2025 BEEFI Price Prediction: Expert Analysis, Market Trends, and Long-Term Investment Outlook

Introduction: Market Position and Investment Value of BEEFI

Beefy.Finance (BEEFI) is a "set and forget" yield farming platform designed for users seeking to benefit from complex farming strategies without the time commitment of active management. Since its inception, the platform has established itself as a prominent solution in the decentralized finance ecosystem. As of December 2025, BEEFI maintains a market capitalization of approximately $8.37 million with a circulating supply of 80,000 tokens, currently trading around $104.65 per token. This innovative platform continues to play an increasingly important role in automated yield farming and liquidity mining strategies.

This article will provide a comprehensive analysis of BEEFI's price trajectory and market dynamics, combining historical performance data, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasting and practical investment strategies for investors considering exposure to this asset class.

Beefy.Finance (BEEFI) Market Analysis Report

I. BEEFI Price History Review and Current Market Status

BEEFI Historical Price Evolution

- March 2021: All-time high reached at $4,116.95, marking the peak valuation of the project during the initial bull market phase.

- October 2020: All-time low established at $3.28, representing the foundational price level early in the token's trading history.

- 2020-2025: Sustained downward trend from peak valuations, with the token experiencing a significant decline of approximately 69.89% over the one-year period, reflecting prolonged bearish market conditions and changing market sentiment.

BEEFI Current Market Stance

Price Performance: As of December 22, 2025, BEEFI is trading at $104.65, representing a modest positive movement of 0.05% over the past 24 hours. The token fluctuated between a 24-hour high of $105.85 and a low of $101.64, indicating relative stability within a narrow trading range.

Market Capitalization and Liquidity: BEEFI maintains a total market capitalization of $8,372,000 with a fully diluted valuation (FDV) of $8,372,000, reflecting a circulating supply of 80,000 tokens against a maximum supply of 80,000 tokens (100% circulating ratio). The 24-hour trading volume stands at $11,644.33, demonstrating moderate liquidity across nine exchange listings.

Price Trend Analysis:

- Intraday (1H): -0.57%

- Daily (24H): +0.05%

- Weekly (7D): -2.46%

- Monthly (30D): -5.47%

- Yearly (1Y): -69.89%

The token demonstrates short-term volatility with downward pressure across medium to long-term timeframes, though intraday fluctuations suggest active trading dynamics.

Market Position: BEEFI ranks at position 1,270 in the broader cryptocurrency market by market capitalization, commanding a market share of 0.00025%. The token is held by 1,218 addresses, indicating a moderately distributed holder base.

Click to view current BEEFI market price

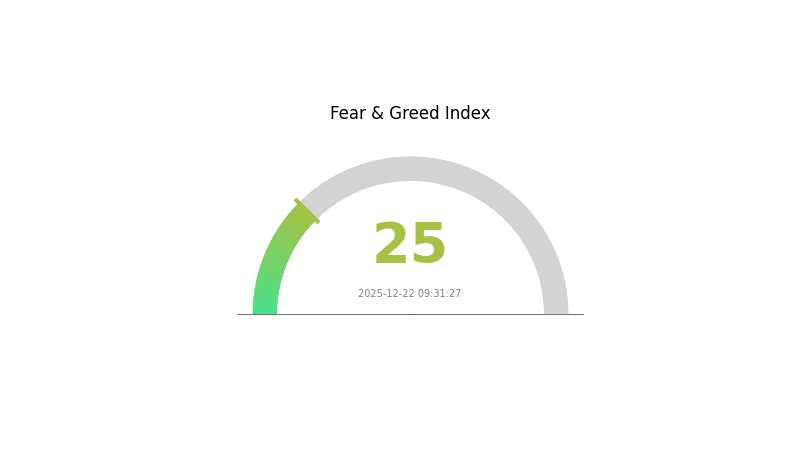

BEEFI Market Sentiment Indicator

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index hitting 25. This exceptional level of pessimism often presents contrarian opportunities for experienced investors. When market sentiment reaches such extremes, prices may be significantly discounted, creating potential entry points for long-term positions. However, extreme fear also signals heightened volatility and uncertainty. Investors should exercise caution and implement proper risk management strategies. Monitor market developments closely and consider dollar-cost averaging to mitigate timing risks during periods of intense market fear.

