2025 ALPHA Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: Market Position and Investment Value of ALPHA

ALPHA (Stella), as a leveraged strategies protocol with zero borrowing costs designed to redefine how leveraged DeFi operates, was launched in 2020. Since its inception, the project has been building infrastructure to drive greater adoption of decentralized exchanges and money markets as fundamental DeFi building blocks. As of December 2025, ALPHA's market capitalization stands at approximately $5.13 million USD, with a circulating supply of 961 million tokens and a current price of $0.005129. This innovative protocol, recognized for its unique approach to reducing friction in leveraged DeFi strategies, is playing an increasingly important role in expanding the accessibility and efficiency of decentralized finance applications.

This article will comprehensively analyze ALPHA's price movements and market trends through 2025-2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and broader macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. ALPHA Price History Review and Current Market Status

ALPHA Historical Price Evolution Trajectory

Based on available data, ALPHA has experienced significant volatility since its inception:

- February 6, 2021: All-time high of $2.93, representing the peak valuation during the early DeFi boom period

- December 21, 2025: All-time low of $0.00502137, marking the lowest trading price in the token's history

- Current Period (2025): A year-over-year decline of -93.34%, reflecting substantial long-term depreciation from historical peaks

ALPHA Current Market Status

As of December 23, 2025, ALPHA is trading at $0.005129, with a 24-hour price change of -0.42%. The token demonstrates modest hourly volatility with a +0.47% increase over the past hour, though it has experienced notable bearish pressure over longer timeframes:

- 7-day performance: -9.73% decline

- 30-day performance: -26.88% decline

- Market capitalization: Approximately $4,928,969 based on circulating supply

- Circulating supply: 961,000,000 ALPHA (96.10% of total supply)

- Total supply: 1,000,000,000 ALPHA

- 24-hour trading volume: $15,246.01

- Market ranking: #1540 by market capitalization

- Number of holders: 11,573

- Listed on: 9 exchanges

The token is currently trading near its all-time low, with a fully diluted valuation of $5,129,000. Market sentiment indicators reflect extreme fear (VIX level: 24), which typically correlates with broader cryptocurrency market weakness.

Click to view current ALPHA market price

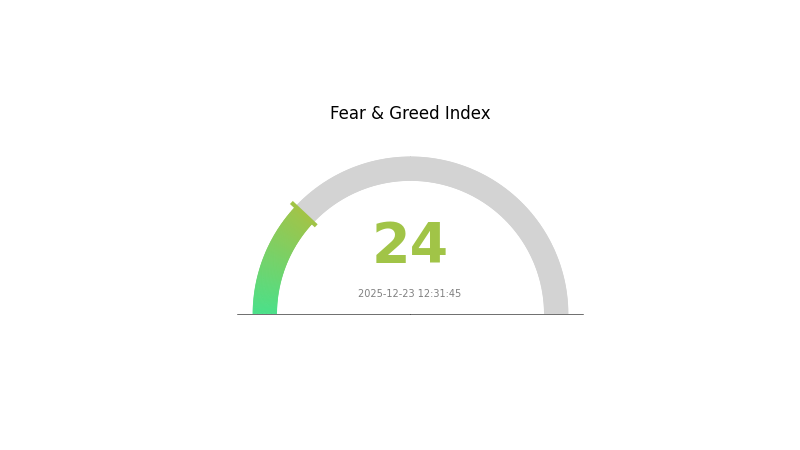

ALPHA Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index plummeting to 24. This severe sentiment indicates heightened market anxiety and risk aversion among investors. When fear reaches such extremes, historically it often signals capitulation, potentially creating accumulation opportunities for contrarian investors. However, extreme fear also suggests increased market volatility and downside risks. Investors should exercise caution, maintain risk management discipline, and avoid emotional decision-making during such turbulent periods. Long-term holders may consider this a potential buying opportunity, while traders should watch for stabilization signals before increasing positions on Gate.com.

