2025 HIFI Price Prediction: Expert Analysis and Market Forecast for the Hi-Fi Audio Token

Introduction: Market Position and Investment Value of HIFI

Hifi Finance (HIFI) operates as a decentralized lending protocol that enables users to borrow cryptocurrency through tokenized debt instruments with fixed interest rates. Since its launch in 2021, the project has established itself as a significant player in the DeFi lending landscape. As of December 2025, HIFI maintains a market capitalization of approximately $3.89 million, with a circulating supply of around 155.26 million tokens trading at $0.02503 per unit.

This innovative protocol, recognized for its fixed-rate lending mechanism addressing a critical gap in today's decentralized finance ecosystem, plays an increasingly vital role in enabling capital efficiency and leveraged asset exposure through its governance and collateral management strategies.

This article provides a comprehensive analysis of HIFI's price movements and market dynamics, incorporating historical trends, market supply and demand factors, ecosystem development, and macroeconomic variables. The analysis aims to deliver professional price forecasts and practical investment strategies for informed market participants looking to understand HIFI's trajectory through 2025 and beyond.

HIFI Price Analysis Report

I. HIFI Price History Review and Current Market Status

HIFI Historical Price Evolution

-

September 2023: All-time high reached at $2.63, marking the peak valuation of the Hifi Lending Protocol token during its historical trading period.

-

December 2025: Significant downtrend continues, with the token trading near all-time low levels. The price declined from $2.63 to $0.02503, representing a substantial depreciation of approximately 95.5% over the year.

HIFI Current Market Position

As of December 24, 2025, HIFI is trading at $0.02503, reflecting a -1.1% change in the last 24 hours. The token is currently positioned at Market Rank #1,696 with a total market capitalization of approximately $4.18 million USD.

Key Market Metrics:

- 24-Hour Price Range: $0.02389 - $0.02604

- 24-Hour Trading Volume: $22,482.91

- Circulating Supply: 155,262,356 HIFI tokens (92.99% of total supply)

- Total Supply: 166,973,487 tokens

- Circulating Market Cap: $3.89 million USD

- Market Dominance: 0.00013%

Recent Price Performance:

- 1-Hour Change: -0.44%

- 7-Day Change: -10.61%

- 30-Day Change: -23.16%

- 1-Year Change: -95.5%

The token exhibits consistent downward pressure across all timeframes, with particularly severe year-over-year decline. The 24-hour trading volume of $22,482.91 indicates relatively low liquidity in the current market environment. HIFI is currently trading near its all-time low of $0.02406476 established on December 23, 2025.

Click to view current HIFI market price

HIFI Market Sentiment Index

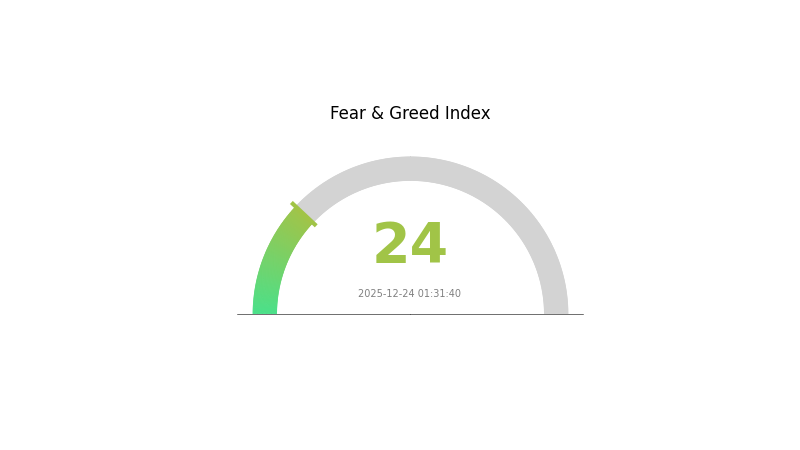

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This significant downward reading reflects heightened market anxiety and pessimistic sentiment among investors. During periods of extreme fear, asset prices often reach oversold conditions, creating potential buying opportunities for contrarian investors. However, traders should exercise caution and conduct thorough due diligence before entering positions. This market condition typically indicates elevated volatility and uncertainty. Stay informed on market developments and manage your risk accordingly through proper position sizing and stop-loss strategies on Gate.com.

