LIKE vs LRC: Understanding the Key Differences Between Two Popular Lyric Formats

Introduction: LIKE vs LRC Investment Comparison

In the cryptocurrency market, the comparison between LIKE vs LRC has consistently been a topic that investors cannot avoid. Both show significant differences in market cap ranking, application scenarios, and price performance, representing distinct crypto asset positioning. LIKE (LIKE): Launched in 2021, it has gained market recognition through its positioning as a social media platform combining NFT, market, and scalable blockchain, allowing creators to output content and share directly with fans. LRC (LRC): Since its launch in 2017, it has been recognized as a decentralized token exchange protocol based on ERC20 and smart contracts, providing zero-risk token trading and enabling multiple exchanges to compete in off-chain matching and on-chain settlement. This article will comprehensively analyze the investment value comparison of LIKE vs LRC around historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future predictions, attempting to answer investors' most concerned question:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

LIKE (Only1) and LRC (Loopring) Historical Price Trends

-

2021: LIKE experienced price movements following its platform launch, with the token reaching $1.041 on September 7, 2021. LRC saw notable growth during the same period, with its price climbing to $3.75 on November 10, 2021, amid broader interest in Layer 2 scaling solutions.

-

2023: LIKE recorded its lowest price point at $0.00133134 on August 6, 2023. LRC similarly faced downward pressure, reaching its historical low of $0.01963893 on December 18, 2019.

-

Comparative Analysis: During recent market cycles, LIKE has declined from its peak of $1.041 to a current level of $0.00202, representing a substantial correction. LRC has similarly declined from its high of $3.75, currently trading at $0.04096, reflecting broader market adjustments in the decentralized exchange and Layer 2 sectors.

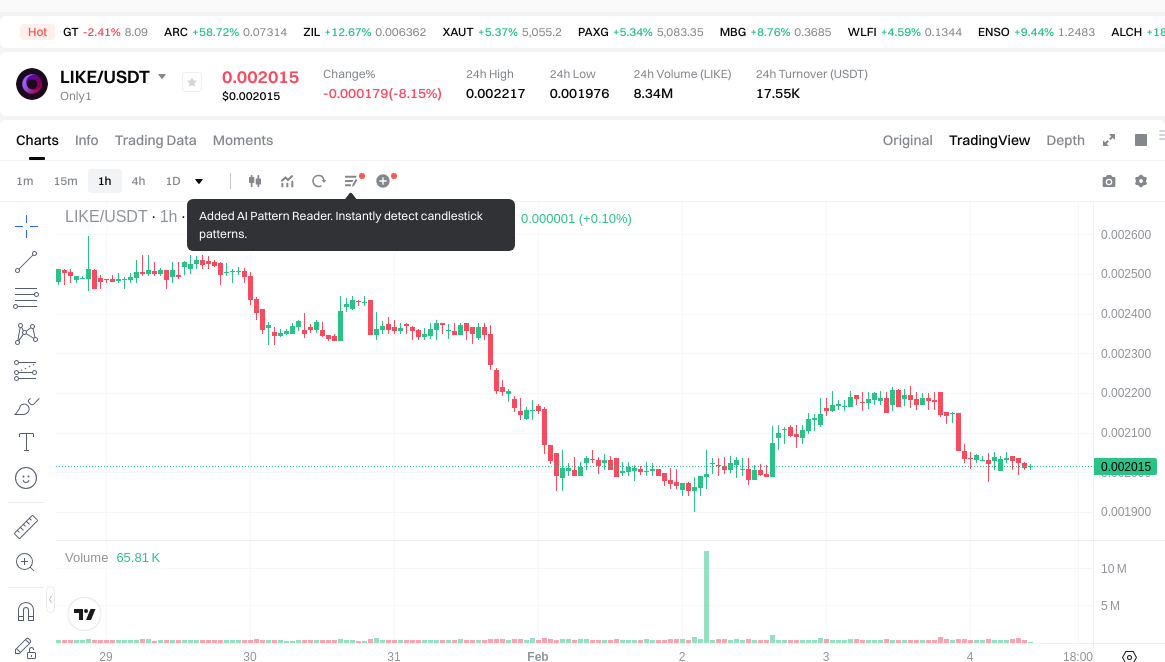

Current Market Status (February 4, 2026)

