What is WLFI token?

What Is World Liberty Financial (WLFI)?

WLFI is the governance token of the World Liberty Financial protocol, granting holders the right to participate in on-chain voting that determines protocol rules, parameters, and resource allocation. The token also incentivizes contributors within the ecosystem. The project’s vision is to promote the use of USD stablecoins by bringing programmable dollars on-chain to facilitate cross-border settlements and fund transfers for both institutions and individuals.

Here, a “governance token” refers to tokens that enable holders to vote on protocol proposals; a “stablecoin” is a token pegged to fiat currency (such as the US dollar), aiming to maintain a stable price; “DeFi” (Decentralized Finance) refers to open financial services provided on-chain via smart contracts.

WLFI Price, Market Cap, and Circulating Supply

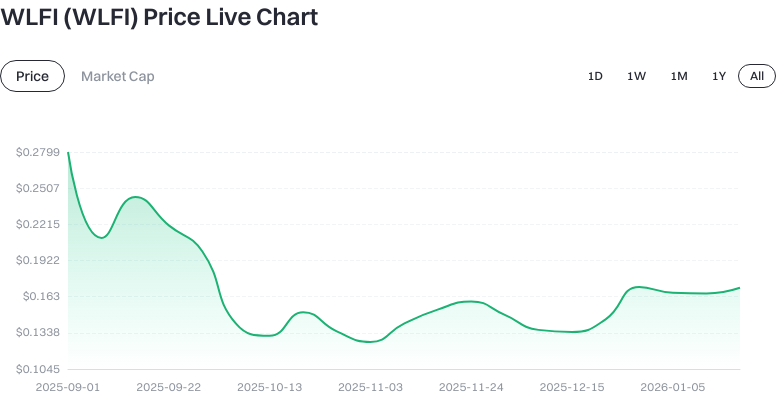

As of 2026-01-23, according to available data:

- Latest price: approximately $0.170300 per WLFI.

- Circulating supply: about 24,669,070,265 WLFI; both max and total supply are 100,000,000,000.

- Circulating market cap: roughly $17,030,000,000; fully diluted valuation (FDV) is also about $17,030,000,000.

- Price change: ~-0.39% over 1 hour, ~-1.33% over 24 hours, ~+1.43% over 7 days, ~+29.84% over 30 days.

- 24-hour trading volume: approximately $3,658,911.

Click to view Latest WLFI Price

Typically, market cap is calculated as price × circulating supply. Using $0.170300 and 24.669 billion tokens as a reference, there may be slight discrepancies between calculated values and reported market cap due to differences in data sources, update times, or calculation methods. Investors are encouraged to verify by multiplying price and supply and refer to official or reputable aggregators for the most current information.

Who Created World Liberty Financial (WLFI) and When?

According to available information, WLFI was launched on 2025-08-31. The project narrative focuses on promoting USD stablecoins and strengthening the global digital adoption of the dollar, aiming to deliver a compliant and programmable USD experience across broader on-chain and cross-border payment scenarios.

Background: In recent years, USD stablecoins have seen significant growth in cross-border settlement, trading, and value storage. Institutional demand for on-chain USD liquidity is rising. Against this backdrop, World Liberty Financial positions itself as a capital bridge connecting Web2 and Web3, leveraging on-chain governance and open interfaces to coordinate both institutional and retail users.

How Does World Liberty Financial (WLFI) Work?

Core mechanisms include:

- Governance Voting: As a governance token, WLFI allows holders to vote on protocol proposals involving parameter changes, payment channel rules, and ecosystem incentives. Standard processes involve proposal submission—voting (weighted by token holdings)—and execution via smart contracts based on vote results.

- Tokenomics: With a max supply of 100 billion tokens, long-term inflation and release schedules are subject to the official economic model. The supply cap sets an upper limit on dilution risk, while release and buyback strategies affect secondary market supply and demand.

- Operating Environment: The protocol is typically deployed on public blockchains supporting smart contracts. Connections with Web2 may be established through compliant interfaces, payment channels, or enterprise integrations, with final clearing and settlement routed via smart contracts on-chain.

