2025 ARIA Price Prediction: Expert Analysis and Future Outlook for Artificial Intelligence Trading Assistant Token

Introduction: ARIA's Market Position and Investment Value

AriaAI (ARIA) stands as a next-generation game development and publishing experiment inspired by Disney-style immersive worlds and AI technology, representing a major leap forward in bringing Web2-quality game design and publishing standards into the Web3 era. Since its launch in August 2025, ARIA has quickly established itself in the gaming and AI-driven blockchain ecosystem. As of December 21, 2025, ARIA has achieved a market capitalization of $12.41 million with a circulating supply of 183 million tokens, currently trading at $0.06784. This innovative asset has demonstrated significant growth potential, with a year-to-date increase of 15.59%, establishing itself as a noteworthy player in the Web3 gaming sector.

This article will provide a comprehensive analysis of ARIA's price trajectory and market dynamics, examining historical performance patterns, market supply and demand fundamentals, ecosystem development, and macroeconomic factors influencing its value. Through this detailed assessment, we aim to deliver professional price forecasts and actionable investment strategies for both prospective and existing investors seeking exposure to the intersection of AI technology and blockchain gaming innovation.

I. ARIA Price Historical Review and Current Market Status

ARIA Historical Price Evolution Trajectory

- August 21, 2025: ARIA reached its all-time low of $0.01, marking the beginning of its price discovery phase in the market.

- October 1, 2025: ARIA reached its all-time high of $0.24838, representing a remarkable 2,383.8% surge from its lowest point and demonstrating strong early market momentum for the project.

- December 21, 2025: ARIA is currently trading at $0.06784, showing a correction from its peak but maintaining a 578.4% gain from its historical low.

ARIA Current Market Situation

As of December 21, 2025, ARIA is trading at $0.06784 with a market capitalization of $67,840,000 and a fully diluted valuation matching this amount. The token has a circulating supply of 183,000,000 ARIA out of a total supply of 1,000,000,000 tokens, representing an 18.3% circulation ratio.

Over the past 24 hours, ARIA has demonstrated positive momentum with a price increase of 3.83%, while the 7-day performance shows a gain of 7.35%. However, the 30-day performance reflects a decline of -14.79%, indicating some consolidation after the October peak. Since its launch, ARIA has achieved a year-to-date return of 15.59%.

The token maintains a market ranking of 1,072, with a market dominance of 0.0021%. Trading volume over 24 hours stands at 84,531.8146 ARIA, and the project is listed on 15 exchanges. ARIA has garnered a holder base of 79,247 addresses, reflecting growing community participation.

Click to view current ARIA market price

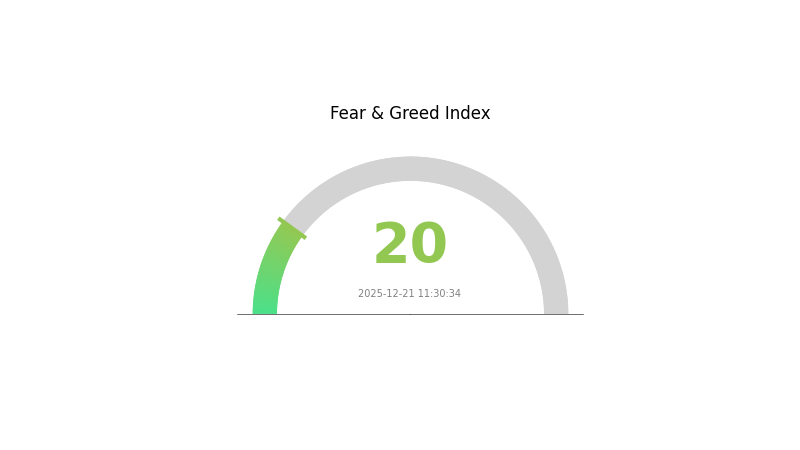

ARIA Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear and Greed Index hitting 20. This indicates a significant downturn in market sentiment as investors express strong pessimism about near-term price movements. During such periods, experienced traders often view extreme fear as a potential buying opportunity, as markets tend to be oversold. However, caution remains essential. Monitor key support levels and risk management strategies carefully. For real-time market data and analysis tools, visit Gate.com to stay informed on market trends and make educated trading decisions.

