2025 AIV Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: AIV's Market Position and Investment Value

AIVille (AIV) is the first MCP-Powered Generative AI Gaming Protocol on BNBChain, representing a novel intersection of artificial intelligence and decentralized gaming. Since its launch in late 2024, AIVille has established itself as a pioneering project that transforms generative agents into on-chain gameplay. As of December 23, 2025, AIV has achieved a market capitalization of approximately $17.95 million with a circulating supply of 2.777 billion tokens, currently trading at around $0.001795. This innovative asset is recognized for its unique approach to integrating Large Language Model (LLM) agents into a Web3 gaming ecosystem.

This article will comprehensively analyze AIV's price trajectory through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development prospects, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies. Our analysis will evaluate both the opportunities and risks inherent in this emerging AI gaming protocol on the BNBChain network.

AIVille (AIV) Market Analysis Report

I. AIV Price History Review and Current Market Status

AIV Historical Price Trajectory

Based on available market data as of December 23, 2025:

- September 29, 2025: All-Time High (ATH) reached at $0.009, representing peak market sentiment and investor optimism during the project's early trading phase.

- December 3, 2025: All-Time Low (ATL) recorded at $0.001764, marking the lowest valuation point in the token's trading history.

- Current Period (December 2025): Price trading in the lower range of its historical spectrum, indicating a significant correction from peak levels achieved earlier in the year.

AIV Current Market Position

As of December 23, 2025, AIV is trading at $0.001795, with a 24-hour trading volume of approximately $11,844.61. The token exhibits the following characteristics:

Price Performance Metrics:

- 1-hour change: -0.27%

- 24-hour change: -0.16%

- 7-day change: -0.44%

- 30-day change: -2.56%

- 1-year change: +113.99% (showing significant appreciation from launch)

Market Capitalization:

- Current Market Cap: $4,985,002.2

- Fully Diluted Valuation (FDV): $17,950,000

- Market Cap to FDV Ratio: 27.77%

Token Distribution:

- Circulating Supply: 2,777,160,000 AIV (27.77% of total supply)

- Total Supply: 10,000,000,000 AIV

- Maximum Supply: 10,000,000,000 AIV

- Token Holders: 14,637

Market Position:

- Market Ranking: 1,529

- Market Dominance: 0.00056%

- Current Market Sentiment: Extreme Fear (VIX Score: 24)

The token operates on the BNBChain as a BEP-20 standard token and maintains presence on Gate.com exchange for trading access.

Click to view current AIV market price

AIV Market Sentiment Index

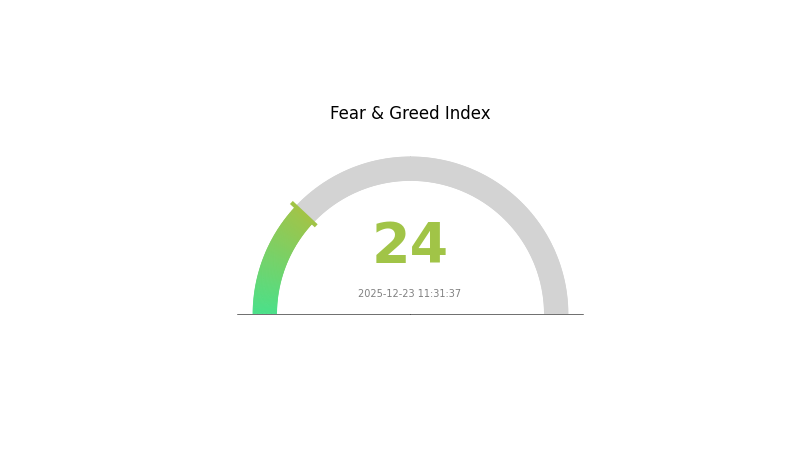

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the index plummeting to 24. This severe sentiment indicates widespread investor anxiety and negative market conditions. Such extreme readings often signal potential bottoming opportunities for contrarian investors, as panic-driven selling may be overdone. However, caution is advised as further downside remains possible. Traders should remain vigilant and consider dollar-cost averaging strategies during these periods of heightened uncertainty. Risk management is critical when navigating such volatile market conditions. Monitor key support levels closely for potential reversal signals.

