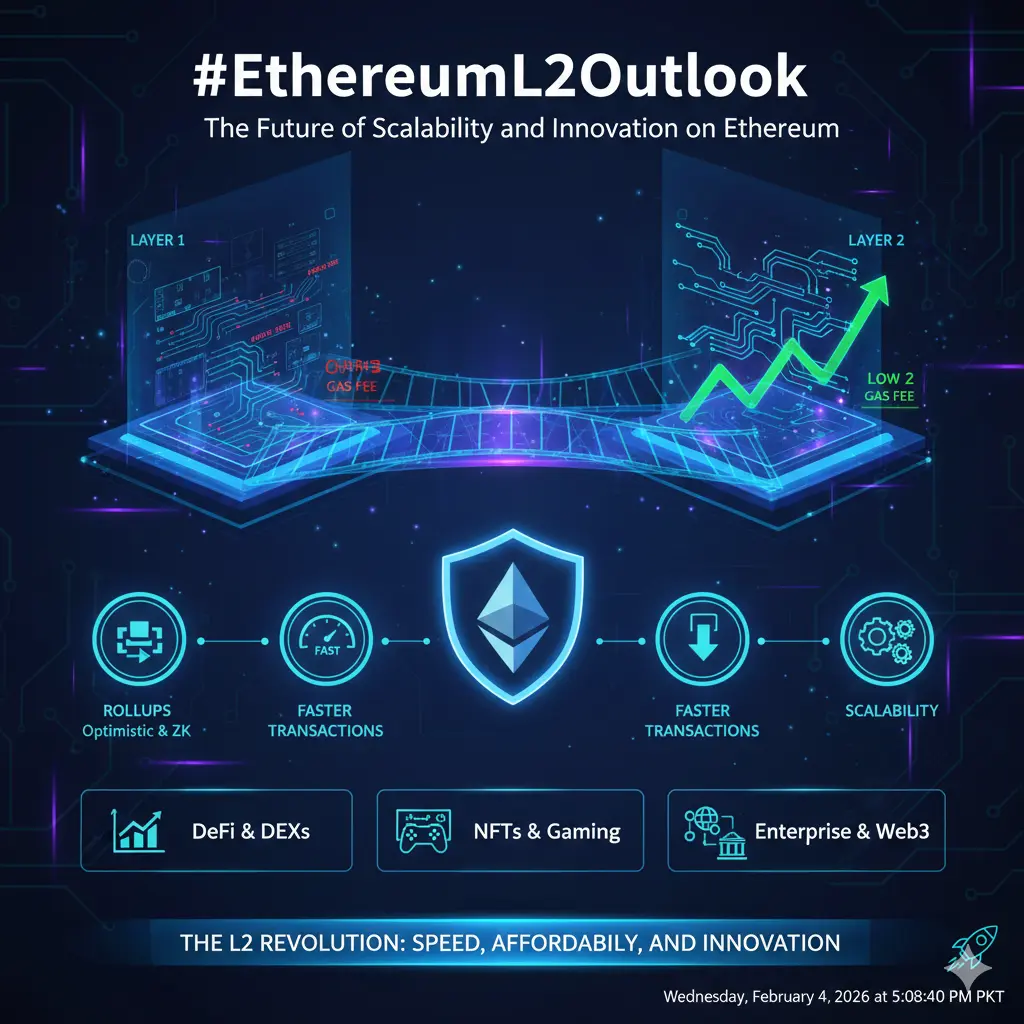

#EthereumL2Outlook Ethereum Layer 2 solutions are no longer experimental sidechains—they are becoming fundamental infrastructure for the network’s scalability, adoption, and long-term competitiveness. As Ethereum faces persistent transaction congestion and high gas fees during periods of network stress, Layer 2s are essential to maintain usability and efficiency. They are transforming Ethereum from a blockchain with structural limitations into a multi-layer ecosystem capable of handling mass adoption, while still preserving the security and decentralization that remain core to its value proposition.

