What is XEN Crypto?

What Is XENCrypto?

XENCrypto is a cryptocurrency token deployed as a smart contract on Ethereum and multiple EVM-compatible blockchains. Rather than operating its own independent blockchain, XEN exists as an on-chain token whose behavior is defined by smart contract logic. These contracts determine how balances are tracked, how participation is recorded, and how tokens are minted and transferred across supported networks.

From a technical standpoint, smart contracts are on-chain programs that execute predefined rules. For non-upgradeable contracts, the core logic is fixed after deployment and cannot be retroactively altered; however, some blockchain systems use upgradeable contract patterns. Users should verify whether a specific XEN contract instance is upgradeable by reviewing official documentation and on-chain code. XEN emphasizes open participation and broad distribution across multiple EVM environments, which has important implications for supply interpretation and valuation.

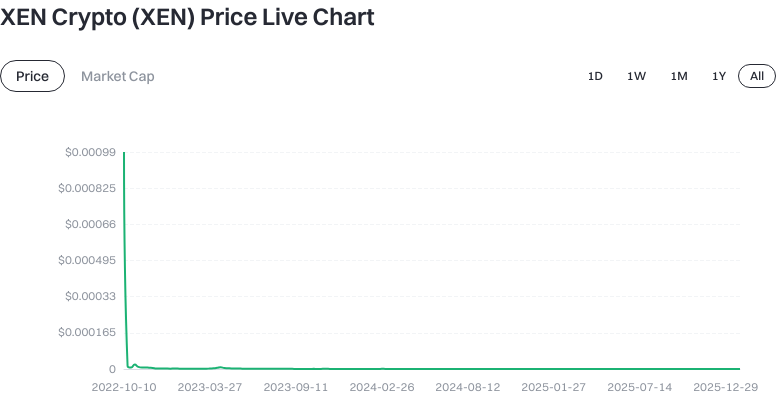

XENCrypto (XEN): Current Price, Market Cap, and Circulating Supply

As of January 27, 2026, based on available market data:

- Latest price: approximately $0.00000001 USD

- 24-hour trading volume: approximately $142,042.56 USD

- Reported total supply: approximately 273,414,855,316,356 XEN

- Fully diluted valuation (FDV): approximately $2,333,376.87 USD

- Available trading pairs: 101

Click to view XEN live price data

Recent price performance shows approximate changes of:

- 1 hour: -0.1681%

- 24 hours: -0.0619%

- 7 days: -1.4862%

- 30 days: -16.2163%

Market capitalization represents the value of tokens actively circulating and traded in the market, while Fully Diluted Valuation (FDV) is a theoretical metric calculated using the reported total supply. For multi-chain tokens like XEN, circulating supply and total supply figures may vary depending on chain, contract deployment, and data provider methodology. FDV should not be interpreted as realized market value.

Who Created XENCrypto (XEN) and When?

XENCrypto was launched as a smart contract on the Ethereum mainnet and later deployed across additional EVM-compatible blockchains, including Avalanche, Polygon, and BNB Chain. The project is commonly associated with the Fair Crypto initiative and promotes permissionless participation through on-chain interactions.

The official project website is https://xen.network/mainnet. Exact launch timestamps, deployment milestones, and contract parameters are documented through official resources linked from the project website and related repositories.

How Does XENCrypto (XEN) Work?

XEN operates through smart contracts deployed within the Ethereum Virtual Machine (EVM) environment. The EVM enables compatible contracts to function across multiple blockchains using consistent execution logic.

Users interact with XEN by submitting on-chain transactions through supported wallets. These interactions may include initiating participation actions, transferring balances, or interacting with ecosystem applications. All on-chain actions require payment of network gas fees, which vary by blockchain and network conditions.

Because XEN exists across multiple blockchains, users must ensure they are interacting with the correct network and verified contract address. Transactions sent to incorrect networks or counterfeit contracts cannot be reversed.

What Can You Do With XENCrypto (XEN)?

XEN can be transferred on-chain and traded in spot markets where supported. Some decentralized applications may integrate XEN as a liquidity or participation asset, depending on the specific protocol design.

Any trading or on-chain interaction involves market risk, smart contract risk, and transaction costs. This information is descriptive only and does not constitute financial or investment advice.

What Wallets and Extensions Support XENCrypto (XEN)?

XEN is compatible with EVM-based self-custody wallets that support networks such as Ethereum, Polygon, Avalanche, and BNB Chain. These wallets rely on private keys or seed phrases to authorize transactions.

