2025 CGPTPrice Prediction: Market Analysis and Future Trends for ChatGPT Subscription Models

Introduction: CGPT's Market Position and Investment Value

ChainGPT (CGPT), as an advanced artificial intelligence model designed for the crypto and blockchain industry, has made significant strides since its inception in 2023. As of 2025, ChainGPT's market capitalization has reached $67,302,007, with a circulating supply of approximately 865,620,670 tokens, and a price hovering around $0.07775. This asset, often referred to as the "AI-powered blockchain assistant," is playing an increasingly crucial role in meeting encryption and blockchain requirements, encoding contracts, explaining concepts, answering questions, and analyzing markets.

This article will comprehensively analyze ChainGPT's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. CGPT Price History Review and Current Market Status

CGPT Historical Price Evolution

- 2023: Initial launch, price started at $0.005

- 2024: Reached all-time high of $0.55862 on March 12

- 2025: Market correction, price declined to current level of $0.07775

CGPT Current Market Situation

CGPT is currently trading at $0.07775, experiencing a 2.64% decrease in the last 24 hours. The token's market capitalization stands at $67,302,007, ranking it 574th in the overall cryptocurrency market. With a circulating supply of 865,620,670 CGPT, representing 86.56% of the total supply, the token has a fully diluted valuation of $77,750,000. The 24-hour trading volume is $633,405, indicating moderate market activity. CGPT has seen significant volatility, with a 1-year price change of -53.61%, reflecting the challenging market conditions in the broader cryptocurrency sector.

Click to view the current CGPT market price

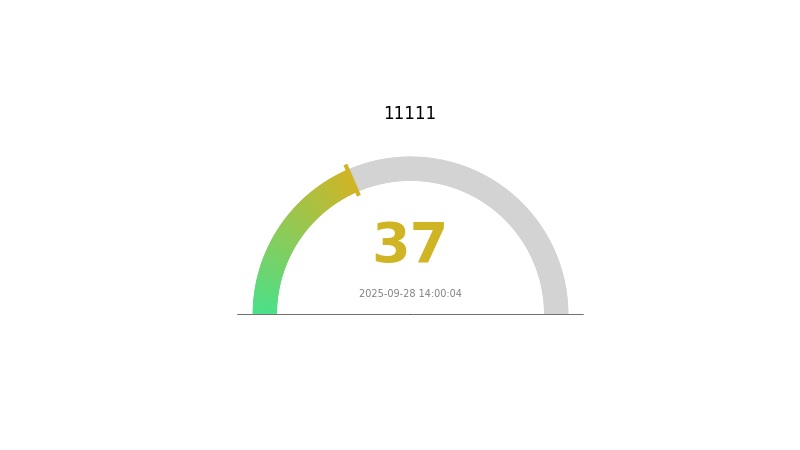

CGPT Market Sentiment Indicator

2025-09-28 Fear and Greed Index: 37 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone, with the Fear and Greed Index at 37. This indicates a cautious mood among investors, potentially presenting buying opportunities for those with a long-term outlook. However, it's crucial to remember that market sentiment can shift rapidly. Traders should stay vigilant, conduct thorough research, and consider diversifying their portfolios to mitigate risks in this uncertain environment. As always, never invest more than you can afford to lose.

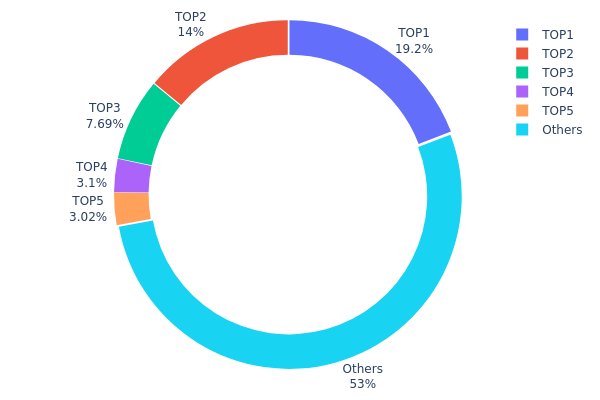

CGPT Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of CGPT tokens among various wallet addresses. Analysis of this data reveals a relatively high concentration of tokens in a few top addresses. The top address holds 19.21% of the total supply, while the top five addresses collectively control 47.02% of CGPT tokens.

This level of concentration raises concerns about potential market manipulation and price volatility. With nearly half of the tokens held by just five addresses, any significant movement from these whales could have a substantial impact on CGPT's market dynamics. However, it's worth noting that 52.98% of tokens are distributed among other addresses, indicating a degree of decentralization among smaller holders.

The current distribution pattern suggests a market structure that may be susceptible to large price swings based on the actions of major holders. While this concentration could provide some stability through potential long-term commitment from large stakeholders, it also poses risks to the token's overall market health and could deter new investors concerned about centralized control.

Click to view the current CGPT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5bdf...03f7ef | 9752.88K | 19.21% |

| 2 | 0x0d07...b492fe | 7118.37K | 14.02% |

| 3 | 0x7d4e...712f45 | 3901.72K | 7.68% |

| 4 | 0x5480...88fcb2 | 1571.56K | 3.09% |

| 5 | 0xde03...a4bb25 | 1535.55K | 3.02% |

| - | Others | 26886.55K | 52.98% |

2. Key Factors Influencing the Future Price of CGPT

Supply Mechanism

- Market Supply: The increasing supply of CGPT tokens in the market may lead to downward pressure on prices.

