2025 BLESS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: BLESS's Market Position and Investment Value

Bless (BLESS) is a decentralized edge computing network providing on-demand CPU and GPU power for AI, machine learning, and advanced data tools near end users. As of December 20, 2025, BLESS has achieved a market capitalization of $111.7 million with a circulating supply of approximately 1.84 billion tokens, currently trading at $0.01117. This innovative asset is playing an increasingly critical role in the decentralized computing infrastructure sector.

This comprehensive analysis examines BLESS's price trajectory and market dynamics through 2030, integrating historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

BLESS Market Analysis Report

I. BLESS Price History Review and Market Status

BLESS Historical Price Movement Trajectory

Based on available data, BLESS has experienced significant volatility since its launch. The token reached its all-time high of $0.2304 on October 15, 2025, representing a peak valuation period for the project. Subsequently, the token entered a correction phase, declining approximately 78.7% from its peak to reach its all-time low of $0.00993 on December 19, 2025, marking the lowest valuation point in the token's trading history.

BLESS Current Market Dynamics

As of December 20, 2025, BLESS is trading at $0.01117 with a 24-hour trading volume of 211,147.69 units. The token exhibits mixed short-term momentum, gaining 8.1% over the last 24 hours while showing weakness over longer timeframes with a 7-day decline of 19.64% and a 30-day decline of 36.13%. The 1-hour period shows minimal negative pressure at -0.62%.

The fully diluted market capitalization stands at $111.7 million, with a circulating supply of 1,841,666,667 BLESS tokens out of a total supply of 10 billion tokens, representing an 18.42% circulation ratio. The token maintains a market dominance of 0.0034% in the broader cryptocurrency market. BLESS is listed across 17 cryptocurrency exchanges and holds 5,501 token holders.

The token operates on the BEP-20 standard on the Binance Smart Chain (BSC) network, with its smart contract address: 0x7c8217517ed4711fe2deccdfeffe8d906b9ae11f.

Click to view current BLESS market price

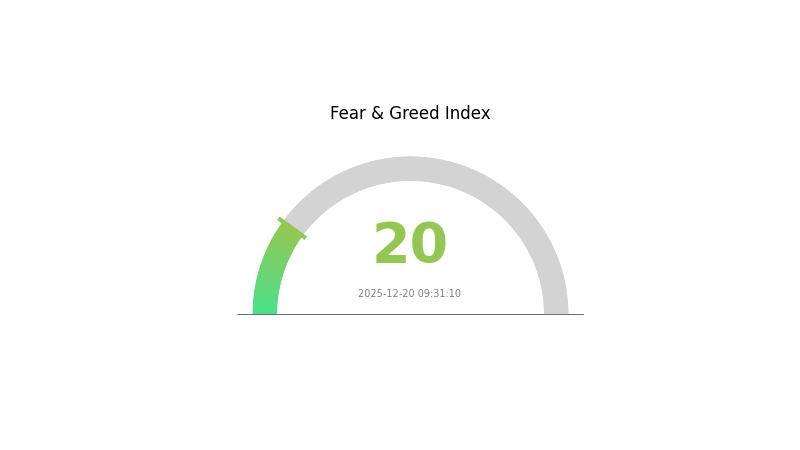

BLESS Market Sentiment Index

2025-12-20 Fear & Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

Market Analysis:

The crypto market is experiencing extreme fear with an index reading of 20. This indicates heightened investor anxiety and significant market pessimism. Such extreme fear conditions often present contrarian opportunities for long-term investors, as panic selling may create attractive entry points. However, caution is warranted as downward pressure may persist. Monitor key support levels and market developments closely. Consider dollar-cost averaging strategies rather than aggressive accumulation during such volatile periods. On Gate.com, you can track real-time sentiment shifts and adjust your portfolio strategy accordingly.