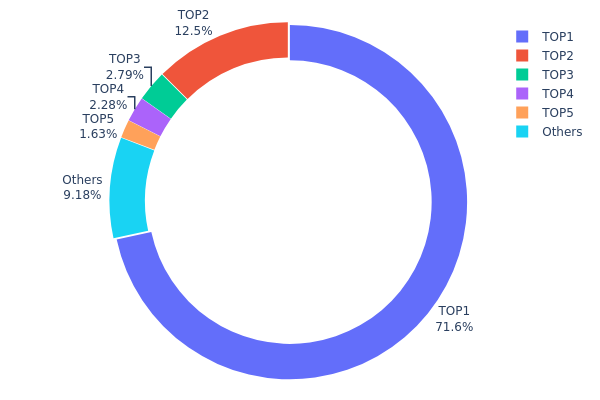

BEEFI Holdings Distribution

The holdings distribution map illustrates how BEEFI tokens are concentrated across different blockchain addresses, providing critical insight into the tokenomics structure and potential market dynamics. This metric quantifies the degree of decentralization by measuring the percentage of total token supply held by the largest stakeholders, which directly reflects market concentration risk and the potential for price manipulation or sudden liquidity shifts.

BEEFI exhibits significant concentration risk, with the top address controlling 71.60% of the total token supply—a level that substantially exceeds healthy decentralization thresholds. The cumulative holdings of the top five addresses account for approximately 90.79% of all tokens, indicating pronounced centralization. The second-largest holder maintains a 12.50% stake, while positions three through five range between 2.79% and 1.63%. Only 9.21% of tokens are distributed among remaining addresses, suggesting a highly stratified ownership structure where decision-making power and market influence remain concentrated among a minimal number of stakeholders.

Such extreme concentration introduces considerable market vulnerability. A single large holder possessing over 71% of circulating supply could theoretically execute coordinated sell-offs with minimal friction, creating acute downward price pressure. Additionally, this distribution pattern may constrain genuine price discovery mechanisms and reduce market depth, as true decentralized price formation requires broader participation from diverse holders. The structural imbalance between the dominant address and secondary stakeholders underscores the importance of monitoring potential redistribution events or large-scale transfers, as these could substantially reshape market dynamics and volatility profiles.

Click to view current BEEFI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb1f1...b0e087 | 57.29K | 71.60% |

| 2 | 0xf977...41acec | 10.00K | 12.50% |

| 3 | 0x28c6...f21d60 | 2.24K | 2.79% |

| 4 | 0xfba2...462d83 | 1.82K | 2.27% |

| 5 | 0xc9c6...ab6041 | 1.31K | 1.63% |

| - | Others | 7.35K | 9.21% |

II. Core Factors Affecting BEEFI's Future Price

Supply and Demand Dynamics

-

Market Supply and Demand Relationship: BEEFI's future price movements are fundamentally influenced by the balance between market participants' buying and selling behavior. As with all assets, the interaction between buyers and sellers on public platforms gradually reveals the true value of BEEFI through price discovery mechanisms.

-

Market Sentiment Impact: Price fluctuations are significantly affected by market sentiment and the speed at which information propagates through the market. Positive or negative sentiment can drive rapid price movements independent of fundamental factors.

-

Current Market Expectations: The market continuously reflects participants' expectations and supply-demand dynamics in real-time pricing, meaning current price levels already incorporate known information about BEEFI's supply conditions.

Technology Development and Ecosystem Building

-

Market Innovation Requirements: BEEFI's future value depends on technological innovation and evolving market demand. As blockchain technology and cryptocurrency markets develop, projects that fail to innovate risk falling behind competitors in terms of adoption and utility.

-

Investor Attention Requirements: For BEEFI to maintain and grow its market value, it requires continued focus from investors and market participants who monitor technological upgrades, ecosystem developments, and protocol improvements that could affect the token's long-term prospects.

III. 2025-2030 BEEFI Price Forecast

2025 Outlook

- Conservative Forecast: $83.70 - $104.63

- Neutral Forecast: $104.63

- Optimistic Forecast: $119.28 (requires sustained ecosystem adoption and positive market sentiment)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Consolidation phase with gradual appreciation as the project matures and market participants increase confidence in the protocol's fundamentals.

- Price Range Forecast:

- 2026: $98.52 - $157.86

- 2027: $75.55 - $155.14

- Key Catalysts: Protocol upgrades, expansion of yield farming opportunities, increased institutional participation, and broader adoption of DeFi yield strategies.