HIFI Holding Distribution

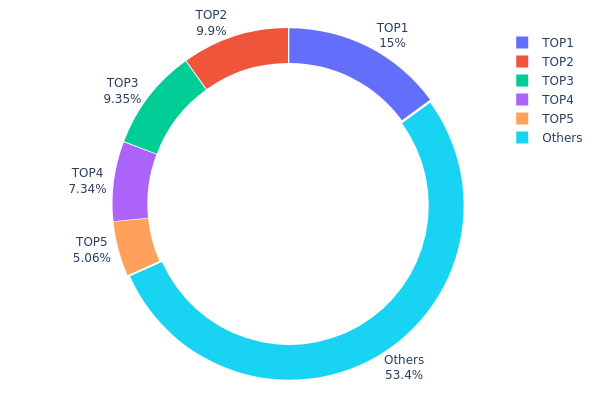

The address holding distribution map illustrates the concentration of token ownership across blockchain addresses, serving as a critical indicator of token decentralization and potential market manipulation risks. By analyzing the top wallet holders and their proportional stakes, market participants can assess the structural integrity and stability of a project's token economy.

HIFI's current holding distribution exhibits moderate concentration characteristics. The top five addresses collectively control 46.6% of the total supply, with the largest holder commanding 14.97%. This concentration level suggests that while significant capital is distributed among major stakeholders, a notable dependency exists on a limited number of addresses. The largest holder's ~15% stake represents a meaningful position but falls below extreme concentration thresholds, indicating that no single entity possesses overwhelming control over the token supply. The relatively balanced distribution among the top five holders—ranging from 14.97% to 5.05%—demonstrates a reasonably diversified institutional or whale position structure.

The remaining 53.4% of tokens distributed among "Others" represents a positive indicator for decentralization health. This substantial retail and mid-tier holder base provides organic liquidity and reduces vulnerability to coordinated whale actions. However, the 46.6% concentration among top addresses warrants monitoring, as significant liquidation or coordinated selling could influence price dynamics. The current structure reflects a typical mature project profile where institutional holdings coexist with genuine distributed ownership, supporting both market depth and stability.

Click to view current HIFI Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xff3b...9f5957 | 25000.00K | 14.97% |

| 2 | 0x167a...aa6476 | 16531.57K | 9.90% |

| 3 | 0x6368...14d6c5 | 15608.84K | 9.34% |

| 4 | 0x91dc...20dc92 | 12262.89K | 7.34% |

| 5 | 0xa07f...11adec | 8442.55K | 5.05% |

| - | Others | 89127.64K | 53.4% |

II. Core Factors Influencing HIFI's Future Price

Institutional and Major Holder Dynamics

- Enterprise Adoption: Enterprise integration of HIFI DeFi lending functions represents a key adoption driver for the token.

- Fixed-Rate DeFi Product Adoption: Increased user and institutional recognition of fixed-rate lending advantages may drive growing demand for HIFI, as more market participants adopt fixed-rate DeFi products.

Macroeconomic Environment

- Inflation Hedge Properties: HIFI's performance in inflationary environments is an important factor influencing its price trajectory. Asset behavior during periods of elevated inflation can significantly impact investor demand and token valuation.

- Interest Rate Policy Impact: Global macroeconomic instability and adjustments to interest rate policies by major central banks may produce negative effects on cryptocurrency prices, including HIFI.

