2025 DIVER Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: DIVER's Market Position and Investment Value

Divergence Protocol (DIVER) is a decentralized platform designed for hedging and trading the volatility of DeFi-native assets, with its flagship product being a synthetic binary option trading market based on AMM technology. Since its launch in 2021, DIVER has established itself as a unique player in the decentralized finance ecosystem. As of December 2025, DIVER maintains a market capitalization of approximately $4.58 million, with a circulating supply of 660 million tokens out of a total supply of 1 billion. The token is currently trading at $0.006934, representing its governance and utility functions within the Divergence Protocol platform.

This comprehensive analysis will examine DIVER's price trajectory through 2030, incorporating historical price patterns, market dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies.

I. DIVER Price History Review and Current Market Status

DIVER Historical Price Evolution

- October 18, 2021: DIVER reached its all-time high (ATH) of $0.454064, representing the peak valuation during the peak of the DeFi market cycle.

- April 9, 2025: DIVER hit its all-time low (ATL) of $0.00490827, marking a significant decline from historical peaks.

- December 24, 2025: DIVER is currently trading at $0.006934, representing a cumulative decline of approximately 98.47% from its ATH.

DIVER Current Market Status

As of December 24, 2025, DIVER is trading at $0.006934 with a 24-hour trading volume of $53,351.50. The token has experienced considerable volatility recently, with a 24-hour price decline of -8.65%, though it gained 0.2% in the past hour. Over a 7-day period, DIVER has declined 6.59%, while the 30-day performance shows a -4.74% decrease. On an annual basis, the token has depreciated 30.86% from its previous year's levels.

The current market capitalization stands at $4,576,440, with a fully diluted valuation of $6,934,000. The circulating supply comprises 660 million DIVER tokens out of a total and maximum supply of 1 billion tokens, representing 66% circulation. The token maintains a market dominance of 0.00021% in the broader cryptocurrency market. With 7,648 token holders and trading activity across limited exchanges, DIVER maintains a presence in the decentralized finance ecosystem despite its significant price depreciation from historical levels.

Click to view current DIVER market price

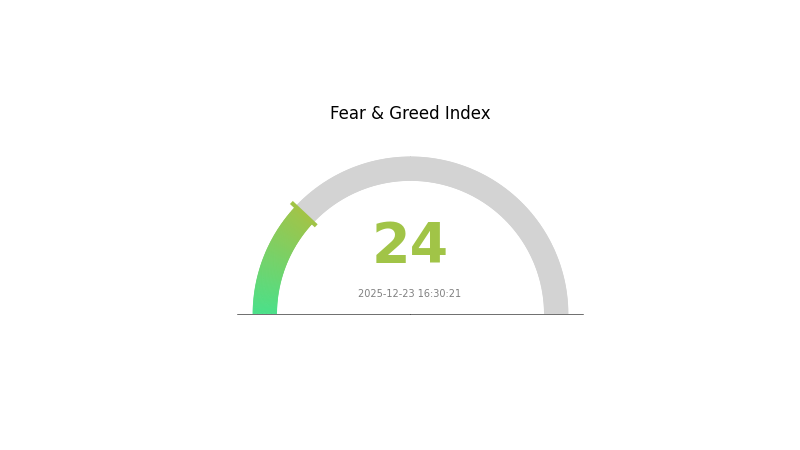

DIVER Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 24. This indicates significant pessimism among investors and heightened market volatility. During such periods, risk-averse traders typically adopt defensive strategies, while contrarian investors may identify potential buying opportunities at depressed prices. Market participants should exercise caution, conduct thorough due diligence, and avoid emotional decision-making. Gate.com provides real-time market sentiment data to help traders navigate these turbulent conditions and make informed investment decisions.