Common supporting tools include:

- Blockchain explorers: for verifying transactions and contract state

- Cross-chain bridges: for moving assets between supported networks, subject to bridge-specific risks

- Market data platforms: for viewing prices and liquidity

Only official and audited tools should be used. Loss of private keys or interaction with malicious contracts can result in permanent loss of assets.

Key Risks and Regulatory Considerations for XENCrypto (XEN)

Price volatility: Tokens with very low unit prices and large reported supplies are highly sensitive to liquidity changes and market sentiment.

Smart contract and multi-chain risk: Multi-chain deployments increase operational complexity. Users must verify contract addresses and understand chain-specific behavior.

Supply interpretation risk: Reported total supply and circulating supply figures depend on contract logic and data provider methodology. FDV is a theoretical construct and may be misleading if treated as actual market value.

Regulatory compliance: Crypto asset usage is subject to jurisdiction-specific regulations, including taxation and reporting obligations.

Security risk: Exchange accounts should use strong authentication, while private keys for non-custodial wallets must be securely backed up offline.

How Do I Buy and Securely Store XENCrypto (XEN) on Gate?

Step 1: Register a Gate account, complete identity verification, enable two-factor authentication, and configure anti-phishing protections.

Step 2: Deposit funds by purchasing stablecoins or transferring assets from an external wallet. Confirm correct deposit networks and requirements.

Step 3: In the spot market, search for “XEN” or “XENCrypto,” select an available trading pair such as XEN/USDT, and place an order.

Step 4: For self-custody, withdraw XEN using the correct network and verified contract address. When holding on-platform, periodically review account security activity.

Step 5: Retain transaction records and perform small test transfers before moving larger balances.

How Does XENCrypto (XEN) Compare to Shiba Inu Coin?

| Category | XENCrypto (XEN) | Shiba Inu (SHIB) |

|---|---|---|

| Core narrative | On-chain participation and multi-chain deployment | Community branding and ecosystem expansion |

| Issuance model | Participation-based minting via smart contracts | Pre-minted Ethereum token with burn events |

| Primary use cases | Transfers, trading, protocol integrations | NFTs, DEX platforms, metaverse initiatives |

| Key risk factors | Supply interpretation and contract complexity | Community sentiment and execution risk |

Both assets operate within the broader EVM ecosystem but follow different economic and community models.

Summary of XENCrypto (XEN)

XENCrypto is a multi-chain EVM-based token governed by smart contracts and designed around open, permissionless participation. Its supply characteristics depend on contract-defined minting logic and vary by chain and data source. Users should approach valuation metrics, such as FDV and circulating supply, with caution and prioritize verified contract information, correct network usage, and robust security practices.

FAQ

How Does Minting and Claiming Work in XEN? How Can Users Participate?

XEN participation typically involves initiating a mint interaction with the smart contract and later submitting a claim transaction after a defined waiting or maturity period. The exact process and parameters depend on the specific contract deployment and chain.

Do I Need To Pay Gas Fees When Holding XEN? What Costs Should I Expect?

Gas fees apply when initiating mint actions, submitting claims, or transferring XEN. Fees vary by blockchain and network congestion and may outweigh outcomes depending on conditions.

Where Can I Trade XEN? How Do I Get Started?

XEN is available on Gate and other supported exchanges. Users can acquire XEN via spot trading or through on-chain participation, subject to prevailing market conditions.

What Is the Total Supply of XEN? Is It Capped?

XEN supply is minted through smart contract participation. Whether a maximum supply exists depends on the specific contract design and deployment and should be verified directly through official documentation and on-chain code. Supply figures may differ across chains and data providers.

What Does “Maturity” Mean in XEN? How Does It Affect Outcomes?

Maturity refers to the waiting period associated with a mint before a claim can be made. Longer maturity selections may alter the mint outcome based on contract-defined rules, but outcomes are not guaranteed and may be offset by fees or market conditions.

Glossary of Key Terms Related to XEN Crypto (XEN)

- Participation-based minting: Token issuance triggered by on-chain interaction rather than computational work

- Mint: The initiation of a contract-defined participation action

- Claim: The transaction used to collect tokens after the maturity period

- Maturity: The waiting period between mint initiation and claim eligibility

- Smart contract: On-chain code that governs XEN logic

- Burn mechanism: Token destruction that reduces supply on a given chain; whether and how XEN is burned depends on specific ecosystem contracts and should not be assumed

Reference & Further Reading on XEN Crypto (XEN)

-

Official Website and Whitepaper

-

Developer Documentation

-

Project Media and Research

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?