What Is an ETF? The Basic Mechanism of Crypto ETFs

This lesson will help you understand how ETFs work and specifically explain why a crypto ETF is not the same as "buying coins directly." Before diving into BTC ETFs, ETH ETFs, and other exchange-traded ETFs, it's important to build a proper and reusable cognitive framework.

I. The Basics of ETFs: What Are They, Essentially?

An ETF (Exchange Traded Fund) is an open-ended index fund traded on exchanges, allowing investors to buy and sell shares just like stocks.

Compared to traditional funds, ETFs have three core features:

- Traded on the secondary market: Investors buy and sell ETF shares via exchange matching, not by directly subscribing to or redeeming assets with the fund company.

- Anchored to a specific asset or index: ETFs don’t create value themselves—they simply “track” the price performance of an asset (such as a stock index, commodity, bond, or crypto asset).

- Price fluctuates around net asset value: In theory, an ETF’s market price should be close to the net asset value (NAV) of its underlying assets.

It’s crucial to understand: An ETF is a financial wrapper, not the asset itself.

II. How Do Traditional ETFs Maintain Price Stability?

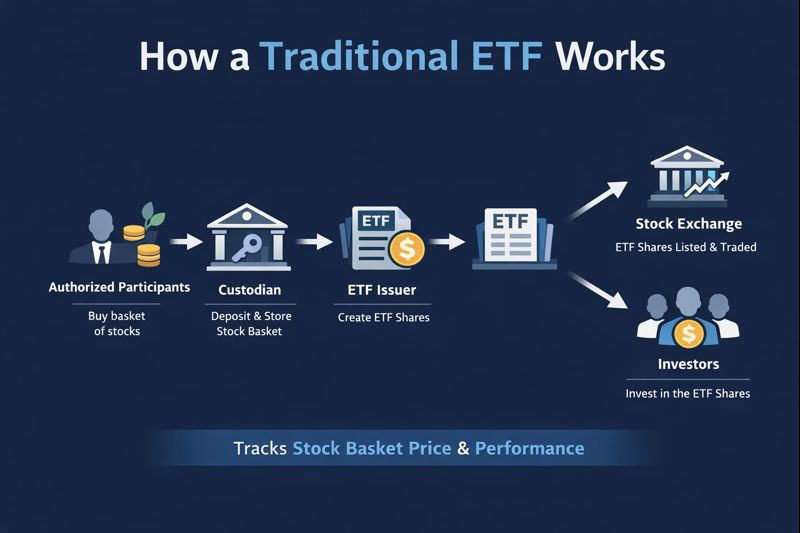

Traditional ETF Process Flowchart

The fact that ETFs closely track their NAV over time isn’t accidental—it relies on a mature, institutionalized market mechanism.

The core of this mechanism is a closed arbitrage loop among professional institutions.

Key Participants

There are three main players in a traditional ETF system:

- Fund Issuer: Responsible for ETF product design, disclosures, and operation.

- Authorized Participant (AP): Usually large investment banks or primary dealers—the only entities allowed to directly subscribe/redeem with the fund.

- Market Maker: Continuously provides buy/sell quotes on the secondary market to improve ETF liquidity and trading depth.

Together, these roles form the “price stability center” of an ETF.

Arbitrage Logic of the Subscription/Redemption Mechanism

This mechanism can be understood intuitively:

- When ETF market price exceeds NAV (premium): → AP → buys underlying assets on the spot market → subscribes to ETF shares from the fund → sells ETF on secondary market → earns risk-free arbitrage

- When ETF market price falls below NAV (discount): → AP → buys ETF on secondary market → redeems for underlying assets from the fund → sells assets on spot market → completes arbitrage

It’s this ongoing, automated, large-scale arbitrage that continually “pulls” ETF prices back to fair value.

In traditional financial markets, this mechanism features:

- Consistent trading hours

- Highly concentrated liquidity

- Unified price sources

- Mature legal and institutional frameworks

This results in very low friction and typically short-lived price deviations.

