2026 3ULL Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: 3ULL's Market Position and Investment Value

PLAYA3ULL GAMES (3ULL), as a gaming-focused blockchain token serving as the primary medium of exchange for in-game assets across multiple gaming titles, has been developing its ecosystem since its launch in 2023. As of February 2026, 3ULL maintains a market capitalization of approximately $610,714, with a circulating supply of around 4.72 billion tokens, and its price hovering near $0.0001293. This gaming-centric asset, recognized for its community-first approach and integration across the PLAYA3ULL GAMES studio portfolio, is playing an increasingly relevant role in the Web3 gaming sector.

This article will comprehensively analyze 3ULL's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. 3ULL Price History Review and Market Status

3ULL Historical Price Evolution Trajectory

- 2023: Token launched on June 8, 2023, with an initial price of $0.003437

- 2024: Price reached a notable level of $0.0035 on December 6, 2024

- 2026: Price declined to $0.0001033 on February 1, 2026

3ULL Current Market Situation

As of February 5, 2026, 3ULL is trading at $0.0001293, representing a 7.36% decrease over the past 24 hours. The 24-hour trading range has been between $0.0001269 and $0.00019, with a total trading volume of $48,751.29.

Over different time periods, 3ULL has experienced varying degrees of price movement. The token has declined 0.84% in the past hour, 15.43% over the past week, and 35.79% over the past month. The one-year performance shows a decline of 83.28% from previous levels.

The token's market capitalization stands at $610,714.40, with a circulating supply of 4,723,235,871 tokens out of a total supply of 7,404,932,030 tokens. The maximum supply is set at 50,000,000,000 tokens. The circulating supply represents approximately 9.45% of the total supply. The fully diluted market capitalization is calculated at $957,457.71.

The current market dominance of 3ULL is 0.000037%, indicating its position within the broader cryptocurrency market. The token is ranked at position 2878 among tracked cryptocurrencies. The market capitalization to fully diluted valuation ratio stands at 9.45%.

PLAYA3ULL GAMES operates as a gaming studio that has raised capital through node sales, utilizing these funds to acquire and develop games where 3ULL serves as the currency for in-game asset purchases. The project maintains a community-first approach, followed by gaming and cryptocurrency considerations.

Click to view the current 3ULL market price

3ULL 市场情绪指标

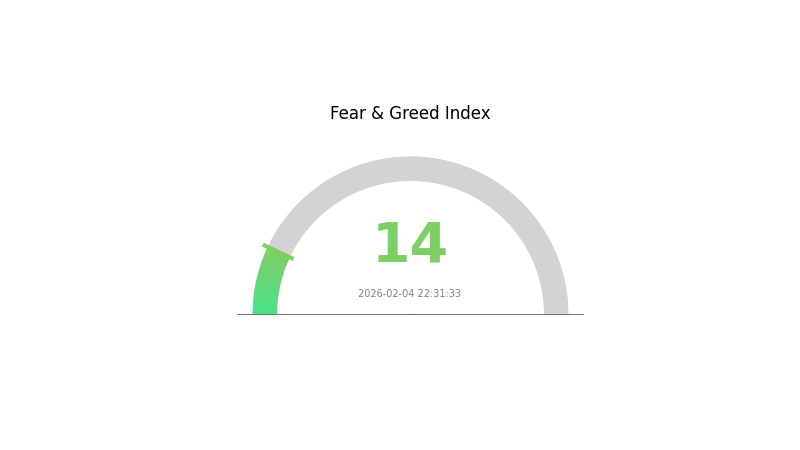

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 14. This exceptionally low reading indicates widespread investor anxiety and pessimistic sentiment throughout the market. When the index reaches such extreme levels, it often signals potential accumulation opportunities for long-term investors, as fear-driven sell-offs may create attractive entry points. However, caution remains necessary as further downward pressure is possible. Traders should monitor key support levels and maintain proper risk management strategies during periods of extreme fear to navigate market volatility effectively.

3ULL Holding Distribution

The holding distribution chart reveals the concentration of 3ULL tokens across different wallet addresses, providing crucial insights into the token's ownership structure and potential market dynamics. By examining how tokens are distributed among top holders, we can assess the degree of centralization and its implications for price stability and market manipulation risks.

Based on the current data, 3ULL exhibits a highly concentrated ownership pattern. The top-ranking addresses collectively control a significant portion of the total token supply, indicating that a relatively small number of entities hold substantial influence over the token's market behavior. This concentration level suggests that large holders, often referred to as "whales," possess considerable power to impact price movements through their trading activities. Such centralized distribution patterns are common in leveraged tokens and exchange-traded products, where institutional participants and liquidity providers typically maintain large positions to facilitate market operations.