- LIKE Current Price: $0.00202

- LRC Current Price: $0.04096

- 24-Hour Trading Volume: LIKE $17,525.33 vs LRC $111,556.26

- Market Sentiment Index (Fear & Greed Index): 14 (Extreme Fear)

View real-time prices:

- Check LIKE current price Market Price

- Check LRC current price Market Price

II. Core Factors Influencing LIKE vs LRC Investment Value

Supply Mechanism Comparison (Tokenomics)

- LRC: Fixed total supply of 1.37 billion tokens, implementing a deflationary model through token burning mechanism

- LIKE: Supply mechanism information not available in provided materials

- 📌 Historical Pattern: Deflationary supply mechanisms through token burning have historically attracted investor interest by reducing circulating supply over time

Institutional Adoption and Market Application

- Institutional Holdings: Comparative data on institutional preference between LIKE and LRC not available in provided materials

- Enterprise Adoption: LRC's value is primarily influenced by network efficiency and market demand, though specific enterprise use cases in cross-border payments, settlements, or investment portfolios require further research

- National Policies: Regulatory attitudes toward these assets vary across jurisdictions and continue to evolve

Technical Development and Ecosystem Building

- LRC Technical Development: Functions as a Layer-2 scaling solution for Ethereum, focusing on network efficiency improvements

- LIKE Technical Development: Technical upgrade information not available in provided materials

- Ecosystem Comparison: LRC operates within the DeFi ecosystem, though specific comparative data on DeFi, NFT, payment systems, and smart contract implementations between LIKE and LRC requires additional analysis

Macroeconomic Environment and Market Cycles

- Performance Under Inflationary Conditions: During periods of uncertainty, demand for digital assets like LRC may experience changes as users seek alternative value storage methods

- Macroeconomic Monetary Policy: Global inflation concerns, geopolitical tensions, and central bank interest rate adjustments can influence demand for digital assets

- Geopolitical Factors: Macroeconomic trends and geopolitical developments may drive shifts in cross-border transaction demand, potentially affecting asset valuations

III. 2026-2031 Price Forecast: LIKE vs LRC

Short-term Forecast (2026)

- LIKE: Conservative $0.00147-$0.002014 | Optimistic $0.002014-$0.00244

- LRC: Conservative $0.02956-$0.04105 | Optimistic $0.04105-$0.05008

Mid-term Forecast (2028-2029)

- LIKE may enter a consolidation phase, with estimated price range of $0.001545-$0.003516

- LRC may enter a growth phase, with estimated price range of $0.036-$0.0725

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Forecast (2030-2031)

- LIKE: Baseline scenario $0.002301-$0.003763 | Optimistic scenario $0.003274-$0.004416

- LRC: Baseline scenario $0.04138-$0.079588 | Optimistic scenario $0.04538-$0.10506

Disclaimer

LIKE:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00243694 | 0.002014 | 0.00147022 | 0 |

| 2027 | 0.0027595828 | 0.00222547 | 0.0018916495 | 10 |

| 2028 | 0.002916255888 | 0.0024925264 | 0.001545366368 | 23 |

| 2029 | 0.0035157084872 | 0.002704391144 | 0.00140628339488 | 33 |

| 2030 | 0.004416270738152 | 0.0031100498156 | 0.002301436863544 | 53 |

| 2031 | 0.004290002715638 | 0.003763160276876 | 0.003273949440882 | 86 |

LRC:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.050081 | 0.04105 | 0.029556 | 0 |

| 2027 | 0.058779495 | 0.0455655 | 0.025061025 | 11 |

| 2028 | 0.072519771525 | 0.0521724975 | 0.035999023275 | 27 |

| 2029 | 0.069204209308875 | 0.0623461345125 | 0.040524987433125 | 52 |

| 2030 | 0.093400744113176 | 0.065775171910687 | 0.045384868618374 | 60 |

| 2031 | 0.10505610457575 | 0.079587958011931 | 0.041385738166204 | 94 |

IV. Investment Strategy Comparison: LIKE vs LRC

Long-term vs Short-term Investment Strategies

- LIKE: May suit investors focused on social media and NFT platform scenarios, though the asset's development trajectory requires careful consideration given limited market visibility

