2025 10SET Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of 10SET

Tenset (10SET) is a deflationary token with ETF 2.0 elements that incorporates hedge fund principles and advocates for "entity operation" concepts, bringing hybrid power to the crypto ecosystem. Since its launch in 2021, 10SET has established itself as a unique asset in the digital currency landscape. As of December 2025, 10SET maintains a market capitalization of approximately $5.20 million, with a circulating supply of around 156.04 million tokens trading at $0.03334 per token. This innovative deflationary mechanism, combined with its staking infrastructure and scarcity-driven design, positions 10SET as a bridge between cryptocurrency and traditional financial markets.

This article will provide a comprehensive analysis of 10SET's price movements and market dynamics as of December 23, 2025. By examining historical price patterns, market supply and demand fundamentals, ecosystem development, and the broader macroeconomic environment, we aim to deliver professional price forecasts and actionable investment strategies for crypto investors seeking exposure to this unique digital asset.

Tenset (10SET) Market Analysis Report

I. 10SET Price History Review and Current Market Status

10SET Historical Price Evolution

- May 2021: Project reached its all-time high (ATH) of $6.48, marking the peak of early market enthusiasm during the crypto bull run.

- December 2025: Price declined to $0.03334, representing an 83.66% decrease over the one-year period, with the all-time low (ATL) of $0.03268889 established on December 19, 2025.

10SET Current Market Performance

As of December 23, 2025, Tenset (10SET) is trading at $0.03334 per token. The 24-hour trading volume stands at $17,153.71, with the market cap currently valued at approximately $5.2 million USD. The token maintains a circulation of 156,044,726.95 units out of a total supply of 156,044,726.95 tokens (74.31% of maximum supply), with a maximum supply cap set at 210,000,000 tokens.

Recent price movements show:

- 1-hour change: +0.032%

- 24-hour change: -0.2%

- 7-day change: -1.3%

- 30-day change: -8.75%

- 1-year change: -83.66%

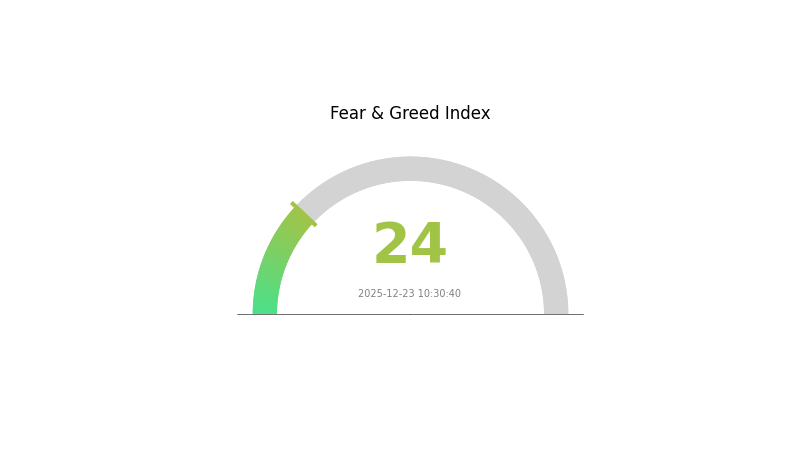

The token currently ranks 1,507 in market capitalization across all cryptocurrencies, with a market dominance of 0.00016%. There are 25,175 active token holders. The current market sentiment indicates extreme fear (VIX: 24).

View current 10SET market price

10SET Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index reaching 24. This indicates significant market anxiety and pessimism among investors. During periods of extreme fear, experienced traders often see opportunities to accumulate quality assets at lower prices. However, risk management remains crucial. On Gate.com, you can track real-time market sentiment and access comprehensive trading tools to make informed decisions. Remember, extreme fear often precedes market recoveries, but always conduct thorough research before making investment moves.

