Is Shardeum (SHM) a good investment?: A Comprehensive Analysis of the Layer-1 Blockchain Network's Potential and Risks

Introduction: Shardeum (SHM) Investment Status and Market Prospects

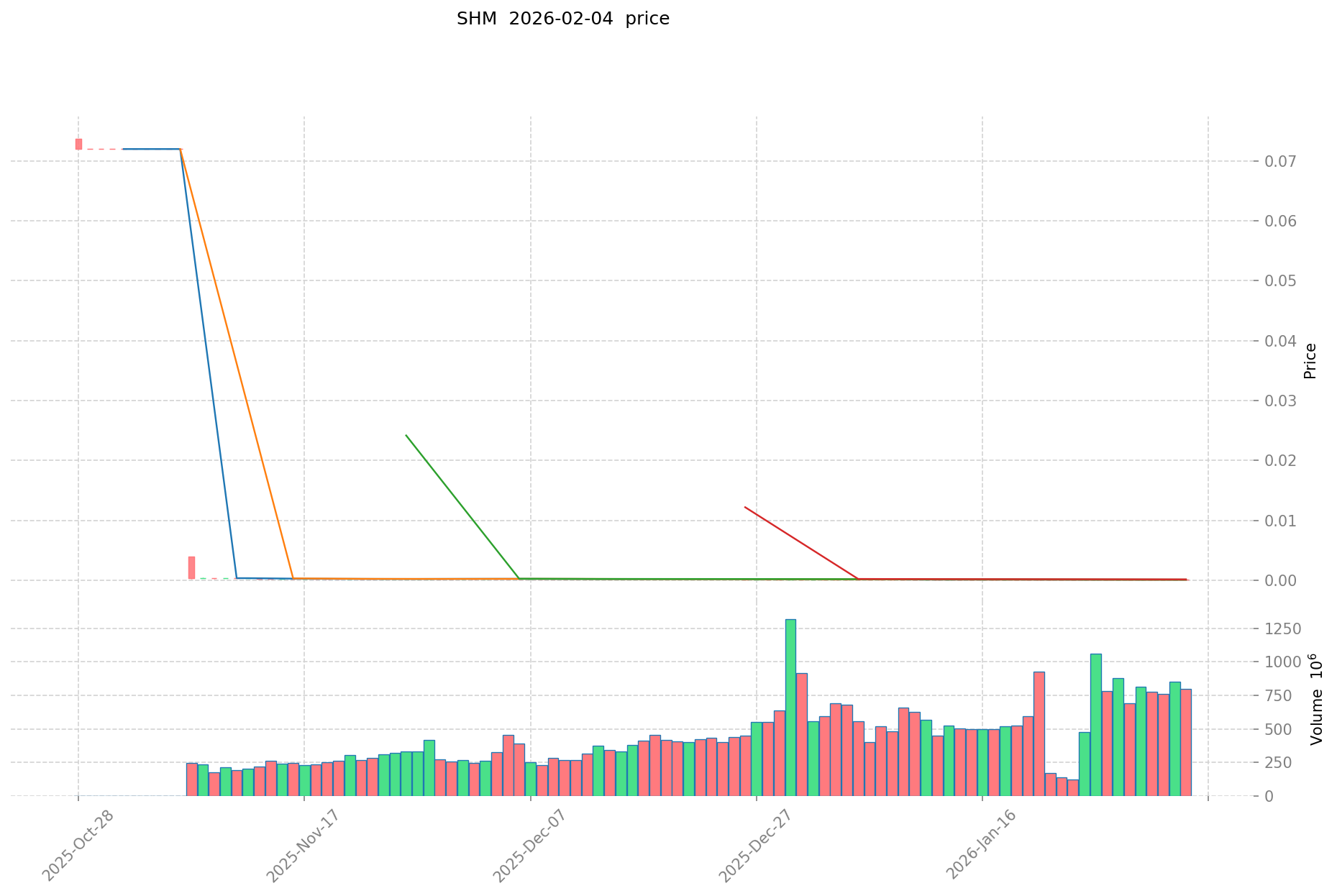

Shardeum (SHM) represents an innovative asset in the cryptocurrency space, positioning itself as an auto-scaling layer-1 blockchain solution. As of February 5, 2026, SHM holds a market capitalization of approximately $625,967, with a circulating supply of about 6.35 billion tokens, and the current price stands around $0.0000986. The project distinguishes itself through its dynamic state sharding technology designed to address blockchain scalability challenges while maintaining decentralization. With a market share of 0.00022% and a 24-hour trading volume of $84,779, SHM has attracted attention from investors exploring opportunities in blockchain infrastructure projects. This article provides a comprehensive analysis of SHM's investment characteristics, historical performance, future price considerations, and associated risks to serve as a reference for market participants.