2028-2030 Long-term Outlook

- Base Case Scenario: $73.96 - $175.48 by 2028 (assumes continued market growth and steady protocol development with moderate regulatory clarity)

- Optimistic Scenario: $129.80 - $189.09 by 2029 (assumes accelerated ecosystem expansion and significant capital inflow into yield farming products)

- Transformation Scenario: $90.83 - $197.38 by 2030 (assumes breakthrough in institutional adoption, significant technological innovations, and BEEFI becoming a dominant yield protocol in the market)

- 2030-12-22: BEEFI projected at $197.38 (long-term accumulation phase with substantial upside potential)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 119.28 | 104.63 | 83.704 | 0 |

| 2026 | 157.86 | 111.95 | 98.51961 | 6 |

| 2027 | 155.14 | 134.9 | 75.54663 | 28 |

| 2028 | 175.48 | 145.02 | 73.9615 | 38 |

| 2029 | 189.09 | 160.25 | 129.8 | 53 |

| 2030 | 197.38 | 174.67 | 90.82965 | 66 |

BEEFI Investment Analysis Report

IV. BEEFI Professional Investment Strategy and Risk Management

BEEFI Investment Methodology

(1) Long-Term Holding Strategy

-

Target Audience: Passive income seekers and yield farming enthusiasts who prefer automated strategies with minimal active management.

-

Operational Recommendations:

- Deposit BEEFI tokens into Beefy Finance's vault contracts to participate in automated yield farming strategies.

- Allow the platform's smart contracts to continuously optimize your farming positions without manual intervention.

- Reinvest earned rewards to maximize compounding effects over extended periods.

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price Action Analysis: Monitor the 24-hour price range ($101.64 - $105.85) to identify support and resistance levels.

- Volume Analysis: Track 24-hour trading volume ($11,644.33) against historical averages to assess market liquidity and conviction.

-

Trading Entry and Exit Points:

- Enter positions during periods of lower volatility within the established trading range.

- Consider the significant year-over-year decline (-69.89%) when evaluating risk-reward ratios for new positions.

BEEFI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of diversified portfolio allocation, focusing on long-term yield accumulation rather than price appreciation.

- Active Investors: 3-8% of portfolio, allowing for tactical adjustments based on market conditions and yield farming performance.

- Professional Investors: Up to 15% of specialized yield farming allocations, with sophisticated hedging strategies and position monitoring.

(2) Risk Hedging Approaches

- Diversification Across Chains: Distribute BEEFI positions across multiple blockchain networks where Beefy operates to reduce single-chain dependency risk.

- Yield Optimization Monitoring: Regularly review vault performance metrics and switch to higher-performing strategies when farming yields decline.

(3) Secure Storage Solutions

-

Self-Custody Best Practices:

- Store private keys in secure, encrypted formats separate from internet-connected devices.

- Maintain backup recovery phrases in multiple secure physical locations.

- Never share seed phrases or private keys with third parties.

-

Smart Contract Interaction Safety:

- Verify all smart contract addresses before depositing funds into vault contracts.

- Use community audit reports and security reviews when evaluating new vault strategies.

- Start with smaller amounts when testing new farming strategies before committing significant capital.

V. BEEFI Potential Risks and Challenges

BEEFI Market Risk

-

High Price Volatility: BEEFI has experienced extreme price depreciation (-69.89% over one year) and historical peak-to-current decline from ATH of $4,116.95 to current price of $104.65, indicating substantial market risk.

-

Liquidity Constraints: With 24-hour trading volume of only $11,644.33 against a market cap of $8,372,000, the token exhibits relatively thin liquidity that could result in significant slippage during large trades.

-

Market Cap Concentration: The project ranks 1,270 in global market capitalization with only 1,218 token holders, suggesting limited market adoption and concentration risk.

BEEFI Regulatory Risk

-

Yield Farming Regulatory Uncertainty: Many jurisdictions remain unclear on the regulatory classification of yield farming strategies and associated token rewards.

-

Securities Classification Concerns: Regulatory authorities in various regions may reclassify yield-bearing tokens as securities, potentially impacting token utility and trading.

BEEFI Technical Risk

-

Smart Contract Vulnerability Exposure: Participation in complex yield farming strategies through Beefy vaults exposes users to potential smart contract vulnerabilities or exploitation.