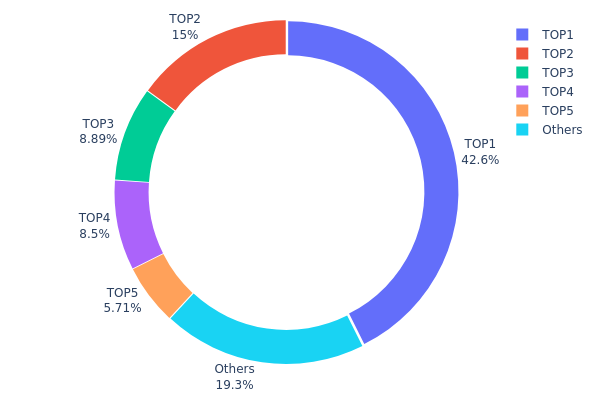

ARIA Holdings Distribution

The address holdings distribution map illustrates the concentration of ARIA tokens across the blockchain network's top addresses, revealing the degree of wealth centralization and potential market structure vulnerabilities. By analyzing the percentage allocation among major holders, this metric provides critical insight into whether token distribution follows a decentralized model or exhibits signs of excessive concentration that could pose risks to market stability and price integrity.

ARIA's current holdings distribution demonstrates a pronounced concentration pattern, with the top five addresses collectively controlling 80.72% of the total token supply. The largest holder (0x4747...376d91) commands 42.62% of all tokens, representing a significant single-point concentration that exceeds typical decentralization thresholds. The second and third largest holders contribute an additional 23.89% combined, while the remaining addresses outside the top five account for only 19.28% of the supply. This distribution structure indicates a highly centralized token model where wealth accumulation is skewed toward a limited number of entities, creating considerable systemic risk.

The concentration levels observed present notable implications for market dynamics and governance structure. With approximately four-fifths of the token supply held by identifiable addresses, the potential for coordinated price manipulation or sudden liquidity shifts remains elevated. The disproportionate holding in the top address alone—exceeding 40% of total supply—could facilitate unilateral decision-making on token movements, governance matters, or strategic distributions. This concentration level suggests that ARIA's on-chain structure currently prioritizes centralized control mechanisms over decentralized distribution, which may impact long-term sustainability and community-driven development, while also highlighting the token's dependence on the stability and trustworthiness of these major holders.

Click to view current ARIA holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4747...376d91 | 426250.00K | 42.62% |

| 2 | 0xf88b...5f02c1 | 150000.00K | 15.00% |

| 3 | 0x28ef...510890 | 88916.67K | 8.89% |

| 4 | 0x40f5...d8cef0 | 85000.00K | 8.50% |

| 5 | 0xc119...3d01cd | 57103.33K | 5.71% |

| - | Others | 192730.00K | 19.28% |

II. Core Factors Affecting ARIA's Future Price

Supply Mechanism

-

Controlled Token Release Strategy: ARIA implements a balanced token distribution model designed to drive ecosystem development while maintaining treasury stability. The project employs a controlled release mechanism to manage token supply over time.

-

Current Impact: Future price movements will depend on whether token supply remains appropriately managed and whether demand can sustain upward momentum. Price performance is inherently linked to supply-demand dynamics in the secondary market.

Institutional and Whale Activity

-

Whale Activity: Large holder movements and trading activity significantly influence price volatility and overall market sentiment for ARIA tokens.

-

Exchange Listings: Listings on major cryptocurrency exchanges, including Gate.com, serve as key catalysts that can impact price movements and market accessibility.

Market Sentiment and Competition

-

Investor Confidence: Market sentiment and investor confidence in artificial intelligence-driven projects represent primary drivers of ARIA's price movements.

-

Market Competition: The GameFi sector faces intense competition, which creates execution risks and affects the project's competitive positioning and long-term viability.

-

Token Burn Mechanisms: Token burns and partnership announcements are identified as key factors driving price changes in the entertainment blockchain sector.

Technology Development and Ecosystem Building

- Execution Risk: The development of intelligent NPCs and generative content involves substantial costs and quality assurance challenges. Uncertainty exists regarding the project's ability to deliver according to its roadmap, which could impact investor confidence and price performance.

III. ARIA Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.03967-$0.06839

- Neutral Forecast: $0.06839

- Bullish Forecast: $0.09643 (requires positive market sentiment and increased adoption)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Forecast:

- 2026: $0.04368-$0.09477 (21% upside potential)

- 2027: $0.05581-$0.09922 (30% upside potential)

- 2028: $0.07794-$0.13522 (38% upside potential)

- Key Catalysts: Ecosystem development, increased institutional participation, technological improvements, and market cycle progression

2029-2030 Long-term Outlook

- Base Case Scenario: $0.07218-$0.12602 (assumes continued steady adoption and favorable market conditions)

- Optimistic Scenario: $0.10586-$0.12511 (assumes accelerated ecosystem growth and mainstream adoption)

- Transformative Scenario: $0.12029-$0.13522 (assumes breakthrough developments and significant network expansion)

- 2030-12-21: ARIA achieves 77% cumulative gain with consolidated support levels establishing new trading ranges

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.09643 | 0.06839 | 0.03967 | 0 |

| 2026 | 0.09477 | 0.08241 | 0.04368 | 21 |

| 2027 | 0.09922 | 0.08859 | 0.05581 | 30 |

| 2028 | 0.13522 | 0.09391 | 0.07794 | 38 |

| 2029 | 0.12602 | 0.11457 | 0.07218 | 68 |

| 2030 | 0.12511 | 0.12029 | 0.10586 | 77 |

ARIA Investment Strategy and Risk Management Report

I. Project Overview

About AriaAI (ARIA)

Aria.AI is a next-generation game development and publishing experiment inspired by Disney-style immersive worlds and AI technology, designed with its own IP-related gameplay at its core. It represents a major leap forward in bringing Web2-quality game design and publishing standards with AI enforcement into the Web3 era.

