Beyond Standard ETFs—Leverage Products, Derivative Structures & Trader Opportunities/Risks

This lesson systematically breaks down how "ETF concepts are further financialized," including leveraged/inverse/synthetic exposure products; why these are more popular in crypto than traditional markets; and how they amplify trading behavior/risk exposure in trending vs range-bound conditions.

I. Why Do ETFs Rapidly Become “Derivative-Like”?

In traditional finance, most ETF derivatives are confined to professional options/futures markets:

- High entry barriers,

- Mainly institutions participate,

- Obvious gap from retail investors,

But in crypto markets things are almost opposite.

Four Structural Premises in Crypto:

- Extremely high volatility—naturally suited for leveraged views.

- Predominantly active traders—not long-term passive allocators.

- 24/7 continuous trading—high sensitivity to pace/trends/events.

- Derivatives experience often unfriendly—liquidation risk/funding rates frustrate users.

Here, the advantage of an ETF is quickly redefined: Not just “hold an asset”—but “express trading views more efficiently and controllably.”

II. Three Main Leverage Paths Around Crypto ETFs

Currently three clear leverage/derivative paths exist around crypto ETFs:

Leveraged ETFs

Core goal: Amplify single-direction daily returns without margin/liquidation risk.

Key features:

- Track n-times daily returns for BTC/ETH etc.,

- Achieve leverage via internal contracts/index rebalancing,

- No liquidation line but path dependency exists,

Essentially leverages are embedded within product structure—risk managed by product itself.

Inverse ETFs

Core goal: Offer short/hedge tools without needing to short spot/open short contracts.

Main features:

- When underlying falls, ETF price rises;

- Used for short-term views or portfolio hedging;

- Long-term holding still faces rebalancing decay;

Inverse ETFs turn single-direction tools into bi-directional ones.

Synthetic Exposure Products

Features include:

- No direct holding of spot ETF;

- Exposure built via contracts/indexes/asset baskets;

Emphasizes trading efficiency/flexibility/product design;

In crypto these structures better match pro trader needs.

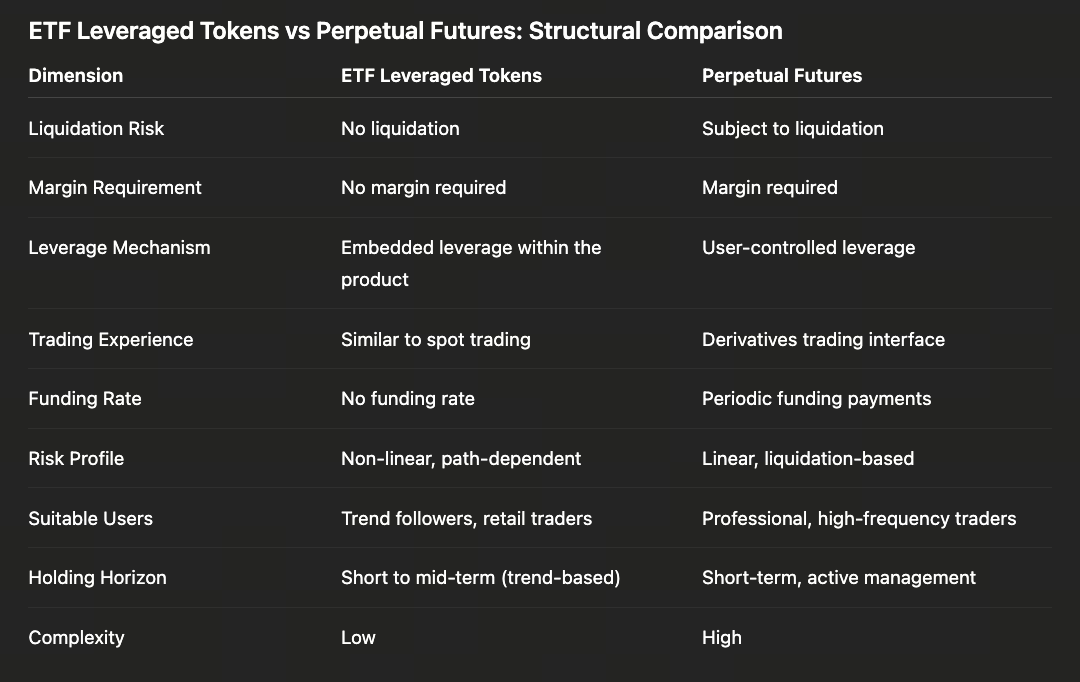

III. Leveraged Tokens vs Perpetual Contracts—Essential Structural Differences

Many users wonder: “If I can use perpetuals why use leveraged tokens?” This is key for this lesson.

The real difference isn’t leverage multiple—it’s risk assumption method.

- Perpetuals expose all risk to user;

- Leveraged tokens absorb/dampen risk within product structure;

