2025 DMTR Price Prediction: Expert Analysis and Market Forecast for Dominator Token's Future Growth

Introduction: DMTR's Market Position and Investment Value

Dimitra (DMTR) is a blockchain platform dedicated to the democratization of global agricultural technology space. Since its launch in 2021, it has been providing access to blockchain, machine learning, IoT sensors, and satellite technology through a mobile platform to help farmers worldwide increase production, reduce costs, and mitigate risks. As of December 2025, DMTR has achieved a market capitalization of approximately $9.94 million, with a circulating supply of about 684.27 million tokens, maintaining a price around $0.01453. This innovative agricultural-focused digital asset is playing an increasingly critical role in addressing sustainability challenges such as poverty, hunger, climate change, carbon emissions, freshwater conservation, and soil protection.

This article will provide a comprehensive analysis of DMTR's price trajectory through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

I. DMTR Price Historical Review and Market Status

DMTR Historical Price Trajectory

DMTR reached its all-time high (ATH) of $5.95 on September 23, 2021, during the peak of the cryptocurrency market cycle. Subsequently, the token experienced a significant correction phase, declining substantially over the following years. The all-time low (ATL) of $0.00269344 was recorded on December 17, 2022, marking a 99.55% decline from the peak. This dramatic drawdown reflects the broader market cycles experienced by altcoins during the 2022 bear market and subsequent market conditions.

DMTR Current Market Status

As of December 22, 2025, DMTR is trading at $0.01453, with a 24-hour trading volume of $16,222.92. The token demonstrates modest short-term momentum, showing a 0.69% gain over the past hour and a 1.25% increase over the last 24 hours. However, longer-term performance remains under pressure, with the token down 2.61% over 7 days and 28.67% over the past 30 days. Year-to-date performance has been significantly negative, with DMTR declining 80.32% from its levels one year ago.

The fully diluted market capitalization stands at approximately $14.11 million, with a circulating supply of 684.27 million tokens out of a total supply of 971.07 million DMTR tokens (with a maximum supply cap of 1 billion tokens). The circulating supply represents approximately 68.43% of the total supply. DMTR maintains a market cap rank of 1,180 among all cryptocurrencies, with a market dominance of 0.00043%.

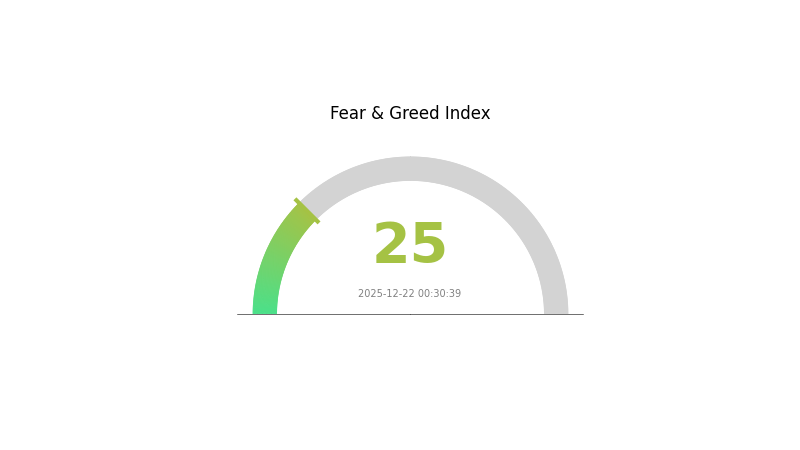

The token is actively traded across 5 exchanges and maintained by 10,324 token holders. Current market sentiment indicates extreme fear conditions (VIX at 25), which may be affecting broader market dynamics and investor risk appetite.

Click to view current DMTR market price

DMTR Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 25. This indicates widespread pessimism and negative sentiment among investors. During such periods, risk aversion is high, and market volatility increases significantly. Traders should exercise caution and avoid impulsive decisions driven by panic. However, extreme fear often presents contrarian opportunities for long-term investors. Consider reviewing your portfolio strategy and risk management measures. Monitor key support levels closely and stay informed about market developments through Gate.com's market data tools.

