2025 CORN Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of CORN

Corn (CORN) is a more convenient way to use Bitcoin, enabling optimized and accessible earning opportunities for the hardest money ever created. Backed by major venture capital firms such as Polychain Capital, Framework, and Tribe Capital, along with over 1,000 ICO participants, Corn has established itself as a significant player in the Bitcoin utility ecosystem. As of December 19, 2025, CORN's market capitalization has reached $144.42 million, with a circulating supply of 525 million tokens and a current price of $0.06877. This asset, recognized for unlocking Bitcoin's utility through its innovative protocol stack, is playing an increasingly critical role in expanding Bitcoin's functionality and creating accessible earning opportunities.

This article will conduct a comprehensive analysis of CORN's price trends from 2025 through 2030, integrating historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

CORN (Corn) - Market Analysis Report

I. CORN Price History Review and Current Market Status

CORN Historical Price Evolution

Based on available data as of December 19, 2025:

- February 25, 2025: CORN reached its all-time high (ATH) of $13.986, representing the peak valuation since the token's market inception.

- November 4, 2025: CORN recorded its all-time low (ATL) of $0.05271, marking the lowest price point in the token's trading history.

CORN Current Market Condition

As of December 19, 2025, 08:26:30 UTC, CORN is trading at $0.06877 with the following market metrics:

Price Performance:

- 1-hour change: -1.70% (down $0.001189)

- 24-hour change: +4.91% (up $0.003219)

- 7-day change: -7.18% (down $0.005320)

- 30-day change: -5.24% (down $0.003803)

- 1-year change: +18.71% (up $0.010839)

Market Capitalization & Volume:

- Market Cap: $36,104,250.0

- Fully Diluted Valuation (FDV): $144,417,000.0

- 24-hour Trading Volume: $450,249.87

- Market Dominance: 0.0046%

Supply Metrics:

- Circulating Supply: 525,000,000 CORN (25% of total supply)

- Total Supply: 2,100,000,000 CORN

- Max Supply: Unlimited (∞)

- Circulating Supply Ratio: 25.0%

Trading Range (24-hour):

- High: $0.07167

- Low: $0.06482

Market Position:

- Global Ranking: #607

- Active Holders: 684

- Listed on 6 exchanges

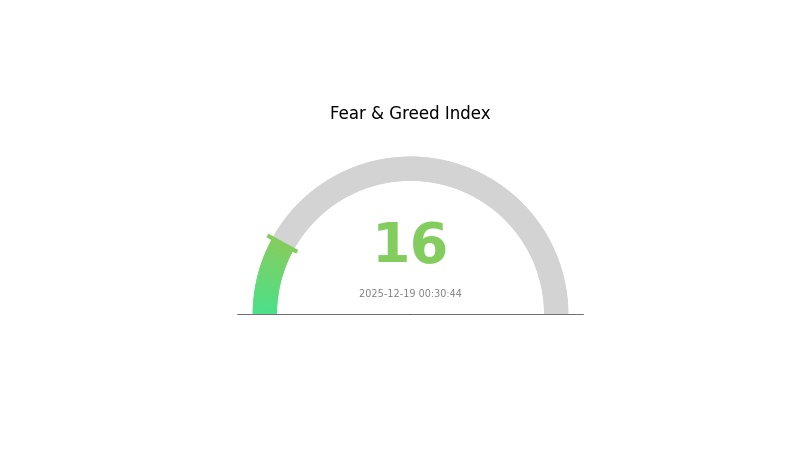

Market Sentiment: Current market conditions reflect extreme fear (VIX: 16), indicating heightened volatility and risk aversion in the broader market environment.

Click to view current CORN market price

CORN Market Sentiment Index

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 16. This severe bearish sentiment reflects significant market uncertainty and investor anxiety. During such extreme fear periods, long-term investors often view market dips as potential buying opportunities, while risk-averse traders may prefer to stay on the sidelines. Market volatility remains elevated, and monitoring key support levels is crucial. Traders should exercise caution and manage risk appropriately while staying informed through Gate.com's real-time market data and analysis tools.