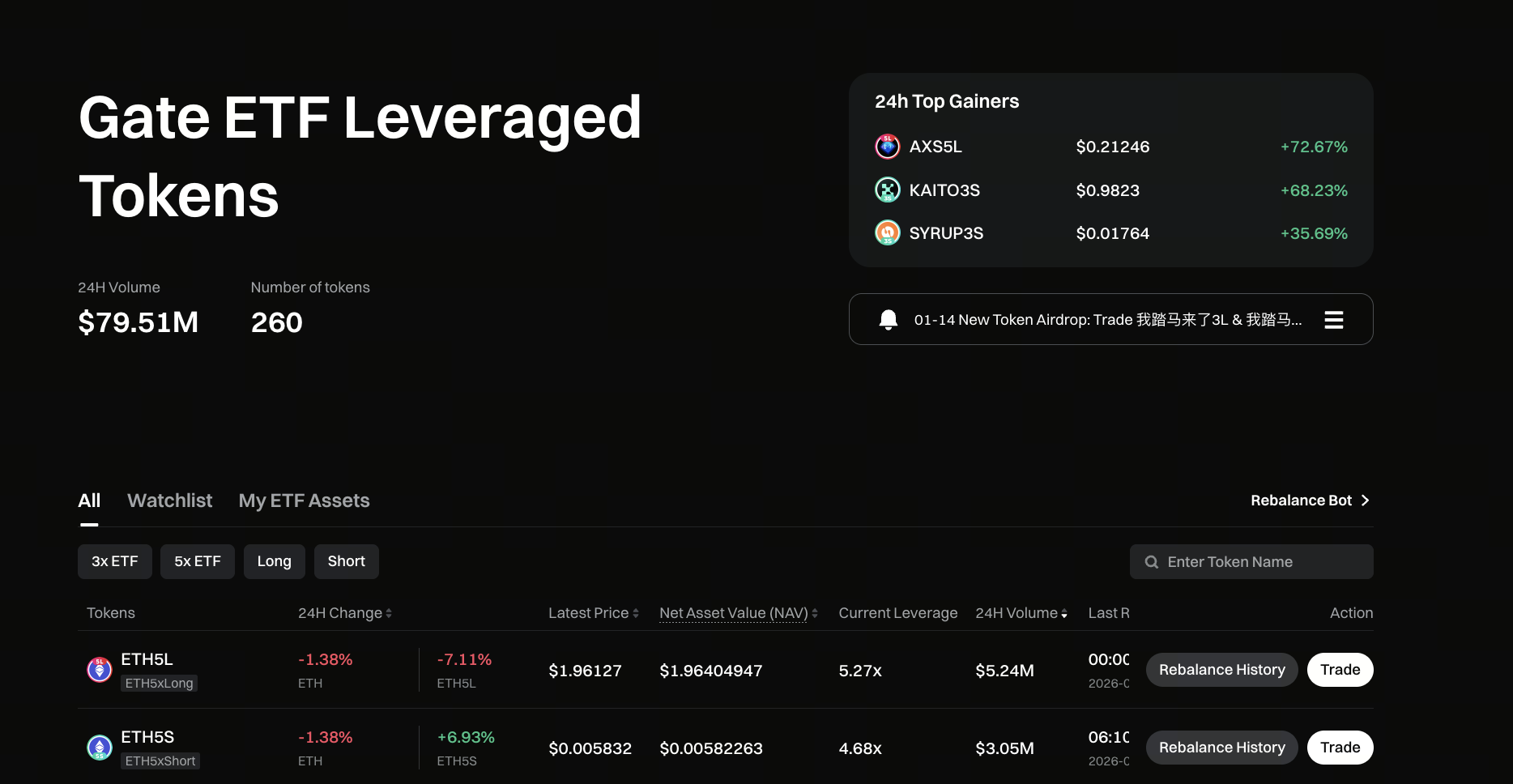

IV. Platform Implementation Example: Gate Leveraged Tokens

Image: https://www.gate.com/leveraged-etf

In crypto markets leveraged ETFs aren’t just traditional finance products—they’re also implemented natively by exchanges tailored for crypto users.

Take Gate Leveraged Tokens as example—the design embeds leverage within token structure rather than exposing users via margin/liquidation mechanics. User experience mirrors spot trading but returns reflect amplified gains/losses versus benchmark asset.

Structurally these platform tokens typically offer:

- No liquidation line—no forced liquidation risk;

- Auto-rebalancing—to maintain target leverage band;

- No margin/funding rate needed—lowers holding/operating costs;

- Optimized for trending markets—better for one-way trends than prolonged ranges;

These products don’t replace perpetuals—they offer smoother-risk/low-barrier leverage alternatives; often preferred for directional trades during strong trends.

Note however that platform leveraged tokens still follow general leveraged ETF rules: path dependency/rebalancing affect long-term returns; they’re trading tools—not passive investments.

V. Hidden Risks of Leveraged ETFs: Path Dependency & Rebalancing Decay

No liquidation doesn’t mean no risk! Two key concepts for leveraged ETFs:

Path Dependency

Leveraged ETFs track multiples of daily—not long-term—returns.

In volatile/ranging markets:

- Underlying price whipsaws up/down;

- Continuous portfolio rebalancing;

- Actual returns can diverge significantly from intuition;

Work well in clear trends; perform poorly during sideways action.

Rebalancing Decay

To keep fixed leverage product must constantly adjust positions/conduct internal trades.

Result:

- Greater volatility = faster decay;

- Longer time = more structural loss;

That’s why leveraged ETFs are trading tools—not long-term investments.

VI. Why Do Crypto Markets Still Favor Leveraged ETF Products?

Despite structural drawbacks leveraged ETFs keep growing because they precisely meet core needs:

- Amplify returns without liquidation risk;

- Beginner-friendly/low learning curve;

- Trading feels like spot/easy strategy integration;

- Well-suited for trending/event-driven markets;

As standard ETF becomes main entry layer—leveraged tokens naturally extend into trading layer.

VII. Summary: The True Role of ETFs Is Evolving

If phase one was asset-on-chain; phase two was capital entry; now phase three sees ETFs as composable financial building blocks reassembled into trading tools.

Understanding this explains:

- Why ETFs don’t reduce volatility;

- Why they foster more derivatives structures;

- Why platform leveraged tokens become key trading instruments;

ETFs haven’t made markets simpler—they’ve multiplied ways to express opinions!

Opportunities and risks always depend on whether you truly understand your tools.