2025 CRWN Price Prediction: Expert Analysis, Market Trends, and Investment Outlook for the Crown Token

Introduction: CRWN's Market Position and Investment Value

Crown by Third Time Games (CRWN) is a play-to-earn virtual horse racing ecosystem token that powers Photo Finish™ LIVE, an official gaming partner of the Kentucky Derby. Led by Ian Cummings, former Creative Director of EA Sports Madden NFL, the project has established itself as a unique intersection of gaming, blockchain technology, and real-world sports engagement. As of December 24, 2025, CRWN maintains a market capitalization of $4.21 million with 250 million tokens in circulation, trading at approximately $0.01683 per token.

Since its launch in July 2025, Photo Finish™ LIVE has demonstrated significant real-world utility, with players having earned over $40 million in genuine rewards through gameplay. The platform leverages advanced simulated genetic algorithms to enable players to breed unique virtual horses and compete against real-life owners. For over a decade, Photo Finish™ has provided NBC Sports with high-fidelity 3D virtual simulations of the Kentucky Derby, featured during live broadcasts, establishing credible institutional partnerships within the gaming and sports entertainment sector.

This article provides a comprehensive analysis of CRWN's price trajectory from 2025 through 2030, integrating historical price movements, market supply dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for market participants.

CRWN Market Analysis Report

I. CRWN Price History Review and Current Market Status

CRWN Historical Price Evolution Trajectory

- 2025 (July): Token reached its all-time high of $0.26626 on July 31, 2025, marking the peak of initial market enthusiasm.

- 2025 (December): Significant bearish pressure emerged, with the token declining sharply from its July peak. On December 23, 2025, CRWN hit its all-time low of $0.0163, representing a severe contraction from historical highs.

CRWN Current Market Status

As of December 24, 2025, CRWN is trading at $0.01683, with a 24-hour trading volume of $16,040.86. The token demonstrates modest positive momentum in the short term, with a 1-hour gain of 0.12% and a 24-hour increase of 0.17%. However, this recent stability masks significant longer-term deterioration, as the token has declined 15.22% over the past 7 days, 47.099% over the past month, and 94.57% over the past year.

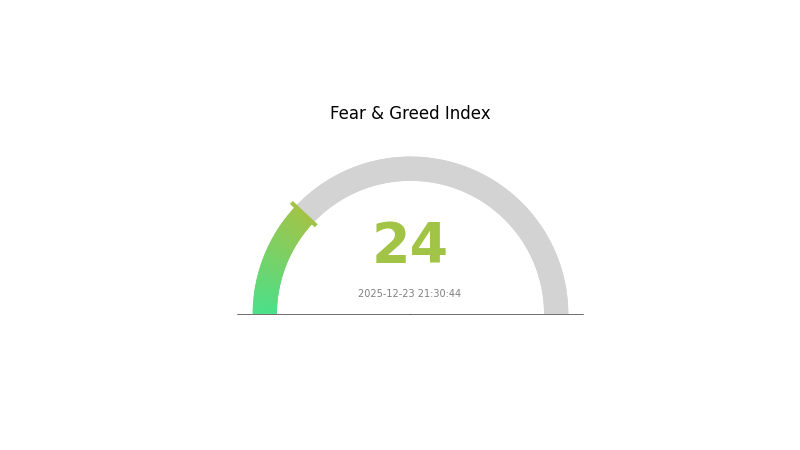

The total market capitalization stands at $4,207,500, with a fully diluted valuation matching this figure. CRWN maintains a circulating supply of 250,000,000 tokens, representing 100% of its total and maximum supply. The token is distributed across 15,469 holders and maintains presence on multiple exchanges, with a current market dominance of 0.00013%. Market sentiment remains extremely fearful, with the VIX indicator at 24, reflecting broader market anxiety and risk aversion.

Click to view current CRWN market price

CRWN Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 24, signaling significant market pessimism. This level typically indicates that investors are highly risk-averse and panic selling may be prevalent. Such extreme fear conditions often present buying opportunities for contrarian investors, as assets may be oversold. However, market participants should exercise caution and conduct thorough research before making investment decisions. Monitor the sentiment closely for potential trend reversals.