III. HIFI Price Forecast for 2025-2030

2025 Outlook

- Conservative Estimate: $0.02429 - $0.02504

- Base Case Estimate: $0.02504

- Optimistic Estimate: $0.02654 (requires sustained market interest and ecosystem development)

2026-2028 Mid-Term Outlook

- Market Stage Expectation: Gradual accumulation phase with incremental growth as adoption metrics improve and platform utility expands

- Price Range Forecast:

- 2026: $0.02141 - $0.03508

- 2027: $0.01887 - $0.03987

- 2028: $0.01793 - $0.04464

- Key Catalysts: Expansion of DeFi integrations, increased institutional participation, protocol upgrades, and growing user adoption on Gate.com and other major trading venues

2029-2030 Long-Term Outlook

- Base Case Scenario: $0.02474 - $0.04349 (assuming continued market development and moderate ecosystem growth)

- Optimistic Scenario: $0.03990 - $0.04378 (assuming accelerated adoption, successful platform scaling, and positive macroeconomic conditions)

- Transformational Scenario: $0.04464+ (contingent on breakthrough innovations, major institutional adoption waves, and significant expansion of the protocol's real-world utility)

- December 24, 2030: HIFI projected at approximately $0.04169 (base case equilibrium valuation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02654 | 0.02504 | 0.02429 | 0 |

| 2026 | 0.03508 | 0.02579 | 0.02141 | 3 |

| 2027 | 0.03987 | 0.03043 | 0.01887 | 21 |

| 2028 | 0.04464 | 0.03515 | 0.01793 | 40 |

| 2029 | 0.04349 | 0.0399 | 0.02474 | 59 |

| 2030 | 0.04378 | 0.04169 | 0.02418 | 66 |

HIFI Finance Professional Investment Strategy and Risk Management Report

IV. HIFI Professional Investment Strategy and Risk Management

HIFI Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: DeFi protocol believers and fixed-rate lending advocates with 2+ year investment horizons

- Operational Recommendations:

- Accumulate HIFI during market downturns when prices are below $0.03, focusing on the protocol's governance utility

- Dollar-cost averaging (DCA) over 6-12 months to reduce timing risk and capture volatility

- Hold tokens through governance participation to benefit from protocol improvements and potential capital efficiency gains

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Monitor price action around $0.02389 (24h low) and $0.02604 (24h high) for short-term trading signals

- Volume Analysis: Track the 24-hour trading volume of $22,482.91 to identify breakout opportunities and validate price movements

- Wave Trading Key Points:

- Enter positions during downtrends when price touches support levels, exit during technical rebounds

- Monitor the -1.1% 24-hour decline and -10.61% 7-day decline to identify potential reversal patterns

HIFI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of cryptocurrency portfolio

- Active Investors: 2-5% of cryptocurrency portfolio

- Professional Investors: 5-10% of cryptocurrency portfolio

(2) Risk Hedging Solutions

- Diversification Strategy: Combine HIFI with established DeFi tokens to reduce protocol-specific risk exposure

- Profit-Taking Protocol: Set predetermined exit prices after 50-100% gains to lock in profits during bull cycles

(3) Secure Storage Solutions

- Hot Wallet Solution: Gate.com Web3 Wallet for frequent trading and governance participation

- Cold Storage Method: For long-term holdings, transfer HIFI to secure offline storage after purchases

- Security Precautions: Enable two-factor authentication (2FA) on all exchange accounts, regularly verify smart contract addresses on Etherscan before transactions, never share private keys or seed phrases with third parties

V. HIFI Potential Risks and Challenges

HIFI Market Risk

- Extreme Price Volatility: HIFI has declined 95.5% over the past year (from approximately $0.531 to $0.02503), indicating severe market sensitivity and potential liquidity challenges

- Low Trading Volume: Daily trading volume of $22,482.91 suggests limited market liquidity, which can result in significant slippage and wider bid-ask spreads

- Market Cap Concentration: With only 6,318 token holders, HIFI faces whale concentration risk where large holders can significantly influence price movements

HIFI Regulatory Risk

- DeFi Protocol Regulatory Uncertainty: Lending protocols face evolving regulatory frameworks globally, particularly regarding lending activities and token governance mechanisms

- Compliance Requirements: Potential future regulations on collateral requirements and liquidation procedures could impact protocol functionality and token utility

