2025 BEAM Price Prediction: Expert Analysis and Market Forecast for the Digital Asset

Introduction: BEAM's Market Position and Investment Value

BEAM (BEAM) is a privacy-focused cryptocurrency developed based on the MimbleWimble protocol, distinguished by its strong privacy features, fungibility, and scalability. Since its launch in 2019, Beam has established itself as a significant player in the privacy-oriented digital asset space. As of December 2025, Beam's market cap has reached approximately $5.2 million, with a circulating supply of around 191.74 million BEAM tokens, trading at approximately $0.02714 per token. This asset, recognized for its "default privacy transactions" architecture, continues to play an increasingly important role in the privacy-preserving blockchain ecosystem.

This article will provide a comprehensive analysis of Beam's price trajectory and market dynamics, combining historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors seeking exposure to BEAM through 2025 and beyond.

I. BEAM Price History Review and Current Market Status

BEAM Historical Price Evolution Trajectory

-

2019: BEAM reached its all-time high of $4.28 on January 5, 2019, marking the peak of the project's initial market enthusiasm following its launch as a MimbleWimble protocol-based cryptocurrency.

-

2025: The cryptocurrency has experienced significant downward pressure, reaching its all-time low of $0.01941531 on October 1, 2025, representing an approximate 99.5% decline from its historical peak.

BEAM Current Market Conditions

As of December 23, 2025, BEAM is trading at $0.02714, with a 24-hour trading volume of $12,706.81. The asset exhibits mixed short-term dynamics: it has gained 0.22% over the past 24 hours but declined 0.18% in the last hour. Over longer timeframes, the downward trend intensifies, with a 7-day decline of 17.7%, a 30-day loss of 18.25%, and a severe year-to-date performance drop of 57.48%.

The current market capitalization stands at approximately $5.20 million based on circulating supply, with a fully diluted valuation of $7.13 million. BEAM maintains a circulating supply of 191,744,025 tokens out of a maximum supply of 262,800,000 tokens (72.96% circulated). The token ranks 1,506 by market capitalization, representing a 0.00022% dominance in the overall cryptocurrency market.

Market sentiment remains bearish, with the indicator reflecting extreme fear conditions. Trading activity remains limited, with BEAM available on approximately 3 exchanges.

Click to view current BEAM market price

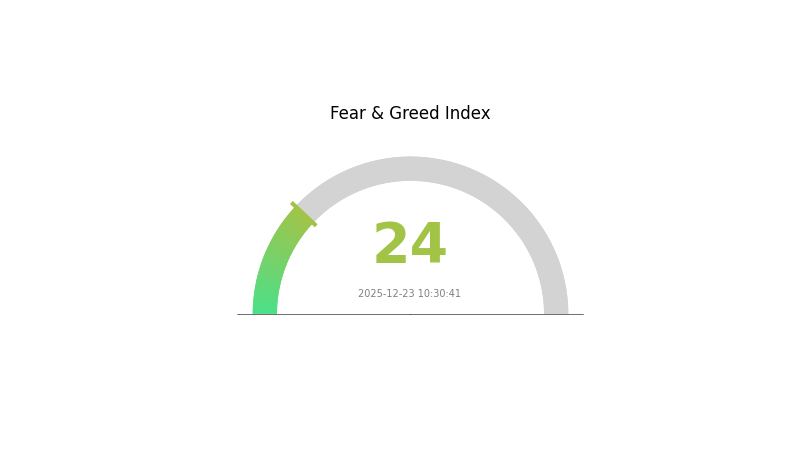

BEAM Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 24. This indicates significant market pessimism and heightened investor anxiety. During such periods, asset prices typically face substantial downward pressure as panic selling dominates market sentiment. However, extreme fear often creates contrarian opportunities for disciplined investors who can identify oversold conditions and strong projects. Market participants should remain cautious yet vigilant, as these extreme sentiment readings frequently precede market reversals. Consider reviewing your portfolio risk management strategies on Gate.com and maintaining a long-term investment perspective amid current market turbulence.

BEAM Holdings Distribution

The address holdings distribution chart provides a visual representation of how BEAM tokens are allocated across wallet addresses on the blockchain. This metric is fundamental for assessing the decentralization level and market structure of the cryptocurrency, as it reveals concentration patterns and the distribution of voting power and control among token holders. By analyzing the top addresses and their respective holdings percentages, market participants can evaluate the potential for price manipulation, the resilience of the network against coordinated actions, and the overall health of the token's ecosystem.

Given the absence of substantive holdings data in the current dataset, a comprehensive assessment of BEAM's concentration characteristics cannot be fully conducted at this time. However, the framework for evaluation would typically focus on whether a significant portion of tokens is concentrated in a limited number of addresses, which could indicate excessive centralization and heightened vulnerability to market volatility initiated by major holders. In assessing the market structure implications, analysts would examine whether the distribution supports a healthy, decentralized ecosystem or presents risks associated with potential whale activity and price manipulation. The stability and security of the on-chain structure depend critically on achieving an optimal balance where no single entity or small group possesses disproportionate control over the token supply.