Key terms:

- DAO: Decentralized Autonomous Organization—a structure governed by token holder voting.

- Smart Contract: On-chain programs that automatically execute predefined rules.

- Gas Fees: Transaction fees required for packaging and executing transactions on-chain.

What Can You Do with World Liberty Financial (WLFI)?

WLFI’s main functions are governance and ecosystem incentives. Holders can influence protocol direction through voting, while participants may earn rewards for activities such as market making, development, or ecosystem promotion.

Example use cases:

- Governance Participation: Vote on proposals such as adjusting fees for on-chain USD channels; execution is automated by smart contracts.

- Ecosystem Incentives: Contributors driving stablecoin payment adoption, integrating merchant APIs, or offering technical support may receive WLFI rewards (according to official plans).

- Priority Access: In some protocols, governance token holders enjoy non-financial benefits such as early product access, higher limits, or greater influence in governance forums.

Wallets and Expansion Options in the WLFI Ecosystem

Wallets & Tools:

- Non-Custodial Wallets: Popular EVM-compatible browser extensions or mobile wallets allow users to self-custody and sign transactions—ideal for those who prefer managing their own private keys.

- Custodial Wallets: Private keys are managed by platforms—easier for beginners but carries platform risk.

- Block Explorer: Used for querying transaction hashes, contract addresses, and token distribution; helps verify withdrawal records and monitor risk.

- Price & Risk Monitoring: Price alerts, whale tracking, and address monitoring tools help set risk thresholds.

Usage tips:

- Only add tokens using official contract addresses to avoid phishing tokens.

- Confirm target chain support and fee estimates before cross-chain transfers or bridging; always test with a small amount first.

Main Risks and Regulatory Considerations for WLFI

Market & Liquidity: Governance token prices can be highly volatile. Low liquidity in secondary markets may result in higher slippage and transaction costs.

Click to view WLFI Fear & Greed Index

Contracts & Governance: Smart contracts may have vulnerabilities; governance voting may face “governance capture,” where decisions are dominated by a small group of large holders.

Token Release & Dilution: Token unlocks or new incentive distributions can create short-term dilution pressure; monitor official schedules for release timing and address changes.

Compliance & Stablecoin Regulation: As WLFI’s narrative is closely tied to USD stablecoins, changing regulations around stablecoins, compliance integration, and cross-border payments in different jurisdictions should be closely watched.

Cross-Chain & Address Risks: Withdrawing to the wrong chain or address can cause irreversible loss; cross-chain bridges may also be vulnerable to security incidents.

How to Buy and Safely Store WLFI on Gate

Step 1: Register and Complete KYC. Open an account on Gate’s website or app; follow instructions for identity verification and set up security features (enable two-factor authentication and anti-phishing code).

Step 2: Fund Your Account. Purchase USDT or other quoted assets via fiat channels or deposit crypto from other wallets. Ensure you select the correct chain and deposit address.

Step 3: Search Trading Pairs. On the spot trading page, search for “WLFI” to confirm availability and trading pairs (such as WLFI/USDT). Check project contract addresses against official listings.

Step 4: Place a Buy Order. Choose between market orders (execute at current price) or limit orders (execute at your chosen price). After setting the amount and confirming the order, view your holdings under “Spot” in your account.

Step 5: Withdraw to a Non-Custodial Wallet (Optional). For self-custody, copy your wallet’s receiving address on the target chain, test with a small transfer first, then withdraw your WLFI. Always verify the token contract address to avoid errors or phishing tokens.

Step 6: Secure Storage. Safeguard your seed phrase and private key—do not screenshot or upload them to the cloud. Enable withdrawal whitelists, review authorizations regularly, and promptly revoke unnecessary DApp permissions.

Tip: If WLFI is not yet listed on Gate, add it to your watchlist and follow official announcements for updates on listings and contract information.

How Does WLFI Compare with USDC?

