2025 FIDA Price Prediction: Expert Analysis and Market Outlook for the Coming Year

Introduction: FIDA's Market Position and Investment Value

FIDA (Bonfida) is a comprehensive product suite connecting the growing ecosystem of Serum and Solana users, serving as the flagship front-end interface for Serum. Since its emergence, FIDA has established itself as a critical infrastructure component within the Solana DeFi landscape. As of December 2025, FIDA's market capitalization stands at approximately $37.25 million, with a circulating supply of around 990.91 million tokens, trading at $0.03759. This asset, recognized as a "one-stop solution for DeFi ecosystem development," is playing an increasingly important role in Solana data analytics and decentralized exchange functionality.

This article will provide a comprehensive analysis of FIDA's price trends through 2030, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for crypto asset investors.

FIDA Market Analysis Report

I. FIDA Price History Review and Current Market Status

FIDA Historical Price Movement

-

November 4, 2021: FIDA reached its all-time high of $59.61, marking the peak of its market valuation during the broader cryptocurrency bull market cycle.

-

June 23, 2025: FIDA touched its all-time low of $0.0527, representing a significant decline from historical peaks as market conditions shifted.

-

December 19, 2025: FIDA is currently trading at $0.03759, positioned below its recent low, reflecting continued downward pressure in the market.

FIDA Current Market Status

As of December 19, 2025, FIDA demonstrates the following market characteristics:

Price Performance:

- Current Price: $0.03759

- 24-hour Change: -3.63%

- 7-day Change: -16.43%

- 30-day Change: -21.94%

- 1-year Change: -87.88%

Market Capitalization and Supply:

- Total Market Cap: $37,248,358.64

- Fully Diluted Valuation (FDV): $37,248,358.64

- Circulating Supply: 990,911,376.51 FIDA

- Total Supply: 990,911,376.51 FIDA

- Market Dominance: 0.0012%

- Market Cap/FDV Ratio: 99.09%

Trading Activity:

- 24-hour Trading Volume: $90,227.24

- 24-hour High: $0.04036

- 24-hour Low: $0.03677

- Number of Active Holders: 50,232

- Exchange Listings: 31

Market Sentiment:

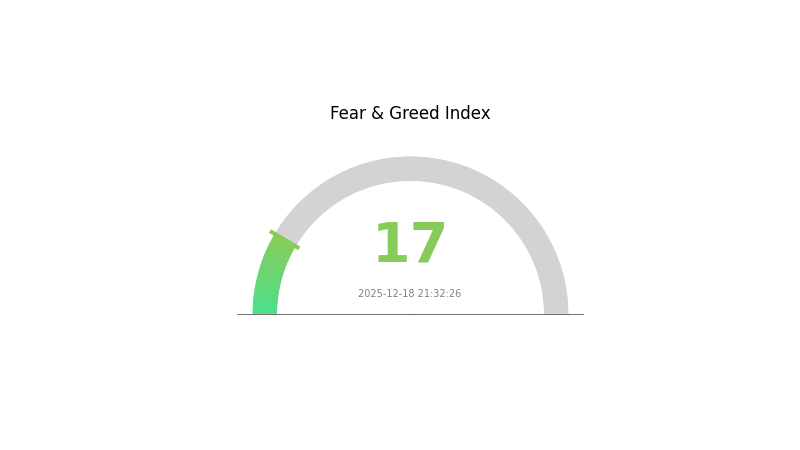

- Current Market Emotion Index: Extreme Fear (VIX Level: 17)

Check current FIDA market price on Gate.com

FIDA Market Sentiment Index

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 17. This exceptionally low reading indicates severe market pessimism and heightened investor anxiety. Such extreme fear conditions often present contrarian opportunities for long-term investors, as panic selling can create attractive entry points. However, caution remains essential during periods of extreme uncertainty. Market participants should consider their risk tolerance and investment horizon carefully. Monitoring this index on Gate.com helps traders understand broader market sentiment and make more informed decisions during volatile periods.