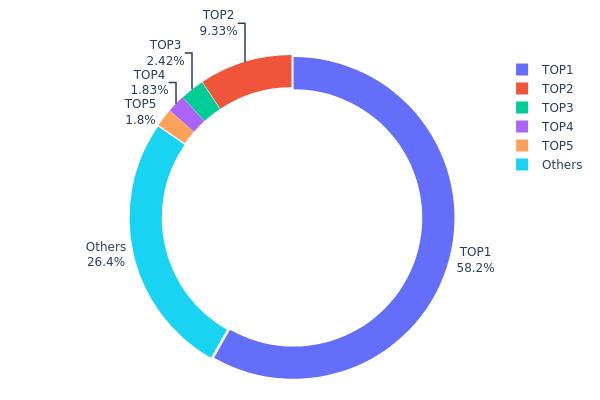

CRWN Holdings Distribution

The address holdings distribution chart illustrates the concentration of token ownership across the blockchain network, revealing the degree of decentralization and potential market risk factors. By analyzing the top holders and their respective percentages of total supply, investors can assess the vulnerability of the asset to whale-driven price manipulation and evaluate the overall health of the token's distribution structure.

CRWN currently exhibits a pronounced concentration pattern, with the top holder commanding 58.21% of the total supply—a significant indicator of centralization risk. The top five addresses collectively control approximately 73.57% of all CRWN tokens in circulation, while the remaining 26.43% is distributed among numerous smaller holders. This distribution model demonstrates substantial concentration among a limited number of addresses, which exceeds typical thresholds for a healthy decentralized ecosystem. The dominance of the leading address in particular suggests potential governance vulnerabilities and raises questions regarding the tokens' original allocation mechanisms.

The current address distribution structure presents notable implications for market dynamics and price stability. With nearly three-quarters of the supply concentrated in five addresses, the token faces elevated exposure to liquidation events, coordinated selling pressure, and potential market manipulation. Such concentration typically correlates with increased price volatility and reduced market resilience during periods of adverse sentiment. Furthermore, the distribution pattern indicates a lower degree of decentralization, which may constrain organic market adoption and institutional confidence. Monitoring the movement and intentions of major holders becomes critical for understanding future price trajectories and assessing the token's long-term viability as a distributed asset.

Visit CRWN Holdings Distribution on Gate.com for current data.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | Cd5sQR...Vswcjd | 145543.88K | 58.21% |

| 2 | HfKFrz...TbgkNm | 23323.66K | 9.32% |

| 3 | 4mwn6j...xrv9Ls | 6039.81K | 2.41% |

| 4 | 3LjkRz...jettLT | 4577.58K | 1.83% |

| 5 | 3vi3VS...5iPEJ3 | 4500.00K | 1.80% |

| - | Others | 66014.60K | 26.43% |

Analysis of Core Factors Influencing CRWN's Future Price Trajectory

II. Core Factors Impacting CRWN's Future Price

Macroeconomic Environment

-

Commodity Price Dynamics: Global economic conditions significantly influence commodity price trends. While global economic crises have shown less severe impacts on commodity prices compared to previous economic downturns, long-term price trajectories remain uncertain. Traditional energy prices have demonstrated sustained decline, which creates both challenges and opportunities for alternative sectors.

-

Renewable Energy Market Demand: Market demand, particularly in renewable energy sectors, plays a crucial role in price determination. Strong overseas demand has been observed, with component exports showing robust growth momentum. European demand has demonstrated unexpected strength, with export volumes to Europe maintaining high growth rates even at elevated baseline levels, signaling sustained market potential.

-

Supply Chain and Geopolitical Factors: Supply chain dynamics and geopolitical factors significantly impact price movements. Regional supply constraints and international logistics networks affect availability and pricing. Additionally, political, economic, and social institutions influence underground economic activities and market structures that can affect pricing mechanisms.

Global economic conditions, renewable energy adoption rates, and supply chain resilience are primary macroeconomic drivers of CRWN's price trajectory.