The current holding structure presents both opportunities and risks for market participants. On one hand, the presence of large holders can provide stability and liquidity, as these entities often have long-term strategic interests aligned with the token's performance. On the other hand, excessive concentration increases vulnerability to sudden price volatility if major holders decide to liquidate their positions. The relatively centralized nature of 3ULL's distribution reflects its character as a specialized financial instrument rather than a broadly distributed community token, which aligns with typical patterns observed in leveraged crypto products.

Click to view current 3ULL Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing 3ULL's Future Price

Supply Mechanism

- Token Supply Structure: The pricing outlook for 3ULL is influenced by market demand dynamics, adoption trends, and broader economic factors. Current analysis suggests an anticipated growth trajectory with projections indicating approximately 5% annual growth through 2027.

- Market Demand Impact: Market sentiment plays a direct role in 3ULL price movements. Positive developments regarding widespread adoption or significant technological breakthroughs tend to generate favorable price responses from investors.

- Current Supply Dynamics: The relationship between circulating supply and market demand continues to shape price expectations, with increasing adoption potentially supporting upward price momentum.

Institutional and Major Holder Dynamics

- Institutional Participation: Broader institutional involvement represents one of the key factors affecting 3ULL's price prospects. The level of institutional engagement in the market influences overall liquidity and price stability.

- Market Confidence: Investor sentiment and confidence directly impact 3ULL's price trajectory. Periods of heightened market optimism regarding the token's utility and adoption potential tend to correlate with positive price action.

Macroeconomic Environment

- Economic Factors: The broader economic landscape, including general market conditions and economic trends, plays a significant role in shaping 3ULL's price outlook. Market participants consider these factors when evaluating the token's investment potential.

- Market Cycle Positioning: The current position within broader crypto market cycles influences price expectations. Understanding cyclical patterns helps inform perspective on potential price movements through 2025-2030.

Technical Development and Ecosystem Building

- Technology Progress: Technical advancements represent a critical factor in 3ULL's value proposition. Breakthroughs or improvements in underlying technology can generate positive market sentiment and support price appreciation.

- Adoption Trends: The pace and breadth of 3ULL adoption across various use cases influences long-term price projections. Growing adoption patterns may support sustained upward price momentum through the forecast period.

- Ecosystem Growth: Development of applications and projects within the 3ULL ecosystem contributes to the token's fundamental value proposition. A robust and expanding ecosystem may provide underlying support for price appreciation over the 2025-2030 timeframe.

III. 2026-2031 3ULL Price Prediction

2026 Outlook

- Conservative prediction: $0.00012

- Neutral prediction: $0.00013

- Optimistic prediction: $0.00019 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: The token may enter a gradual recovery phase with modest growth potential as the broader crypto market matures

- Price range prediction:

- 2027: $0.00011 - $0.00018

- 2028: $0.00010 - $0.00019

- 2029: $0.00012 - $0.00021

- Key catalysts: Market sentiment improvement, potential protocol upgrades, and increased trading volume on platforms like Gate.com could support price appreciation

2030-2031 Long-term Outlook

- Baseline scenario: $0.00011 - $0.00024 (assuming steady market development and maintained project activity)

- Optimistic scenario: $0.00019 - $0.00024 (assuming enhanced adoption and favorable regulatory environment)

- Transformative scenario: Up to $0.00024 (requires significant breakthrough in utility or widespread market adoption)

- As of February 5, 2026: 3ULL trading at approximately $0.00012 - $0.00013 (reflecting current market positioning)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00019 | 0.00013 | 0.00012 | 0 |

| 2027 | 0.00018 | 0.00016 | 0.00011 | 23 |

| 2028 | 0.00019 | 0.00017 | 0.0001 | 31 |

| 2029 | 0.00021 | 0.00018 | 0.00012 | 38 |

| 2030 | 0.00024 | 0.00019 | 0.00011 | 50 |

| 2031 | 0.00024 | 0.00022 | 0.00017 | 70 |

IV. 3ULL Professional Investment Strategy and Risk Management

3ULL Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors interested in gaming ecosystem development and blockchain gaming adoption

- Operational recommendations:

- Consider holding 3ULL as part of a diversified gaming token portfolio

- Monitor the studio's game development progress and node sales performance

- Store assets using Gate Web3 Wallet for secure long-term custody

(II) Active Trading Strategy

- Technical analysis tools:

- Volume analysis: Monitor the 24-hour trading volume of approximately $48,751 to identify liquidity patterns

- Support and resistance levels: Track the historical low of $0.0001033 and recent price movements

- Swing trading considerations:

- Be aware of the token's recent volatility, with a 7-day decline of 15.43%

- Consider market sentiment and overall gaming sector trends before entering positions

3ULL Risk Management Framework

(I) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: May allocate up to 5-7% with active monitoring

