2026 NC Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: NC's Market Position and Investment Value

Nodecoin (NC), as a real-time predictive intelligence platform aggregating user signals, social activity, and on-chain data, has been evolving since its launch in 2025. As of February 2026, NC maintains a market capitalization of approximately $378,572, with a circulating supply of around 295.99 million tokens, and a current price hovering at $0.001279. This asset, positioned as a next-generation network driven by verified human signals and market behavior, is playing an increasingly important role in decentralized bandwidth sharing and AI data retrieval sectors.

This article will comprehensively analyze NC's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. NC Price History Review and Market Status

NC Historical Price Evolution Trajectory

- 2025: NC launched at an initial price of $0.1, experiencing significant volatility throughout the year, with the price reaching its peak of $0.335 on January 17, 2025

- 2026: Market entered a correction phase, with the price declining substantially from previous highs, reaching $0.001235 on February 6, 2026

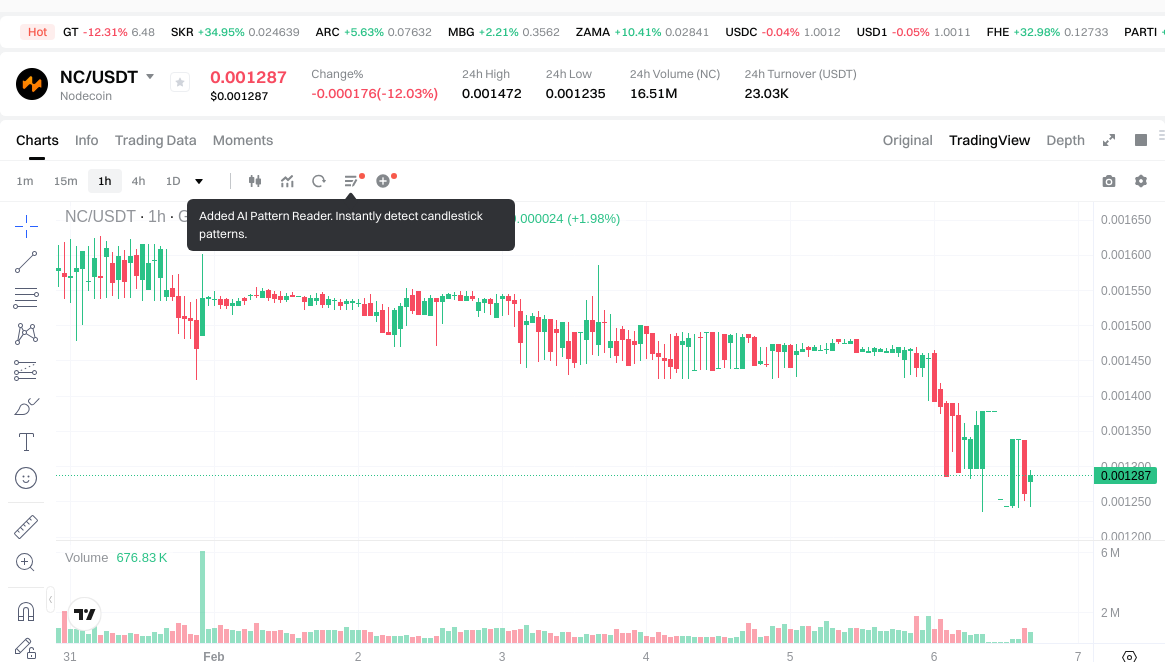

NC Current Market Situation

As of February 6, 2026, Nodecoin (NC) is trading at $0.001279, reflecting a notable decline across multiple timeframes. The token has experienced a price decrease of 1.95% over the past hour, 11.79% over the past 24 hours, and 22.88% over the past week. The 30-day performance shows a decline of 33.47%, while the yearly performance indicates a decrease of 97.8%.

The current market capitalization stands at approximately $378,572, with a circulating supply of 295,990,695 NC tokens, representing 29.6% of the total supply of 999,962,813 tokens. The fully diluted market cap is calculated at $1,278,952. The 24-hour trading volume has reached $22,903.

NC's market dominance is currently at 0.000054%, ranking at position 3249 in the cryptocurrency market. The token has 128,161 holders, and the market sentiment indicator shows a value of 9, described as "Extreme Fear".

The 24-hour price range has fluctuated between a low of $0.001235 and a high of $0.001472. The current price represents a decline of 99.62% from its peak of $0.335, recorded on January 17, 2025.