Three, 2025-2030 CRWN Price Forecast

2025 Outlook

- Conservative forecast: $0.01453 - $0.01800

- Neutral forecast: $0.01670 - $0.02000

- Optimistic forecast: $0.02000 - $0.02204 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market stage expectation: Gradual recovery phase with increasing institutional adoption and ecosystem expansion

- Price range forecast:

- 2026: $0.01608 - $0.02267

- 2027: $0.01576 - $0.02606

- Key catalysts: Enhanced protocol functionality, increased liquidity on Gate.com and other major platforms, growing community engagement, and broader market recovery

2028-2030 Long-term Outlook

- Base case: $0.01836 - $0.03013 (assumes steady adoption and market maturation by 2028)

- Optimistic scenario: $0.02013 - $0.03033 (assumes accelerated mainstream adoption and significant partnership announcements by 2029)

- Transformational scenario: $0.02001 - $0.03658 (assumes breakthrough technological advancement and widespread institutional integration by 2030)

Note: These forecasts represent potential price trajectories based on current market data. Actual outcomes may vary significantly based on macroeconomic conditions, regulatory environment, and project-specific developments. Investors should conduct independent research before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02204 | 0.0167 | 0.01453 | 0 |

| 2026 | 0.02267 | 0.01937 | 0.01608 | 15 |

| 2027 | 0.02606 | 0.02102 | 0.01576 | 24 |

| 2028 | 0.03013 | 0.02354 | 0.01836 | 39 |

| 2029 | 0.03033 | 0.02684 | 0.02013 | 59 |

| 2030 | 0.03658 | 0.02858 | 0.02001 | 69 |

CRWN Investment Strategy and Risk Management Report

IV. CRWN Professional Investment Strategy and Risk Management

CRWN Investment Methodology

(1) Long-term Hold Strategy

- Suitable for: Community members and believers in the Photo Finish™ LIVE ecosystem who want to participate in the play-to-earn gaming economy

- Operation recommendations:

- Accumulate CRWN tokens during price dips to build a long-term position in the gaming ecosystem

- Hold tokens to participate in potential governance and reward distributions within the Photo Finish™ LIVE platform

- Set a long-term investment horizon of 2+ years to allow the gaming ecosystem to mature and expand its player base

(2) Active Trading Strategy

- Technical analysis tools:

- Support and Resistance Levels: Monitor the 24-hour trading range ($0.0163 - $0.0184) to identify entry and exit points

- Volume Analysis: Track 24-hour trading volume of approximately $16,040 to gauge market liquidity and momentum shifts

- Wave trading key points:

- Trade during peak gaming activity periods when player engagement and token utility increase

- Consider the significant 7-day decline of -15.22% and 30-day decline of -47.099% as potential consolidation phases before potential rebounds

CRWN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of total crypto portfolio

- Active investors: 2-5% of total crypto portfolio

- Professional investors: 5-10% of total crypto portfolio

(2) Risk Hedging Solutions

- Diversification Strategy: Combine CRWN holdings with established gaming and blockchain assets to reduce concentrated risk exposure

- Dollar-Cost Averaging: Implement regular purchases over time rather than lump-sum investments to mitigate timing risk

(3) Safe Storage Solutions

- Hot Wallet Method: Use Gate.com Web3 Wallet for active trading and frequent transactions with CRWN tokens

- Cold Storage Approach: Transfer long-term holdings to secure self-custody wallets that support Solana blockchain assets

- Security Considerations: Enable multi-signature authentication, use hardware-backed security features, and never share private keys or seed phrases with any third parties

V. CRWN Potential Risks and Challenges

CRWN Market Risk

- Extreme Price Volatility: The token has experienced a -94.57% decline over the past year, indicating significant price instability and potential for further downside movements

- Low Trading Liquidity: With a 24-hour trading volume of approximately $16,040 on only 3 exchanges, the token faces limited liquidity, making large trades difficult to execute without significant price impact

- Market Concentration: Only 15,469 token holders suggests concentrated ownership, creating potential for sudden price swings during large holder exits

CRWN Regulatory Risk

- Gaming Compliance Uncertainty: As a gaming-based token tied to Photo Finish™ LIVE's play-to-earn model, CRWN faces regulatory scrutiny regarding gaming licenses, gambling regulations, and prize distribution rules across different jurisdictions

- Sports Betting Regulations: The connection to the Kentucky Derby and real horse racing creates compliance requirements around sports betting and gaming regulations that vary by region