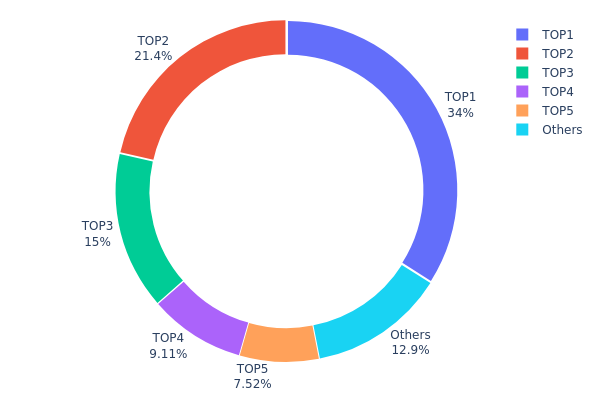

DIVER Holdings Distribution

The address holdings distribution chart illustrates the concentration of DIVER tokens across on-chain addresses, revealing the degree of decentralization and potential market structure risks. By analyzing the distribution of the top token holders relative to total supply, this metric provides critical insights into network participation patterns and the vulnerability of the token to concentrated selling pressure.

DIVER exhibits a pronounced concentration pattern that warrants careful consideration. The top five addresses collectively control 87.06% of the total supply, with the largest single address commanding 34.00% of all tokens in circulation. This level of concentration is significant, particularly when the top three addresses alone account for 70.44% of holdings. While moderate concentration is not uncommon in early-stage projects, the current distribution suggests limited decentralization and indicates that key price movements could be substantially influenced by the actions of a small number of stakeholders. The remaining 12.94% distributed among other addresses demonstrates minimal participation breadth in the broader holder base.

This concentrated distribution structure presents meaningful implications for market dynamics and stability. The extreme concentration creates potential vulnerability to significant price volatility should any of the top holders initiate substantial liquidation activities. Furthermore, the lack of widespread token distribution among numerous addresses suggests limited grassroots adoption and decentralization maturity. Markets with such skewed distributions typically experience higher price manipulation risks and reduced market resilience. For investors evaluating DIVER's long-term viability and stability, the current on-chain structure indicates that network health and price discovery mechanisms remain dependent on coordinated behavior among a select few large stakeholders rather than distributed market participation.

Click to view current DIVER Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc627...cba873 | 340000.00K | 34.00% |

| 2 | 0x9190...566523 | 214428.30K | 21.44% |

| 3 | 0xa862...840618 | 150000.00K | 15.00% |

| 4 | 0xa45a...526584 | 91093.44K | 9.10% |

| 5 | 0x40ea...63e99d | 75204.60K | 7.52% |

| - | Others | 129273.66K | 12.94% |

II. Core Factors Affecting DIVER's Future Price

Based on the provided materials, there is insufficient specific information about DIVER token to accurately complete this analysis. The search results returned contain general information about macroeconomic factors, sector rotation, and commodity markets (such as gold and oil), but do not include any data specifically related to DIVER's supply mechanisms, institutional holdings, technical developments, or ecosystem activities.

To provide a comprehensive analysis of DIVER's price drivers, the following information would be required:

- Supply and emission schedules specific to DIVER

- Major institutional or whale holdings data

- Development roadmap and technical upgrades

- Active ecosystem projects and DApp integrations

- Community and adoption metrics

- Regulatory developments affecting DIVER

Recommendation: Please provide materials or resources that specifically address DIVER's tokenomics, project developments, and market dynamics to enable a thorough analysis according to the template structure.

III. 2025-2030 DIVER Price Forecast

2025 Outlook

- Conservative Forecast: $0.00659-$0.00811

- Base Case Forecast: $0.00693

- Bullish Forecast: $0.00811 (requiring sustained market interest and positive sentiment)

2026-2027 Medium-term Outlook

- Market Phase Expectations: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Predictions:

- 2026: $0.00444-$0.00873

- 2027: $0.00739-$0.00869

- Key Catalysts: Ecosystem development maturation, increased adoption metrics, potential protocol upgrades, and broader market recovery cycles

2028-2030 Long-term Outlook

- Base Scenario: $0.00597-$0.01018 in 2028 (assuming steady market conditions and consistent protocol development)

- Bullish Scenario: $0.00808-$0.01152 in 2029 (assuming accelerated ecosystem growth and increased institutional participation)

- Transformational Scenario: $0.00718-$0.01218 in 2030 (under conditions of mainstream adoption, significant utility expansion, and favorable macroeconomic environment)