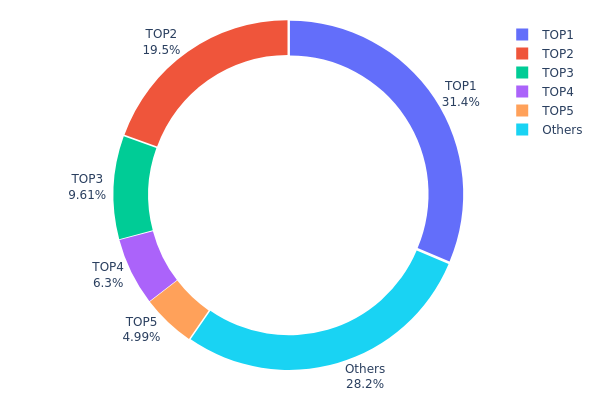

ALPHA Holdings Distribution

The address holdings distribution chart presents a comprehensive snapshot of how ALPHA tokens are distributed across blockchain addresses, reflecting the concentration of ownership and the degree of decentralization within the token's ecosystem. This metric serves as a critical indicator for assessing market structure stability, potential systemic risks, and the influence of major stakeholders on price dynamics.

Current analysis of ALPHA's holdings distribution reveals a moderate to significant concentration pattern. The top five addresses collectively control approximately 71.74% of the total token supply, with the leading address alone holding 31.36%. This concentration level warrants careful consideration, as it suggests that a relatively small number of entities possess substantial influence over the token's liquidity and price movements. The top two addresses account for over half of all holdings at 50.85%, indicating that decision-making by these major stakeholders could materially impact market conditions. However, the remaining 28.26% distributed among other addresses provides a meaningful level of diversification that partially mitigates extreme centralization risks.

The current distribution pattern reflects typical characteristics of established cryptocurrency tokens during their maturity phase, where early investors, development teams, or strategic partners maintain significant stakes. While the concentration does present potential risks regarding market manipulation and liquidity constraints during periods of high volatility, the existence of a substantial "Others" category suggests reasonable market participation beyond the largest holders. This structure indicates moderate decentralization with identifiable concentration points that market participants should monitor, particularly regarding any large-scale liquidation events or coordinated movements by top-tier address holders.

View current ALPHA holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x326d...70a601 | 313609.86K | 31.36% |

| 2 | 0x580c...02f68e | 194941.03K | 19.49% |

| 3 | 0xfac6...425260 | 96149.48K | 9.61% |

| 4 | 0xb80c...637953 | 63000.00K | 6.30% |

| 5 | 0x3462...ea955c | 49883.80K | 4.98% |

| - | Others | 282415.82K | 28.26% |

II. Core Factors Affecting ALPHA's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Global central banks' policies will directly influence ALPHA's price. Currently, the accommodative trends of the Federal Reserve and other central banks are creating a positive atmosphere for risk assets like ALPHA. As the primary driver of cryptocurrency valuations, shifts in monetary policy stance can significantly amplify or dampen price movements.

-

Scarcity and Supply Dynamics: The inherent scarcity characteristics of ALPHA serve as a key valuation driver. In an environment of monetary expansion, scarce assets tend to benefit from increased institutional and retail investor demand seeking value preservation and portfolio diversification.

Institutional and Market Sentiment Dynamics

-

Institutional Participation: Institutional involvement and market sentiment represent critical factors in price determination. The level of institutional adoption and participation directly correlates with price volatility and directional momentum.

-

Market Momentum Effects: Short-term price momentum significantly influences analyst price predictions. Rising price trajectories within short periods tend to drive upward revisions in price forecasts, while market attention levels affect the variance in analyst estimates.

III. 2025-2030 ALPHA Price Forecast

2025 Outlook

- Conservative Forecast: $0.00425 - $0.00595

- Base Case Forecast: $0.00513

- Bullish Forecast: $0.00595 (requires sustained positive market sentiment and increased institutional adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental adoption growth

- Price Range Forecasts:

- 2026: $0.00282 - $0.00764 (7% upside potential)

- 2027: $0.00395 - $0.00797 (28% upside potential)

- 2028: $0.00706 - $0.00874 (41% upside potential)

- Key Catalysts: Enhanced protocol functionality, ecosystem expansion, strategic partnerships, and improving macroeconomic conditions