- Securities Classification Risk: Regulatory bodies may reassess whether CRWN qualifies as a security, potentially triggering new compliance requirements and trading restrictions

CRWN Technology Risk

- Solana Blockchain Dependency: CRWN operates on the Solana network, creating exposure to any technical issues, network downtime, or consensus failures on the Solana blockchain

- Smart Contract Vulnerabilities: The token's functionality depends on smart contracts that may contain undiscovered bugs or security flaws that could result in token loss or system failures

- Gaming Platform Integration Risk: The project's success depends on the continuous development and stability of the Photo Finish™ LIVE platform, which could face technical challenges or shutdowns

VI. Conclusion and Action Recommendations

CRWN Investment Value Assessment

CRWN represents a niche cryptocurrency token tied to the Photo Finish™ LIVE gaming ecosystem. While the project benefits from established brand partnerships with the Kentucky Derby and NBC Sports, along with proven gaming experience from its creative leadership, the token currently faces significant headwinds. The -94.57% year-over-year decline, limited trading liquidity across only 3 exchanges, and highly concentrated token holder base present substantial risks. The current price of $0.01683 reflects market pessimism, though this could represent either a capitulation opportunity for long-term believers or a warning signal of deeper fundamental issues. Prospective investors should conduct thorough due diligence on the Photo Finish™ LIVE platform's current player activity, reward distribution mechanisms, and future development roadmap before committing capital.

CRWN Investment Recommendations

✅ Beginners: Start with micro-positions (less than 1% of crypto portfolio) only after thoroughly understanding the Photo Finish™ LIVE gaming ecosystem and current player engagement metrics. Consider purchasing through Gate.com with dollar-cost averaging over multiple months rather than lump-sum purchases.

✅ Experienced Investors: Implement a tiered entry strategy using technical support levels around $0.0163 while maintaining strict stop-loss orders. Consider this a speculative position suitable only for investors who can afford complete loss of capital and understand gaming-based crypto assets.

✅ Institutional Investors: Conduct extensive due diligence on Photo Finish™ LIVE's user metrics, monthly active players, retention rates, and revenue generation before considering allocation. Request audited financial statements and technical security assessments of smart contracts.

CRWN Trading Participation Methods

- Gate.com Spot Trading: Purchase CRWN directly using major trading pairs during stable market conditions with competitive fees

- Dollar-Cost Averaging Program: Set up automatic recurring purchases on Gate.com over 3-6 month periods to reduce timing risk and emotional decision-making

- Limit Order Strategy: Place limit buy orders at established support levels using Gate.com's advanced trading tools to accumulate at optimal prices while avoiding market impact

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

What is the CRON stock forecast for 2025?

Wall Street analysts forecast CRON's 2025 revenue between $48.1 billion and $57.5 billion, averaging $53 billion. Earnings predictions range from -$30 million to $20.1 million, with average earnings at -$5.9 million.

Is CRON a good buy?

CRON shows strong fundamentals with solid trading volume and growing adoption. Its market position continues to strengthen, making it attractive for investors seeking exposure to the blockchain sector with long-term growth potential.

How high is Cronos expected to go?

Cronos is expected to reach a maximum price of $0.3581150 by the end of this year. Long-term predictions suggest it could achieve even higher prices in the future as the project gains momentum.

2025 UNA Price Prediction: Bullish Trends and Key Factors Shaping the Token's Future Value

Is Sidus (SIDUS) a good investment?: Analyzing the Potential and Risks of this Gaming Cryptocurrency

MAVIA vs CHZ: A Comparative Analysis of Two Leading Blockchain Gaming Ecosystems

GOG vs LINK: The Battle for Digital Distribution Supremacy in the Gaming Industry

Is NEXPACE (NXPC) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

Is Decimated (DIO) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

2025 BLD Price Prediction: Expert Analysis and Market Forecast for Buildel Token's Future Growth

What is token economics model: allocation mechanisms, inflation design, burn mechanisms, and governance utility explained

2025 HIFI Price Prediction: Expert Analysis and Market Forecast for the Hi-Fi Audio Token

2025 LIME Price Prediction: Expert Analysis and Market Outlook for the Coming Year

Top Meme Coins to Watch for Investment in 2025: Which Ones Will Surge?