-

Dependency on External Protocols: BEEFI's value is tied to the performance and security of underlying yield farming protocols and liquidity pools it integrates with.

-

Automated Strategy Risk: The "set and forget" automation model, while convenient, may execute suboptimal positions during extreme market conditions without user intervention.

VI. Conclusion and Action Recommendations

BEEFI Investment Value Assessment

Beefy.Finance operates as a yield farming platform designed for users seeking passive income generation without active daily management. However, BEEFI faces significant headwinds including severe long-term price depreciation, limited trading liquidity, and concentrated token holder distribution. The platform's utility-focused model means the token's primary value derives from governance and fee mechanisms rather than fundamental asset backing. Investors should carefully evaluate whether the current risk-reward profile aligns with their financial objectives before allocation.

BEEFI Investment Recommendations

✅ Beginners: Allocate minimal exploratory positions (0.5-1% of capital) through Gate.com, focusing on understanding the yield farming mechanics rather than price appreciation expectations.

✅ Experienced Investors: Consider modest allocations (2-5%) if you have existing yield farming strategies and understand smart contract risks. Monitor vault performance metrics and be prepared to exit if yields decline significantly.

✅ Institutional Investors: Conduct comprehensive technical audits of Beefy's smart contracts and underlying yield protocols before any substantial allocation. Structure positions with appropriate risk hedging and maintain dedicated monitoring infrastructure.

BEEFI Trading Participation Methods

-

Exchange Trading: Purchase BEEFI directly on Gate.com using standard trading pairs, which provides exposure to price movements and liquidity access.

-

Vault Participation: Deposit compatible assets (typically LP tokens or stablecoins) into Beefy Finance vaults to generate protocol revenue shares and farming rewards.

-

Governance Participation: Accumulate BEEFI tokens to participate in protocol governance decisions regarding strategy implementation and fee structures.

Cryptocurrency investments carry extreme risk and are highly speculative. This report does not constitute investment advice. Investors must evaluate their personal risk tolerance and financial situation carefully before making any investment decisions. Always consult with qualified financial professionals before committing capital. Never invest more than you can afford to lose.

FAQ

What is BEEFI and how does it work?

BEEFI is a decentralized yield farming protocol that enables users to earn rewards by providing liquidity and staking assets. It operates through smart contracts that optimize yield generation and automate reward distribution across multiple blockchain ecosystems.

What factors influence BEEFI token price movements?

BEEFI token price is influenced by limited supply of 80,000 tokens, market demand, trading volume, institutional adoption, DeFi sector trends, and overall cryptocurrency market sentiment.

Where can I buy and trade BEEFI tokens?

You can buy and trade BEEFI tokens on major crypto platforms. Use decentralized exchanges (DEX) or centralized platforms that support BEEFI. Check liquidity and trading pairs before trading to ensure the best rates.

What is the historical price performance of BEEFI?

BEEFI reached an all-time high of 23120 in April 2024. As of December 2025, the token trades significantly lower. Historically, BEEFI has experienced substantial volatility, with analysts projecting continued market developments in the coming quarters.

What are the risks associated with BEEFI investment?

BEEFI investment carries market volatility risk, price fluctuation exposure, and regulatory uncertainties. Supply chain disruptions and operational challenges can impact returns significantly.

2025 AAVE Price Prediction: Analyzing Growth Potential and Market Factors in the DeFi Lending Landscape

2025 EULPrice Prediction: Market Analysis and Future Trends for Euler Finance Token in the DeFi Ecosystem

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 DEEP Price Prediction: Analyzing Future Market Trends and Growth Potential for Digital Economy Enhanced Protocols

2025 EDGEPrice Prediction: Analysis of Growth Potential and Market Factors Influencing the Future Value

2025 BENQI Price Prediction: Analyzing Market Trends and Future Valuation for the DeFi Protocol

Understanding Hard Cap in Cryptocurrency: A Comprehensive Guide

Promising Cryptocurrencies to Watch for Major Growth in 2025

What is GRIN: A Comprehensive Guide to Global Research Identifier Numbers and Their Impact on Scientific Collaboration

What is REP: A Comprehensive Guide to Repetition Training and Its Benefits for Fitness and Muscle Growth

What is VFY: A Comprehensive Guide to Virtual Financial Yield and Its Applications in Modern Investment Strategies