- Historical Pattern: Previous supply changes have shown a significant impact on CGPT's price movements.

- Current Impact: The expected supply changes are likely to influence CGPT's price in the short to medium term.

Institutional and Whale Dynamics

- Enterprise Adoption: The adoption of CGPT by well-known enterprises could potentially drive up its value.

- National Policies: Government policies related to cryptocurrencies may affect CGPT's price and adoption rate.

Macroeconomic Environment

- Inflation Hedging Properties: CGPT's performance in inflationary environments could impact its attractiveness as an investment.

- Geopolitical Factors: International political situations may influence the global cryptocurrency market, including CGPT.

Technological Development and Ecosystem Building

- Ecosystem Applications: The development of major DApps and ecosystem projects based on CGPT could drive its value and utility.

III. CGPT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.05081 - $0.07817

- Neutral prediction: $0.07817 - $0.0813

- Optimistic prediction: $0.0813 - $0.09 (requires favorable market conditions)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.07769 - $0.11788

- 2028: $0.07044 - $0.12845

- Key catalysts: Increasing adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.11602 - $0.12414 (assuming steady market growth)

- Optimistic scenario: $0.13226 - $0.14028 (assuming strong market performance)

- Transformative scenario: $0.15 - $0.18 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: CGPT $0.14028 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0813 | 0.07817 | 0.05081 | 0 |

| 2026 | 0.09887 | 0.07973 | 0.05661 | 2 |

| 2027 | 0.11788 | 0.0893 | 0.07769 | 14 |

| 2028 | 0.12845 | 0.10359 | 0.07044 | 33 |

| 2029 | 0.13226 | 0.11602 | 0.08818 | 49 |

| 2030 | 0.14028 | 0.12414 | 0.09559 | 59 |

IV. CGPT Professional Investment Strategies and Risk Management

CGPT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate CGPT tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use for trend identification

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Identify support and resistance levels

- Monitor trading volume for trend confirmation

CGPT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-20%

(2) Risk Hedging Solutions

- Portfolio diversification: Spread investments across different crypto assets

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. CGPT Potential Risks and Challenges

CGPT Market Risks

- High volatility: Cryptocurrency markets are known for extreme price fluctuations

- Liquidity risk: Potential difficulties in buying or selling large amounts

- Market sentiment: Susceptible to rapid changes in investor sentiment

CGPT Regulatory Risks

- Regulatory uncertainty: Evolving global regulations may impact CGPT's operations

- Compliance challenges: Adapting to varying international legal requirements

- Potential restrictions: Governments may impose limitations on AI-related projects

CGPT Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- AI model limitations: Challenges in maintaining and improving the AI system

- Network congestion: Possible transaction delays during high network activity

VI. Conclusion and Action Recommendations

CGPT Investment Value Assessment

CGPT presents a unique value proposition in the AI-blockchain intersection, offering potential long-term growth. However, short-term volatility and regulatory uncertainties pose significant risks.

CGPT Investment Recommendations

✅ Beginners: Start with small, regular investments to understand market dynamics ✅ Experienced investors: Consider a balanced approach with strategic entry and exit points ✅ Institutional investors: Conduct thorough due diligence and consider CGPT as part of a diversified crypto portfolio

CGPT Trading Participation Methods

- Spot trading: Buy and sell CGPT tokens on Gate.com

- Staking: Participate in CGPT staking programs if available

- DeFi integration: Explore decentralized finance options involving CGPT tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is CGPt a good coin?

CGPt shows potential with good trading volume and is considered a mid-risk altcoin. Its market recognition makes it a viable investment option in 2025.

What is the future of ChainGPT?

ChainGPT's future looks promising, with a projected price of $0.2258 in one year, indicating significant growth potential. However, short-term fluctuations are expected.

What is the all-time high of CGPT coin?

The all-time high of CGPT coin is $0.016654, recorded on Livecoinwatch. The exact date of this peak is not specified.

What is the price prediction for GTC in 2030?

Based on current market analysis, the price of GTC is predicted to reach $0.000075 by 2030.

2025 SKAI Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 CAMP Price Prediction: Bullish Trends and Key Factors Driving Growth in the Cryptocurrency Market

2025 LAI Price Prediction: Bullish Outlook as AI Integration Accelerates Adoption

Will Crypto Recover in 2025?

KAITO Price Prediction 2025, 2x or 10x?

Turbo Coin : A meme coin created by AI

Regulation Impact: What the Trading Pause Means for Cryptocurrency Custodians

Is AVA (AVA) a good investment?: A Comprehensive Analysis of Price Potential, Risk Factors, and Market Outlook for 2024

Exploring USDC's Role in Stabilizing Market Fluctuations

LMTS vs MANA: A Comprehensive Comparison of Two Leading Metaverse Tokens in the Digital Economy

What is PTB (Portal to Bitcoin) fundamentals: whitepaper logic, use cases, and roadmap analysis?