- December 24, 2025: DIVER trading at average price of $0.00693 (baseline consolidation phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00811 | 0.00693 | 0.00659 | 0 |

| 2026 | 0.00873 | 0.00752 | 0.00444 | 8 |

| 2027 | 0.00869 | 0.00813 | 0.00739 | 17 |

| 2028 | 0.01018 | 0.00841 | 0.00597 | 21 |

| 2029 | 0.01152 | 0.00929 | 0.00808 | 34 |

| 2030 | 0.01218 | 0.01041 | 0.00718 | 50 |

Divergence Protocol (DIVER) Professional Investment Analysis Report

IV. DIVER Professional Investment Strategy and Risk Management

DIVER Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: DeFi derivatives enthusiasts, risk hedging participants, and long-term cryptocurrency portfolio allocators

- Operation Recommendations:

- Accumulate DIVER tokens during market downturns, particularly when prices fall below historical support levels, to build a strategic position in the decentralized volatility trading platform

- Maintain a 12-24 month holding horizon to capture potential protocol adoption and governance participation value as the platform matures

- Reinvest any governance rewards or protocol incentives back into the position to compound returns over time

(2) Active Trading Strategy

- Market Context Analysis:

- Current 24-hour price change: -8.65% (as of December 24, 2025)

- 7-day trend: -6.59% decline, indicating recent downward momentum

- Year-to-date performance: -30.86%, reflecting significant bearish pressure

- Volatility Trading Opportunities:

- Monitor intraday volatility patterns, as DIVER exhibits high price sensitivity with the 24-hour range between $0.006932 and $0.00771

- Consider swing trading around key resistance and support levels established by historical price movements

DIVER Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of total portfolio

- Active Investors: 1-3% of total portfolio

- Professional Investors: 3-5% of total portfolio

(2) Risk Mitigation Strategies

- Portfolio Diversification: DIVER should represent only a small allocation within a broader DeFi or cryptocurrency portfolio due to its speculative nature and current market performance

- Dollar-Cost Averaging (DCA): Implement systematic, regular purchases over extended periods to reduce exposure to short-term price volatility and entry-point risk

- Stop-Loss Implementation: Set protective stops at 15-20% below entry price to limit potential downside exposure in bearish market conditions

(3) Secure Storage Solution

- Self-Custody Recommendation: Transfer DIVER tokens to a secure hardware wallet for holdings exceeding $1,000 to minimize exchange counterparty risk

- Exchange Custody Alternative: For active trading, maintain DIVER on Gate.com to access liquidity and trading functionality while utilizing the exchange's insurance mechanisms

- Security Best Practices: Enable multi-signature authentication, maintain offline backup of private keys, and never share wallet credentials or recovery phrases with any third parties

V. DIVER Potential Risks and Challenges

DIVER Market Risk

- Price Volatility Exposure: DIVER has declined 30.86% year-over-year, indicating significant downside pressure and potential further erosion of token value during prolonged bear market conditions

- Liquidity Constraints: With 24-hour trading volume of only $53,351.50 and 7,648 token holders, DIVER exhibits limited liquidity depth, creating substantial slippage risk for larger position entries or exits

- Market Cap Concentration Risk: The relatively small market capitalization of $4.58 million makes DIVER susceptible to manipulation and large position exits that could trigger rapid price declines

DIVER Regulatory Risk

- DeFi Compliance Uncertainty: As a decentralized derivatives platform, Divergence Protocol faces evolving regulatory scrutiny regarding options trading and synthetic asset issuance across multiple jurisdictions

- Derivatives Regulation: Binary options and synthetic derivatives face restrictive regulatory treatment in numerous countries, potentially limiting platform access and token utility in regulated markets

- Governance Token Classification: Regulatory authorities may reclassify DIVER as an unregistered security, subjecting the token and platform to enforcement actions or operational restrictions

DIVER Technology Risk

- Smart Contract Vulnerability: As a protocol built on decentralized mechanics, Divergence remains exposed to potential smart contract bugs, auditing gaps, or unforeseen technical exploits that could compromise platform integrity

- Protocol Adoption Risk: Limited market traction and relatively low trading volumes suggest the core AMM-based binary options product may not be gaining sufficient user adoption to justify current token economics