Click to view the current NC market price

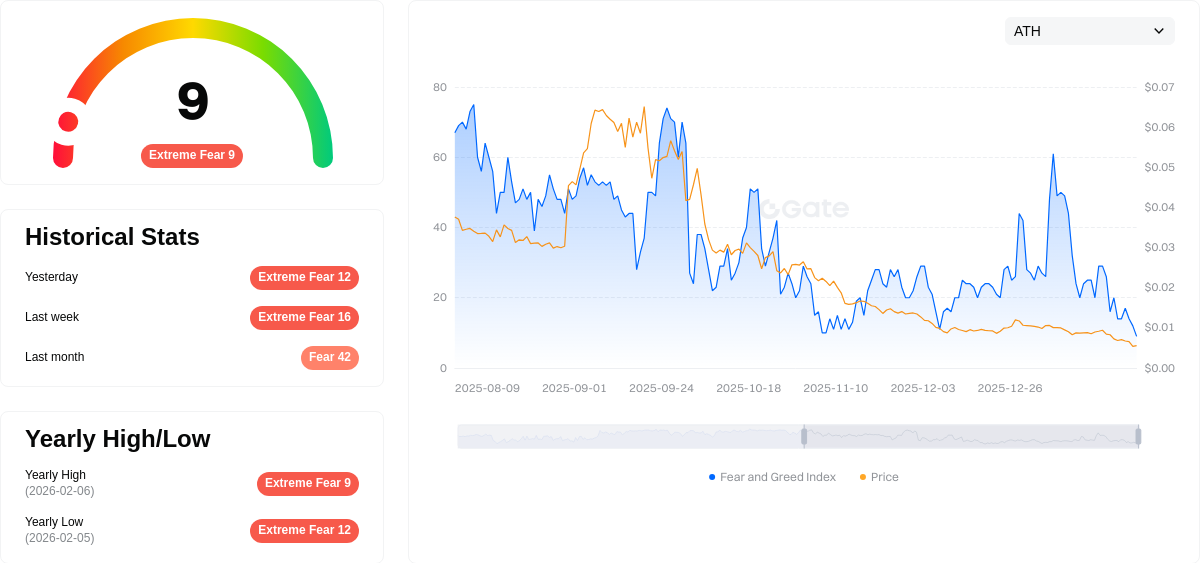

NC Market Sentiment Indicator

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index plummeting to 9. This indicates severe pessimism among investors and widespread market anxiety. Such extreme readings often signal potential capitulation, which historically can precede market reversals. Risk-averse investors should exercise caution, while contrarian traders may view this as a potential accumulation opportunity. Monitor market developments closely as extreme fear conditions typically don't persist long-term.

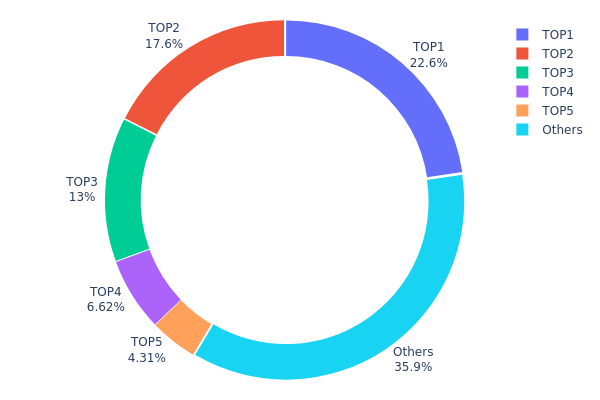

NC Holdings Distribution

The holdings distribution chart illustrates how NC tokens are allocated across different wallet addresses on the blockchain, reflecting the degree of concentration or decentralization within the token's ecosystem. By analyzing the distribution pattern, we can assess whether the token supply is dominated by a few large holders (whales) or more evenly spread among numerous participants, which has significant implications for market stability and manipulation risks.

Based on the current data, NC exhibits a moderately concentrated holdings structure. The top address controls 22.60% of the total supply (approximately 226 million tokens), while the second and third largest holders possess 17.56% and 13.00% respectively. The top three addresses collectively account for 53.16% of the circulating supply, indicating that more than half of all NC tokens are held by just three entities. The top five addresses combined hold 64.09% of the supply, leaving only 35.91% distributed among other holders. This concentration level suggests that NC's token distribution leans toward centralization, with a relatively small number of addresses controlling the majority of the supply.

