2025 ROAM Price Prediction: Expert Analysis and Market Outlook for the Upcoming Year

Introduction: ROAM's Market Position and Investment Value

ROAM (ROAM) stands as the largest decentralized wireless network globally, dedicated to creating an open-access infrastructure that ensures automated wireless connections, seamless switching between different networks, and secure connectivity for individuals, smart devices, and AI agents. Since its launch, Roam has leveraged blockchain-based credential infrastructure to facilitate widespread WiFi OpenRoaming adoption, offer global smart eSIM services, and enable privacy-protected data layers for AI applications. As of December 2025, ROAM has achieved a market capitalization of approximately $61.7 million with a circulating supply of approximately 331.2 million tokens, currently trading at $0.0617 per token. This innovative asset, recognized for its role in decentralized telecommunications infrastructure, is playing an increasingly critical function in establishing next-generation wireless connectivity ecosystems.

This article will conduct a comprehensive analysis of ROAM's price trajectory through 2030, integrating historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

ROAM Token Market Analysis Report

I. ROAM Price History Review and Current Market Status

ROAM Historical Price Evolution

Based on available data, ROAM has experienced significant price volatility since its launch:

- March 6, 2025: All-Time High (ATH) reached at $0.9, representing the peak market valuation during this period

- October 10, 2025: All-Time Low (ATL) recorded at $0.02625, marking the lowest point in token history

- December 20, 2025: Current trading price at $0.0617, reflecting an 83.33% decline over the past year

ROAM Current Market Situation

Price Metrics:

- Current Price: $0.0617 USD

- 24-Hour Change: -0.37%

- 7-Day Change: -4.73%

- 30-Day Change: -9.02%

- 1-Year Change: -83.33%

- 24-Hour High/Low: $0.06312 / $0.06084

Market Capitalization Indicators:

- Market Cap: $20,435,387.24 USD

- Fully Diluted Valuation (FDV): $61,700,000.00 USD

- Market Cap to FDV Ratio: 33.12%

- Market Dominance: 0.0019%

- 24-Hour Trading Volume: $58,573.14 USD

Token Distribution:

- Circulating Supply: 331,205,627.91 ROAM (33.12% of total supply)

- Total Supply: 1,000,000,000 ROAM

- Maximum Supply: 1,000,000,000 ROAM

- Token Holders: 26,998

Network Information:

- Blockchain: Solana (SOL)

- Contract Address: RoamA1USA8xjvpTJZ6RvvxyDRzNh6GCA1zVGKSiMVkn

- Listed on 10 cryptocurrency exchanges

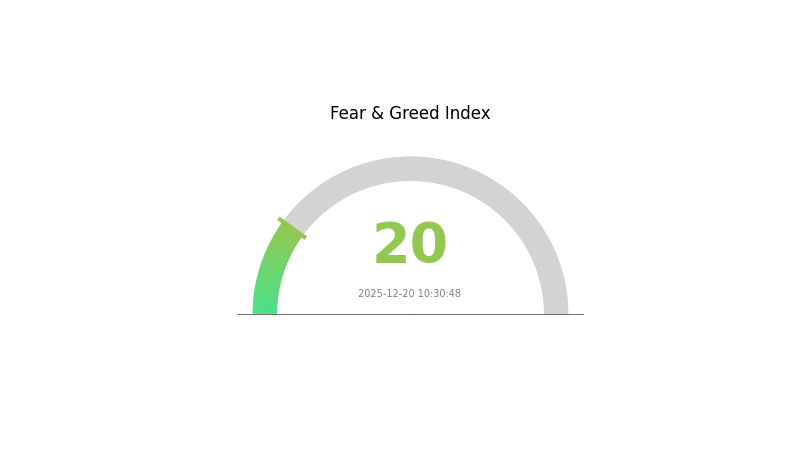

- Current Market Sentiment: Extreme Fear (VIX: 20)

Click to view current ROAM market price

ROAM Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index reading at 20. This indicates significant market pessimism and investor anxiety. During periods of extreme fear, opportunities often emerge for long-term investors. However, caution is advised as market volatility remains elevated. Monitor key support levels closely and consider dollar-cost averaging if you believe in the market's long-term potential. Stay informed through Gate.com's comprehensive market data and analysis tools to make informed investment decisions.