AIV Holdings Distribution

An address holdings distribution chart illustrates how token supply is distributed across different wallet addresses on the blockchain. This metric serves as a critical indicator for assessing the decentralization level, market structure health, and potential concentration risks within a cryptocurrency project. By examining the top holder positions and the percentage of tokens they control, analysts can evaluate whether wealth distribution aligns with the project's decentralization objectives.

The current AIV holdings data reveals a moderately concentrated distribution pattern. The top two addresses collectively control approximately 40% of the total supply, with the largest holder accounting for 20% and the second-largest at 19.99%. The third-largest address holds 10%, while the fourth and fifth positions account for 8% and 4% respectively. This configuration indicates that while significant supply concentration exists among top holders, the distribution does not exhibit extreme centralization, as the remaining 38.01% is dispersed among other addresses.

This distribution structure presents both opportunities and risks for market dynamics. The concentration among the top five addresses could potentially amplify price volatility during periods of large transaction activity, as coordinated movements by these major holders could significantly impact market conditions. However, the presence of nearly 38% holdings distributed among other addresses suggests a meaningful degree of participation from broader stakeholders. The current structure indicates a cryptocurrency with moderate decentralization characteristics—neither severely compromised by extreme whale concentration nor fully distributed across numerous participants. This balance reflects a typical pattern in maturing blockchain projects where early investors and stakeholders maintain substantial positions while secondary distribution continues to develop.

For current AIV holdings distribution data, visit Gate.com.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa817...997f53 | 2000000.00K | 20.00% |

| 2 | 0xa815...302d0f | 1999840.00K | 19.99% |

| 3 | 0x8b78...bd6862 | 1000000.00K | 10.00% |

| 4 | 0xb66f...d95686 | 800000.00K | 8.00% |

| 5 | 0xcc2e...d1c517 | 400000.00K | 4.00% |

| - | Others | 3800160.00K | 38.01% |

II. Core Factors Affecting AIV's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Global monetary policy shifts by major central banks significantly influence market sentiment and capital flows toward alternative assets like AIV. Expectations for interest rate changes and quantitative easing measures can drive price volatility in cryptocurrency markets.

-

Inflation Hedge Properties: AIV's potential role as an inflation hedge depends on macroeconomic conditions and global economic performance. During periods of elevated inflation, alternative assets may attract increased institutional and retail attention as portfolio diversification tools.

-

Geopolitical Factors: International tensions and geopolitical uncertainties can redirect capital flows toward decentralized and crypto-based assets, potentially increasing demand for AIV as investors seek assets outside traditional financial systems.

Note: The provided source materials do not contain specific information about AIV's supply mechanisms, institutional holdings, corporate adoption, national policies, or technological development. Additional authoritative sources on AIV would be required to complete other sections of this analysis.

III. Price Forecast for AIV from 2025 to 2030

2025 Outlook

- Conservative Prediction: $0.00167 - $0.00180

- Neutral Prediction: $0.00180 - $0.00230

- Optimistic Prediction: $0.00258 (requiring sustained market momentum and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with consolidation periods, characterized by increasing institutional interest and ecosystem development

- Price Range Forecast:

- 2026: $0.00177 - $0.00269 (22% upside potential)

- 2027: $0.00183 - $0.00356 (36% cumulative growth)

- 2028: $0.00231 - $0.00336 (67% cumulative growth)

- Key Catalysts: Regulatory clarity, strategic partnerships, product innovation, and market sentiment improvements driving incremental value recognition

2029-2030 Long-term Outlook

- Base Case: $0.00210 - $0.00471 (77% to 119% cumulative growth by 2030, reflecting moderate mainstream adoption)