I. Shardeum (SHM) Price History Review and Current Investment Value

Historical Price Trends and Investment Performance of SHM

- May 2025: SHM recorded its all-time high at $0.65, reflecting early market enthusiasm following its mainnet launch and initial exchange listings.

- January 2026: Market correction phase led to significant price adjustments, with SHM experiencing substantial declines from previous peak levels.

- February 2026: The token demonstrated volatility patterns typical of emerging Layer-1 blockchain projects, with 24-hour fluctuations ranging between $0.0000978 and $0.00009993.

Current SHM Investment Market Landscape (February 2026)

- Current SHM Price: $0.0000986

- Market Sentiment (Fear & Greed Index): Data indicates neutral-to-cautious sentiment reflected in a market emotion score of 2

- 24-Hour Trading Volume: $84,779.08

- Institutional Holdings: Limited institutional participation observed with only 3 exchange listings currently supporting SHM trading

- Market Capitalization: Circulating market cap stands at $625,967.00 with total market cap at $5,892,336.00

- Circulation Ratio: 10.62% of total supply (6.35 billion tokens) currently in circulation

Click to view real-time SHM market price

II. Core Factors Influencing Whether SHM is a Good Investment

Supply Mechanism and Scarcity (SHM Investment Scarcity)

- Maximum Supply: 59,760,000,000 SHM tokens with a circulating supply of 6,348,549,754 tokens (approximately 10.62% of total supply)

- Current circulation represents a relatively low percentage of maximum supply, suggesting potential future supply expansion could impact scarcity dynamics

- The token distribution mechanism and release schedule may influence price development and investment considerations over time

- Investment consideration: Understanding the supply schedule and unlock mechanisms is relevant for evaluating long-term investment potential

Institutional Investment and Mainstream Adoption (Institutional Investment in SHM)

- Exchange availability: Currently listed on 3 exchanges, indicating early-stage market presence

- Market capitalization of approximately $625,967 with a fully diluted valuation of $5,892,336 as of February 5, 2026

- Market dominance stands at 0.00022%, reflecting limited mainstream adoption at present

- Limited available data on institutional holdings or major corporate partnerships

Macroeconomic Environment's Impact on SHM Investment

- As a Layer-1 blockchain project focused on scalability solutions, SHM's investment appeal may be influenced by broader crypto market conditions and technological innovation cycles

- Market sentiment indicators suggest neutral to cautious positioning (market emotion rating: 2)

- Recent price performance shows volatility: -0.81% (24H), -8.03% (7D), and -37.83% (30D), reflecting challenging short-term market conditions

Technology and Ecosystem Development (Technology & Ecosystem for SHM Investment)

- Dynamic State Sharding Technology: Shardeum implements an auto-scaling architecture designed to maintain low gas fees and high transaction throughput as network participation increases

- Transaction-Level Consensus: The protocol performs consensus at the transaction level, potentially reducing computational requirements for validator nodes

- Decentralization Approach: The consensus mechanism is designed to enable broader node operation participation, which may support network decentralization objectives

- Ecosystem stage: As a relatively new Layer-1 blockchain, the project's ecosystem applications and developer activity represent areas to monitor for long-term value assessment

III. SHM Future Investment Forecast and Price Outlook (Is Shardeum(SHM) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term SHM investment outlook)

- Conservative forecast: $0.0000601 - $0.0000854

- Neutral forecast: $0.0000854 - $0.0001085

- Optimistic forecast: $0.0001085 - $0.0001301

Mid-term Investment Outlook (2027-2028, mid-term Shardeum(SHM) investment forecast)

- Market stage expectation: Following its mainnet launch in May 2025, SHM may enter a phase of ecosystem development and user adoption expansion, with market sentiment and exchange trading volume serving as key determinants of price trajectory

- Investment return forecast:

- 2027: $0.0000926 - $0.0001452

- 2028: $0.0000908 - $0.0001687

- Key catalysts: Dynamic state sharding implementation progress, validator node participation rate, transaction throughput growth, and broader Layer-1 blockchain competitive landscape

Long-term Investment Outlook (Is SHM a good long-term investment?)