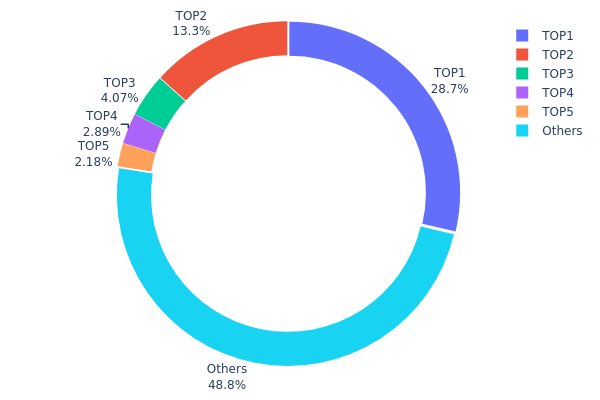

DMTR Token Holder Distribution

The token holder distribution map illustrates the concentration of DMTR tokens across blockchain addresses, revealing the decentralization characteristics and potential market structure risks. This metric tracks the top token holders and their respective ownership percentages, providing critical insight into whether token supply is widely distributed or concentrated among a small number of entities.

The current DMTR distribution data reveals a moderately concentrated holding pattern with notable risk factors. The top address commands 28.68% of total supply, while the second-largest holder maintains 13.33%, and the combined top five addresses control approximately 51.14% of all tokens in circulation. This distribution suggests a moderate degree of wealth concentration that warrants attention. The presence of a burn address (0x0000...00dead) holding 2.89% is a positive indicator, as it demonstrates a portion of the token supply has been permanently removed from circulation. However, the significant concentration among the top two holders—collectively representing 42.01% of supply—creates potential vulnerability to coordinated selling pressure or strategic manipulation of market sentiment.

The data reveals that approximately 48.86% of DMTR tokens are distributed across remaining holders outside the top five, indicating a reasonably dispersed secondary holder base. This broader distribution suggests some degree of decentralization; however, the dominance of the top addresses remains a defining characteristic. The concentration metrics indicate moderate centralization risk, with the top holder's 28.68% stake providing substantial influence over network decisions and market dynamics. Such distribution patterns typically correlate with higher price volatility sensitivity to large holder movements and potential governance centralization concerns, though the presence of significant distributed holdings mitigates extreme concentration scenarios.

View current DMTR token holder distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe642...5a69a2 | 286805.51K | 28.68% |

| 2 | 0x175c...69c9cc | 133311.75K | 13.33% |

| 3 | 0x3cc9...aecf18 | 40681.40K | 4.06% |

| 4 | 0x0000...00dead | 28928.32K | 2.89% |

| 5 | 0x446b...d027ba | 21848.27K | 2.18% |

| - | Others | 488424.76K | 48.86% |

II. Core Factors Impacting DMTR's Future Price

Supply Mechanism

- Limited Supply: DMTR features a fixed supply mechanism that constrains token availability, which has historically supported price dynamics in the cryptocurrency market.

- Historical Impact: Past supply constraints have demonstrated their influence on token valuations, with limited circulating supplies typically supporting price stability and appreciation potential.

- Current Impact: The existing supply structure continues to play a role in DMTR's price formation, with supply limitations expected to maintain relevance as ecosystem adoption grows.

Market Adoption and Platform Dynamics

- User Adoption: DMTR's price is significantly influenced by platform user activity levels and user engagement trends. Increased user adoption directly correlates with demand for the token.

- Ecosystem Applications: The development of the ecosystem system and related applications will directly impact DMTR's future price trajectory. Expansion of use cases drives token utility and demand.

Macroeconomic Environment

- Market Sentiment: Market sentiment and broader cryptocurrency market trends play important roles in DMTR's price movements. Current market conditions show optimism regarding DMTR's price direction, with recent price movements demonstrating bullish momentum.

- Technology and Innovation: Competition and technological innovation within the sector influence DMTR's positioning and price performance relative to alternative solutions.