- Optimistic Case: $0.00462 - $0.00471 (119% upside with strong ecosystem expansion and network effects)

- Transformational Case: $0.00395+ (contingent on breakthrough technological advancement, enterprise-level integration, and broader cryptocurrency market adoption)

- 2025-12-23: AIV trading range $0.00167 - $0.00258 (market consolidation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00258 | 0.0018 | 0.00167 | 0 |

| 2026 | 0.00269 | 0.00219 | 0.00177 | 22 |

| 2027 | 0.00356 | 0.00244 | 0.00183 | 36 |

| 2028 | 0.00336 | 0.003 | 0.00231 | 67 |

| 2029 | 0.00471 | 0.00318 | 0.0021 | 77 |

| 2030 | 0.00462 | 0.00395 | 0.00209 | 119 |

AIVille (AIV) Professional Investment Strategy and Risk Management Report

IV. AIV Professional Investment Strategy and Risk Management

AIV Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: AI gaming protocol enthusiasts, Web3 community participants, and investors with high risk tolerance for emerging blockchain gaming projects

- Operational Recommendations:

- Accumulate positions during price consolidation phases, particularly when AIV trades near its 24-hour low of $0.001786

- Maintain a disciplined dollar-cost averaging (DCA) approach to reduce timing risk

- Secure holdings in personal wallets to reduce counterparty risk and strengthen commitment to long-term positions

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price Action Analysis: Monitor support levels at $0.001764 (all-time low as of December 3, 2025) and resistance at $0.009 (all-time high as of September 29, 2025)

- Volume Analysis: Track the current 24-hour trading volume of $11,844.61 to identify potential breakout opportunities or volume confirmation signals

- Swing Trading Key Points:

- Entry opportunities may emerge when price stabilizes above recent support levels with increasing volume

- Exit strategically at technical resistance levels or when bearish divergence signals appear

AIV Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of total crypto portfolio allocation

- Active Investors: 1-2% of total crypto portfolio allocation

- Professional Investors: 2-5% of total crypto portfolio allocation

(2) Risk Hedging Approaches

- Position Sizing Control: Implement strict position limits to prevent overexposure to this emerging and highly volatile protocol

- Profit-Taking Strategy: Establish predetermined exit targets at 30-50% gains to lock in profits and reduce downside risk

(3) Secure Storage Solutions

- Self-Custody Approach: Maintain holdings in personal blockchain wallets with strong security protocols to ensure full control over AIV assets

- Security Considerations: Use secure seed phrase management, enable multi-signature authentication where possible, and maintain regular backups of recovery credentials

V. AIV Potential Risks and Challenges

AIV Market Risk

- High Volatility Exposure: AIV has demonstrated significant price fluctuations, with a 113.99% year-to-date gain balanced against recent 7-day and 30-day declines, indicating substantial price instability

- Limited Trading Liquidity: With only one exchange listing and relatively modest 24-hour volume, AIV may face liquidity challenges during rapid price movements

- Market Capitalization Risk: At a total market cap of $17.95 million and circulating market cap of approximately $4.985 million, AIV remains a micro-cap asset vulnerable to sudden valuation changes

AIV Regulatory Risk

- Emerging Protocol Status: As a newly launched MCP-powered gaming protocol, AIV faces regulatory uncertainty surrounding blockchain-based AI gaming mechanisms

- Gaming Classification Uncertainty: Regulatory bodies may impose restrictions on blockchain gaming protocols, potentially affecting AIV's operational framework and token utility

- Jurisdiction-Specific Challenges: Different regulatory approaches across jurisdictions could limit AIV's accessibility to certain markets or user demographics

AIV Technology Risk

- Protocol Maturity: As the first MCP-driven generative AI gaming protocol on BNBChain, AIV lacks an established track record, and potential smart contract vulnerabilities or protocol flaws could impact value