Current Market Data (As of December 21, 2025)

| Metric | Value |

|---|---|

| Current Price | $0.06784 |

| 24h Change | +3.83% |

| 7d Change | +7.35% |

| 30d Change | -14.79% |

| 1y Change | +15.59% |

| Market Cap | $12,414,720 |

| Fully Diluted Valuation | $67,840,000 |

| 24h Volume | $84,531.81 |

| Circulating Supply | 183,000,000 ARIA |

| Total Supply | 1,000,000,000 ARIA |

| All-Time High | $0.24838 (October 1, 2025) |

| All-Time Low | $0.01 (August 21, 2025) |

| Market Ranking | #1072 |

| Token Holders | 79,247 |

II. ARIA Professional Investment Strategy and Risk Management

ARIA Investment Methodology

(1) Long-Term Holding Strategy

Target Audience: Growth-oriented investors with medium to high risk tolerance who believe in the long-term potential of AI-driven gaming in Web3.

Operational Recommendations:

- Dollar-Cost Averaging (DCA): Purchase fixed amounts of ARIA at regular intervals (weekly or monthly) to reduce timing risk and benefit from price volatility.

- Accumulation on Dips: When ARIA drops 15-20% from recent highs, consider accumulation if fundamental thesis remains intact, as this provides improved entry points.

- Storage Solution: Utilize Gate.com Web3 Wallet for secure, self-custodial storage of ARIA tokens with multi-signature security features enabled.

(2) Active Trading Strategy

Technical Analysis Tools:

- RSI Indicator: Monitor Relative Strength Index for overbought (>70) and oversold (<30) conditions; use these signals for entry and exit timing decisions.

- Moving Average Crossover: Track 20-day and 50-day moving average crossovers; bullish crossover signals potential uptrend entry points, bearish crossover suggests profit-taking opportunities.

Swing Trading Key Points:

- Support/Resistance Levels: Identify key technical levels at $0.06 (support) and $0.08 (resistance) for position sizing and stop-loss placement.

- Volume Confirmation: Ensure price movements are supported by above-average trading volume on Gate.com to validate trend strength and reduce false signal risk.

ARIA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation; focus on long-term accumulation with minimal active trading.

- Aggressive Investors: 5-10% portfolio allocation; engage in more frequent trading with defined entry/exit strategies.

- Professional Investors: 3-15% portfolio allocation; implement sophisticated hedging strategies and use leverage cautiously.

(2) Risk Hedging Strategies

- Portfolio Diversification: Balance ARIA holdings with established cryptocurrencies and other gaming-focused tokens to reduce concentration risk.

- Take-Profit Scaling: Systematically sell portions of holdings at predetermined price targets (e.g., 25% at $0.10, 25% at $0.15) to secure gains while maintaining upside exposure.

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate.com Web3 Wallet provides institutional-grade security with decentralized custody, eliminating counterparty risk while maintaining easy access for trading.

- Self-Custody Best Practice: Store ARIA tokens in a personal wallet address for maximum security control and independence from exchange default risk.

- Critical Security Considerations:

- Never share private keys or recovery phrases with anyone

- Enable all available security features including two-factor authentication

- Verify contract addresses before any token transfer to prevent phishing attacks

- Use hardware security modules for large holdings when possible

III. ARIA Potential Risks and Challenges

ARIA Market Risks

- High Volatility Exposure: ARIA has experienced 72% decline from all-time high ($0.24838) to current price, demonstrating extreme price volatility typical of early-stage gaming tokens; sudden price reversals can result in significant losses.

- Liquidity Risk: With 24-hour volume of $84,531.81, large position entries or exits may face slippage and market impact, particularly during low-volume periods.

- Market Sentiment Dependency: As a new gaming project, ARIA's price is heavily influenced by social media sentiment and speculative trading rather than fundamental adoption metrics, creating unpredictable short-term price movements.

ARIA Regulatory Risks

- Gaming Regulatory Uncertainty: Blockchain-based gaming with tokenized rewards faces increasing regulatory scrutiny in multiple jurisdictions; potential classification as gambling or securities could restrict platform access in major markets.

- Geographic Restrictions: Certain countries may impose restrictions on gaming tokens or blockchain projects, potentially limiting ARIA's addressable market and user base expansion.