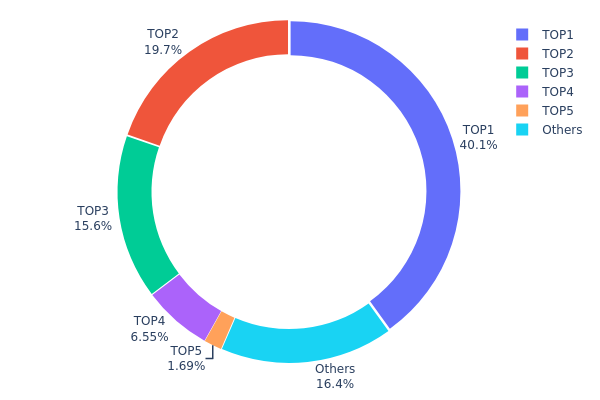

BLESS Holdings Distribution

The address holdings distribution map provides a snapshot of token concentration across the blockchain network by tracking the top wallet addresses and their respective holdings. This metric is essential for understanding the decentralization level of a token and assessing potential risks related to whale accumulation and market manipulation.

The BLESS token exhibits a pronounced concentration pattern, with the top three addresses controlling approximately 75.34% of the total supply. The largest holder (0x070f...73f5f0) commands 40.06% of all BLESS tokens, representing a significant concentration risk. The second and third largest addresses hold 19.69% and 15.59% respectively, further reinforcing the top-heavy distribution structure. This level of concentration suggests that price movements could be substantially influenced by the actions of these major stakeholders, as their trading decisions or liquidation events would have outsized market impact.

Beyond the top three addresses, the distribution becomes more fragmented. The fourth and fifth ranked addresses hold 6.54% and 1.68% respectively, while the remaining addresses account for 16.44% of the supply. This bifurcated structure indicates that while a small number of dominant holders control the majority of BLESS tokens, a moderately distributed tail of smaller investors exists. The current holdings distribution reflects moderate centralization characteristics that warrant attention, as concentrated ownership can limit the token's practical utility and raise concerns regarding decentralization ideals commonly associated with blockchain assets.

Click to view the current BLESS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x070f...73f5f0 | 123898.00K | 40.06% |

| 2 | 0x73d8...4946db | 60896.08K | 19.69% |

| 3 | 0x0d07...b492fe | 48223.00K | 15.59% |

| 4 | 0x4998...ecc9db | 20251.68K | 6.54% |

| 5 | 0x75f8...8a5f66 | 5217.42K | 1.68% |

| - | Others | 50787.25K | 16.44% |

II. Core Factors Affecting BLESS Future Price

Supply Mechanism

- Token Allocation for Airdrops: BLESS reserved 8.5% of tokens for airdrops, with claims opened on September 24th. This supply mechanism directly impacts token circulation and market dynamics.

- Historical Patterns: The release of allocated tokens through airdrops has historically influenced price volatility in emerging projects during their initial launch phases.

- Current Impact: As an emerging DePIN (Decentralized Physical Infrastructure Network) project, the gradual token distribution through airdrops is expected to create incremental selling pressure, while also expanding the holder base and potentially increasing adoption.

Market Sentiment and Volatility

- Price Volatility: As a newly emerged project, BLESS token has already experienced significant price fluctuations. The token has traded in consolidation ranges (approximately $0.00025-$0.00030 USD), indicating market participants are still determining fair value.

- Social Media Influence: Market sentiment driven by news, social media discussions, and investor confidence plays a crucial role in short-term price movements.

- Market Psychology: Future price performance will largely depend on social momentum and overall market sentiment toward DePIN sector tokens.

Regulatory Dynamics

- Monitoring Requirements: Regulatory developments, including potential ETF approvals and government policy changes toward cryptocurrency, remain critical price drivers.

- Regulatory Uncertainty: As with most emerging tokens, regulatory clarity will be essential for sustained growth and institutional adoption.

Macroeconomic Environment

- Federal Reserve Policy: The U.S. Federal Reserve is exercising caution in unwinding restrictive monetary policies while inflation remains above the 2% target. This cautious approach may create a supportive environment for alternative assets like BLESS.

- Inflation Hedging Characteristics: Within the current inflationary environment, decentralized infrastructure tokens are increasingly viewed as potential hedges against traditional monetary instability.

- Market Risk Factors: High market volatility risks remain inherent to BLESS as an emerging DePIN project, particularly during its early post-launch phases.

