2025 EDGEPrice Prediction: Analysis of Growth Potential and Market Factors Influencing the Future Value

Introduction: EDGE's Market Position and Investment Value

Definitive (EDGE) as an onchain trading platform democratizing advanced trading tools, has achieved significant milestones since its inception. As of 2025, EDGE's market capitalization has reached $61,258,636, with a circulating supply of approximately 203,024,680 tokens, and a price hovering around $0.30173. This asset, known as the "advanced trading tool for the masses," is playing an increasingly crucial role in decentralized finance and multi-chain trading.

This article will comprehensively analyze EDGE's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic conditions, to provide investors with professional price predictions and practical investment strategies.

I. EDGE Price History Review and Current Market Status

EDGE Historical Price Evolution

- 2025 April: EDGE reached its all-time low of $0.02603, marking the beginning of its market presence

- 2025 August: The token hit its all-time high of $0.95518, showcasing significant growth in a short period

- 2025 September: EDGE experienced a correction, with price fluctuating between its ATH and current levels

EDGE Current Market Situation

EDGE is currently trading at $0.30173, representing a 68.41% decrease from its all-time high. The token has seen a 24-hour trading volume of $39,814.20, with a market capitalization of $61,258,636.72. EDGE's circulating supply stands at 203,024,680.07 tokens, which is 20.30% of its total supply of 1,000,000,000 tokens. The token has experienced recent downward pressure, with a 2.16% decrease in the last 24 hours and a more significant 33.1% drop over the past 30 days. Despite these short-term challenges, EDGE maintains a market dominance of 0.0073%.

Click to view the current EDGE market price

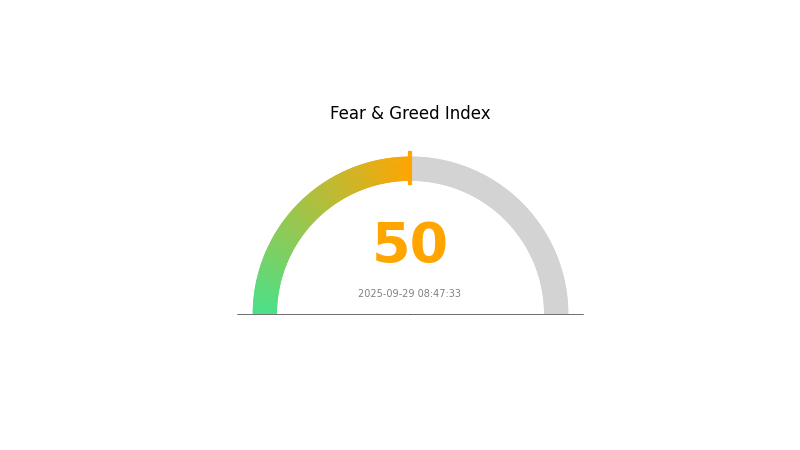

EDGE Market Sentiment Indicator

2025-09-29 Fear and Greed Index: 50 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment appears balanced today, with the Fear and Greed Index at 50, indicating a neutral stance. This equilibrium suggests that investors are neither overly fearful nor excessively greedy. Such a state often presents opportunities for cautious investment, as the market lacks extreme emotions that could lead to irrational decisions. Traders may find this an ideal time to reassess their strategies and portfolio allocations, keeping in mind that market conditions can shift rapidly.

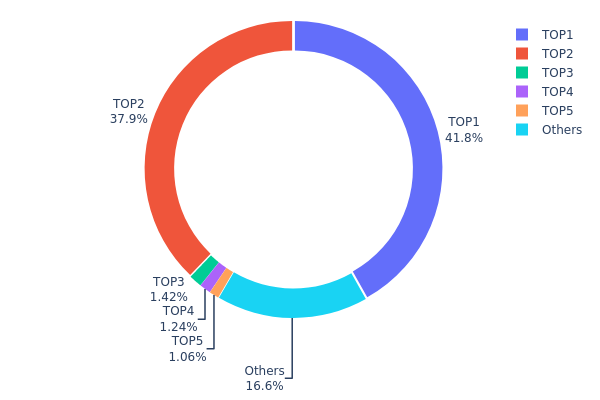

EDGE Holdings Distribution

The address holdings distribution data for EDGE reveals a highly concentrated ownership structure. The top two addresses collectively hold 79.69% of the total supply, with 41.84% and 37.85% respectively. This level of concentration raises concerns about centralization and potential market manipulation risks.

The third to fifth largest holders each possess between 1-1.5% of the total supply, while the remaining addresses collectively account for 16.61%. This stark imbalance in token distribution suggests a significant power disparity among EDGE holders, potentially impacting market dynamics and price volatility. Such a concentrated structure may lead to increased susceptibility to large-scale sell-offs or accumulation events, potentially resulting in heightened price fluctuations and reduced market stability.

From a broader perspective, this distribution pattern indicates a low level of decentralization within the EDGE ecosystem. The concentration of tokens in a few addresses could potentially compromise the project's resilience and governance structure, as decision-making power may be disproportionately influenced by a small number of large holders.