Click to view the current BEAM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing BEAM's Future Price

Technology Development and Ecosystem Construction

-

MimbleWimble Protocol: BEAM's core technology is built on the MimbleWimble protocol, a blockchain format and protocol that provides excellent scalability, privacy, and fungibility. The protocol utilizes elliptic curve cryptography and implements Confidential Transaction technology through zero-sum verification, where output totals minus input totals always equal zero. This ensures transactions don't create new funds from nothing and conceals actual transaction amounts, providing BEAM with outstanding anonymity features.

-

Privacy and Scalability Enhancement: MimbleWimble's design delivers robust privacy protection through advanced cryptographic primitives while maintaining strong scalability characteristics. The protocol's ability to combine privacy with efficient transaction verification makes it a compelling technical foundation for BEAM's long-term development.

-

Ecosystem Applications: BEAM is establishing itself within the gaming ecosystem, with gaming projects and DAOs building on the Beam game chain. Merit Circle, a prominent DAO gaming guild, has announced plans to deploy games on the Beam game chain, including titles like Edenhorde Eclipse (a card game in alpha testing) and other upcoming gaming applications, expanding BEAM's utility and ecosystem reach.

Macroeconomic Environment

- Cryptocurrency Market Dynamics: BEAM's future price trends are dependent on broader cryptocurrency market sentiment and dynamics. Market sentiment, technological advancements, user adoption rates, and macroeconomic events all influence BEAM's price movements. Recent cryptocurrency market conditions show a period of stabilization and consolidation, with inflation data remaining elevated but showing marginal slowdown, while labor market conditions continue to cool, supporting a "soft landing with slower growth" narrative in the broader economy.

III. 2025-2030 BEAM Price Forecast

2025 Outlook

- Conservative Forecast: $0.02204 - $0.02721

- Base Case Forecast: $0.02721

- Optimistic Forecast: $0.0283 (requires sustained market sentiment and positive ecosystem developments)

2026-2027 Mid-term Perspective

- Market Stage Expectation: Gradual recovery and consolidation phase with modest growth trajectory

- Price Range Predictions:

- 2026: $0.01971 - $0.03719

- 2027: $0.01689 - $0.03734

- Key Catalysts: Enhanced protocol adoption, ecosystem expansion initiatives, and improved market conditions

2028-2030 Long-term Outlook

- Base Scenario: $0.02374 - $0.04608 (assumes steady protocol development and moderate market participation)

- Optimistic Scenario: $0.03059 - $0.06518 (assumes accelerated adoption and positive macro conditions)

- Transformative Scenario: $0.04819 - $0.06518 (requires breakthrough technological innovations, mainstream institutional adoption, and sustained bull market conditions)

- 2030-12-31: BEAM projected at $0.06518 maximum (bull market peak scenario with sustained growth momentum)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0283 | 0.02721 | 0.02204 | 0 |

| 2026 | 0.03719 | 0.02775 | 0.01971 | 2 |

| 2027 | 0.03734 | 0.03247 | 0.01689 | 19 |

| 2028 | 0.04608 | 0.03491 | 0.02374 | 28 |

| 2029 | 0.04819 | 0.04049 | 0.02916 | 49 |

| 2030 | 0.06518 | 0.04434 | 0.03059 | 63 |

BEAM Investment Strategy and Risk Management Report

IV. BEAM Professional Investment Strategy and Risk Management

BEAM Investment Methodology

(1) Long-term Holding Strategy

- Suitable investors: Privacy-focused cryptocurrency enthusiasts and investors seeking exposure to MimbleWimble protocol technology

- Operation recommendations:

- Accumulate BEAM during market downturns when prices are significantly below historical highs, taking advantage of the -57.48% year-over-year decline

- Dollar-cost averaging (DCA) approach to reduce timing risk, particularly given the high volatility and limited market liquidity (current 24H volume of 12,706.81)

- Hold through blockchain development cycles as the project matures its privacy features and scalability improvements

(2) Active Trading Strategy

- Technical analysis tools:

- Support and resistance levels: Current price of $0.02714 shows proximity to recent lows ($0.02712), suggesting potential support formation around this zone

- Volume analysis: Monitor the 24-hour trading volume trends on Gate.com to identify liquidity conditions before executing larger positions

- Wave trading key points:

- Capitalize on the -17.7% weekly decline and -18.25% monthly decline to identify entry opportunities during oversold conditions

- Set profit-taking targets based on historical price levels, with particular attention to the $0.03-$0.04 resistance zone

BEAM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% portfolio allocation maximum

- Active investors: 2-5% portfolio allocation

- Professional investors: 5-10% portfolio allocation

(2) Risk Hedging Solutions

- Position sizing: Limit individual trades to no more than 2-3% of total portfolio given BEAM's high volatility and relatively low market liquidity

- Diversification strategy: Combine BEAM holdings with more established privacy-focused cryptocurrencies to reduce concentration risk