III. BLESS Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.00643 - $0.00900

- Neutral Forecast: $0.00900 - $0.01200

- Optimistic Forecast: $0.01200 - $0.01331 (requires sustained market demand and positive ecosystem developments)

2026-2028 Mid-term Perspective

- Market Stage Expectation: Gradual accumulation and consolidation phase with incremental price appreciation driven by ecosystem maturation and increased adoption.

- Price Range Forecast:

- 2026: $0.00634 - $0.01464 (9% upside potential)

- 2027: $0.00886 - $0.01516 (20% cumulative growth)

- 2028: $0.00943 - $0.02058 (27% cumulative expansion)

- Key Catalysts: Ecosystem expansion, strategic partnerships, increased utility adoption on Gate.com and other major platforms, and improved market sentiment in the broader crypto sector.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01151 - $0.02441 (56% appreciation by 2029, assuming stable market conditions and moderate adoption growth)

- Optimistic Scenario: $0.01744 - $0.02441 (assuming accelerated platform adoption and positive macro environment)

- Transformative Scenario: $0.02092 - $0.02218 (87% cumulative growth by 2030, contingent on breakthrough ecosystem developments and mainstream institutional interest)

- 2030-12-31: BLESS projected at $0.02218 average valuation (strong long-term accumulation phase completion)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01331 | 0.01109 | 0.00643 | 0 |

| 2026 | 0.01464 | 0.0122 | 0.00634 | 9 |

| 2027 | 0.01516 | 0.01342 | 0.00886 | 20 |

| 2028 | 0.02058 | 0.01429 | 0.00943 | 27 |

| 2029 | 0.02441 | 0.01744 | 0.01151 | 56 |

| 2030 | 0.02218 | 0.02092 | 0.01109 | 87 |

BLESS Professional Investment Strategy and Risk Management Report

IV. BLESS Professional Investment Strategy and Risk Management

BLESS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Institutional investors and long-term believers in edge computing infrastructure

- Operational recommendations:

- Establish positions during periods of market volatility when BLESS trades at significant discounts to historical highs

- Accumulate gradually over time to average entry costs and reduce timing risk

- Hold through market cycles, focusing on the fundamental value proposition of decentralized edge computing networks

(2) Active Trading Strategy

- Technical analysis considerations:

- Price volatility: BLESS demonstrates 8.1% gains in 24-hour trading with significant long-term downtrends (-36.13% over 30 days), suggesting opportunistic swing trading windows

- Support and resistance levels: Monitor the historical low of $0.00993 as key support and recent highs around $0.0114 as resistance zones

- Swing trading key points:

- Capitalize on daily momentum shifts within the broader downtrend

- Monitor volume patterns during the $211,147 average daily trading volume

BLESS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% portfolio allocation

- Active investors: 3-8% portfolio allocation

- Professional investors: 8-15% portfolio allocation

(2) Risk Hedging Strategies

- Diversification approach: Balance BLESS holdings with established blockchain infrastructure tokens to reduce concentration risk

- Dollar-cost averaging: Deploy capital systematically over multiple tranches rather than lump-sum investment to mitigate timing risk

(3) Secure Storage Solutions

- Self-custody approach: Transfer BLESS tokens to secure wallets after purchase from Gate.com

- Security best practices: Maintain private key security, enable two-factor authentication on exchange accounts, and verify contract addresses before transfers

- Critical security notes: BLESS trades on BSC network (contract: 0x7c8217517ed4711fe2deccdfeffe8d906b9ae11f); verify contract integrity on BscScan before engaging

V. BLESS Potential Risks and Challenges

BLESS Market Risks

- Severe price depreciation: BLESS has declined 36.13% over 30 days and 21.26% over one year, indicating significant market headwinds and potential structural challenges

- Low trading liquidity: Daily volume of approximately $211,147 suggests limited market depth, creating risks for large position entries or exits

- Market positioning concerns: Ranking #858 among cryptocurrencies with only 5,501 token holders indicates limited adoption and community engagement

BLESS Regulatory Risks

- Emerging regulatory environment: Edge computing networks utilizing decentralized models may face evolving regulatory scrutiny as governments clarify framework for distributed computing infrastructure

- Compliance uncertainty: The intersection of AI computing services and decentralized networks creates potential regulatory ambiguity across jurisdictions