- Base scenario: $0.0000880 - $0.0001404 (assuming steady ecosystem maturation and maintained decentralization characteristics)

- Optimistic scenario: $0.0001687 - $0.0001894 (assuming accelerated adoption of auto-scaling architecture and enhanced network effect)

- Risk scenario: Below $0.0000601 (under conditions of intensified market competition or technical implementation challenges)

Click to view SHM long-term investment and price forecast: Price Prediction

2026-2031 Long-term Outlook

- Base scenario: $0.0000880 - $0.0001404 (corresponding to steady progress and gradual mainstream application expansion)

- Optimistic scenario: $0.0001452 - $0.0001894 (corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $0.0001894 (contingent on breakthrough ecosystem developments and mainstream proliferation)

- 2031-12-31 forecast high: $0.0001873 (based on optimistic development assumptions)

Disclaimer: The above forecasts are based on historical data analysis and market research materials, and do not constitute investment advice. Cryptocurrency markets involve substantial risks, and investors should conduct independent research and risk assessment.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0001300728 | 0.00009854 | 0.0000601094 | 0 |

| 2027 | 0.000145169128 | 0.0001143064 | 0.000092588184 | 16 |

| 2028 | 0.0001686590932 | 0.000129737764 | 0.0000908164348 | 31 |

| 2029 | 0.000189482004322 | 0.0001491984286 | 0.000088027072874 | 51 |

| 2030 | 0.000174420422954 | 0.000169340216461 | 0.000140552379662 | 72 |

| 2031 | 0.000187349548481 | 0.000171880319707 | 0.000134066649372 | 74 |

IV. Shardeum Investment Strategy and Risk Management (How to invest in Shardeum)

Investment Methodology (Shardeum investment strategy)

Long-term Holding (HODL Shardeum)

For conservative investors, a long-term holding strategy may be considered. This approach involves acquiring SHM tokens and maintaining positions through market cycles, reducing the impact of short-term price fluctuations. Given Shardeum's auto-scaling Layer-1 architecture and dynamic state sharding technology, investors adopting this strategy typically focus on the project's long-term technical development and ecosystem growth potential.

Active Trading

Active trading strategies rely on technical analysis and swing trading operations. Traders may utilize price trends, volume patterns, and market sentiment indicators to identify entry and exit points. With SHM's 24-hour trading volume of approximately $84,779 and observed price volatility (7-day change: -8.03%, 30-day change: -37.83%), active traders should employ rigorous risk controls and position management techniques.

Risk Management (Risk management for Shardeum investment)

Asset Allocation Ratios

- Conservative Investors: May consider allocating 1-3% of their cryptocurrency portfolio to SHM, maintaining diversification across multiple established digital assets.

- Aggressive Investors: Could allocate 5-10% to SHM, accepting higher volatility in exchange for potential growth opportunities.

- Professional Investors: May employ dynamic allocation strategies based on market conditions, technical indicators, and fundamental analysis, potentially ranging from 3-15% depending on risk tolerance and investment thesis.

Risk Hedging Solutions

Multi-asset portfolio construction combined with hedging instruments can help manage Shardeum investment risks. Investors may consider:

- Diversification across different blockchain ecosystems and use cases

- Correlation analysis with major cryptocurrencies to optimize portfolio balance

- Periodic rebalancing to maintain target allocation ratios

- Stop-loss mechanisms for active trading positions

Secure Storage

Hot Wallets: Suitable for active trading and frequent transactions, but carry higher security risks. Users should enable two-factor authentication and use reputable wallet providers.

Cold Wallets: Recommended for long-term holdings. Hardware wallets provide offline storage solutions that significantly reduce exposure to online threats.

Hardware Wallet Recommendations: Industry-standard hardware wallets such as Ledger and Trezor offer robust security features for cryptocurrency storage. Users should purchase directly from official sources and verify device authenticity.

V. Shardeum Investment Risks and Challenges (Risks of investing in Shardeum)

Market Risks

High Volatility: SHM has demonstrated substantial price fluctuations, with a 30-day decline of -37.83% and currently trading at $0.0000986. The token's historical price range spans from an all-time low of $0.0000961 (January 31, 2026) to an all-time high of $0.65 (May 8, 2025), indicating extreme volatility that may not be suitable for risk-averse investors.