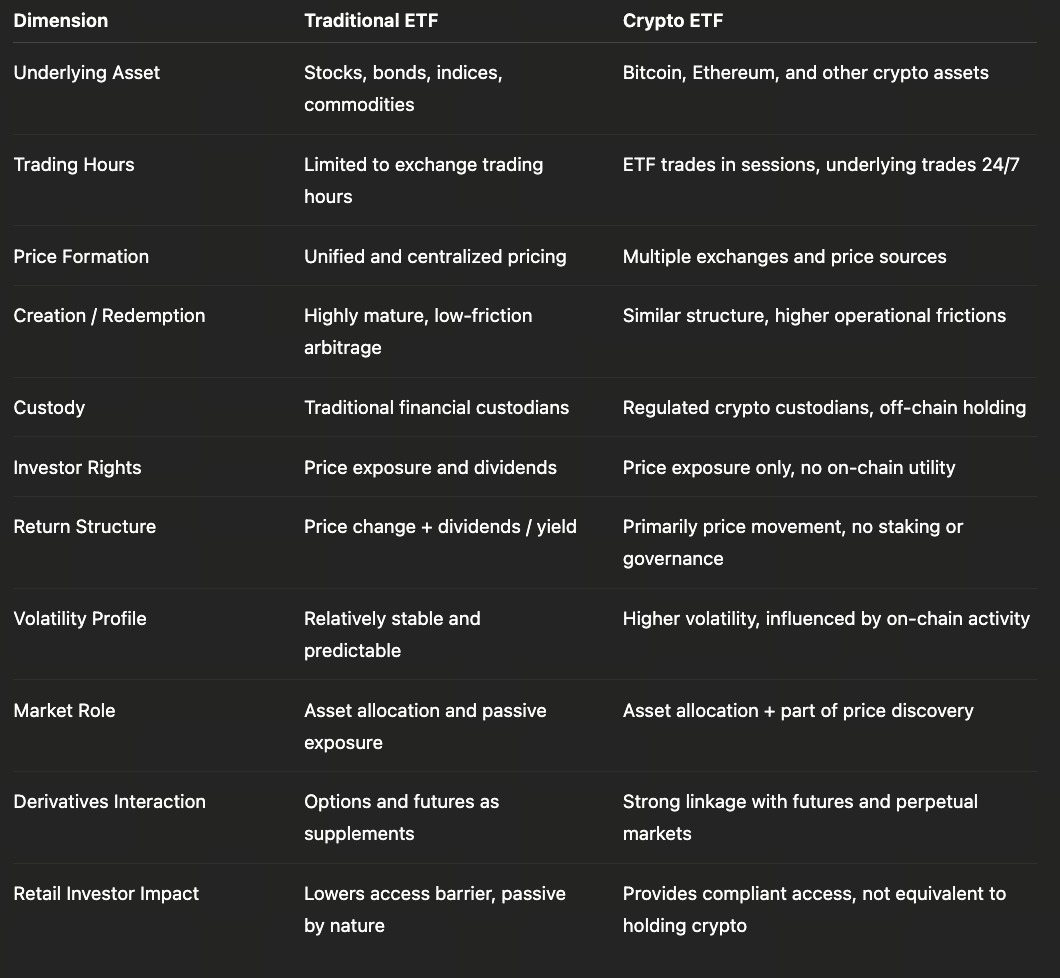

III. Crypto ETFs: Why Do They Look Similar but Are Fundamentally Different?

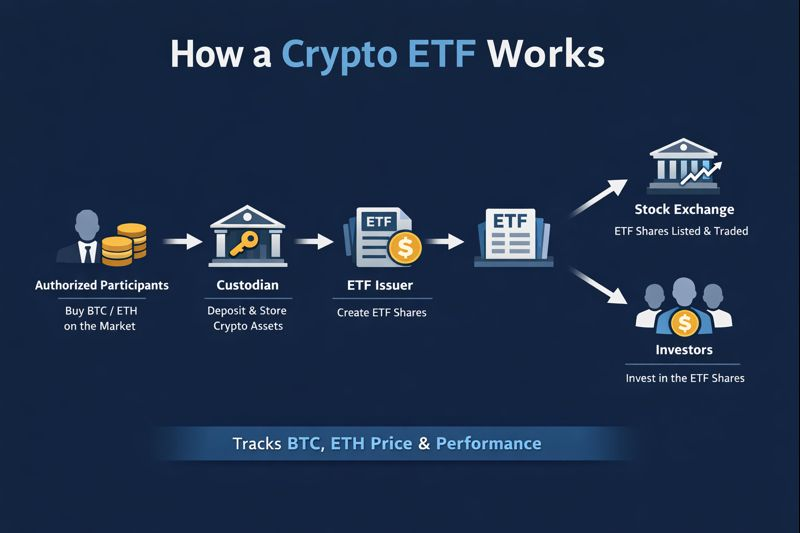

Crypto ETF Process Flowchart

When ETFs enter the crypto market, they retain their name but their operating environment changes fundamentally.

Structural Differences in Underlying Assets

Crypto assets have characteristics completely distinct from traditional assets:

- 24/7 nonstop trading

- Multiple exchanges and price sources running in parallel

- High volatility

- Self-custody on-chain and free transferability

Meanwhile, crypto ETFs themselves:

- Only trade during traditional securities market hours

- Rely on compliant custodians

- Use more centralized pricing references

- Are not linked to on-chain markets in real time

This creates natural gaps in timing, liquidity, and price transmission between ETFs and the real crypto market.

This is one of the fundamental reasons why crypto ETFs are more prone to tracking errors and short-term deviations.

IV. A Common Misconception: Buying an ETF ≠ Buying Coins

This is the easiest yet most important point to overlook when it comes to crypto ETFs.

When you buy an ETF, you get:

- Price exposure to asset volatility

- A compliant, regulated investment tool

- Lower entry barriers and easier operation

But you do NOT get:

- Private key ownership

- On-chain asset control

- Rights to participate in DeFi, NFTs, governance, or the ecosystem

In short: An ETF is TradFi’s “acceptable version” of crypto assets—not the crypto world itself.

V. Why Is Understanding the ETF Mechanism So Important?

Because in the ETF era, the crypto market is no longer a single system but three parallel markets operating simultaneously:

- On-chain native market: DeFi, DEXs, on-chain assets

- Centralized trading market: CEXs, contracts, leverage, structured products

- Traditional financial market: ETFs, funds, derivatives

The ETF is the key bridge connecting the third system to the first two. Understanding ETFs isn’t just about whether or not to buy—they help answer deeper questions:

- Why doesn’t ETF inflow always immediately drive up coin prices?

- Why might ETFs change overall volatility structures?

- Why do some trends happen in ETF markets rather than on-chain?