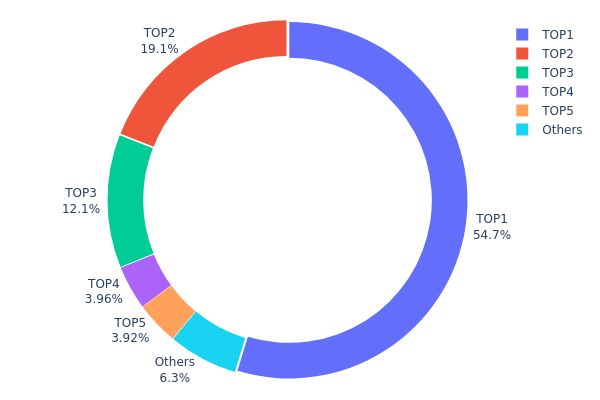

ROAM Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across the top wallet addresses within the ROAM ecosystem. This metric serves as a critical indicator of decentralization level, market structure stability, and potential vulnerability to price manipulation or sudden liquidity shifts. By examining how tokens are distributed among major holders, we can assess the resilience and health of the project's token economy.

ROAM exhibits pronounced concentration characteristics, with the top holder commanding 54.69% of total supply and the top three addresses collectively controlling 85.82% of all tokens in circulation. This significant concentration represents a considerable centralization risk. The first address alone possesses over half of the token supply, creating a scenario where a single entity holds disproportionate control over market dynamics. The second and third addresses contribute an additional 31.13% combined, reinforcing the oligarchic structure of token distribution. While addresses ranked four and five hold more modest proportions at 3.96% and 3.91% respectively, the remaining 6.31% scattered among other addresses further emphasizes how token ownership is heavily skewed toward the top tier.

This extreme concentration of holdings presents material implications for market structure and price stability. Major holders possess substantial leverage to influence token price movements, liquidity availability, and market sentiment through concentrated sell-side pressure or strategic accumulation. The current distribution raises concerns regarding potential market manipulation risks and suggests limited decentralization of governance influence. Such structural imbalance typically correlates with heightened volatility and reduced market resilience during adverse conditions, as concentrated stakeholders may act in coordinated fashion during market stress events.

Click to view current ROAM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | Gs84rw...HwP4pb | 544605.76K | 54.69% |

| 2 | 7MsbGV...F9MP1n | 190000.00K | 19.08% |

| 3 | ELXrUP...hYn7dK | 120000.00K | 12.05% |

| 4 | 7AXkmt...N7RLkw | 39460.55K | 3.96% |

| 5 | 7cAui6...Lx4xR8 | 38988.20K | 3.91% |

| - | Others | 62703.42K | 6.31% |

II. Core Factors Affecting ROAM's Future Price

Network Adoption and Ecosystem Development

- Network Adoption Growth: As more users join the Roam network and platform utility expands, demand for ROAM tokens is likely to increase, potentially driving up its price.

- Ecosystem Expansion: The market performance of ROAM tokens is closely tied to the continued development of its ecosystem system.

- Exchange Listing Impact: ROAM's price trajectory is influenced by its listing status on exchanges and market accessibility.

Market Sentiment and Industry Trends

- Investor Confidence: Investor confidence in decentralized wireless networks is a key factor that may influence Roam's price movements.

- Market Sentiment Drivers: Market sentiment is typically driven by news, social media discussions, and industry dynamics.

- Industry Trends: Industry trends play an important role in shaping price movements and long-term market potential.

Macroeconomic Environment

- Macroeconomic Conditions: The macroeconomic environment is a critical factor affecting ROAM token valuations and overall market performance.

- Market Demand: Market demand for ROAM tokens directly impacts price movements and investment interest.

III. 2025-2030 ROAM Price Forecast

2025 Outlook

- Conservative Forecast: $0.05281 - $0.06141

- Neutral Forecast: $0.06141

- Optimistic Forecast: $0.07615 (requires sustained market sentiment and ecosystem development momentum)

2026-2028 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and accumulation phase with progressive adoption of the ROAM ecosystem, supported by increasing market confidence and potential protocol upgrades.