Price Manipulation: With a relatively limited exchange presence (available on 3 exchanges) and a 24-hour trading volume of approximately $84,779, SHM may be susceptible to price manipulation risks common in lower-liquidity digital assets. The circulating supply of 6.35 billion tokens represents approximately 10.62% of the maximum supply of 59.76 billion, which creates potential dilution concerns as additional tokens enter circulation.

Regulatory Risks

Policy Uncertainty Across Jurisdictions: Cryptocurrency regulations vary significantly across different countries and continue to evolve. Shardeum, as a Layer-1 blockchain project, may face:

- Changing classification standards for digital assets and blockchain platforms

- Varying compliance requirements across different regulatory regimes

- Potential restrictions on trading, holding, or using SHM tokens in certain jurisdictions

- Uncertainty regarding taxation treatment and reporting obligations

Investors should monitor regulatory developments in their respective jurisdictions and assess potential impacts on SHM accessibility and legal status.

Technical Risks

Network Security Vulnerabilities: As an auto-scaling Layer-1 blockchain employing dynamic state sharding and transaction-level consensus, Shardeum's architecture introduces both innovations and potential security considerations. While the design aims to maintain decentralization while scaling, any blockchain network may face:

- Smart contract vulnerabilities or exploitation risks

- Potential consensus mechanism challenges during network stress

- Node security concerns affecting network integrity

Upgrade Failures: Blockchain protocol upgrades and improvements carry inherent risks. Technical implementations may encounter unexpected issues, compatibility problems, or community disagreements that could temporarily or permanently affect network functionality and token value.

VI. Conclusion: Is Shardeum a Good Investment?

Investment Value Summary

Shardeum presents a technical approach to blockchain scalability through auto-scaling Layer-1 architecture and dynamic state sharding. However, the token has experienced substantial price volatility, with a -37.83% decline over 30 days and current trading near historical lows. The project's long-term potential depends on successful technical implementation, ecosystem adoption, and broader market conditions. Short-term price movements remain highly unpredictable and subject to various market forces.

Investor Recommendations

✅ Beginners: Consider dollar-cost averaging strategies combined with secure wallet storage. Beginners should thoroughly research the project, start with small allocations within their risk tolerance, and prioritize learning about cryptocurrency security practices before making investment decisions.

✅ Experienced Investors: May explore swing trading opportunities combined with diversified portfolio allocation. Experienced investors should conduct independent technical and fundamental analysis, monitor on-chain metrics, and implement disciplined risk management protocols.

✅ Institutional Investors: Could evaluate strategic long-term allocation as part of broader blockchain infrastructure investment thesis. Institutional participants should conduct comprehensive due diligence, assess regulatory compliance requirements, and consider portfolio correlation effects.

⚠️ Notice: Cryptocurrency investments carry high risks, including potential total loss of capital. This content is provided for informational purposes only and does not constitute investment advice, financial guidance, or a recommendation to buy, sell, or hold any digital asset. Investors should conduct independent research, assess their risk tolerance, and consult qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What is Shardeum and how does its technology differentiate it from other Layer-1 blockchains?

Shardeum is an auto-scaling Layer-1 blockchain that employs dynamic state sharding technology to address scalability challenges while maintaining decentralization. Unlike traditional blockchains that experience network congestion and rising fees as usage increases, Shardeum's architecture automatically scales by adding more shards as transaction volume grows, performing consensus at the transaction level rather than block level. This approach potentially reduces computational requirements for validator nodes and aims to maintain low gas fees and high throughput regardless of network participation levels.

Q2: What are the current market indicators suggesting about SHM's investment status as of February 2026?

As of February 5, 2026, SHM demonstrates early-stage market characteristics with a price of $0.0000986, market capitalization of approximately $625,967, and 24-hour trading volume of $84,779. The token has experienced significant volatility, with declines of -8.03% over 7 days and -37.83% over 30 days. Market sentiment indicators show neutral-to-cautious positioning (emotion rating: 2), with only 3 exchange listings and a market dominance of 0.00022%, indicating limited mainstream adoption at present. These metrics suggest SHM remains a speculative asset with substantial risk factors.

Q3: How does SHM's supply mechanism impact long-term investment considerations?