Such a concentrated holdings pattern presents both opportunities and risks for the market. On one hand, large holders may have strong incentives to support the project's long-term development and maintain price stability. On the other hand, this structure increases the potential for significant price volatility if major holders decide to liquidate their positions. The heavy concentration also raises concerns about market manipulation, as coordinated actions by top holders could substantially influence price movements and trading volumes. From a decentralization perspective, the current distribution indicates that NC has not yet achieved a widely distributed ownership structure, which may affect investor confidence regarding the project's governance and resistance to centralized control.

Click to view the current NC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | F5o3ML...yEnSiU | 225996.12K | 22.60% |

| 2 | 9cM2M6...DtKnUg | 175617.80K | 17.56% |

| 3 | 7QaLNh...YubMfZ | 130000.00K | 13.00% |

| 4 | u6PJ8D...ynXq2w | 66241.15K | 6.62% |

| 5 | 9i33D8...5TLQzW | 43108.26K | 4.31% |

| - | Others | 358999.46K | 35.91% |

II. Core Factors Influencing NC's Future Price

Supply Mechanism

- Supply Dynamics: NC's supply structure plays a significant role in its price formation. The token's supply mechanism and distribution patterns directly affect market scarcity and investor expectations.

- Historical Pattern: Historical data shows that assets with controlled supply mechanisms tend to demonstrate stronger price resilience during bull market cycles, with scarcity driving upward price momentum.

- Current Impact: The current supply dynamics continue to influence NC's market valuation, with supply-side factors interacting with demand pressures to shape price trajectories.

Institutional and Major Holder Dynamics

- Market Positioning: NC's institutional adoption and major holder activities contribute to its market positioning and liquidity profile.

- Community Engagement: The strength of community participation and ecosystem development represents a key driver of long-term value creation.

Macroeconomic Environment

- Monetary Policy Impact: Major central banks are expected to maintain cautious monetary policies in response to ongoing economic uncertainties. These policy stances create a backdrop for digital asset valuations, including NC.

- Inflation Hedge Attributes: Digital assets have increasingly been evaluated for their potential role in portfolio diversification amid inflationary pressures, though performance varies across different market conditions.

- Geopolitical Factors: International developments and regulatory shifts continue to influence sentiment across cryptocurrency markets, with NC subject to broader market dynamics.

Technology Development and Ecosystem Building

- AI Infrastructure Focus: NC has positioned itself within the emerging AI infrastructure narrative, tapping into the growth potential of artificial intelligence applications in blockchain ecosystems.

- Emerging Market Growth Potential: The project's focus on emerging market opportunities provides exposure to high-growth segments, though this also introduces additional volatility considerations.

- Ecosystem Applications: The development and adoption of applications within NC's ecosystem will be crucial for sustaining long-term value, with community engagement and developer activity serving as important indicators of project health.

III. 2026-2031 NC Price Prediction

2026 Outlook

- Conservative prediction: $0.00099 - $0.00129

- Neutral prediction: $0.00129

- Optimistic prediction: $0.0014 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: The token is anticipated to enter a gradual growth phase, with price volatility reflecting broader market sentiment and project development milestones.

- Price range prediction:

- 2027: $0.00069 - $0.00179

- 2028: $0.00083 - $0.00207

- 2029: $0.00164 - $0.00191

- Key catalysts: Sustained ecosystem expansion, increased adoption rates, and potential technological upgrades may serve as primary drivers for price appreciation during this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00162 - $0.00186 (assuming steady market conditions and moderate adoption growth)

- Optimistic scenario: $0.00211 - $0.00235 (assuming accelerated ecosystem development and favorable regulatory environment)

- Transformative scenario: $0.00314 (under exceptionally favorable conditions including widespread adoption and significant network effect amplification)

- 2026-02-06: NC shows early-stage price dynamics with potential for gradual appreciation over the forecast period

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0014 | 0.00129 | 0.00099 | 0 |

| 2027 | 0.00179 | 0.00134 | 0.00069 | 5 |

| 2028 | 0.00207 | 0.00157 | 0.00083 | 22 |

| 2029 | 0.00191 | 0.00182 | 0.00164 | 42 |

| 2030 | 0.00235 | 0.00186 | 0.00162 | 45 |

| 2031 | 0.00314 | 0.00211 | 0.00116 | 64 |

IV. NC Professional Investment Strategies and Risk Management

NC Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors who believe in decentralized AI-driven predictive intelligence platforms and have a long-term perspective on the intersection of bandwidth-sharing networks and signal aggregation technologies