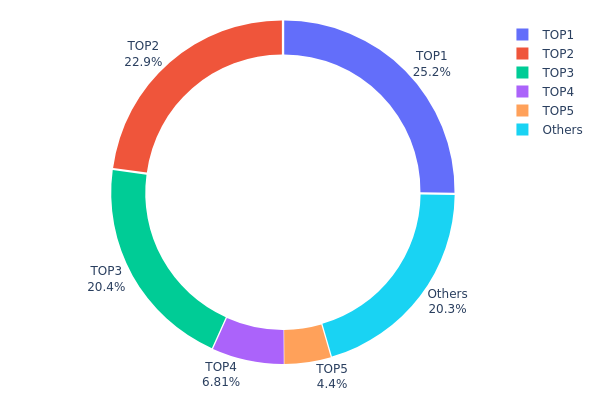

FIDA Holdings Distribution

The address holdings distribution chart illustrates the concentration of FIDA tokens across individual wallet addresses, serving as a critical indicator of token decentralization and potential market manipulation risk. By analyzing the top token holders and their respective portfolio weights, investors can assess the degree of wealth concentration within the FIDA ecosystem and evaluate the sustainability of the token's market structure.

Current data reveals a highly concentrated distribution pattern, with the top three addresses collectively controlling 68.46% of total FIDA supply. The leading address holds 25.18%, followed closely by the second and third addresses at 22.86% and 20.42% respectively. This significant concentration among a limited number of holders presents notable structural risks. The top five addresses account for 79.67% of all tokens, leaving only 20.33% distributed among remaining holders. Such extreme concentration raises concerns regarding potential price volatility triggered by coordinated movements or strategic liquidations from major holders, particularly given the potential for whale-driven market manipulation.

The distribution pattern indicates a relatively low degree of decentralization in FIDA's token structure. While the presence of "Others" category holding 20.33% suggests some level of retail participation, the dominance of institutional or early-stage holders remains pronounced. This concentration dynamic suggests that price discovery mechanisms may be significantly influenced by the actions of top-tier holders, potentially limiting organic market price formation. The current holdings distribution reflects a market structure characteristic of earlier-stage tokens or projects with concentrated founder and investor allocations, warranting careful monitoring of large holder movements and trading behaviors on platforms like Gate.com to anticipate potential market shifts.

View current FIDA holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 6b4ayp...TQJfQA | 249525.16K | 25.18% |

| 2 | 9WzDXw...YtAWWM | 226615.07K | 22.86% |

| 3 | 8Mm46C...zrMZQH | 202386.56K | 20.42% |

| 4 | 8HUWJo...nUQ1kC | 67500.00K | 6.81% |

| 5 | AEpdbR...N6KtCo | 43602.37K | 4.40% |

| - | Others | 201281.88K | 20.33% |

II. Core Factors Influencing FIDA's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Federal Reserve rate cuts enhance confidence among risk asset traders and may signal the beginning of a loose monetary cycle, which drives cryptocurrency price increases including FIDA.

-

Overall Market Trends: FIDA's price volatility is closely related to the overall cryptocurrency market trends and industry dynamics, which will influence FIDA's long-term price movements.

Technology Development and Ecosystem Construction

-

Fundamental Analysis Tools: Bonfida provides comprehensive fundamental analysis tools that enable users to research industry, economic, and political factors affecting cryptocurrency prices, supporting better market analysis.

-

Market Sentiment and Adoption: Cryptocurrency prices are influenced by various factors including market demand, adoption rates, technological development, regulatory changes, and overall market sentiment.

III. 2025-2030 FIDA Price Forecast

2025 Outlook

- Conservative Forecast: $0.03253 - $0.03782

- Neutral Forecast: $0.03782

- Bullish Forecast: $0.04501 (requires sustained ecosystem development and increased institutional adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual accumulation phase with steady growth trajectory, driven by protocol maturation and expanding use cases within the Solana ecosystem

- Price Range Predictions:

- 2026: $0.02692 - $0.04721 (10% growth potential)

- 2027: $0.02614 - $0.0483 (17% growth potential)

- 2028: $0.03334 - $0.0514 (23% growth potential)

- Key Catalysts: Platform feature releases, strategic partnerships, increased DeFi integration, and broader market sentiment recovery