- Price Range Forecast:

- 2026: $0.03989 - $0.09698 (11% upside potential)

- 2027: $0.06216 - $0.10194 (34% cumulative gains)

- 2028: $0.05914 - $0.11274 (49% cumulative appreciation)

- Key Catalysts: Ecosystem expansion, strategic partnerships, protocol improvements, and broader cryptocurrency market recovery trends.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.05231 - $0.12309 (66% cumulative gains by 2029, assuming steady ecosystem development and moderate market growth)

- Optimistic Scenario: $0.06206 - $0.1196 (83% cumulative appreciation by 2030, contingent on major adoption milestones and positive macroeconomic conditions)

- Transformational Scenario: Potential for higher valuations given successful execution of major network upgrades and mainstream institutional adoption of ROAM-based applications

- 2030-12-20: ROAM approaches long-term support level near $0.11283 average valuation (consolidation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07615 | 0.06141 | 0.05281 | 0 |

| 2026 | 0.09698 | 0.06878 | 0.03989 | 11 |

| 2027 | 0.10194 | 0.08288 | 0.06216 | 34 |

| 2028 | 0.11274 | 0.09241 | 0.05914 | 49 |

| 2029 | 0.12309 | 0.10258 | 0.05231 | 66 |

| 2030 | 0.1196 | 0.11283 | 0.06206 | 83 |

ROAM Investment Strategy and Risk Management Report

IV. ROAM Professional Investment Strategy and Risk Management

ROAM Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Believers in decentralized wireless network infrastructure and those seeking exposure to emerging telecommunications technologies powered by blockchain.

- Operational Recommendations:

- Accumulate ROAM tokens during market downturns, particularly following periods of sustained price decline to dollar-cost average your entry positions.

- Hold positions through market cycles, focusing on the fundamental development of Roam's WiFi OpenRoaming adoption and global eSIM services expansion.

- Regularly monitor project milestones, network adoption metrics, and partnership announcements that could signal network growth.

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Identify key price levels at $0.06084 (24H low) and $0.0617 (current price) as near-term support zones, with resistance at previous highs around $0.09 levels.

- Moving Averages: Utilize 7-day and 30-day price trends to assess momentum; current 7-day decline of -4.73% and 30-day decline of -9.02% indicate downward pressure.

- Wave Trading Key Points:

- Monitor 24-hour price volatility (ranging between $0.06084 and $0.06312) for short-term trading opportunities.

- Watch for reversal signals when price stabilizes above support levels, indicating potential accumulation phases.

ROAM Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation - suitable for those with limited risk tolerance seeking emerging technology exposure.

- Active Investors: 3-8% portfolio allocation - appropriate for investors comfortable with higher volatility in exchange for growth potential.

- Professional Investors: 5-15% portfolio allocation - for portfolio managers including alternative assets as part of diversified technology-focused holdings.

(2) Risk Hedging Strategies

- Portfolio Diversification: Balance ROAM holdings with established cryptocurrencies and traditional assets to mitigate concentration risk from early-stage projects.

- Position Sizing: Implement strict position limits to prevent excessive exposure; consider reducing holdings if ROAM exceeds allocated portfolio percentage due to price appreciation.

(3) Secure Storage Solution

- Hot Wallet Option: Gate.com Web3 Wallet - recommended for active traders requiring frequent access and transaction capability while maintaining self-custody security standards.

- Cold Storage Method: For long-term holdings exceeding 6 months, transfer ROAM to offline storage solutions with multi-signature security protocols to eliminate exchange counterparty risk.

- Security Precautions: Never share private keys or seed phrases; enable two-factor authentication on all exchange accounts; use hardware security keys for critical account recovery options; verify contract addresses before any token transfers to avoid phishing scams.

V. ROAM Potential Risks and Challenges

ROAM Market Risks

- Price Volatility Risk: ROAM has experienced extreme volatility, declining 83.33% over one year from $0.1 launch price to $0.0617 current price, with all-time high of $0.9 achieved in March 2025 followed by sustained decline. This indicates significant speculative activity and unstable valuation.

- Liquidity Risk: 24-hour trading volume of $58,573.13 is relatively low for a project with $61.7 million fully diluted valuation, potentially limiting ability to exit large positions without significant price slippage.

- Market Adoption Risk: As a decentralized wireless network project, ROAM's success depends on achieving critical adoption of WiFi OpenRoaming technology and global smart eSIM services, which remain early-stage with uncertain market demand.

ROAM Regulatory Risks

- Telecommunications Regulation Uncertainty: Wireless network services operate in heavily regulated industries with varying requirements across jurisdictions; regulatory restrictions could limit OpenRoaming adoption or eSIM deployment in key markets.