Three. 2025-2030 DMTR Price Forecast

2025 Outlook

- Conservative Forecast: $0.01385 - $0.01458

- Neutral Forecast: $0.01458 - $0.02056

- Optimistic Forecast: $0.02056 (requires sustained market demand and positive ecosystem developments)

Mid-term Period 2026-2028 Outlook

- Market Stage Expectation: Potential growth phase with gradual price appreciation driven by ecosystem expansion and increased adoption

- Price Range Predictions:

- 2026: $0.00966 - $0.02618 (20% upside potential)

- 2027: $0.01597 - $0.02931 (50% upside potential)

- 2028: $0.02380 - $0.02943 (76% upside potential)

- Key Catalysts: Project development milestones, increased institutional interest, broader market sentiment improvement, and ecosystem partnerships

Long-term Outlook 2029-2030

- Base Case Scenario: $0.02751 - $0.03191 by 2029 (89% upside potential from current levels; assumes steady ecosystem growth and moderate market recovery)

- Optimistic Scenario: $0.03631 by 2029 with potential extension to $0.045 by 2030 (assumes accelerated adoption and favorable market cycles)

- Bull Case Scenario: $0.045 by 2030 (119% upside potential; requires major technological breakthroughs, significant institutional adoption, and favorable macroeconomic conditions)

Note: These price forecasts are based on historical data patterns and market analysis. Investors should conduct thorough due diligence and consider trading on reputable platforms such as Gate.com for risk management purposes.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02056 | 0.01458 | 0.01385 | 0 |

| 2026 | 0.02618 | 0.01757 | 0.00966 | 20 |

| 2027 | 0.02931 | 0.02187 | 0.01597 | 50 |

| 2028 | 0.02943 | 0.02559 | 0.0238 | 76 |

| 2029 | 0.03631 | 0.02751 | 0.01926 | 89 |

| 2030 | 0.045 | 0.03191 | 0.02553 | 119 |

Dimitra (DMTR) Professional Investment Analysis Report

IV. DMTR Professional Investment Strategy and Risk Management

DMTR Investment Methodology

(1) Long-term Holding Strategy

- Target Investor Profile: Agricultural technology enthusiasts, ESG-focused investors, and those seeking exposure to blockchain-based agricultural innovation

- Operational Recommendations:

- Dollar-cost averaging (DCA) to accumulate positions over time, reducing the impact of price volatility

- Regular portfolio rebalancing to maintain target allocation percentages

- Secure storage through cold wallet solutions or Gate.com's institutional-grade custody services

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Monitor momentum shifts and trend confirmation when trading DMTR on Gate.com's advanced charting tools

- Relative Strength Index (RSI): Identify overbought/oversold conditions for entry and exit optimization

-

Swing Trading Key Points:

- Monitor 24-hour volume trends; current 24-hour volume stands at $16,222.92

- Track price action within the recent range of $0.01416 (24h low) to $0.01465 (24h high)

- Consider the broader downtrend context: 30-day decline of -28.67% and one-year decline of -80.32%

DMTR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation

- Moderate Investors: 2-5% portfolio allocation

- Aggressive Investors: 5-10% portfolio allocation

(2) Risk Mitigation Strategies

- Position Sizing: Never allocate more than 2% of total portfolio to a single micro-cap asset like DMTR

- Stop-Loss Implementation: Set stop-loss orders at 15-20% below entry points to limit downside exposure

- Diversification: Combine DMTR holdings with established layer-1 and layer-2 blockchain tokens to reduce concentration risk

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for active trading and frequent transactions

- Cold Storage Approach: Hardware wallet solutions for long-term holdings exceeding six months

- Security Considerations: Enable two-factor authentication on all exchange accounts; never share private keys; verify smart contract addresses before token transfers; stay vigilant against phishing attempts targeting agricultural tech projects

V. DMTR Potential Risks and Challenges

DMTR Market Risks

- Extreme Price Volatility: DMTR has experienced a historic high of $5.95 (September 23, 2021) and a low of $0.00269344 (December 17, 2022), representing a 99.55% decline from ATH. The current price of $0.01453 remains substantially below historical peaks.

- Low Trading Liquidity: With 24-hour volume of only $16,222.92 and a circulation ratio of 68.43%, DMTR demonstrates limited trading depth, making significant position entry/exit challenging.

- Market Capitalization Challenges: The token's $14.1 million fully diluted valuation places it outside top 1,000 cryptocurrencies by market cap (current ranking: 1,180), limiting institutional adoption and market confidence.