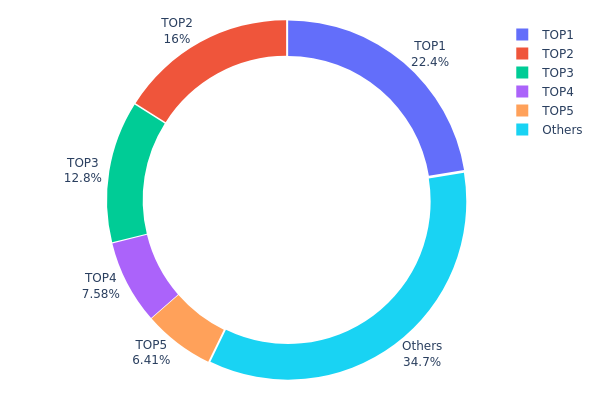

10SET Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across blockchain addresses, representing the percentage allocation of total 10SET supply among top holders and the remaining addresses. This metric serves as a critical indicator for assessing market structure, decentralization level, and potential systemic risks inherent in the token's ecosystem.

Current analysis of 10SET's holdings distribution reveals moderate concentration characteristics. The top five addresses collectively hold 65.22% of the total supply, with the largest holder commanding 22.42% of circulating tokens. The first address dominates with 35 million tokens, followed by the second address holding 25 million tokens, while the third largest holder maintains 20 million tokens. This tiered distribution pattern indicates that wealth concentration remains relatively significant, though not critically severe. Notably, the "Others" category representing distributed smaller holders accounts for 34.78% of total holdings, suggesting a meaningful degree of fragmentation outside the top tier.

The concentration dynamics present both structural considerations and market implications. With the top three addresses controlling approximately 51.25% of the supply, there exists a potential vulnerability to coordinated token movements that could influence price dynamics or governance outcomes. However, the presence of substantial holdings beyond the top five (34.78%) demonstrates that 10SET maintains a reasonably diversified holder base, mitigating extreme centralization risks. This distribution pattern reflects a market structure where institutional or significant stakeholders maintain considerable influence, while simultaneously allowing sufficient liquidity and participation from smaller holders. The current configuration suggests a maturing token economy with balanced but concentrated ownership characteristics.

For current 10SET holdings distribution data, visit Gate.com.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x49c0...0a29b5 | 35000.00K | 22.42% |

| 2 | 0x3a5c...cb5c41 | 25000.00K | 16.02% |

| 3 | 0xf112...b6a665 | 20000.00K | 12.81% |

| 4 | 0x78b7...0662c7 | 11821.31K | 7.57% |

| 5 | 0x086f...993431 | 10000.00K | 6.40% |

| - | Others | 54223.41K | 34.78% |

II. Core Factors Affecting 10SET's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Federal Reserve interest rate decisions and forward guidance regarding future rate paths significantly influence risk asset movements, including cryptocurrencies. Market expectations of rate changes can have substantial effects on asset valuations and investor sentiment.

-

Market Sentiment: Investor confidence and emotional factors play a critical role in price volatility. Market sentiment shifts, driven by economic data releases and policy announcements, can lead to substantial price fluctuations in digital assets.

Technology and Innovation

- Regulatory Framework: Policy monitoring and regulatory developments represent key drivers of price movements, as government actions and compliance requirements can substantially impact the cryptocurrency market's direction and investor confidence.

Note: The provided source materials contain limited specific information regarding 10SET's tokenomics, institutional holdings, enterprise adoption, geopolitical factors, ecosystem development, and technical upgrades. Therefore, additional sections from the original template have been excluded to maintain accuracy and avoid speculation beyond available data.

Three、2025-2030 10SET Price Forecast

2025 Outlook

- Conservative Forecast: $0.03166

- Neutral Forecast: $0.03333

- Optimistic Forecast: $0.043

2026-2027 Medium-term Outlook

- Market Phase Expectation: Recovery and gradual expansion phase, with increasing market participation and institutional interest.

- Price Range Forecast:

- 2026: $0.02595 - $0.04389 (14% potential upside)

- 2027: $0.02749 - $0.05005 (23% potential upside)

- Key Catalysts: Ecosystem development maturation, increased adoption of 10SET protocol, market sentiment recovery, and potential macroeconomic improvements in the cryptocurrency sector.