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00624 - $0.01009 (56% upside by 2029, assuming steady market development and moderate adoption acceleration)

- Optimistic Scenario: $0.00905 - $0.01339 (76% upside by 2030, assuming breakthrough in mainstream adoption and strong market tailwinds)

- Transformation Scenario: Higher valuations possible under extreme favorable conditions including regulatory clarity, major institutional inflows, and network effects reaching inflection point

Note: Price forecasts are based on historical data analysis and market trends. Trading activity on Gate.com and other platforms should be conducted with appropriate risk management and due diligence.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00595 | 0.00513 | 0.00425 | 0 |

| 2026 | 0.00764 | 0.00554 | 0.00282 | 7 |

| 2027 | 0.00797 | 0.00659 | 0.00395 | 28 |

| 2028 | 0.00874 | 0.00728 | 0.00706 | 41 |

| 2029 | 0.01009 | 0.00801 | 0.00456 | 56 |

| 2030 | 0.01339 | 0.00905 | 0.00624 | 76 |

ALPHA (Stella) Investment Strategy and Risk Management Report

IV. ALPHA Professional Investment Strategy and Risk Management

ALPHA Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: DeFi protocol enthusiasts and leveraged strategy believers with medium-to-long investment horizons

- Operation Recommendations:

- Accumulate during market downturns when price volatility increases opportunities for favorable entry points

- Hold tokens through protocol development cycles to capture potential value appreciation as the leverage ecosystem matures

- Participate in community governance activities to maintain engagement with protocol evolution

(2) Active Trading Strategy

- Technical Analysis Tools:

- Price Action Analysis: Monitor the 24-hour trading range ($0.005069 - $0.005331) to identify breakout opportunities and support/resistance levels

- Volume Indicators: Track the 24-hour trading volume of approximately $15,246 to assess liquidity conditions and trading intensity

- Wave Trading Key Points:

- Exercise caution given the -9.73% weekly decline and -26.88% monthly decline, indicating bearish momentum

- Establish clear stop-loss levels below recent lows ($0.00502137) to manage downside risk

- Scale position sizing appropriately, starting with smaller allocations given the token's declining trend

ALPHA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio

- Aggressive Investors: 3-5% of total crypto portfolio

- Professional Investors: 5-8% of total crypto portfolio with active monitoring protocols

(2) Risk Hedge Solutions

- Dollar-Cost Averaging (DCA): Implement systematic purchases over extended periods to reduce timing risk and average entry prices across market cycles

- Portfolio Diversification: Combine ALPHA holdings with established DeFi protocols and stable assets to balance risk exposure across different protocol types and market caps

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 wallet for frequent traders requiring quick access and seamless integration with Gate.com exchange infrastructure

- Cold Storage Approach: Transfer tokens to hardware storage solutions for long-term holders prioritizing maximum security over trading convenience

- Security Considerations: Enable multi-signature verification where available, use hardware security keys for critical access, maintain secure backups of recovery phrases in offline locations, and verify contract addresses (0xa1faa113cbe53436df28ff0aee54275c13b40975 for ETH and BSC) before any transaction

V. ALPHA Potential Risks and Challenges

ALPHA Market Risk

- Severe Price Decline: ALPHA has experienced a -93.34% decline over the past year, with all-time high of $2.93 declining to current $0.005129, indicating substantial loss of market confidence

- Liquidity Risk: Trading volume of only $15,246 in 24 hours is relatively low, potentially creating challenges for large position exits without significant price impact

- Extreme Volatility: The token maintains extreme price swings, creating significant psychological and financial stress for retail investors

ALPHA Regulatory Risk

- DeFi Protocol Oversight: Regulatory frameworks for leveraged DeFi protocols remain evolving and unclear across major jurisdictions, potentially impacting protocol operations

- Leverage Mechanism Scrutiny: Regulators may impose restrictions on zero-cost borrowing mechanisms or leverage multipliers, fundamentally altering the protocol's core value proposition

- Compliance Uncertainty: As DeFi regulation tightens globally, protocols may face unexpected compliance demands that affect token utility and value