Technically, Ethereum’s approach of combining a secure base layer with scalable rollups, both optimistic and zero-knowledge (zk), represents a forward-looking, modular architecture. Rollups process transactions off-chain, drastically reducing costs and congestion, while anchoring their finality to Ethereum itself. This design ensures that developers and users can scale without compromising on decentralization or security—an advantage over alternative chains that prioritize throughput at the expense of core security. For Ethereum, this modular design is not a temporary fix; it is a blueprint for future network robustness.

Market attention, however, often misses this nuance. During bearish periods or volatile phases, narrative and price movements dominate headlines, while Layer 2 adoption quietly progresses. Metrics such as active user growth, transaction volume, and dApp integration on L2s continue to rise steadily. Fees remain lower, execution times faster, and applications more efficient, creating an invisible yet meaningful layer of growth. From a structural perspective, these developments are more consequential than short-term speculative trends and will underpin Ethereum’s long-term dominance in programmable blockchains.

Strategically, investors and users should focus on Layer 2 projects with real-world utility, active developer communities, and demonstrable adoption. Not every Layer 2 will thrive—some may consolidate or become obsolete—but those that consistently deliver measurable value will become the backbone of Ethereum’s scaling strategy. Exposure should be selective, patient, and grounded in fundamentals. Overemphasizing hype-driven projects can lead to short-term volatility, whereas measured engagement with high-quality L2s positions participants to benefit from structural growth over time.

The interaction between Layer 2s and Ethereum’s base layer is also important. Contrary to fears that L2 migration could reduce activity or fee revenue on Ethereum, it actually strengthens the network’s security and settlement model. Every L2 transaction ultimately relies on Ethereum for finality, increasing demand for ETH and reinforcing its economic value. In essence, scaling through L2s does not cannibalize the base layer—it enhances it, ensuring Ethereum remains the dominant settlement and security layer for a multi-chain, multi-layer ecosystem.

Macro conditions further influence L2 adoption dynamics. During periods of heightened volatility, selectively accumulating exposure to Layer 2s can be safer than chasing base-layer speculation. L2s allow users to participate in Ethereum’s growth without overpaying for congested transactions or facing prohibitive fees. This is particularly appealing for long-term investors who prioritize sustainable adoption metrics, developer engagement, and ecosystem integration over short-term hype or trading-driven momentum.

Layer 2s also act as a laboratory for Ethereum innovation. They enable new protocols, tokenomics models, and user experiences that are difficult to implement on the base layer. Observing adoption patterns, successes, and even failures on L2s provides Ethereum developers with critical insights into scalability, governance, and network design. This feedback loop strengthens the entire Ethereum ecosystem, making L2 experimentation a crucial driver for both technological evolution and strategic planning.

For developers and dApp creators, Layer 2s open doors to improved user experience, lower operational costs, and faster transaction processing. Applications that were previously constrained by gas fees can now operate efficiently, attracting new users and increasing engagement. As adoption scales, network effects strengthen, which in turn incentivizes further development and creates a virtuous cycle of growth for both Layer 2 solutions and Ethereum itself.

From an investment perspective, patience and selective allocation remain paramount. Short-term price fluctuations should not distract from the structural progress happening within the ecosystem. Investors should prioritize utility, adoption metrics, and developer engagement rather than chasing speculative hype. Diversification across high-quality L2s, paired with base-layer exposure, can balance risk while maintaining participation in Ethereum’s scaling narrative.

Ultimately, Ethereum’s Layer 2 ecosystem represents a pivotal chapter in the network’s evolution. L2s are increasing efficiency, lowering costs, attracting developers, and preparing Ethereum for mass adoption. Ignoring this transformation risks missing the core story of Ethereum’s future growth. Those who approach the Layer 2 landscape with strategic patience, measured exposure, and a focus on real-world utility are best positioned to benefit as Ethereum continues to scale, innovate, and solidify its role as the leading programmable blockchain in the years ahead.