2028-2030 Long-term Outlook

- Base Case: $0.03415 - $0.06239 by 2028 (36% growth scenario)

- Optimistic Case: $0.04371 - $0.07555 by 2029 (61% cumulative growth from 2025)

- Transformative Case: $0.04403 - $0.08612 by 2030 (94% cumulative growth scenario with sustained institutional adoption and mainstream integration)

- Key Drivers: Successful ecosystem expansion, regulatory clarity improvements, cross-chain interoperability enhancements, and increased liquidity on platforms like Gate.com.

Risk Factors: Price projections remain subject to market volatility, regulatory changes, and broader cryptocurrency market sentiment shifts. Investors should conduct thorough due diligence before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.043 | 0.03333 | 0.03166 | 0 |

| 2026 | 0.04389 | 0.03816 | 0.02595 | 14 |

| 2027 | 0.05005 | 0.04103 | 0.02749 | 23 |

| 2028 | 0.06239 | 0.04554 | 0.03415 | 36 |

| 2029 | 0.07555 | 0.05396 | 0.04371 | 61 |

| 2030 | 0.08612 | 0.06475 | 0.04403 | 94 |

Tenset (10SET) Investment Strategy and Risk Management Report

Four. 10SET Professional Investment Strategy and Risk Management

10SET Investment Methodology

(1) Long-Term Holding Strategy

-

Suitable Investors: Long-term believers in deflationary token models, investors seeking exposure to hybrid cryptocurrency-traditional finance bridges, and those with moderate to high risk tolerance.

-

Operational Recommendations:

- Accumulate 10SET during market downturns when prices are near historical lows (current ATL: $0.03268889 as of December 19, 2025)

- Hold positions for 12+ months to benefit from potential staking rewards and token deflation mechanisms

- Diversify 10SET holdings across multiple holding periods to average entry costs

(2) Active Trading Strategy

-

Market Observation Tools:

- 24-hour volatility tracking: Monitor the current $0.03253-$0.03402 price range on Gate.com for entry and exit signals

- Price trend analysis: Track the 24-hour change of -0.2%, 7-day decline of -1.3%, and 30-day decline of -8.75% to identify potential reversal points

-

Wave Trading Key Points:

- Enter positions during downtrend phases when technical indicators show oversold conditions

- Set profit-taking targets at 15-25% above entry price given current market conditions

- Maintain strict stop-loss orders at 8-10% below entry price to manage downside risk

10SET Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation to 10SET

- Active Investors: 3-7% of portfolio allocation to 10SET

- Professional Investors: 5-10% of portfolio allocation to 10SET

(2) Risk Hedging Solutions

- Staking Strategy Hedging: Participate in 10SET staking mechanisms to generate yield and offset potential price depreciation through regular returns

- Portfolio Diversification: Balance 10SET holdings with stable-value assets and other cryptocurrency positions to reduce concentration risk

(3) Secure Storage Solutions

- Hot Wallet Strategy: Use Gate.com's integrated wallet for active trading and frequent transactions

- Self-Custody Approach: Transfer long-term holdings to personal wallet addresses for enhanced security and full control

- Security Precautions: Enable multi-factor authentication on all exchange accounts, regularly verify contract addresses (BSC: 0x1AE369A6AB222aFF166325B7b87Eb9aF06C86E57) before transactions, and never share private keys or seed phrases

Five. 10SET Potential Risks and Challenges

10SET Market Risk

- Significant Price Depreciation: The token has declined 83.66% over the past year, reflecting substantial downward pressure and potential continued bearish sentiment

- Low Trading Volume: Daily volume of $17,153.71 indicates limited liquidity, potentially amplifying price volatility during large buy or sell orders

- Low Market Capitalization: At $5.2 million market cap, 10SET is highly susceptible to manipulation and sharp price swings

10SET Regulatory Risk

- Evolving Regulatory Framework: Deflationary tokens and ETF-like mechanisms face uncertain regulatory treatment globally, with potential restrictions in certain jurisdictions

- Compliance Uncertainty: As a hybrid product blending cryptocurrency and traditional finance concepts, 10SET may face regulatory scrutiny or classification challenges