- Operational Recommendations:

- Consider accumulating NC during periods of market volatility when prices approach support levels, as the current price of $0.001279 represents a significant decline from historical levels

- Monitor the project's development progress, particularly the evolution of its signal and prediction engine capabilities and user growth metrics beyond the current 128,161 holders

- Storage Solution: Utilize Gate Web3 Wallet for secure storage of NC tokens, which are deployed on the Solana blockchain as SPL20 tokens. Gate Web3 Wallet provides multi-chain support with enhanced security features suitable for long-term asset custody

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of $22,903.18 to identify periods of increased market activity that may signal potential price movements

- Support and Resistance Levels: The current all-time low of $0.001235 (recorded on February 6, 2026) serves as a critical support level, while resistance may be observed at previous consolidation zones

- Swing Trading Considerations:

- Given the high short-term volatility (1H: -1.95%, 24H: -11.79%), swing traders should implement strict stop-loss orders to manage downside risk

- Consider the low market cap of approximately $378,572 and limited exchange availability (7 exchanges), which may result in liquidity constraints during rapid price movements

NC Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: No more than 0.5-1% of total portfolio allocation to NC, given its high volatility and early-stage development status

- Aggressive Investors: 2-5% allocation may be considered for those with higher risk tolerance and belief in the project's long-term potential

- Professional Investors: Up to 3-7% allocation with active position management and hedging strategies, contingent on thorough due diligence of the platform's technology and market adoption trajectory

(II) Risk Hedging Solutions

- Position Sizing: Implement a dollar-cost averaging approach to mitigate timing risk, particularly given the 97.8% decline over the past year

- Diversification: Balance NC holdings with exposure to established blockchain infrastructure projects and stablecoins to reduce portfolio volatility

(III) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet offers comprehensive support for Solana-based SPL20 tokens with user-friendly interface and advanced security protocols including multi-signature options

- Cold Storage Solution: For substantial holdings intended for long-term investment, consider transferring assets to hardware wallet solutions compatible with Solana ecosystem after initial accumulation

- Security Precautions: Never share private keys or seed phrases; enable two-factor authentication on all exchange and wallet accounts; verify contract address (B89Hd5Juz7JP2dxCZXFJWk4tMTcbw7feDhuWGb3kq5qE) before any transactions to avoid phishing attempts

V. NC Potential Risks and Challenges

NC Market Risks

- Extreme Volatility: NC has experienced a 97.8% decline over the past year, with recent performance showing continued downward pressure (7D: -22.88%, 30D: -33.47%), indicating significant market uncertainty and potential for further price deterioration

- Limited Liquidity: With a market cap of only $378,572 and availability on just 7 exchanges, NC faces liquidity constraints that may result in high slippage during larger transactions and difficulty exiting positions during adverse market conditions

- Low Market Dominance: NC's market share of 0.000054% reflects minimal market recognition, which may limit price appreciation potential and increase vulnerability to broader market downturns

NC Regulatory Risks

- Decentralized Network Scrutiny: The platform's bandwidth-sharing model, where users contribute internet resources, may face regulatory examination regarding data privacy, network security, and compliance with telecommunications regulations in various jurisdictions

- Token Classification Uncertainty: As regulatory frameworks for crypto assets continue to evolve globally, NC could face reclassification risks that may impact its trading status or operational requirements

- Cross-border Operations: The nature of decentralized bandwidth-sharing networks operating across multiple jurisdictions may expose the project to complex regulatory compliance obligations

NC Technical Risks

- Platform Development Risk: As an evolving project transitioning from bandwidth-sharing to predictive intelligence, there are inherent risks regarding successful technology integration and market adoption of the signal aggregation features

- Network Security: The reliance on user-contributed internet resources for AI data retrieval introduces potential vulnerabilities related to network integrity and data verification

- Smart Contract Risk: As an SPL20 token on Solana, NC is subject to potential smart contract vulnerabilities or exploits that could impact token functionality or holder assets

VI. Conclusion and Action Recommendations

NC Investment Value Assessment

NC represents an early-stage project attempting to bridge decentralized bandwidth-sharing networks with predictive intelligence capabilities. While the concept of aggregating user signals, social activity, and on-chain data for market sentiment analysis addresses a potential market need, the token currently faces significant challenges. The substantial price decline of 97.8% over the past year, combined with a low market cap of $378,572 and limited liquidity, reflects considerable market skepticism. The circulating supply of approximately 29.6% of maximum supply suggests potential future dilution concerns. Long-term value proposition depends heavily on successful execution of the platform's evolution into a viable signal and prediction engine with meaningful user adoption beyond the current 128,161 holders.