- Compliance Evolution: Regulatory standards for AI-integrated gaming platforms remain undefined; future regulations could impose costly compliance requirements affecting project viability and token utility.

ARIA Technology Risks

- AI Integration Execution Risk: Successfully integrating sophisticated AI technology into gaming requires substantial development expertise; technical failures or delays could undermine the project's core value proposition.

- Smart Contract Vulnerability: ARIA operates on BSC (Binance Smart Chain) using BEP-20 standard; any vulnerabilities in smart contracts could expose users to fund loss and diminish token value.

- Adoption and Scaling Challenges: Converting the concept of AI-driven immersive gaming into an actual, widely-adopted product requires significant user acquisition and retention, with no guarantee of product-market fit.

IV. Conclusion and Action Recommendations

ARIA Investment Value Assessment

Aria.AI presents an intriguing intersection of gaming, AI technology, and Web3 innovation that appeals to forward-thinking investors. However, the project remains in early stages with significant execution risk. The 72% decline from all-time highs reflects market skepticism about near-term commercialization prospects. ARIA's value proposition depends critically on successful game development, user adoption, and AI technology integration—outcomes that remain highly uncertain. The token's current market cap of $12.4M suggests limited institutional adoption and early-stage project status, making it suitable only for risk-tolerant investors with conviction in AI-gaming convergence.

ARIA Investment Recommendations

✅ Beginners: Start with small positions (1-3% of portfolio) using dollar-cost averaging on Gate.com, treating ARIA as a speculative holding with potential but accepting possible total loss. Focus on learning blockchain gaming fundamentals before increasing exposure.

✅ Experienced Investors: Implement a structured approach combining core long-term holdings (50-60% of position) with tactical trading around identified support/resistance levels (40-50% of position). Use Gate.com's advanced trading tools for swing trading with strict stop-losses at 15-20% below entry points.

✅ Institutional Investors: Conduct thorough due diligence on the development team, game pipeline, and technology roadmap before considering allocation. If proceeding, establish position limits at 3-5% and require quarterly reviews of project milestones and adoption metrics.

ARIA Trading Participation Methods

- Spot Trading on Gate.com: Purchase ARIA directly at market price for long-term holding or tactical entries; provides straightforward exposure with minimal leverage risk.

- Limit Orders: Set buy orders at support levels (e.g., $0.06, $0.055) and sell orders at resistance levels (e.g., $0.08, $0.10) to automate trading discipline.

- Gate.com Wallet Integration: Transfer purchased ARIA to Gate.com Web3 Wallet for self-custody security while maintaining quick access for trading when market opportunities arise.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their risk tolerance and financial situation. It is strongly recommended to consult with professional financial advisors before investing. Never invest more than you can afford to lose entirely.

FAQ

What is the price prediction for Aria AI?

Aria AI is projected to reach $0.0776564 by 2030 and $0.0991115 by 2035, based on an estimated annual growth rate of 5%.

What is ARIA token and what are its main use cases?

ARIA token powers the AriaAI ecosystem, primarily used for in-game purchases, accessing exclusive content, and acquiring virtual goods. It enables users to unlock special privileges and participate in the platform's digital economy.

What factors could influence ARIA's price in the future?

ARIA's price is influenced by whale activity, market demand, trading volume, and overall cryptocurrency market trends. Large holder movements can significantly impact price, while adoption growth and market sentiment drive long-term direction.

How does ARIA compare to other AI-related cryptocurrencies?

ARIA ranks #1435 on CoinGecko with a market cap of $134.66K and circulating supply of 180 million tokens. It outperformed the global crypto market with a 6.40% weekly increase, demonstrating strong relative performance in the AI cryptocurrency sector.

What is the historical price performance of ARIA and what are the key support/resistance levels?

ARIA shows support levels at $1.80, $2.00, and $2.10, with resistance at $2.30, $2.40, $2.50, $2.57, and $3.12. These key levels guide future price movements and trading strategies.

2025 COPI Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Digital Asset Landscape

How Does Competitor Analysis Impact Crypto Market Share in 2025?

2025 AXS Price Prediction: Analyzing Market Trends and Potential Growth Factors for Axie Infinity's Token

2025 SHARDS Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 CREO Price Prediction: Analyzing Growth Potential and Market Trends for the Emerging Cryptocurrency

2025 STARHEROES Price Prediction: Analyzing Market Trends and Growth Potential for the Rising Crypto Asset

Exploring Next-Gen Solutions for DeFi Lending Liquidity

Discover the Bee Network Launch and BEE Token Ecosystem Essentials

2025 WALLET Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 FHE Price Prediction: Expert Analysis and Market Forecast for Fully Homomorphic Encryption Tokens

DuckChain Token Launch: Comprehensive Guide and Price Insights