) on Gate

Step 1: Register & verify identity. Visit Gate’s official site to create an account, complete email or phone verification, and follow KYC instructions.

Step 2: Deposit funds. Use Gate’s supported channels to deposit fiat or stablecoins like USDT; check the platform for up-to-date deposit methods and fees.

Step 3: Search trading pairs. In Gate’s spot market, search for “TFUEL” to find TFUEL/USDT pairs; review price and market depth info.

Step 4: Place an order. Choose a market order (executes at current price) or limit order (sets your own price), enter the buy amount, confirm your order.

Step 5: Withdraw to your wallet. For greater control over your assets, withdraw purchased TFUEL to your personal wallet. Copy your wallet address, enter it along with withdrawal amount on Gate’s withdrawal page; double-check network details and fees before submitting.

Step 6: Secure storage. Write down wallet mnemonic phrases offline using pen/paper—avoid photos or cloud storage; enable two-factor authentication for both wallet and account; consider cold storage options for large assets to minimize online risks.

Step 7: Ongoing review. Regularly check transaction records and balances; during major market moves, assess your positions and risk tolerance—use batch trading when necessary to avoid concentrated transactions.

How Is Theta Fuel (TFUEL) Different from Theta (THETA)?

Role distinction: TFUEL is "fuel" for payment and settlement; THETA focuses on governance and staking, securing network consensus. Use case differences: TFUEL covers gas fees, bandwidth/storage costs, rewards nodes; THETA is for governance participation and node staking. Supply mechanisms: TFUEL has no hard maximum supply cap—its issuance/burning can dynamically adjust; THETA generally operates with a fixed or stable total supply. Price drivers: TFUEL’s value is driven by network usage intensity and transaction demand; THETA is influenced by staking rates, governance expectations, and security value. Both tokens are complementary in supporting the Theta ecosystem.

Summary of Theta Fuel (TFUEL)

TFUEL is the utility token of the Theta Network—responsible for on-chain fee settlement and content distribution costs—balanced through reward mechanisms and periodic token burning. It currently has mid-range price and market cap levels; its fully diluted valuation closely matches circulating market cap, indicating high circulation rate. For users interested in decentralized video/content delivery, TFUEL serves as a “usage layer” asset; best practices include phased buying via compliant platforms, prompt withdrawal to self-custody wallets, secure key management, plus monitoring network activity, burn rates, and regulatory shifts. Regardless of short-term trends, diversification and prudent position management remain key for long-term participation in such assets.

FAQ

Is TFUEL suitable for beginner investors?

As the fuel token powering Theta Network transactions/services rather than a traditional investment asset, beginners should first understand TFUEL’s actual use cases before participating—avoid blindly following trends. If you are optimistic about decentralized streaming growth, consider allocating a small amount via Gate for hands-on experience but always prepare for associated risks.

What distinguishes TFUEL from standard tokens?

TFUEL is a functional token primarily used to pay transaction fees and reward node contributors within the Theta Network; standard tokens may lack defined application scenarios. This direct linkage means TFUEL’s demand—and thus its value—is tied to network activity levels.

Will TFUEL’s supply keep growing indefinitely?

TFUEL follows a defined economic model with an upper supply limit to prevent unchecked inflation. Newly generated TFUEL rewards validator nodes and edge node contributors; simultaneously, some transaction fees are burned. This balance between inflationary issuance and burning helps stabilize token price over time.

Where can I safely trade TFUEL?

Gate offers secure TFUEL trading with robust protection measures and ample liquidity. Before trading on Gate, enable two-factor authentication and withdrawal whitelist features for additional safety. After your trade is complete, transfer TFUEL into a self-custody wallet instead of leaving it long-term on exchanges.

Can TFUEL be used for everyday payments?

TFUEL is mainly used within the Theta ecosystem—to pay network fees or reward content creators—and not as a general-purpose payment tool. Few merchants currently accept TFUEL; in most cases you’ll need to convert it into fiat or stablecoins before spending.

Quick Reference Glossary: Theta Fuel (TFUEL) Terms

- Edge Computing: Using edge nodes near data sources for computation/storage—reduces latency/bandwidth costs.

- Video Streaming: Distributed video delivery via blockchain networks—boosts efficiency/user experience.

- Node Rewards: Validators/data relays receive TFUEL as incentives.

- Fuel Mechanism: TFUEL serves as operational fuel—users pay it to execute actions.

- Decentralized CDN: Distributed node networks replace traditional content delivery networks—enhancing resource distribution.

- Staking Validation: Users stake TFUEL to join consensus/validation processes—earning rewards.

Further Reading & References on Theta Fuel (TFUEL)

-

Official Site / Whitepaper:

-

Development / Documentation:

-

Media / Research:

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?