DMTR Regulatory Risks

- Agricultural Sector Uncertainty: Blockchain applications in agriculture remain largely unregulated across most jurisdictions, creating potential compliance challenges as governments establish frameworks

- Jurisdiction-Specific Constraints: Different countries maintain varying regulatory stances on cryptocurrency utilities for agriculture, potentially limiting geographic expansion

- Changing Compliance Requirements: Future agricultural and financial regulations could impact token utility and project viability

DMTR Technical Risks

- Smart Contract Vulnerabilities: The single Ethereum contract address (0x51cb253744189f11241becb29bedd3f1b5384fdb) creates a single point of failure; any exploit could result in significant losses

- Technology Adoption Rate: Success depends on widespread farmer adoption of blockchain-based agricultural solutions, which remains uncertain despite sustainability benefits

- Integration Complexity: Coordinating IoT sensors, satellite technology, machine learning, and blockchain infrastructure presents substantial technical execution risk

VI. Conclusion and Action Recommendations

DMTR Investment Value Assessment

Dimitra presents a compelling long-term vision for democratizing agricultural technology through blockchain integration. However, the token faces significant headwinds: an 80.32% one-year decline, low market liquidity, minimal trading volume, and unproven adoption rates among target farmer demographics. The project's fundamental mission—reducing poverty, hunger, and environmental degradation through tech-enabled farming—remains strategically sound, but market execution and investor sentiment remain uncertain.

DMTR Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% portfolio allocation) only after thoroughly understanding agricultural blockchain applications; use Gate.com's educational resources to build knowledge before committing capital

✅ Experienced Investors: Consider tactical positions during multi-month consolidation periods; employ strict risk management with 15-20% stop-loss orders; maintain positions well below 5% portfolio weight

✅ Institutional Investors: Conduct comprehensive due diligence on Dimitra's farmer adoption metrics, revenue generation models, and technology scalability before considering positions; evaluate the project against established agricultural technology competitors

DMTR Trading Participation Methods

- Direct Purchase: Acquire DMTR tokens directly on Gate.com, which supports this micro-cap asset across multiple trading pairs

- Staking and Rewards: Monitor Dimitra's official platform for any yield-generation or staking opportunities that provide returns beyond price appreciation

- Portfolio Diversification: Combine small DMTR allocations with larger positions in established blockchain infrastructure tokens to balance portfolio risk

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. All investors should make decisions based on their individual risk tolerance and financial situation. Consult with professional financial advisors before committing capital. Never invest more than you can afford to lose completely.

FAQ

What is the all time high for Dimitra coin?

The all-time high for Dimitra coin is $2.51, which was reached at its launch. This represents the highest price ever paid for DMTR since the coin was launched.

What is the price of DMTR?

The current price of DMTR is $0.014311 as of December 22, 2025, down 0.06% in the past 24 hours. Real-time prices fluctuate based on market conditions.

Who is the owner of Dimitra coin?

Jon Trask is the founder and owner of Dimitra coin. He played a pivotal role in creating the project and continues to lead its development and vision.

2025 BLESS Price Prediction: Analyzing Market Trends and Future Potential for Investors

2025 HONEYPrice Prediction: Market Analysis and Future Outlook for the Sweet Commodity

Is Roam (ROAM) a Good Investment?: Analyzing Market Potential and Long-Term Prospects for this Digital Nomad Token

Is Fluence (FLT) a good investment?: Analyzing the potential and risks of this decentralized cloud computing platform

2025 GRASS Price Prediction: Analyzing Market Trends and Potential Growth Factors

Is Dimitra (DMTR) a Good Investment?: Analyzing the Potential and Risks of Agricultural Blockchain Technology

Is FreeStyle Classic Token (FST) a good investment?: A Comprehensive Analysis of Risks, Returns, and Market Potential

Understanding Polymarket: A Guide to Decentralized Prediction Markets

Is Arena-Z (A2Z) a good investment?: A Comprehensive Analysis of Risks, Opportunities, and Market Potential

Is Turtle (TURTLE) a good investment?: A Comprehensive Analysis of Risks, Opportunities, and Market Potential in 2024

Is TCOM (TCOM) a good investment?: A comprehensive analysis of China's leading online travel platform's growth potential and market outlook