- Exchange Listing Risk: Currently listed on only 2 exchanges with limited availability, restricting institutional adoption and regulatory clarity

10SET Technology Risk

- Smart Contract Vulnerabilities: The deflationary mechanism and staking protocols may contain undetected bugs or vulnerabilities affecting token stability

- Cross-Chain Bridge Risk: Integration with multiple blockchains presents potential security and operational risks

- Protocol Upgrades: Future technical modifications to achieve "entity operation" concepts could introduce unforeseen complications or bugs

Six. Conclusions and Action Recommendations

10SET Investment Value Assessment

Tenset represents a speculative investment opportunity combining deflationary tokenomics with hybrid cryptocurrency-traditional finance mechanics. While the project's innovative approach to ETF 2.0 elements and staking mechanisms holds conceptual merit, significant challenges temper this opportunity. The token's 83.66% year-over-year decline, minimal liquidity ($17,153.71 daily volume), and small market cap ($5.2 million) indicate a highly distressed asset currently trading near all-time lows. Success depends heavily on project execution, regulatory acceptance, and market sentiment recovery. This is a high-risk, speculative position suitable only for investors with substantial risk capital.

10SET Investment Recommendations

✅ Beginners: Consider small exploratory positions (0.5-1% of investment capital) only after thorough research. Use Gate.com for secure trading and storage. Prioritize education over aggressive accumulation.

✅ Experienced Investors: Evaluate 10SET as a tactical trading opportunity around technical support levels. Implement strict risk management with 8-10% stop-losses and defined profit targets. Consider the asset's low liquidity constraints.

✅ Institutional Investors: Monitor 10SET's regulatory developments and project milestones before considering meaningful allocation. The low liquidity and market cap currently limit meaningful institutional participation.

10SET Trading Participation Methods

- Direct Purchase on Gate.com: Access the BSC-based token (contract: 0x1AE369A6AB222aFF166325B7b87Eb9aF06C86E57) through Gate.com's spot trading with competitive fees and deep liquidity relative to other exchange options

- Staking Participation: Engage with 10SET's staking mechanism if offered on Gate.com to generate ongoing yield alongside price appreciation potential

- Technical Analysis Trading: Utilize Gate.com's advanced charting tools and order types to execute swing trading strategies around identified support and resistance levels

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their personal risk tolerance and financial situation. Consulting with professional financial advisors is strongly recommended. Never invest more capital than you can afford to lose completely.

FAQ

What is the price prediction for 10SET in 2025?

Based on market analysis, 10SET price predictions for 2025 range from $0.03525 to $0.21116. These forecasts reflect current market conditions and technical analysis. Note that we are currently in late 2025, so actual performance data is now available for comparison.

What factors could influence 10SET's price movement?

10SET's price is influenced by market trading volume, investor sentiment, project developments, regulatory changes, and overall cryptocurrency market conditions. Macroeconomic factors and Bitcoin's price movements also significantly impact altcoin valuations.

Is 10SET a good investment and what are the risks?

10SET offers promising growth potential with its innovative tokenomics and community-driven model. While all cryptocurrencies carry volatility risks, 10SET's strong fundamentals and increasing adoption suggest positive long-term prospects. Consider your risk tolerance before investing.

How Will HOLO Price Evolve by 2030 Based on Current Market Trends?

2025 TCT Price Prediction: Navigating the Future of Cryptocurrency Investments

2025 TRUST Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 COS Price Prediction: Expert Analysis and Market Forecast for the Decentralized Storage Token

NKN (NKN) price soaring: What is the driving force behind the 2025 craze?

Aergo Price Analysis: 112% Surge in 90 Days - What's Next for 2025?

Understanding the Impact of a Major Platform's Cash P2P Closure on Traders

Predicting the Next Bitcoin Bull Market Peak: Insights for 2025

Advancements in Local Growth and Regulatory Adherence in Poland's Crypto Sector

A Complete Guide to Puffer Finance: Everything You Should Know

What is MLT: A Comprehensive Guide to Machine Learning Testing and Its Applications in Modern Software Development