Click to view the current EDGE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf6ba...aef071 | 418446.10K | 41.84% |

| 2 | 0x421a...be36da | 378529.22K | 37.85% |

| 3 | 0x85bc...48e1e3 | 14166.87K | 1.41% |

| 4 | 0xb5e9...c663af | 12402.43K | 1.24% |

| 5 | 0xdefe...c68bde | 10588.26K | 1.05% |

| - | Others | 165867.12K | 16.61% |

II. Key Factors Affecting EDGE's Future Price

Market Sentiment and Community Activities

- News and Announcements: News releases and community sentiment can be significant price drivers for EDGE.

- Historical Pattern: Price charts often represent market sentiment, indicating the importance of technical analysis.

- Current Impact: HODLers tend to focus on long-term fundamental analysis, while short-term traders may be more influenced by immediate market sentiment.

Technical Development and Ecosystem Building

- AI Integration: Future expansion of AI applications to EDGE-end AI, such as AI chips built into cars, phones, and PCs.

- Growth Potential: According to Morgan Stanley reports, AI semiconductors in this category are expected to grow rapidly from 2023 to 2027.

III. EDGE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.17499 - $0.25000

- Neutral prediction: $0.25000 - $0.30171

- Optimistic prediction: $0.30171 - $0.36507 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.20318 - $0.5737

- 2028: $0.30135 - $0.51035

- Key catalysts: Technological advancements, wider market adoption, and favorable regulatory environment

2029-2030 Long-term Outlook

- Base scenario: $0.49820 - $0.62026 (assuming steady market growth and adoption)

- Optimistic scenario: $0.62026 - $0.81874 (assuming strong market performance and widespread use)

- Transformative scenario: $0.81874 - $1.00000 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: EDGE $0.62026 (105% increase from 2025 levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.36507 | 0.30171 | 0.17499 | 0 |

| 2026 | 0.46341 | 0.33339 | 0.29338 | 10 |

| 2027 | 0.5737 | 0.3984 | 0.20318 | 32 |

| 2028 | 0.51035 | 0.48605 | 0.30135 | 61 |

| 2029 | 0.74232 | 0.4982 | 0.31387 | 65 |

| 2030 | 0.81874 | 0.62026 | 0.33494 | 105 |

IV. EDGE Professional Investment Strategies and Risk Management

EDGE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate EDGE tokens during market dips

- Set clear long-term price targets

- Store tokens in secure cold wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and support/resistance levels

- Relative Strength Index (RSI): Helps determine overbought/oversold conditions

- Key points for swing trading:

- Monitor trading volume for potential trend reversals

- Set stop-loss orders to manage risk

EDGE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Set automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage option: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for EDGE

EDGE Market Risks

- High volatility: Significant price fluctuations in short periods

- Limited liquidity: Potential difficulty in executing large trades

- Market sentiment: Susceptibility to overall crypto market trends

EDGE Regulatory Risks

- Uncertain regulations: Potential for new laws affecting DeFi platforms

- Cross-border compliance: Challenges in adhering to various international regulations

- Tax implications: Evolving tax treatment of DeFi transactions

EDGE Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the platform's code

- Network congestion: Possible transaction delays during high traffic periods

- Interoperability issues: Challenges in connecting with other blockchain networks

VI. Conclusion and Action Recommendations

EDGE Investment Value Assessment

EDGE presents a high-risk, high-potential opportunity in the DeFi space. Long-term value lies in its advanced trading tools and multi-chain support, but short-term volatility and regulatory uncertainties pose significant risks.

EDGE Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the platform ✅ Experienced investors: Consider allocating a portion of DeFi portfolio to EDGE ✅ Institutional investors: Conduct thorough due diligence and consider OTC options for large positions

EDGE Trading Participation Methods

- Spot trading: Available on Gate.com and other supported exchanges

- DeFi liquidity provision: Participate in liquidity pools on the Definitive platform

- Staking: Explore potential staking options if offered by the project

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

Bitcoin Hyper ($HYPER) is predicted to 1000x, based on current market trends and growth potential as of 2025-09-29.

What crypto has the highest price prediction?

Bitcoin (BTC) has the highest price prediction for 2025, followed closely by Ethereum (ETH). These predictions are based on current market trends and expert analysis.

How much will $1 Bitcoin be worth in 2025?

Based on analyst predictions, $1 Bitcoin could be worth between $125,000 and $200,000 in 2025, driven by ETF inflows and institutional adoption.

What is the price prediction for definitive edge?

EDGE is predicted to trade between $0.048463 and $0.070655 in 2025, with a potential high of $0.070655 by 2030.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Top Crypto Exchanges for Beginners: A Review of Leading Platforms

Top 6 Best Decentralized Exchanges — A Review of Leading DEX Platforms

How Will Bitcoin Change the World in the Next 10 Years?

What is NFT minting and how much does it cost to mint tokens

Cloud Mining: Top Platforms Guide