- LRC: May suit investors interested in Layer 2 scaling solutions and decentralized exchange infrastructure, with focus on Ethereum ecosystem developments

Risk Management and Asset Allocation

- Conservative Investors: LIKE 10-15% vs LRC 20-30%

- Aggressive Investors: LIKE 25-35% vs LRC 35-45%

- Hedging Tools: stablecoin allocation, options strategies, cross-asset portfolio diversification

V. Potential Risk Comparison

Market Risk

- LIKE: Limited trading volume ($17,525.33 in 24-hour period) may result in liquidity constraints and increased price volatility during market fluctuations

- LRC: Trading volume of $111,556.26 suggests relatively higher liquidity, though market sentiment conditions (Fear & Greed Index at 14 - Extreme Fear) indicate cautious market environment

Technical Risk

- LIKE: Scalability and network stability information requires further verification

- LRC: As a Layer 2 solution, technical performance depends on Ethereum mainnet developments and potential security considerations inherent to scaling technologies

Regulatory Risk

- Global regulatory frameworks continue to evolve, with varying approaches across jurisdictions potentially affecting both assets differently based on their classification as social platform tokens versus DeFi protocol tokens

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- LIKE Advantages: Positioning in social media and NFT sectors may offer exposure to creator economy developments

- LRC Advantages: Established presence in Layer 2 scaling solutions with deflationary tokenomics through burning mechanism

✅ Investment Recommendations:

- Novice Investors: Consider starting with smaller position sizes and prioritizing assets with clearer documentation and higher liquidity levels

- Experienced Investors: May evaluate both assets as part of diversified portfolio strategy, weighing ecosystem maturity and technical roadmaps

- Institutional Investors: Comprehensive due diligence on regulatory compliance, liquidity depth, and use case validation recommended before position establishment

⚠️ Risk Warning: Cryptocurrency markets exhibit substantial volatility. This content does not constitute investment advice.

VII. FAQ

Q1: What are the main differences between LIKE and LRC in terms of their use cases?

LIKE is a social media platform token focused on NFT integration and creator-fan interactions, while LRC is a Layer 2 scaling protocol for decentralized exchanges. LIKE operates in the social media and creator economy space, allowing content creators to monetize their work and engage directly with fans through NFT functionality. In contrast, LRC (Loopring) serves as a technical infrastructure solution for Ethereum, providing zero-risk token trading through off-chain matching and on-chain settlement, primarily targeting DeFi users and traders seeking lower transaction costs and faster execution.

Q2: Which asset shows better liquidity between LIKE and LRC?

LRC demonstrates significantly better liquidity compared to LIKE. As of February 4, 2026, LRC's 24-hour trading volume stands at $111,556.26, while LIKE's volume is only $17,525.33. This approximately 6x difference in trading volume suggests that LRC offers more favorable conditions for entering and exiting positions with minimal slippage. The lower liquidity of LIKE may result in increased price volatility and difficulty executing larger trades without significantly impacting market price.

Q3: How do the supply mechanisms of LIKE and LRC differ?

LRC implements a clearly defined deflationary model with a fixed total supply of 1.37 billion tokens and a token burning mechanism that reduces circulating supply over time. This deflationary approach has historically attracted investors by creating potential scarcity value. In contrast, specific information about LIKE's supply mechanism, total token count, and whether it employs inflationary or deflationary dynamics is not currently available in public documentation, which may present challenges for investors attempting to assess long-term tokenomics.

Q4: What are the price projections for LIKE and LRC through 2031?