(3) Secure Storage Solutions

- Hot wallet solution: Use Gate.com's built-in wallet for active trading and frequent transactions, with robust security features including two-factor authentication

- Cold storage method: Transfer long-term holdings to offline storage solutions for enhanced security against hacking attempts

- Security considerations: Never share private keys or seed phrases; enable all available security features on Gate.com; regularly audit wallet access logs for unauthorized activity

V. BEAM Potential Risks and Challenges

BEAM Market Risk

- Low trading liquidity: With only 3 exchange listings and 24-hour volume of 12,706.81, BEAM faces significant liquidity constraints that could result in high slippage during large trades

- Market cap concentration: The relatively small fully diluted valuation of $7,132,392 creates vulnerability to price manipulation and sudden market movements

- High historical volatility: From a peak of $4.28 in January 2019 to current levels represents an 87% decline, indicating severe price instability

BEAM Regulatory Risk

- Privacy coin restrictions: Many jurisdictions are increasingly scrutinizing privacy-focused cryptocurrencies, with some exchanges delisting privacy coins due to regulatory concerns

- Compliance uncertainty: Beam's MimbleWimble protocol and default privacy features may face legal challenges in jurisdictions with strict anti-money laundering requirements

- Exchange delisting potential: Regulatory pressure could result in removal from remaining exchanges, severely impacting liquidity and accessibility

BEAM Technical Risk

- Adoption barriers: Limited merchant acceptance and real-world utility compared to mainstream cryptocurrencies creates fundamental demand challenges

- Protocol scalability: While MimbleWimble offers improvements, the network's ability to handle mainstream transaction volumes remains unproven

- Development dependency: The project relies on continued developer commitment to maintain and upgrade the protocol, with community-driven development presenting sustainability concerns

VI. Conclusions and Action Recommendations

BEAM Investment Value Assessment

BEAM presents a high-risk, speculative investment opportunity centered on privacy technology and MimbleWimble protocol innovation. The project demonstrates technical merit through its implementation of privacy-by-default transactions and scalable node synchronization. However, the 87% decline from all-time highs, limited market liquidity across only 3 exchanges, and uncertain regulatory environment significantly constrain near-term growth prospects. The project's finite supply structure provides potential long-term value accumulation, but this must be weighed against substantial technological adoption and market acceptance challenges.

BEAM Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of portfolio) through Gate.com's user-friendly trading interface; focus on understanding the MimbleWimble protocol and privacy coin mechanics before increasing exposure

✅ Experienced investors: Consider tactical positions during significant drawdowns, employing technical analysis on Gate.com charts; maintain strict position sizing discipline given liquidity constraints

✅ Institutional investors: Conduct thorough due diligence on regulatory compliance before considering BEAM positions; evaluate against alternative privacy-focused solutions; implement robust risk management protocols given market concentration risks

BEAM Trading Participation Methods

- Spot trading: Purchase BEAM directly on Gate.com with multiple trading pair options for flexible entry and exit strategies

- Limit orders: Utilize Gate.com's advanced order types to execute trades at predetermined price levels, managing slippage in low-liquidity conditions

- Portfolio tracking: Monitor BEAM performance through Gate.com's portfolio management tools alongside broader market sentiment indicators

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their individual risk tolerance and are strongly advised to consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

Does Beam Coin have a future?

Yes, Beam Coin shows promising potential with strong focus on gaming ecosystem development. Growing developer adoption and increasing transaction volume demonstrate solid market interest. Long-term success depends on continued innovation and mainstream adoption growth.

Can BeamX hit 1 dollar?

Yes, BeamX has previously reached $1.00, demonstrating it's achievable. With growing adoption and market momentum, reaching $1 again remains possible as the project continues developing.

What is the price target for beam in 2025?

Beam's price target for 2025 ranges from $21.00 to $80.00, with an average forecast showing significant upside potential of approximately 63.26% based on current analyst predictions.

Can Beam reach $10?

Beam reaching $10 would require extraordinary growth of over 360,000%. While possible theoretically, current market dynamics and price projections suggest this milestone is highly unlikely in the foreseeable future.

2025 XLM Price Prediction: Stellar Lumens' Potential Growth Trajectory in a Maturing Crypto Ecosystem

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 FTT Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Digital Asset Ecosystem

2025 TURBO Price Prediction: Analyzing Market Trends and Future Valuation Prospects in the Evolving Cryptocurrency Ecosystem

2025 HTPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Huobi Token

2025 MTLPrice Prediction: Analyzing Future Growth Trends and Market Potential for Metal Token

2025 WAI Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 EVAA Price Prediction: Expert Analysis and Market Outlook for the Next Generation of Digital Assets

Is Clover Finance (CLV) a good investment?: A Comprehensive Analysis of Risk, Potential, and Market Outlook

Is CateCoin (CATE) a good investment?: A Comprehensive Analysis of Risks, Potential Returns, and Market Outlook for 2024

Is LumiWave (LWA) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Growth Prospects