- Development Sustainability: The project's ability to maintain active development, release feature updates, and compete effectively with established derivatives protocols is unclear given current market positioning

VI. Conclusions and Action Recommendations

DIVER Investment Value Assessment

DIVER represents a specialized investment in a decentralized volatility trading protocol with a differentiated binary options product design. However, the token faces significant headwinds: a 30.86% year-over-year decline, minimal trading liquidity of approximately $53,000 daily, and a small holder base of 7,648 addresses. The platform's flagship AMM-based synthetic options market addresses a genuine DeFi need for volatility hedging and derivative access, but current market metrics suggest limited platform adoption and investor confidence. DIVER's $4.58 million market capitalization reflects highly speculative positioning with substantial downside risk. Long-term viability depends on successful protocol adoption, sustained development momentum, and favorable regulatory treatment of decentralized derivatives trading.

DIVER Investment Recommendations

✅ Beginners: Initiate minimal exploratory positions (0.5% of portfolio maximum) only after thoroughly understanding the protocol's binary options mechanics. Use Gate.com as your entry point with strict position sizing discipline.

✅ Experienced Investors: Implement tactical accumulation during confirmed support bounces, particularly around $0.005-0.006 levels, while maintaining tight risk controls. Consider DIVER as a tactical speculative hedge rather than core portfolio holding.

✅ Institutional Investors: Conduct detailed operational due diligence on Divergence Protocol's technical architecture, governance mechanisms, and regulatory positioning before considering any allocation. Position sizing should reflect the asset's extreme liquidity constraints and speculative classification.

DIVER Trading Participation Methods

- Direct Purchase on Gate.com: Execute spot purchases directly through Gate.com's trading interface, accessing DIVER's ETH-based liquidity pool

- Limit Order Strategy: Place limit orders below current market price to establish positions with favorable risk-reward ratios during high-volatility periods

- Governance Participation: Long-term holders can participate in Divergence protocol governance through DIVER token voting mechanisms, aligning incentives with platform development direction

Cryptocurrency and DeFi token investments carry extreme risk, including potential total loss of capital. This report does not constitute investment advice. Investors must assess their personal risk tolerance, investment horizon, and financial objectives before making any allocation decisions. Consult with qualified financial professionals before committing capital. Never invest funds you cannot afford to lose completely. Divergence Protocol and DIVER are early-stage, highly speculative assets suitable only for experienced cryptocurrency investors with high risk tolerance.

FAQ

What is the price prediction for DIVER in 2025 and 2030?

DIVER price predictions for 2025 range from $0.008 to $0.012, driven by ecosystem expansion and adoption growth. By 2030, analysts project prices between $0.015 and $0.025, assuming sustained protocol development and market maturation.

What are the key factors that could influence DIVER's future price?

DIVER's price is influenced by market sentiment, trading volume, adoption rates, protocol developments, regulatory changes, and broader cryptocurrency market trends. Positive ecosystem growth and increased utility typically drive upward price momentum.

What are the risks and potential returns of investing in DIVER?

DIVER offers high growth potential with significant upside as adoption increases. However, crypto volatility presents substantial risk. Success depends on market conditions and project execution. Conduct thorough research before investing.

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 MLNPrice Prediction: Analyzing Key Factors That Will Drive MLN Valuation in the Coming Market Cycle

2025 UNCX Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 CHESSPrice Prediction: Market Analysis and Future Trends for the CHESS Token Ecosystem

2025 EDGE Price Prediction: Will This Crypto Asset Reach New Heights or Face a Downturn?

2025 ITHACA Price Prediction: Analyzing Market Trends and Potential Growth Factors

How Volatile Is GIGGLE's Price? A Look at 475% Swings and Support Levels

How to Use Technical Indicators (MACD, RSI, KDJ, Bollinger Bands) for Crypto Trading Signals

What is DEGOD: A Comprehensive Guide to Decentralized Governance and On-Chain Development

How Active is the CSPR Casper Network Community and Ecosystem in 2025?

What is KDA: A Comprehensive Guide to Cardano's Key Decentralized Applications