Is Nodecoin (NC) a good investment?: A Comprehensive Analysis of Risks, Potential Returns, and Market Prospects

Introduction: Nodecoin (NC) Investment Position and Market Prospects

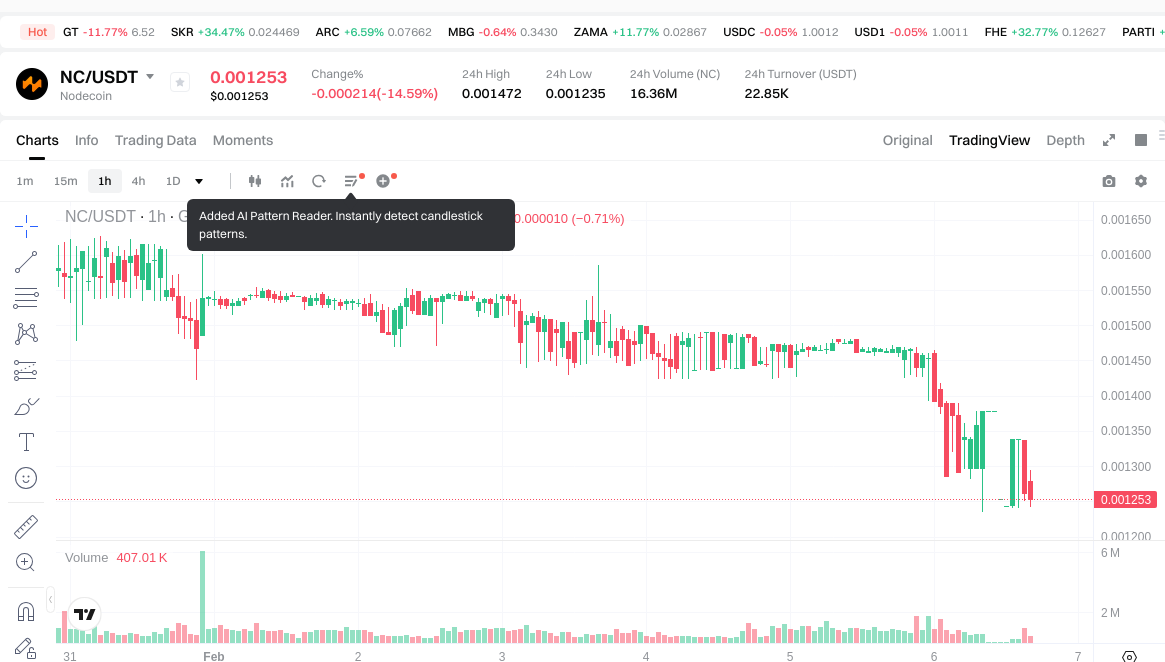

Nodecoin (NC) represents an emerging digital asset in the cryptocurrency landscape, having launched in January 2025 with a focus on real-time predictive intelligence and decentralized bandwidth sharing. As of February 6, 2026, NC maintains a market capitalization of approximately $378,572, with a circulating supply of 295,990,695 tokens and a current trading price around $0.001279. Positioned as a platform that aggregates user signal inputs, social activity, and on-chain data to deliver structured market sentiment insights, Nodecoin operates within a network where users contribute unused internet resources to support AI data retrieval. The project has evolved into a signal and prediction engine, establishing itself as a next-generation network driven by verified human signals and market behavior. With over 128,161 holders and trading activity across 7 exchanges, NC has attracted attention from market participants examining its potential role in the decentralized intelligence sector. This analysis examines NC's investment characteristics, historical performance, future price considerations, and associated risks to provide a comprehensive reference for those evaluating the asset's position in the digital currency market.

I. Nodecoin (NC) Price History Review and Current Investment Value

Historical Price Performance and Investment Returns

- January 2025: NC launched at $0.1, with early investors experiencing notable returns during initial price appreciation

- January 2025: NC reached $0.335 during its early trading period

- February 2026: Price declined from previous levels to $0.001235

Current NC Investment Market Status (February 2026)

- NC current price: $0.001279

- 24-hour trading volume: $22,799.49

- Market capitalization: $378,572.10

- Circulating supply: 295,990,695 NC (29.60% of total supply)

- Fully diluted market cap: $1,278,952.44

Click to view real-time NC market price

II. Core Factors Affecting Whether NC is a Good Investment

Supply Mechanism and Scarcity (NC investment scarcity)

- Maximum supply capped at 1,000,000,000 NC tokens → influences price dynamics and investment considerations

- Current circulating supply represents approximately 29.6% of total supply → suggests potential future dilution as more tokens enter circulation

- Investment consideration: The relationship between circulating supply (295,990,695 tokens) and maximum supply may impact long-term scarcity dynamics

Institutional Investment and Mainstream Adoption (Institutional investment in NC)