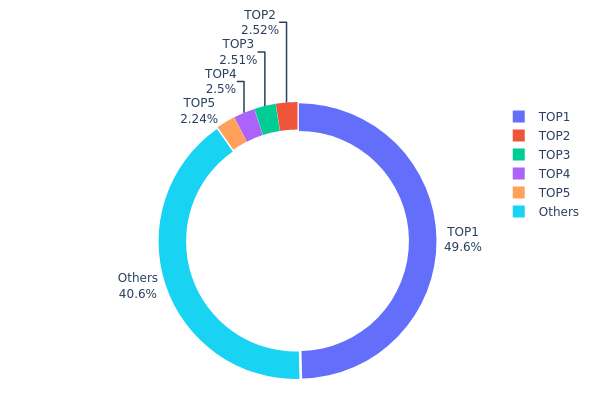

CORN Holdings Distribution

The address holdings distribution chart illustrates the concentration of CORN tokens across blockchain addresses, providing critical insight into the token's decentralization status and potential market vulnerability. By analyzing the distribution of the top holders relative to the total supply, this metric reveals the degree of wealth concentration and the structural stability of the asset's on-chain ecosystem.

CORN exhibits significant concentration risk, with the top holder commanding 49.62% of the total supply—a level that substantially exceeds healthy decentralization benchmarks. The top five addresses collectively control 59.36% of circulating tokens, while the remaining 40.64% is distributed among other holders. This distribution pattern demonstrates pronounced concentration at the apex, creating potential systemic fragility. The dominance of a single address holding nearly half of all CORN tokens presents considerable counterparty risk and raises concerns about the token's true decentralized nature. The secondary tier of holders (ranks 2-5) maintains relatively modest positions between 2.23% and 2.51%, indicating limited institutional or significant participant diversity beyond the primary holder.

The current distribution architecture poses material implications for market dynamics and price stability. The substantial concentration creates conditions favorable to potential market manipulation, price volatility amplification, and abrupt liquidation scenarios should the principal holder execute significant transactions. Furthermore, the lack of meaningful distribution beyond the top five addresses suggests limited organic adoption and community engagement at the token-holder level, reinforcing questions about long-term market resilience and the asset's resistance to destabilizing capital movements.

Click to view the current CORN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9896...098ff9 | 621270.00K | 49.62% |

| 2 | 0xe71e...e13508 | 31500.00K | 2.51% |

| 3 | 0x6f82...cecce7 | 31403.40K | 2.50% |

| 4 | 0x3179...bdccb3 | 31306.80K | 2.50% |

| 5 | 0xb53d...fbbaaf | 28000.00K | 2.23% |

| - | Others | 508526.18K | 40.64% |

II. Core Factors Affecting CORN's Future Price

Supply Mechanism

-

Supply and Demand Balance: The core driver of CORN's price is the fluctuation in supply and demand. Changes in supply or demand directly impact price trends. When supply exceeds demand, prices tend to decline; conversely, when demand exceeds supply, prices rise.

-

Historical Patterns: Corn prices exhibit cyclical fluctuations, with supply-demand relationships and prices being mutually influential. Historically, increases in supply or decreases in demand have exerted downward pressure on prices, while production constraints have supported price appreciation.

-

Current Impact: Global economic slowdown in 2025 may lead to reduced demand for commodities like corn. However, production expectations continue to shape near-term price movements, with high yield expectations potentially suppressing prices in the medium term.

Macroeconomic Environment

-

Monetary Policy Impact: Global economic deceleration in 2025 is expected to result in declining demand for commodities. Central bank policy decisions will continue to influence broader commodity market sentiment and investment flows.

-

Inflation Hedge Properties: Corn prices demonstrate certain correlation with inflation trends. During periods of elevated inflation expectations, agricultural commodities gain attention as inflation-hedging assets. In Q1 2025, with CPI rising 2.8% year-over-year, market focus on agricultural products' inflation-resistant characteristics increased correspondingly.

-

Geopolitical Factors: Trade tensions in the Black Sea region continue to influence global grain supply chains. Trade policy adjustments, such as import agreements with major suppliers, directly impact domestic price volatility and market confidence.