ALPHA Technical Risk

- Smart Contract Vulnerability: Like all DeFi protocols, ALPHA faces inherent risks from smart contract bugs, exploits, or unforeseen interactions with other protocols

- Liquidity Provider Risk: The protocol's viability depends on maintaining sufficient liquidity in underlying DEX and money market pools; insufficient liquidity could impair protocol functionality

- Systemic Protocol Risk: Integration with external DeFi infrastructure creates cascading failure possibilities if core dependencies experience outages or security incidents

VI. Conclusion and Action Recommendations

ALPHA Investment Value Assessment

ALPHA (Stella) represents a specialized DeFi leverage protocol addressing a specific market need for zero-cost borrowing in leveraged strategies. However, the token currently faces significant headwinds: a catastrophic -93.34% year-over-year decline, weak trading liquidity of only $15,246 daily volume, and declining weekly/monthly momentum (-9.73% and -26.88% respectively). The fully-diluted valuation of $5.13 million and 96.1% circulating supply ratio suggest limited near-term appreciation catalysts. While the protocol concept addresses genuine DeFi infrastructure needs, current market conditions and price action indicate elevated risk with uncertain recovery prospects.

ALPHA Investment Recommendations

✅ Beginners: Avoid direct ALPHA purchases until protocol demonstrates stronger market adoption and price stabilization; instead, gain DeFi leverage exposure through more established protocols with stronger liquidity

✅ Experienced Traders: Consider small speculative positions only if you can absorb complete loss of capital; implement strict 2-3% position sizing with defined stop-loss orders at $0.004800 levels

✅ Institutional Investors: Conduct extensive protocol analysis and team vetting before any allocation; ALPHA's current market cap and liquidity profile make it unsuitable for significant institutional exposure

ALPHA Trading Participation Methods

- Gate.com Spot Trading: Purchase and trade ALPHA directly on Gate.com's spot market using USD, USDT, or other trading pairs during liquid market hours

- Limited Derivative Options: Check for available perpetual or margin trading on Gate.com, though limited liquidity may restrict position sizing and exit opportunities

- Protocol Interaction: Directly engage with the Stella protocol through alphaventuredao.io to access leverage strategies, understanding that smart contract risks exist beyond typical exchange trading

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. All investors must carefully assess their risk tolerance and financial capacity before any purchase decision. It is strongly recommended to consult qualified financial advisors. Never invest capital you cannot afford to lose completely.

FAQ

Why is the alpha coin falling?

Alpha coin price decline is primarily driven by massive token issuance and market oversupply. Initial volatility often occurs post-launch as the market discovers fair value. Monitor trading volume and fundamental developments for potential recovery signals.

What is ALPHA token and what is its use case?

ALPHA token powers Alpha Finance Lab, a cross-chain DeFi platform enabling users to access decentralized financial services across multiple blockchain networks. It facilitates liquidity provision and reward generation within the ecosystem.

What factors influence ALPHA price predictions?

ALPHA price predictions are influenced by market supply and demand dynamics, overall cryptocurrency market trends, project development milestones, trading volume, investor sentiment, and macroeconomic conditions affecting the broader crypto market.

Is ALPHA a good investment for the future?

Yes, ALPHA demonstrates strong investment potential with growing utility and ecosystem adoption. Its limited supply and increasing market demand position it well for future appreciation and long-term value growth.

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 MLNPrice Prediction: Analyzing Key Factors That Will Drive MLN Valuation in the Coming Market Cycle

2025 UNCX Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 CHESSPrice Prediction: Market Analysis and Future Trends for the CHESS Token Ecosystem

2025 EDGE Price Prediction: Will This Crypto Asset Reach New Heights or Face a Downturn?

2025 ITHACA Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 CALCIFY Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 PUBLIC Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Is Morpher (MPH) a good investment?: A Comprehensive Analysis of Features, Market Potential, and Risk Factors for 2024

Is Soil (SOIL) a good investment?: A Comprehensive Analysis of Price Potential, Use Cases, and Market Outlook for 2024

Is Creditlink (CDL) a good investment?: A Comprehensive Analysis of Performance, Risk Factors, and Future Prospects