Technically, Ethereum’s approach of combining a secure base layer with scalable rollups, both optimistic and zero-knowledge (zk), represents a forward-looking, modular architecture. Rollups process transactions off-chain, drastically reducing costs and congestion, while anchoring their finality to Ethereum itself. This design ensures that developers and users can scale without compromising on decentralization or security—an advantage over alternative chains that prioritize throughput at the expense of core security. For Ethereum, this modular design is not a temporary fix; it is a blueprint for future network robustness.

Market attention, however, often misses this nuance. During bearish periods or volatile phases, narrative and price movements dominate headlines, while Layer 2 adoption quietly progresses. Metrics such as active user growth, transaction volume, and dApp integration on L2s continue to rise steadily. Fees remain lower, execution times faster, and applications more efficient, creating an invisible yet meaningful layer of growth. From a structural perspective, these developments are more consequential than short-term speculative trends and will underpin Ethereum’s long-term dominance in programmable blockchains.

Strategically, investors and users should focus on Layer 2 projects with real-world utility, active developer communities, and demonstrable adoption. Not every Layer 2 will thrive—some may consolidate or become obsolete—but those that consistently deliver measurable value will become the backbone of Ethereum’s scaling strategy. Exposure should be selective, patient, and grounded in fundamentals. Overemphasizing hype-driven projects can lead to short-term volatility, whereas measured engagement with high-quality L2s positions participants to benefit from structural growth over time.

The interaction between Layer 2s and Ethereum’s base layer is also important. Contrary to fears that L2 migration could reduce activity or fee revenue on Ethereum, it actually strengthens the network’s security and settlement model. Every L2 transaction ultimately relies on Ethereum for finality, increasing demand for ETH and reinforcing its economic value. In essence, scaling through L2s does not cannibalize the base layer—it enhances it, ensuring Ethereum remains the dominant settlement and security layer for a multi-chain, multi-layer ecosystem.

Macro conditions further influence L2 adoption dynamics. During periods of heightened volatility, selectively accumulating exposure to Layer 2s can be safer than chasing base-layer speculation. L2s allow users to participate in Ethereum’s growth without overpaying for congested transactions or facing prohibitive fees. This is particularly appealing for long-term investors who prioritize sustainable adoption metrics, developer engagement, and ecosystem integration over short-term hype or trading-driven momentum.

Layer 2s also act as a laboratory for Ethereum innovation. They enable new protocols, tokenomics models, and user experiences that are difficult to implement on the base layer. Observing adoption patterns, successes, and even failures on L2s provides Ethereum developers with critical insights into scalability, governance, and network design. This feedback loop strengthens the entire Ethereum ecosystem, making L2 experimentation a crucial driver for both technological evolution and strategic planning.

For developers and dApp creators, Layer 2s open doors to improved user experience, lower operational costs, and faster transaction processing. Applications that were previously constrained by gas fees can now operate efficiently, attracting new users and increasing engagement. As adoption scales, network effects strengthen, which in turn incentivizes further development and creates a virtuous cycle of growth for both Layer 2 solutions and Ethereum itself.

From an investment perspective, patience and selective allocation remain paramount. Short-term price fluctuations should not distract from the structural progress happening within the ecosystem. Investors should prioritize utility, adoption metrics, and developer engagement rather than chasing speculative hype. Diversification across high-quality L2s, paired with base-layer exposure, can balance risk while maintaining participation in Ethereum’s scaling narrative.

Ultimately, Ethereum’s Layer 2 ecosystem represents a pivotal chapter in the network’s evolution. L2s are increasing efficiency, lowering costs, attracting developers, and preparing Ethereum for mass adoption. Ignoring this transformation risks missing the core story of Ethereum’s future growth. Those who approach the Layer 2 landscape with strategic patience, measured exposure, and a focus on real-world utility are best positioned to benefit as Ethereum continues to scale, innovate, and solidify its role as the leading programmable blockchain in the years ahead.