(II) Risk Hedging Solutions

- Portfolio diversification: Balance 3ULL holdings with established gaming tokens and major cryptocurrencies

- Position sizing: Limit exposure to micro-cap tokens given the relatively low market capitalization

(III) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for active trading and staking participation

- Cold storage approach: For long-term holdings, consider offline storage methods

- Security precautions: Enable two-factor authentication and never share private keys or seed phrases

V. 3ULL Potential Risks and Challenges

3ULL Market Risks

- High volatility: The token has experienced an 83.28% decline over one year, indicating substantial price fluctuation

- Low liquidity: With a 24-hour trading volume of approximately $48,751, executing large orders may face slippage

- Limited market presence: Trading on 6 exchanges with a market dominance of 0.000037% suggests limited mainstream adoption

3ULL Regulatory Risks

- Gaming token classification: Uncertainty around regulatory treatment of gaming utility tokens in various jurisdictions

- Node sales structure: Potential scrutiny of the capital-raising model through node sales

- Cross-border operations: Compliance challenges for a gaming studio operating across multiple regions

3ULL Technical Risks

- Game development execution: Dependence on the studio's ability to deliver high-quality games as promised

- In-game economy design: Sustainability of the model requiring 3ULL for all in-game asset purchases

- Token utility adoption: Risk that developed games may not achieve sufficient player adoption to drive token demand

VI. Conclusion and Action Recommendations

3ULL Investment Value Assessment

3ULL represents a gaming studio's approach to integrating cryptocurrency into game economies through a node sales funding model. With a circulating supply of approximately 4.72 billion tokens out of a maximum supply of 50 billion, the token has a market cap to fully diluted valuation ratio of 9.45%. While the project focuses on community-first principles and aims to develop high-quality games utilizing 3ULL for in-game purchases, investors should note the significant price decline of over 83% in the past year and relatively low trading volume. The long-term value proposition depends heavily on successful game development and player adoption, while short-term risks include continued volatility and liquidity constraints.

3ULL Investment Recommendations

✅ Beginners: Consider observing the project's game development milestones before investing; if participating, allocate only a small portion of your portfolio ✅ Experienced investors: May explore small speculative positions while monitoring the studio's delivery on game releases and community growth ✅ Institutional investors: Conduct thorough due diligence on the team's track record, game pipeline, and business model sustainability before considering allocation

3ULL Trading Participation Methods

- Spot trading: Purchase 3ULL on Gate.com and other supported exchanges for direct token ownership

- Portfolio inclusion: Add 3ULL as part of a broader gaming and metaverse token portfolio strategy

- Community engagement: Participate in the Playa3ull Games ecosystem through node ownership to potentially benefit from platform growth

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is 3ULL? What are its uses and value?

3ULL is a digital asset operating on decentralized platforms, designed to facilitate trading and enable secure, efficient value transfer across networks. It has gained recognition in the crypto community for its utility and innovation potential.

What are the main factors affecting 3ULL price?

3ULL price is influenced by market sentiment, trading volume, technical developments, user adoption trends, macroeconomic conditions, interest rate changes, liquidity cycles, and regulatory signals.

How to predict 3ULL price? What prediction methods or tools are available?

Moving averages are popular tools for 3ULL price prediction. Simple Moving Average (SMA) calculates average closing prices over a period, while Exponential Moving Average (EMA) assigns greater weight to recent prices. These technical indicators help analyze price trends and support forecasting analysis.

How has 3ULL performed historically? What were the major price fluctuations in the past?

3ULL reached an all-time high of $0.0105 and an all-time low of $0.00012. The token has experienced significant volatility, with a 8.96% decline over the past week, reflecting the dynamic nature of this cryptocurrency asset.

What are the risks of investing in 3ULL? What should I pay attention to?

3ULL carries market volatility and price fluctuation risks. Investors should carefully assess their experience, financial capacity, and risk tolerance. Understand project fundamentals and market dynamics before investing.

What are the advantages or disadvantages of 3ULL compared to similar cryptocurrencies?

3ULL offers decentralized finance services with strong privacy protection and low transaction fees. However, it has relatively lower market recognition and liquidity compared to mainstream cryptocurrencies, which may impact trading volume and price stability.

What are professional analysts' views on the future price trend of 3ULL?

Professional analysts expect 3ULL to demonstrate strong growth potential driven by increasing market adoption and ecosystem development. Long-term price appreciation is anticipated as the platform expands its user base and utility applications.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

BUCK vs LTC: A Comprehensive Comparison of Two Leading Stablecoin and Cryptocurrency Solutions

Top AI Stocks for Investment

SHFT vs DOT: A Comprehensive Comparison of Two Leading Blockchain Layer-2 Solutions

What Are Nodes?

Money-Making Games: Top 23 Projects for Earning