III. CORN Price Forecast for 2025-2030

2025 Outlook

- Conservative Forecast: $0.03709 - $0.05835

- Neutral Forecast: $0.06869

- Optimistic Forecast: $0.07762 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with increasing adoption and utility expansion

- Price Range Predictions:

- 2026: $0.04975 - $0.08779

- 2027: $0.05955 - $0.103

- Key Catalysts: Enhanced protocol features, expanded partnerships, growing DeFi integration, and increased institutional interest

2028-2030 Long-term Outlook

- Base Case Scenario: $0.09174 - $0.12751 by 2028 (assuming steady ecosystem growth and market maturation)

- Optimistic Scenario: $0.10962 - $0.12278 by 2029 (contingent on breakthrough technological advancements and mainstream adoption acceleration)

- Transformative Scenario: $0.1162 - $0.15571 by 2030 (contingent on market-wide regulatory clarity, significant enterprise adoption, and protocol innovation leadership)

Note: These projections are based on historical trend analysis and current market indicators. Investors should conduct thorough research on Gate.com and other reliable platforms before making investment decisions. Cryptocurrency markets remain highly volatile and unpredictable.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.07762 | 0.06869 | 0.03709 | 0 |

| 2026 | 0.08779 | 0.07315 | 0.04975 | 6 |

| 2027 | 0.103 | 0.08047 | 0.05955 | 17 |

| 2028 | 0.12751 | 0.09174 | 0.05045 | 33 |

| 2029 | 0.12278 | 0.10962 | 0.07235 | 59 |

| 2030 | 0.15571 | 0.1162 | 0.07437 | 68 |

CORN Investment Strategy and Risk Management Report

IV. CORN Professional Investment Strategy and Risk Management

CORN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with strong conviction in Bitcoin infrastructure development and those seeking exposure to Bitcoin utility protocols

- Operational recommendations:

- Accumulate CORN during market pullbacks, particularly when the token trades below $0.08

- Maintain positions through market cycles, focusing on the long-term development of Corn's protocol ecosystem

- Dollar-cost averaging (DCA) approach to reduce timing risk and build positions systematically over time

- Secure storage in institutional-grade custody solutions for larger holdings

(2) Active Trading Strategy

- Technical analysis considerations:

- Support and resistance levels: Monitor the $0.06482 (24H low) and $0.07167 (24H high) price levels for short-term trading signals

- Volume analysis: With 24-hour volume at approximately 450,249.86942 CORN tokens, track liquidity patterns to identify optimal entry and exit points

- Wave trading key points:

- Capitalize on the 4.91% positive momentum observed in the 24-hour period while monitoring the negative 7-day (-7.18%) and 30-day (-5.24%) trends

- Maintain strict stop-loss orders given CORN's volatility profile, with historical range from $0.05271 to $13.986

CORN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of total crypto holdings

- Aggressive investors: 3-8% of total crypto holdings

- Professional investors: 5-15% of total crypto holdings (with sophisticated hedging strategies)

(2) Risk Hedging Solutions

- Position sizing: Implement strict position limits to prevent excessive exposure to a single protocol token, given CORN's current market cap ranking of 607

- Diversification strategy: Balance CORN holdings with established Bitcoin infrastructure tokens and diversified cryptocurrency exposure to mitigate concentration risk

(3) Secure Storage Solutions

- Custody approach: For institutional investors, utilize qualified custody providers that support ERC-20 tokens on Ethereum mainnet

- Self-custody considerations: Maintain private control of seed phrases with multi-signature wallet configurations for holdings exceeding institutional thresholds

- Security precautions: Implement cold storage for long-term holdings, enable two-factor authentication on trading accounts, and maintain regular security audits of wallet addresses

V. CORN Potential Risks and Challenges

CORN Market Risk

- Liquidity risk: With only 6 exchange listings and a relatively modest 24-hour trading volume, CORN faces limited liquidity that could result in significant slippage during large transactions

- Price volatility: The token's historical range from $0.05271 to $13.986 demonstrates extreme volatility, creating substantial risk for unprepared investors

- Market concentration: Circulating supply represents only 25% of total supply (525M of 2.1B tokens), presenting potential dilution risk as vesting schedules unlock additional tokens