For 2026, LIKE is projected to trade between $0.00147-$0.00244, while LRC is forecasted at $0.02956-$0.05008. By 2031, LIKE's baseline scenario estimates $0.002301-$0.003763 (optimistic: $0.003274-$0.004416), representing potential growth of 53-86% from 2026 levels. LRC's 2031 projections show $0.04138-$0.079588 (optimistic: $0.04538-$0.10506), indicating potential growth of 60-94%. These forecasts depend on multiple factors including institutional adoption, ecosystem development, and broader market conditions.

Q5: What risks should investors consider when comparing LIKE and LRC?

Three primary risk categories require evaluation. First, market risk: LIKE's limited liquidity may cause significant price volatility during market stress, while both assets are currently trading in an Extreme Fear environment (Fear & Greed Index: 14). Second, technical risk: LIKE's scalability and network stability require further verification, whereas LRC's performance depends on Ethereum mainnet developments and Layer 2 security considerations. Third, regulatory risk: evolving global frameworks may affect these assets differently based on their classifications as social platform tokens versus DeFi protocol tokens.

Q6: How should different investor types approach LIKE vs LRC allocation?

Conservative investors might consider allocating 10-15% to LIKE and 20-30% to LRC within their cryptocurrency portfolio, while aggressive investors could increase exposure to 25-35% for LIKE and 35-45% for LRC. Novice investors should prioritize smaller position sizes and focus on assets with clearer documentation and higher liquidity levels, suggesting LRC may be more suitable initially. Experienced investors can evaluate both assets as complementary components within a diversified strategy, while institutional investors should conduct comprehensive due diligence on regulatory compliance, liquidity depth, and validated use cases before establishing positions.

Q7: What factors most significantly influence the investment value of LIKE versus LRC?

Several core factors drive investment value differently for each asset. For LRC, the deflationary supply mechanism through token burning, established Layer 2 technical infrastructure, and integration within the DeFi ecosystem represent primary value drivers. For LIKE, positioning in the creator economy and NFT sectors offers exposure to social media developments, though limited market visibility and documentation present evaluation challenges. Additionally, macroeconomic conditions including inflation concerns, interest rate policies, and geopolitical factors may affect both assets, potentially driving demand for alternative value storage methods and cross-border transaction solutions.

Q8: Based on historical performance, which asset has shown more resilience during market downturns?

Historical data shows both assets experienced significant corrections from their peaks. LIKE declined from $1.041 (September 7, 2021) to $0.00202 currently, representing approximately 99.8% drawdown, with its lowest point at $0.00133134 (August 6, 2023). LRC declined from $3.75 (November 10, 2021) to $0.04096 currently, representing approximately 98.9% drawdown, with historical low at $0.01963893 (December 18, 2019). While both assets experienced severe corrections typical of cryptocurrency markets, LRC's relatively smaller percentage decline and higher current trading volume suggest potentially greater resilience, though neither asset has demonstrated strong downside protection during market stress.

Top Layer 2 projects worth following in 2025: From Arbitrum to zkSync

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

2025 Layer-2 Solution: Ethereum Scalability and Web3 Performance Optimization Guide

What is Layer 2 in crypto assets? Understand the scaling solution for Ethereum

How Layer 2 Changes the Crypto Assets Experience: Speed, Cost, and Mass Adoption

Pepe Unchained (PEPU): Building the New Era of Meme Coins on Layer 2

Is LIORA (LIORA) a good investment?: A Comprehensive Analysis of Price, Technology, and Market Potential in 2024

Is Hyperbot (BOT) a good investment?: A Comprehensive Analysis of Price, Tokenomics, and Future Potential

LIORA vs STX: A Comprehensive Comparison of Two Leading Enterprise Solutions

BOT vs LINK: Which Blockchain Oracle Solution Offers Better Performance and Reliability for Smart Contracts?

MTV vs MANA: A Comprehensive Comparison of Two Revolutionary Blockchain-Based Entertainment Platforms