Nature:

- WLFI: A governance token primarily used for voting and ecosystem incentives; its price fluctuates according to market dynamics.

- USDC: A USD-pegged stablecoin aiming for a 1:1 parity with the US dollar; used mainly for payments, settlements, and as a safe haven.

Price Performance:

- WLFI: Not price-pegged; exhibits higher volatility.

- USDC: Seeks price stability through reserves and redemption mechanisms; generally low volatility.

Use Cases:

- WLFI: Governance participation and earning ecosystem incentives or privileges.

- USDC: Serves as an on-chain dollar for trading, cross-platform transfers, and payments.

Risk Profile:

- WLFI: Exposed to risks related to governance, token release schedules, technology vulnerabilities, and market volatility.

- USDC: Faces risks from issuer compliance obligations, reserve management practices, and regulatory changes.

Issuance & Supply:

- WLFI: Max supply of 100 billion (per current data); dilution depends on release strategy.

- USDC: Supply expands or contracts based on user minting/redemption; the $1 target peg does not guarantee zero deviation.

They are not substitutes—WLFI centers on governance/incentives while USDC is designed for payments/settlement. Both can be complementary within an ecosystem.

Summary of World Liberty Financial (WLFI)

WLFI positions itself as a governance hub connecting Web2 and Web3 capital flows—coordinating rules and incentives via token voting while expanding use cases for USD stablecoins on-chain. Current price and supply data demonstrate a clear supply cap alongside recent volatility trends. Investors should verify contract addresses and ensure market cap calculations align with supply data; consider token release schedules, governance structures, and regulatory context when assessing long-term value. For newcomers, following step-by-step instructions on Gate—enabling security settings and using non-custodial wallets for self-custody—can effectively mitigate operational and counterparty risks. All decisions should reference official documentation and disclosures—this content does not constitute investment advice.

FAQ

On Which Exchanges Can I Trade WLFI Tokens?

WLFI can be traded on major cryptocurrency exchanges like Gate. On Gate you can buy WLFI using fiat deposits or swap other crypto assets; both spot trading and derivatives are supported. To ensure fund security, choose licensed exchanges with strong reputations.

How Should I Safely Hold and Store WLFI?

You can hold WLFI either in an exchange wallet (easy for trading but requires trust in the platform) or in a non-custodial wallet such as hardware wallets. Beginners should start by storing assets on reputable exchanges like Gate; once familiar with crypto operations, transfer assets to cold storage wallets. In all cases, securely back up your private keys and seed phrases—never share them with anyone.

What Is the Total Supply of WLFI? Is There Unlimited Issuance?

The total supply and issuance model of WLFI are determined by the project team. Understanding the token’s economic model is crucial as it directly impacts long-term value. Check the official whitepaper or review token details on Gate for specifics about circulating supply, unlock schedules, and inflation mechanisms.

What Are the Key Investment Risks Associated with WLFI?

Crypto investments carry risks related to price volatility, liquidity constraints, and regulatory changes. WLFI’s price can fluctuate sharply; exchange liquidation policies may impact liquidity; national policies toward digital assets are also evolving. Thoroughly research fundamentals before investing—only allocate funds you can afford to lose; avoid excessive leverage.

How Does WLFI Differ from Other Crypto Assets Like BTC or ETH?

WLFI is a project-specific token; BTC is the first blockchain asset while ETH underpins smart contract platforms. Application scenarios, technological foundations, and market recognition differ widely between tokens. WLFI’s value depends on real-world ecosystem adoption—compare its innovations and use cases when assessing its potential.

Key Terms Related to WLFI

- Token Supply: The circulating amount of tokens along with total and max supply—reflects scarcity expectations and potential inflation.

- Market Cap: The product of token price × circulating supply—measures overall market size and investment value.

- Liquidity: Trading activity level in markets—the higher the 24-hour volume, the greater the liquidity.

- Fully Diluted Valuation (FDV): Market cap calculated at max supply—helps assess long-term value potential and inflation risk.

- Volatility: Price swings over different time periods—indicates market risk as well as investment opportunities.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?