- Compliance Complexity: Global expansion of eSIM services requires compliance with telecommunications regulations, data privacy laws (GDPR, CCPA), and local licensing requirements that could increase operational costs or restrict service availability.

- Cryptocurrency Regulatory Evolution: Regulatory crackdowns on blockchain-based projects could impact token utility or trading capability if ROAM tokens are reclassified as securities in major jurisdictions.

ROAM Technology Risks

- Network Security Vulnerabilities: As a decentralized wireless infrastructure project, security breaches or attacks on network credentials could compromise user connectivity and data privacy, undermining core value proposition.

- Technology Obsolescence: Rapid evolution in wireless technology (5G/6G advancement) or alternative solutions to OpenRoaming could diminish demand for Roam's infrastructure before achieving significant scale.

- Integration Challenges: Seamless integration with existing wireless networks and AI applications requires complex technical implementations; execution delays or compatibility issues could impede adoption timelines.

VI. Conclusion and Action Recommendations

ROAM Investment Value Assessment

ROAM operates in the promising but nascent decentralized wireless network space, with compelling utility in WiFi OpenRoaming, global smart eSIM services, and AI privacy-protected data layers. However, the project faces significant execution risks and market adoption challenges. The token has experienced substantial depreciation (83.33% decline over one year) following its $0.1 launch price, indicating market skepticism regarding valuation or development progress. The relatively small 24-hour trading volume and low market dominance (0.0019%) suggest limited institutional confidence. Success depends critically on achieving mainstream adoption of OpenRoaming technology and demonstrating sustainable demand for eSIM services in competitive telecommunications markets.

ROAM Investment Recommendations

✅ Beginners: Start with minimal positions (1-2% of crypto allocation) through regular dollar-cost averaging on Gate.com to gain exposure without excessive risk. Focus on understanding the project's wireless network adoption metrics before increasing allocation.

✅ Experienced Investors: Consider 3-8% portfolio allocation after conducting detailed technical analysis of price support levels and network development milestones. Implement disciplined stop-loss orders at 15-20% below entry points to manage downside risk.

✅ Institutional Investors: Evaluate 5-15% allocation within alternative technology portfolios if satisfied with project governance and regulatory compliance frameworks. Establish formal custody procedures and regulatory compliance protocols before significant positions.

ROAM Trading Participation Methods

- Exchange Trading: Access ROAM on Gate.com with fiat currency on-ramps and high liquidity pairs for immediate market exposure and flexible position management.

- DCA Strategy: Set up automated recurring purchases of ROAM on Gate.com to systematically accumulate positions while reducing timing risk and emotional decision-making.

- Staking/Yield Programs: Monitor for ROAM staking opportunities or yield-generating protocols once network infrastructure matures to generate additional returns on long-term holdings.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. Consult professional financial advisors before investing. Never invest funds you cannot afford to lose completely.

FAQ

Does Roam coin have a future?

Yes, Roam coin shows potential for future growth. Market analysis suggests ROAM could reach $0.9 by 2026, driven by increasing adoption and investor interest in the ecosystem. Its success depends on technological development and market conditions.

How much is the roam coin worth?

As of today, Roam coin is worth $0.0634. The circulating supply is 330,851,925 ROAM tokens with a maximum supply capped at 1,000,000,000 ROAM.

How secure is Roam coin?

Roam coin leverages blockchain-based authentication technology to ensure secure connectivity across millions of access points. It eliminates manual login risks through decentralized security protocols, providing robust protection against unauthorized access and data breaches.

2025 DSYNC Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 BLESS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Pi Network Mainnet Launch and Future

Jelly-My-Jelly: Beyond Memes - Analyzing Its Whitepaper Logic and Real Use Cases

EGL1: The Rising Dark Horse with 60% Completed Roadmap

Manyu Whitepaper Deep Dive: Core Logic, Use Cases, and Technical Innovation

Understanding Peaq Network: The Future of Web3 Infrastructure

Is Quickswap (QUICK) a good investment?: A Comprehensive Analysis of the Polygon DEX Token's Potential and Risks in 2024

QUACK vs THETA: A Comprehensive Comparison of Two Leading Decentralized Streaming Platforms

Exploring Monad: Understanding the Innovative Blockchain Technology

Is Velora (VLR) a good investment?: A Comprehensive Analysis of Price Performance, Market Potential, and Risk Factors for 2024