- Geographic Restrictions: Certain jurisdictions may restrict access to HIFI and the underlying lending protocol

HIFI Technical Risk

- Smart Contract Vulnerabilities: As a lending protocol, HIFI relies on complex smart contracts for collateral management, liquidation, and rehypothecation mechanisms, creating potential exploit vectors

- Protocol Adoption Risk: The protocol's success depends on achieving critical mass in user adoption for fixed-rate lending, which remains competitive and uncertain

- Collateral Risk: The rehypothecation strategy and complex collateral mechanisms increase systemic risk if underlying assets experience rapid devaluation

VI. Conclusion and Action Recommendations

HIFI Investment Value Assessment

HIFI Finance operates in the competitive DeFi lending sector with a focus on fixed-rate lending and collateral efficiency. However, the token faces significant headwinds: a 95.5% year-long decline, limited liquidity ($22,482.91 daily volume), and small holder base (6,318 addresses). While the protocol addresses a genuine need for fixed-rate borrowing in DeFi, the current market conditions and token performance suggest elevated risk. The token's governance utility and potential protocol improvements provide long-term optionality, but near-term price stability remains questionable.

HIFI Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of crypto portfolio) through Gate.com, focus on understanding the protocol's mechanics before expanding positions, and practice risk management discipline

✅ Experienced Investors: Consider DCA strategy during weakness below $0.025, participate in protocol governance to understand tokenomics evolution, and maintain strict position sizing given volatility

✅ Institutional Investors: Conduct comprehensive due diligence on protocol adoption metrics and user growth, evaluate the fixed-rate lending market competitiveness, and structure positions with appropriate hedging given the illiquid trading environment

HIFI Trading Participation Methods

- Spot Trading: Purchase HIFI directly on Gate.com during technical support levels with limit orders to minimize slippage

- Governance Participation: Hold HIFI tokens to vote on protocol proposals and participate in treasury decisions that could enhance token utility

- Liquidity Provision: Consider providing liquidity for HIFI/ETH or HIFI/stablecoin pairs to earn trading fees, though assess impermanent loss risks carefully

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

Is hifi a good investment?

HiFi shows strong potential as a cryptocurrency investment. With growing adoption, innovative use cases, and solid market fundamentals, HiFi offers attractive opportunities for investors seeking exposure to the decentralized finance ecosystem.

Will HiFi Coin go up again?

Yes, HiFi Coin is projected to rise significantly. Market analysis suggests HIFI could reach $1.70 this year and $5.17 by 2025, driven by positive trends and growing adoption in the DeFi sector.

Why is the hifi coin pumping?

HIFI coin is pumping due to strategic exchange listings on major platforms, increased trading volume, and growing market adoption. Enhanced visibility and positive market sentiment are driving investor interest and price momentum.

2025 EULPrice Prediction: Market Analysis and Future Trends for Euler Finance Token in the DeFi Ecosystem

2025 EDGEPrice Prediction: Analysis of Growth Potential and Market Factors Influencing the Future Value

2025 BENQI Price Prediction: Analyzing Market Trends and Future Valuation for the DeFi Protocol

2025 ASTER Price Prediction: Analyzing Market Trends and Growth Potential for the Emerging Cryptocurrency

2025 OMG Price Prediction: Analyzing Market Trends and Future Potential of the Token in a Maturing Crypto Ecosystem

2025 MORPHO Price Prediction: Analyzing Market Trends and Growth Potential for the DeFi Token

Is Sovrun (SOVRN) a good investment?: A Comprehensive Analysis of the Digital Advertising Platform's Potential and Market Position

Is CrossFi (XFI) a good investment?: A Comprehensive Analysis of Its Market Potential and Risk Factors

Is REI Network (REI) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Prospects

Is Basenji (BENJI) a good investment?: A Comprehensive Analysis of Risk, Market Potential, and Future Prospects

Is QORPO WORLD (QORPO) a good investment?: A Comprehensive Analysis of Token Value, Market Potential, and Risk Factors for 2024