- Model Context Protocol Dependency: The project's reliance on enhanced MCP (eMCP) technology creates technical concentration risk if the underlying protocol experiences issues

- Integration Complexity: The coordination between LLM agents and on-chain mechanics may present unforeseen technical challenges or performance limitations

VI. Conclusion and Action Recommendations

AIV Investment Value Assessment

AIVille represents an innovative convergence of generative AI and blockchain gaming, combining novel concepts with the growing Web3 ecosystem. However, as a micro-cap token with limited liquidity and exchange listings, AIV carries substantial execution risk. The 27.77% circulating supply ratio provides potential upside if the protocol achieves significant adoption, yet the current market conditions reflect cautious sentiment. Investors should view AIV as a speculative venture rather than a core holding, suitable only for portfolios with high risk tolerance and dedicated research capacity.

AIV Investment Recommendations

✅ Beginners: Start with minimal allocation (under 1% of crypto portfolio) through Gate.com, focusing on understanding the AIVille protocol mechanics before committing additional capital

✅ Experienced Investors: Consider strategic accumulation during consolidation phases, employing technical analysis to identify optimal entry points while maintaining strict stop-loss discipline

✅ Institutional Investors: Conduct comprehensive due diligence on the MCP protocol infrastructure and evaluate AIVille's competitive positioning within the AI gaming sector before institutional participation

AIV Trading Participation Methods

- Gate.com Exchange Trading: Access AIV directly through Gate.com's spot trading interface for immediate liquidity and secure transactions

- Limit Order Strategy: Place orders at technical support levels to accumulate during price weakness and reduce average acquisition costs

- Portfolio Rebalancing: Periodically review AIV allocations to maintain intended risk exposure and adjust positions based on performance and emerging opportunities

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and are strongly advised to consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

What is the prediction for AIV stock?

AIV stock is expected to show long-term growth potential. Based on 5-year forecasts, the price target is approximately $6.986 USD by December 2030, indicating positive outlook for investors seeking medium to long-term exposure.

Should I sell my Aurora Innovation stock?

Based on current analysis, Aurora Innovation stock shows sell signals with declining momentum. The stock price fell to $4.17 as of December 15, 2025. Consider selling to mitigate further losses, as technical indicators suggest continued downward pressure.

What factors will drive AIV stock price in 2025?

AIV stock price in 2025 will be driven by market demand, economic conditions, company earnings performance, and industry trends. Trading volume and investor sentiment will also significantly influence price movements.

How has Aurora Innovation stock performed compared to competitors in the autonomous vehicle industry?

Aurora Innovation has outperformed competitors through its successful commercial driverless launch on the Dallas-Houston corridor in May 2025 and early revenue generation. Its capital-light retrofit model enables faster market entry compared to OEM-dependent competitors, positioning it as a strong contender in autonomous vehicle sector.

What is the long-term growth potential for AIV stock?

AIV shows strong long-term growth potential with forecasted price reaching $6.986 by 2030. Five-year investments are expected to generate significant returns based on positive market trends and fundamental analysis.

What is EPT: A Comprehensive Guide to Early Pregnancy Testing

What is ARIA: A Comprehensive Guide to Accessible Rich Internet Applications

What is CARV: A Comprehensive Guide to Decentralized Data Analytics and Insights Platform

How Does KGEN Compare to Its Competitors in 2025?

What is Moni

What is FET: Understanding Field-Effect Transistors and Their Applications in Modern Electronics

Ultimate Guide to Cryptocurrency Trading for Beginners in 2025

What is UOS: A Comprehensive Guide to Understanding Unified Operating System

What is BOX: A Comprehensive Guide to Understanding Box Storage and Cloud Collaboration Solutions

What is XDB: A Comprehensive Guide to Understanding Distributed Database Technology

What is CLORE: A Comprehensive Guide to Understanding This Revolutionary Blockchain Protocol