- Holder base: Approximately 128,161 holders as of February 2026 → indicates growing community participation

- Market capitalization ranking at 3,254 globally → reflects current positioning within the broader crypto market

- Market share: 0.000054% of total crypto market cap → indicates early-stage adoption relative to established assets

Macroeconomic Environment's Impact on NC Investment

- NC experienced significant price volatility with 1-year performance showing -97.8% change → reflects broader market conditions and risk factors

- 24-hour trading volume of $22,799.49 → suggests moderate liquidity levels for investment consideration

- Price range variations (24H high: $0.001472, 24H low: $0.001235) → indicates active price discovery in current market conditions

Technology and Ecosystem Development (Technology & Ecosystem for NC investment)

- Platform foundation: Built on decentralized bandwidth-sharing network where users contribute unused internet resources to support AI data retrieval

- Core functionality: Real-time predictive intelligence platform aggregating user signal inputs, social activity, and on-chain data

- Ecosystem positioning: Evolved into a signal and prediction engine providing verifiable, reliable real-time intelligence driven by verified human signals and market behavior

- Application scope: Delivers live, structured view of market sentiment and actionable insights for next-generation network applications

III. NC Future Investment Forecast and Price Outlook (Is Nodecoin(NC) worth investing in 2026-2030)

Short-term Investment Forecast (2026, short-term NC investment outlook)

- Conservative forecast: $0.00088 - $0.00110

- Neutral forecast: $0.00118 - $0.00137

- Optimistic forecast: $0.00140 - $0.00146

Mid-term Investment Outlook (2027-2029, mid-term Nodecoin(NC) investment forecast)

- Market stage expectation: Gradual growth phase with potential volatility as the project matures its real-time predictive intelligence platform and expands its decentralized bandwidth-sharing network.

- Investment return forecast:

- 2027: $0.00116 - $0.00177

- 2028: $0.00108 - $0.00176

- 2029: $0.00110 - $0.00209

- Key catalysts: Platform adoption rate, user signal input growth, AI data retrieval capabilities enhancement, on-chain data integration expansion, and verified human signals accumulation.

Long-term Investment Outlook (Is Nodecoin a good long-term investment?)

- Base scenario: $0.00143 - $0.00214 (assuming steady ecosystem development and moderate market adoption through 2030-2031)

- Optimistic scenario: $0.00188 - $0.00293 (assuming accelerated platform adoption, significant bandwidth-sharing network expansion, and favorable AI-driven prediction market conditions)

- Risk scenario: $0.00088 - $0.00110 (under conditions of limited user growth, intensified competition in the predictive intelligence space, or adverse market sentiment)

Click to view NC long-term investment and price prediction: Price Prediction

2026-02-06 - 2031 Long-term Outlook

- Base scenario: $0.00143 - $0.00201 USD (corresponding to steady progress and gradual mainstream application growth)

- Optimistic scenario: $0.00188 - $0.00293 USD (corresponding to large-scale adoption and favorable market conditions)

- Transformative scenario: Above $0.00293 USD (if ecosystem achieves breakthrough developments and mainstream popularization)

- 2031-12-31 predicted high: $0.00293 USD (based on optimistic development assumptions)

Disclaimer: These price predictions are speculative projections based on current data and market trends. Cryptocurrency investments carry significant risk, and actual prices may vary substantially due to market volatility, regulatory changes, technological developments, and other unforeseen factors. This analysis does not constitute financial advice.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00145806 | 0.001279 | 0.00088251 | 0 |

| 2027 | 0.0017654037 | 0.00136853 | 0.0011632505 | 7 |

| 2028 | 0.001755002872 | 0.00156696685 | 0.0010812071265 | 22 |

| 2029 | 0.00209284092486 | 0.001660984861 | 0.00109625000826 | 29 |

| 2030 | 0.00213968069794 | 0.00187691289293 | 0.001651683345778 | 46 |

| 2031 | 0.002932113321335 | 0.002008296795435 | 0.001425890724758 | 57 |

IV. Nodecoin (NC) Investment Strategy and Risk Management (How to invest in Nodecoin)

Investment Methodology (Nodecoin investment strategy)

Long-term Holding (HODL Nodecoin): Suitable for Conservative Investors

For investors with a longer time horizon, holding Nodecoin may be considered as part of a diversified portfolio strategy. This approach reduces the impact of short-term price fluctuations and allows investors to potentially benefit from the project's development over time. Given Nodecoin's position as a real-time predictive intelligence platform aggregating user signals and on-chain data, long-term holders may focus on the platform's adoption trajectory and network growth metrics.