NC Investment Recommendations

✅ Beginners: Approach NC with extreme caution or avoid altogether. If considering participation, allocate no more than 0.5-1% of risk capital and prioritize education about the project fundamentals, Solana ecosystem, and market dynamics before investing. Use Gate.com for initial trading due to its comprehensive security features

✅ Experienced Investors: Consider NC only as a high-risk, speculative position with appropriate position sizing (1-3% of portfolio). Conduct thorough due diligence on platform development progress, competitive positioning, and technical roadmap. Implement strict stop-loss strategies and monitor the project's ability to demonstrate meaningful traction in its predictive intelligence capabilities

✅ Institutional Investors: NC's current market capitalization and liquidity profile may not meet institutional investment criteria. For those with specific interest in decentralized AI and signal aggregation technologies, consider waiting for clearer evidence of product-market fit, increased liquidity, and reduced volatility before substantial allocation

NC Trading Participation Methods

- Spot Trading on Gate.com: Access NC/USDT trading pairs on Gate.com, which offers competitive trading fees, advanced order types, and robust security infrastructure for both beginners and professional traders

- Gate Web3 Wallet Integration: Utilize Gate Web3 Wallet for self-custody of NC tokens, enabling direct interaction with Solana-based decentralized applications while maintaining control over private keys

- Dollar-Cost Averaging: For those with long-term conviction, implement systematic periodic purchases to mitigate timing risk and take advantage of current price volatility

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is NC? What are its uses and basic characteristics?

NC is a utility token designed for the Web3 ecosystem. It serves as a governance and utility token within its platform, enabling holders to participate in ecosystem decisions and access platform services. Its basic characteristics include decentralized governance, transaction utility, and potential value appreciation within the network economy.

How has NC's historical price performed? What is the price change over the past year?

NC price declined 98.73% over the past year. The highest price reached $0.1586 while the lowest dropped to $0.001720, showing significant volatility in market performance.

What is the NC price prediction for 2024-2025? What do experts think?

NC price prediction for 2024-2025 remains uncertain, but experts anticipate significant price volatility. Current price stands at 0.01362 USD with moderate market activity and a market cap of 2.83 million USD.

What are the main factors affecting NC price fluctuations?

NC price is primarily influenced by market sentiment, regulatory policies, trading volume, and macroeconomic conditions. Positive news and institutional adoption typically drive price increases, while regulatory uncertainty and market downturns create downward pressure.

NC and other similar assets compared, what are the advantages and disadvantages?

NC offers superior technological efficiency and faster transaction speeds. Advantages include lower fees and robust security. Disadvantages include smaller ecosystem and lower liquidity compared to established competitors, affecting price stability and adoption rates.

What are the main risks of investing in NC? How to mitigate them?

NC investment risks include market volatility and price fluctuations. Mitigate by diversifying your portfolio, conducting thorough research, and staying informed on market trends and project developments.

What is NC's liquidity and trading volume? Where can I purchase NC?

NC maintains solid liquidity with consistent trading activity across multiple platforms. You can purchase NC on major exchanges offering spot trading pairs like NC/USDT. The token is actively traded with reliable market depth, ensuring smooth transactions for both buyers and sellers in the cryptocurrency market.

Survey Note: Detailed Analysis of the Best AI in 2025

What Is the Best AI Crypto in 2025?

What is the Best AI Now?

Why ChatGPT is Likely the Best AI Now?

How Does Solidus Ai Tech's Market Cap Compare to Other AI Cryptocurrencies?

MomoAI: AI-Powered Social Gaming Revolution on Solana

Is PlayZap Games (PZP) a good investment?: A Comprehensive Analysis of the Gaming Token's Potential, Risks, and Market Outlook

Is SubQuery Network (SQT) a good investment?: A Comprehensive Analysis of Token Utility, Market Position, and Future Growth Potential

Is Juice (JUC) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Prospects

Is Nodecoin (NC) a good investment?: A Comprehensive Analysis of Features, Risks, and Market Potential

What does the Metaverse, or the digital world of the future, mean?