The Uniqueness and Controversies of ETH ETFs

This lesson focuses on how ETF inflows change the pricing logic, volatility structure, and dominant players for both Bitcoin and Ethereum; whether ETFs actually "stabilize the market" or amplify pro-cyclical effects; and how ETF narratives reshape competition among institutions, retail investors, and crypto-native capital.

I. ETH vs BTC: Fundamental Differences in Asset Properties

While BTC and ETH are both crypto assets and often discussed together regarding price action, they are fundamentally different financially and economically.

BTC: More Like a “Financial Asset”

Bitcoin’s core properties are highly concentrated with a clear narrative:

- Fixed supply (21 million)

- Clear halving mechanism

- Increasing scarcity over time

- Simple use case with slow changes

Thus in traditional finance, BTC is naturally seen as:

- Digital gold,

- Long-term store of value,

- Macro tool for hedging fiat risk,

BTC’s value logic is essentially “holding equals participation.” You don’t need to use it or understand complex tech—just believe in its scarcity and network security.

ETH: More Like a “Platform Asset”

ETH plays a completely different role. Ethereum isn’t a “single-purpose asset,” but rather:

- A decentralized computing platform,

- Settlement layer for blockchain economy,

- Infrastructure for smart contracts and financial activity,

ETH’s value comes not just from “existing,” but from:

- Network usage,

- Application activity,

- Ongoing financial operations,

BTC is an asset that’s “held,” ETH is a network that’s “used.” This fundamental difference means that the impact of an ETF mechanism is inherently different for each.

II. The First Core Controversy for ETH ETFs: No Staking Capability

The Role of Staking in ETH System

Under PoS (Proof-of-Stake), staking isn’t optional—it’s essential:

- Validators secure the network via staking,

- Network operations rely on staked economic collateral,

- Holders earn ongoing block rewards through staking,

For long-term ETH holders, ETH isn’t just a price asset—it’s “network capital” that generates on-chain yield.

Staking rewards are a critical part of ETH’s long-term returns and valuation method.

Structural Conflict Within ETF Framework

In a compliant ETH ETF structure:

- ETH is held by custodians,

- No on-chain staking participation,

- No validator responsibilities,

- No staking rewards generated,

This means an ETH ETF holds a “passive, static, non-yielding version” of ETH.

Structural Implications

This difference isn’t minor—it directly impacts an ETF’s appeal:

- For long-term holders, return structure is weakened,

- There’s a clear yield gap versus native holding,

- The “utilitarian value” of ETH can’t be captured by an ETF,

That’s why enthusiasm for ETH ETFs has been much lower than for BTC ETFs from day one.

III. Second Controversy: ETH’s Value Capture Is Less Financialized

BTC Value Logic: Easy to Model

BTC’s financial logic is extremely straightforward:

- Clear supply path,

- Quantifiable scarcity,

- Stable narrative with slow change,

This makes BTC ideal for:

- Being made into an ETF,

- Inclusion in macro portfolios,

- Analysis via traditional financial models,

ETH Value Source: Multilayered & Dynamic

ETH’s value comes from a complex system:

- Gas fees,

- Demand generated by app interactions,

- Layer 2 settlement returns,

- Evolving mechanisms like MEV and Blob fees,

These variables:

- Change with tech upgrades,

- Adjust with ecosystem structure,

- Can’t be captured by a single metric,

To ETF investors, ETH looks like a continuously evolving economic system—not a static asset.

IV. Debate Over ETH ETF’s Relationship With Layer 2s

A recurring question: Will Layer 2 growth dilute ETH’s value?

From an ETF perspective:

Traditional investors often wonder—

- Lots of transactions occur on L2s,

- Mainnet gas income appears to decline,

- Is ETH earning less?

This concern isn’t baseless—ETH’s value capture is shifting from “direct fees” to “system-level settlement.”

The real issue isn’t whether there’s value—

But rather:

- Is it intuitive?

- Is it easily represented by financial products?

- Can it be told as a simple story?

Layer 2 makes ETH more like a global settlement/security layer rather than just a transaction fee engine—technically an upgrade but narratively harder for finance to grasp.

V. Why Is Market Response to ETH ETFs More Subdued?

Compared with BTC ETFs’ strong reaction after launch, ETH ETFs see more muted response—not because ETH isn’t important but because:

- Narrative isn’t singular enough,

- Yield model isn’t intuitive,

- Technical/financial logics are deeply intertwined,

From a TradFi viewpoint, ETH resembles a tech platform company with ever-changing business models/tech paths—hard to value with PE or single indicators—rather than a simple buy-and-hold target.

VI. Disparity in Fund Flows Between ETH & BTC ETFs

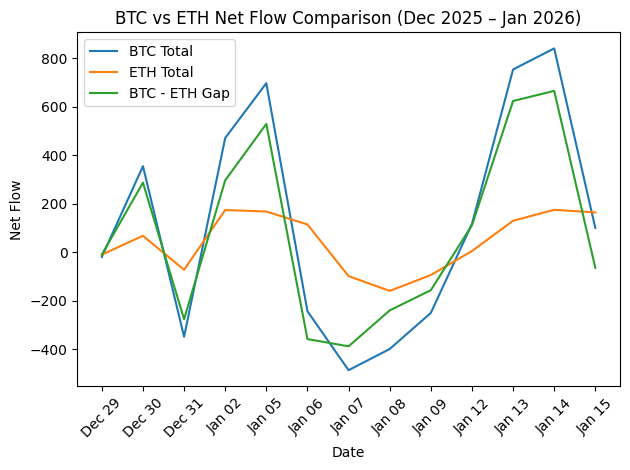

BTC vs ETH fund flow chart (Dec 2025 – Jan 2026)

Data source: https://farside.co.uk/btc/

The chart shows that during this period, BTC saw much greater fund flow volatility than ETH—especially January 2nd, 5th, and 13th–14th—reflecting risk appetite concentrating into mainstream/trend assets when markets heat up.

By contrast, ETH flows were steadier; mostly positive but with limited daily swings—indicating capital was more structurally allocated than driven by sentiment. Between January 6th–9th both saw net outflows; BTC’s retreat was larger—showing leverage/short-term money impacts BTC more during corrections.

Overall: Changes in the BTC–ETH gap are key risk sentiment indicators—rapid widening points to trend/capital concentration; narrowing or reversal signals defensive or balanced positioning.

VII. Are ETH ETFs Still Important?

Despite controversy, ETH ETFs remain significant because they:

- Bring ETH into mainstream finance discussions,

- Provide compliant/low-barrier price exposure,

- Serve as institutions’ first step toward understanding ETH,

But it must be clear: The ETH ETF isn’t ETH’s final financial form—it’s only a transitional tool. It allows TradFi to “see” ETH but cannot fully express its use value, yield structure, or ecosystem potential.