Active Trading: Technical Analysis and Swing Operations

Active traders may utilize technical analysis tools to identify entry and exit points based on price movements. With Nodecoin demonstrating notable volatility—including a 24-hour price change of -12.75% and 7-day change of -22.75% as of February 6, 2026—swing trading opportunities may present themselves. Traders should monitor key support levels (recent low at $0.001235) and resistance zones, while considering volume patterns (24-hour trading volume of approximately $22,799) to inform trading decisions.

Risk Management (Risk management for Nodecoin investment)

Asset Allocation Ratio: Conservative / Aggressive / Professional Investors

- Conservative Investors: May consider allocating 1-3% of their cryptocurrency portfolio to Nodecoin, recognizing its relatively small market capitalization of approximately $378,572 and early-stage development.

- Aggressive Investors: Could allocate 5-10% to Nodecoin, accepting higher volatility in exchange for potential growth exposure in the predictive intelligence sector.

- Professional Investors: May implement dynamic allocation strategies based on market conditions, technical indicators, and fundamental developments within the Nodepay ecosystem.

Risk Hedging Solutions: Multi-asset Portfolio + Hedging Tools

Investors may consider diversifying across multiple cryptocurrency categories (large-cap, mid-cap, and alternative tokens) to reduce concentration risk. Additionally, maintaining positions in stablecoins or traditional assets can provide portfolio stability during periods of heightened volatility. Given Nodecoin's market dominance of only 0.000054%, portfolio diversification becomes particularly relevant.

Secure Storage: Hot and Cold Wallets + Hardware Wallet Recommendations

For Nodecoin holdings, investors should implement appropriate storage solutions:

- Hot Wallets: Suitable for active trading amounts, with multi-factor authentication enabled

- Cold Storage: Recommended for long-term holdings to minimize exposure to online security threats

- Hardware Wallets: Provide enhanced security through offline private key storage, particularly important given the SPL20 token standard used by Nodecoin on the Solana blockchain

V. Nodecoin (NC) Investment Risks and Challenges (Risks of investing in Nodecoin)

Market Risk: High Volatility and Price Fluctuation

Nodecoin exhibits substantial price volatility, with the token experiencing a 30-day decline of -33.37% and a year-over-year decrease of -97.8% as of February 6, 2026. The current price of $0.001279 represents a considerable distance from its previous high of $0.335 recorded on January 17, 2025. This volatility pattern reflects both broader cryptocurrency market dynamics and project-specific factors. The relatively low 24-hour trading volume may contribute to increased price sensitivity and potential liquidity concerns during periods of market stress.

Regulatory Risk: Policy Uncertainty Across Different Jurisdictions

As a decentralized bandwidth-sharing network that has evolved into a predictive intelligence platform, Nodecoin may face regulatory scrutiny in multiple jurisdictions. Different countries maintain varying approaches to cryptocurrency regulation, data privacy requirements, and decentralized network operations. Changes in regulatory frameworks could impact the project's operational model, particularly regarding its infrastructure that relies on users contributing unused internet resources for AI data retrieval. Investors should monitor regulatory developments in their respective jurisdictions and in regions where the platform operates.

Technical Risk: Network Security Vulnerabilities and Upgrade Challenges

Nodecoin's technical infrastructure carries inherent risks associated with blockchain technology and decentralized systems. Potential vulnerabilities in smart contracts, network consensus mechanisms, or the bandwidth-sharing infrastructure could affect platform stability and token value. Additionally, as the project continues to evolve its signal and prediction engine capabilities, technical upgrades may introduce implementation challenges or temporary service disruptions. With approximately 128,161 holders and a circulating supply of 295,990,695 NC (representing 29.6% of total supply), the project's technical execution remains crucial to maintaining user trust and network integrity.

VI. Conclusion: Is Nodecoin a Good Investment?

Investment Value Summary

Nodecoin represents a project in the emerging predictive intelligence sector, combining decentralized bandwidth sharing with real-time market sentiment analysis and on-chain data aggregation. While the platform's conceptual framework addresses growing demand for verified market intelligence, the token has experienced substantial price declines from its earlier levels. The project's relatively small market capitalization of approximately $378,572 and limited market dominance suggest it remains in early development stages. Price volatility remains pronounced, with notable fluctuations across multiple timeframes.

Investor Recommendations

✅ Beginners: Consider dollar-cost averaging (DCA) strategies to mitigate timing risk, combined with secure wallet storage practices. New investors should limit exposure to small-cap tokens like Nodecoin and prioritize understanding the project's fundamentals and technical infrastructure before committing capital.

✅ Experienced Investors: May explore swing trading opportunities given the token's volatility profile, while maintaining diversified portfolio allocations across multiple cryptocurrency categories. Active monitoring of platform development milestones and user adoption metrics can inform tactical positioning decisions.

✅ Institutional Investors: Should conduct thorough due diligence on the project's technical architecture, team credentials, competitive positioning, and regulatory risk profile before considering strategic allocation. Given the token's current market metrics and early-stage characteristics, institutional involvement may be premature without additional evidence of sustainable growth and platform adoption.