- Token classification risks: Regulatory bodies may reassess BLESS token classification, potentially impacting trading availability and use cases

BLESS Technology Risks

- Competitive pressure: Established cloud computing providers and alternative decentralized infrastructure projects present significant competition

- Network adoption challenges: Achieving critical mass of both computing providers and users remains essential for network viability

- Technical execution risk: Successfully maintaining a reliable edge computing network at scale presents ongoing engineering and infrastructure challenges

VI. Conclusion and Action Recommendations

BLESS Investment Value Assessment

Bless represents a speculative opportunity within the decentralized edge computing space, addressing genuine infrastructure needs for AI and machine learning applications. However, significant market headwinds—including steep 30-day and annual price declines, low liquidity, and limited token holder adoption—suggest the project faces material execution and market acceptance challenges. The token's current trading dynamics reflect investor skepticism regarding near-term catalysts and network viability. Long-term value depends critically on the network achieving meaningful adoption among both computing providers and users seeking edge computing resources.

BLESS Investment Recommendations

✅ Beginners: Limit exposure to 1-2% of total portfolio only after thorough research into edge computing fundamentals; consider starting with minimal positions to understand market dynamics before scaling

✅ Experienced investors: Establish positions opportunistically during market volatility, utilizing dollar-cost averaging techniques to build positions at favorable valuations while maintaining disciplined position sizing

✅ Institutional investors: Conduct comprehensive due diligence on network metrics, computing provider participation, and development roadmap before considering allocation; size positions appropriately for liquidity constraints

BLESS Trading Participation Methods

- Gate.com spot trading: Direct BLESS/USDT trading pairs offering transparent pricing and established market infrastructure

- Limit order strategies: Utilize Gate.com's limit order functionality to establish positions at predetermined price levels rather than market prices

- Blockchain direct transfers: Transfer BLESS tokens to self-custody wallets from Gate.com after purchase, ensuring direct asset control via the BSC blockchain

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors must make decisions based on their personal risk tolerance and are encouraged to consult professional financial advisors. Never invest capital you cannot afford to lose completely.

FAQ

What is bless coin price prediction?

Bless coin price prediction forecasts BLESS trading within $0.007151 to $0.01024 range in 2025, with anticipated market adjustments. Predictions analyze historical data and market trends to estimate future price movements.

What is bless crypto?

Bless (BLESS) is a cryptocurrency for a decentralized computing platform that uses unused device power. BLESS tokens are used to pay for computing tasks and can be staked for network incentives.

What factors affect BLESS coin price?

BLESS coin price is influenced by market sentiment, trading volume, technological developments, supply and demand dynamics, and broader cryptocurrency market trends.

What is the current market cap and circulating supply of BLESS?

BLESS currently has a market cap of approximately $18.86 million with a circulating supply of 1.84 billion tokens. These metrics reflect the token's position in the broader cryptocurrency market landscape.

How does BLESS compare to other similar cryptocurrency projects?

BLESS distinguishes itself through its strong Solana ecosystem integration, efficient tokenomics with 1.8 billion circulating supply, and consistent trading volume of $3.7+ million daily. Compared to similar projects, BLESS offers faster transaction speeds, lower fees, and innovative utility features within the Web3 landscape.

2025 DSYNC Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 ROAM Price Prediction: Expert Analysis and Market Outlook for the Upcoming Year

Pi Network Mainnet Launch and Future

Jelly-My-Jelly: Beyond Memes - Analyzing Its Whitepaper Logic and Real Use Cases

EGL1: The Rising Dark Horse with 60% Completed Roadmap

Manyu Whitepaper Deep Dive: Core Logic, Use Cases, and Technical Innovation

Is FreeStyle Classic Token (FST) a good investment?: A Comprehensive Analysis of Risks, Returns, and Market Potential

Understanding Polymarket: A Guide to Decentralized Prediction Markets

Is Arena-Z (A2Z) a good investment?: A Comprehensive Analysis of Risks, Opportunities, and Market Potential

Is Turtle (TURTLE) a good investment?: A Comprehensive Analysis of Risks, Opportunities, and Market Potential in 2024

Is TCOM (TCOM) a good investment?: A comprehensive analysis of China's leading online travel platform's growth potential and market outlook