SHM has a maximum supply of 59,760,000,000 tokens, with approximately 6.35 billion tokens currently in circulation, representing only 10.62% of total supply. This low circulation ratio means substantial additional supply may enter the market over time, potentially creating dilution pressure on token value. Investors should understand the token release schedule and unlock mechanisms, as future supply expansion could significantly impact scarcity dynamics and price development. The circulating market cap of $625,967 versus fully diluted valuation of $5,892,336 illustrates this significant differential.

Q4: What are appropriate portfolio allocation strategies for different investor types considering SHM?

Conservative investors may consider allocating 1-3% of their cryptocurrency portfolio to SHM while maintaining diversification across established digital assets. Aggressive investors could allocate 5-10%, accepting higher volatility for potential growth opportunities. Professional investors might employ dynamic allocation strategies ranging from 3-15% based on market conditions and technical indicators. All investor types should implement risk management protocols including stop-loss mechanisms, periodic rebalancing, and secure storage solutions using hardware wallets for long-term holdings and reputable hot wallets with two-factor authentication for active trading.

Q5: What are the primary risk factors investors should evaluate before investing in SHM?

Key risk factors include extreme price volatility (historical range from $0.0000961 to $0.65), limited liquidity with only 3 exchange listings, potential price manipulation concerns, and regulatory uncertainty across different jurisdictions. Technical risks involve network security vulnerabilities inherent in the dynamic state sharding architecture, potential consensus mechanism challenges, and upgrade implementation risks. Additionally, the low market dominance (0.00022%) and limited institutional participation suggest early-stage project status with uncertain ecosystem development trajectory. These factors collectively indicate high-risk investment characteristics unsuitable for risk-averse participants.

Q6: What is the realistic price forecast range for SHM through 2031?

Based on historical data analysis, short-term 2026 forecasts range from $0.0000601 (conservative) to $0.0001301 (optimistic). Mid-term projections for 2027-2028 suggest ranges of $0.0000926-$0.0001452 (2027) and $0.0000908-$0.0001687 (2028), contingent on ecosystem development progress and network adoption rates. Long-term forecasts through 2031 vary from $0.0000880-$0.0001404 (base scenario) to $0.0001687-$0.0001894 (optimistic scenario), with transformative scenarios exceeding $0.0001894. However, these projections carry substantial uncertainty, and risk scenarios include potential declines below $0.0000601 under adverse market conditions or technical implementation challenges.

Q7: How should investors approach storage security for SHM tokens?

Investors should implement tiered storage strategies based on their trading frequency and holdings duration. For active trading, reputable hot wallets with mandatory two-factor authentication provide necessary accessibility while maintaining reasonable security. For long-term holdings representing significant value, hardware wallets such as Ledger or Trezor offer optimal security through offline storage, substantially reducing exposure to online threats. Hardware wallets should be purchased directly from official manufacturers to ensure authenticity. Investors should never share private keys or seed phrases, implement strong passwords, and maintain backup recovery information in secure physical locations separate from the hardware devices themselves.

Q8: What key metrics and developments should investors monitor to assess SHM's investment potential?

Critical monitoring metrics include exchange trading volume trends, additional exchange listings, validator node participation rates, transaction throughput data, and on-chain activity metrics. Development milestones such as dynamic state sharding implementation progress, ecosystem application launches, developer activity levels, and partnership announcements provide fundamental indicators. Market metrics including circulating supply changes, token unlock schedules, institutional participation data, and correlation with broader cryptocurrency market movements inform tactical positioning. Regulatory developments across major jurisdictions and competitive positioning relative to other Layer-1 scaling solutions also represent material factors influencing long-term investment viability.

Top Layer 2 projects worth following in 2025: From Arbitrum to zkSync

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

What is Layer 2 in crypto assets? Understand the scaling solution for Ethereum

How Layer 2 Changes the Crypto Assets Experience: Speed, Cost, and Mass Adoption

Pepe Unchained (PEPU): Building the New Era of Meme Coins on Layer 2

2026 XELS Price Prediction: Expert Analysis and Market Forecast for Digital Asset Growth

Is Göztepe S.K. Fan Token (GOZ) a good investment?: A comprehensive analysis of risks, returns, and market potential for football fans and crypto investors

Is Griffin AI (GAIN) a good investment?: A Comprehensive Analysis of the Emerging AI Token's Potential and Risks

Is STEPN Failing to Generate Profits? Exploring the Factors Behind Its Downturn

LABUBU vs BTC: Which Digital Asset Will Dominate the Future of Collectibles and Cryptocurrency?