⚠️ Important Notice: Cryptocurrency investment carries substantial risk, including the potential for complete loss of capital. This content is provided for informational purposes only and does not constitute investment advice, financial guidance, or a recommendation to buy or sell any asset. Investors should conduct independent research and consult with qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What is Nodecoin (NC) and what makes it different from other cryptocurrencies?

Nodecoin is a decentralized predictive intelligence platform that aggregates user signal inputs, social activity, and on-chain data to deliver structured market sentiment insights. Unlike traditional cryptocurrencies, NC operates as a signal and prediction engine where users contribute unused internet bandwidth to support AI data retrieval, creating a next-generation network driven by verified human signals and market behavior. The platform focuses on providing real-time, actionable intelligence rather than serving as a simple medium of exchange.

Q2: Why has NC experienced such significant price decline since its launch?

NC has declined approximately 97.8% from its peak, falling from $0.335 in January 2025 to $0.001279 as of February 2026. This dramatic decline reflects several factors: the token remains in early development stages with only 29.6% of total supply in circulation, the project has a relatively small market capitalization of $378,572, and trading volume remains modest at around $22,799 daily. Additionally, the broader cryptocurrency market volatility and the challenges of establishing a new predictive intelligence platform have contributed to price pressure.

Q3: How risky is investing in Nodecoin compared to established cryptocurrencies?

Nodecoin carries substantially higher risk than established cryptocurrencies. With a market capitalization ranking of 3,254 globally and market dominance of only 0.000054%, NC exhibits extreme volatility—including 30-day declines of -33.37% and recent 24-hour changes of -12.75%. The relatively low trading volume may amplify price fluctuations and create liquidity concerns. Conservative investors should limit NC allocation to 1-3% of their cryptocurrency portfolio, while recognizing the potential for complete capital loss.

Q4: What are the key factors that could drive NC price appreciation?

Several catalysts could influence NC's future price trajectory: increased platform adoption and user signal input growth, enhanced AI data retrieval capabilities, expansion of the decentralized bandwidth-sharing network, successful integration of additional on-chain data sources, and accumulation of verified human signals. Long-term price forecasts project potential ranges from $0.00143 to $0.00293 by 2031 under optimistic scenarios, though these projections remain speculative and depend heavily on execution and market conditions.

Q5: How should investors approach NC storage and security?

Given Nodecoin's SPL20 token standard on the Solana blockchain, investors should implement layered security measures. For active trading, hot wallets with multi-factor authentication are appropriate for small amounts. Long-term holdings should be stored in cold storage solutions or hardware wallets to minimize online security threats. Given the token's early-stage status and the approximately 128,161 holder base, proper custody practices are essential to protect against potential vulnerabilities or market disruptions.

Q6: Is Nodecoin suitable for long-term holding or short-term trading?

Both strategies carry distinct risk-reward profiles with NC. Long-term holding may suit investors with higher risk tolerance who believe in the platform's predictive intelligence vision and can withstand continued volatility, potentially allocating 1-3% of their portfolio. Short-term traders may find opportunities in NC's price swings—with 24-hour ranges varying significantly—but must manage risk carefully given low liquidity and rapid price movements. Active traders should employ technical analysis and strict stop-loss protocols given the token's demonstrated volatility patterns.

Q7: What regulatory risks should NC investors consider?

Nodecoin faces multi-jurisdictional regulatory uncertainty affecting both cryptocurrency operations and its unique business model. As a decentralized bandwidth-sharing network supporting AI data retrieval, the platform may encounter regulatory scrutiny regarding data privacy, network infrastructure requirements, and decentralized service provision across different countries. Changes in cryptocurrency regulations, data protection laws, or technology-specific frameworks could impact the project's operational model and token utility, creating potential compliance challenges that investors should monitor continuously.

Q8: What are the realistic price expectations for Nodecoin through 2030?

Price forecasts remain highly speculative given NC's early stage and volatility. Conservative projections suggest a range of $0.00088-$0.00110 for 2026, potentially reaching $0.00143-$0.00214 by 2030-2031 under base scenarios. Optimistic forecasts project $0.00188-$0.00293 by 2031, assuming accelerated platform adoption and favorable market conditions. However, given the token's 97.8% decline from peak and current market metrics, investors should approach these projections with significant caution and recognize that actual outcomes may vary substantially due to market dynamics, competition, and execution challenges.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

Comprehensive Guide to the Winklevoss Twins and Bitcoin

Comprehensive Guide to Borrowing Against Crypto

What is CREO: A Comprehensive Guide to Parametric 3D Design Software

What is BUZ: A Comprehensive Guide to Understanding the Latest Blockchain Utility Token

What is SQT: A Comprehensive Guide to Structured Query Testing in Modern Software Development