CORN Regulatory Risk

- Bitcoin protocol interaction complexity: Regulatory treatment of Bitcoin utility protocols remains uncertain, with potential government scrutiny of yield-bearing Bitcoin derivatives

- Compliance uncertainty: Cross-jurisdictional regulatory frameworks for protocol tokens continue to evolve, creating potential enforcement risks

- Token classification ambiguity: Regulatory agencies may reclassify protocol tokens, affecting trading and custody arrangements

CORN Technical Risk

- Smart contract risk: As an ERC-20 token, CORN depends on Ethereum network security and protocol implementation correctness

- Protocol scalability: Corn's protocol stack development progress and technical execution remain critical to long-term value proposition realization

- Integration dependencies: Protocol functionality relies on successful Bitcoin-Ethereum interoperability and third-party service provider reliability

VI. Conclusion and Action Recommendations

CORN Investment Value Assessment

CORN presents a novel investment opportunity in the Bitcoin infrastructure sector, backed by substantial venture capital support ($16.5 million from Polychain Capital, Framework, and Tribe Capital). The project aims to enhance Bitcoin's utility through a protocol stack and token ecosystem. However, the investment carries significant risks including market immaturity, limited exchange liquidity, high volatility, and substantial token dilution potential. The token's 25% circulating supply ratio against total supply indicates considerable future dilution, and the current market cap of $144.4 million remains modest within the broader cryptocurrency landscape.

CORN Investment Recommendations

✅ Beginners: Start with minimal allocations (0.5-1% of crypto portfolio) through Gate.com's regulated trading platform, using dollar-cost averaging over multiple months while educating yourself on Bitcoin infrastructure protocols.

✅ Experienced investors: Implement a disciplined 2-5% allocation with defined entry/exit parameters, utilizing technical analysis to identify optimal accumulation zones between $0.06-$0.07, and maintain strict risk management protocols.

✅ Institutional investors: Consider 5-10% allocations through qualified custody solutions, establish hedging strategies against Bitcoin infrastructure concentration risk, and monitor regulatory developments affecting protocol token classification.

CORN Trading Participation Methods

- Exchange trading: Trade CORN on Gate.com with market, limit, and margin order options while respecting platform leverage restrictions

- Spot accumulation: Build positions through regular spot purchases on Gate.com, taking advantage of market weakness to reduce average entry prices

- Portfolio rebalancing: Systematically rebalance CORN holdings against other holdings to maintain target allocation percentages across market cycles

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and are strongly advised to consult professional financial advisors. Never invest capital you cannot afford to lose in its entirety.

FAQ

What is the price of corn in 2025?

The price of corn in 2025 is approximately $4.35 per bushel for new-crop delivery. This reflects current market data and agricultural commodity pricing trends for the year.

What is the USDA corn outlook for 2025?

The USDA predicts U.S. corn production will reach a record 16.8 billion bushels in 2025, up 12% compared to last year. Corn yields are expected to be at historically high levels, with stable ethanol production demand throughout the year.

Is corn a buy or sell stock?

As of December 2025, CORN is currently rated for a sell. Market conditions are prone to changes, so continuous monitoring of technical indicators and market trends is recommended for trading decisions.

Is corn a good investment?

Corn offers solid investment potential with stable global demand and real-world utility. Strong agricultural fundamentals and commodity market dynamics support long-term value growth. Current market conditions present favorable opportunities for strategic investors.

Is Lombard (BARD) a good investment?: Analyzing the potential risks and rewards of this AI stock

MP vs CRO: Unlocking Growth Potential in Digital Marketing Strategies

2025 SOV Price Prediction: Analyzing Potential Growth and Market Trends for Sovryn

OSMO vs BTC: Which Cryptocurrency Offers Better Investment Potential in 2024?

Pi Network Mainnet Launch and Future

Avalanche (AVAX) 2025 Price Analysis and Market Trends

How to Use Technical Indicators Like MACD, RSI, and Bollinger Bands for Crypto Trading?

Dropee Question of the Day December 19, 2025

Spur Protocol Daily Quiz Answer Today December 19, 2025

What is TWT Trust Wallet Token Price and Market Cap in 2025?

Xenea Daily Quiz Answer December 19, 2025