2029-2030 Long-term Outlook

- Base Case: $0.03029 - $0.06546 by 2029 (assumes moderate ecosystem adoption and stable market conditions)

- Bullish Case: $0.04885 - $0.06546 by 2029-2030 (assumes accelerated protocol adoption and positive regulatory environment)

- Transformative Case: $0.08116 by 2030 (assumes breakthrough in institutional adoption, major protocol upgrades, and favorable cryptocurrency market cycles with 52% cumulative growth)

The projected trajectory demonstrates consistent upward momentum through 2030, with FIDA potentially reaching $0.08116 at peak levels, contingent upon sustained development velocity and market expansion within the Solana-based DeFi landscape.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04501 | 0.03782 | 0.03253 | 0 |

| 2026 | 0.04721 | 0.04141 | 0.02692 | 10 |

| 2027 | 0.0483 | 0.04431 | 0.02614 | 17 |

| 2028 | 0.0514 | 0.04631 | 0.03334 | 23 |

| 2029 | 0.06546 | 0.04885 | 0.03029 | 29 |

| 2030 | 0.08116 | 0.05716 | 0.03715 | 52 |

FIDA Investment Strategy and Risk Management Report

IV. FIDA Professional Investment Strategy and Risk Management

FIDA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors and protocol believers who support the Solana ecosystem development

- Operation suggestions:

- Accumulate during market downturns when FIDA experiences significant price corrections, leveraging dollar-cost averaging to reduce average acquisition costs

- Hold through market cycles to benefit from potential protocol adoption growth and ecosystem expansion

- Monitor key metrics including trading volume on Serum DEX and API demand growth rates among market makers

(2) Active Trading Strategy

- Technical analysis tools:

- Price action analysis: Track the 24-hour, 7-day, and 30-day price trends to identify support and resistance levels given FIDA's high volatility

- Volume analysis: Monitor the 24-hour trading volume of $90,227.24 as a confirmation signal for trend strength and breakout validity

- Wave operation key points:

- Execute buy signals during temporary downturns in the short-term price cycle, taking advantage of the -3.63% 24-hour decline

- Set profit-taking targets at resistance levels identified through historical price analysis, with particular attention to the -16.43% 7-day decline indicating recent selling pressure

FIDA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% portfolio allocation to FIDA given its high volatility and speculative nature

- Active investors: 3-8% portfolio allocation to balance growth potential with portfolio stability

- Professional investors: 5-15% allocation depending on specific fund mandates and risk parameters

(2) Risk Hedging Solutions

- Diversification strategy: Combine FIDA holdings with other Solana ecosystem tokens and stablecoins to reduce single-asset concentration risk

- Position sizing: Scale positions based on volatility indicators to limit downside exposure while maintaining upside participation potential

(3) Secure Storage Solutions

- Hot wallet option: Gate.com Web3 Wallet for frequent trading and active management with multi-signature security features

- Hardware security approach: Transfer long-term holdings to secure offline storage solutions to protect against exchange-related risks

- Security considerations: Never share private keys, enable two-factor authentication on all trading accounts, and regularly verify contract addresses before transfers to prevent phishing attacks

V. FIDA Potential Risks and Challenges

FIDA Market Risk

- Extreme price volatility: FIDA has experienced an 87.88% decline over the past year and dropped from an all-time high of $59.61 to current levels near $0.0376, indicating significant speculative activity and potential market manipulation risks

- Low trading liquidity: With 24-hour volume of only $90,227.24 relative to market capitalization, large trades could substantially impact pricing and create slippage risks

- Market sentiment deterioration: The -21.94% 30-day decline and recent all-time low of $0.0527 on June 23, 2025, signal weakening investor confidence and potential further downside pressure

FIDA Regulatory Risk

- Blockchain regulatory uncertainty: Changes in Solana ecosystem regulation or token classification could impact FIDA's utility and market demand

- Compliance requirements: Future regulatory frameworks may impose restrictions on trading, holding, or use of protocol tokens like FIDA

- Geographic restrictions: Different jurisdictions may impose varying restrictions on token trading, limiting market access and liquidity

FIDA Technical Risk

- Protocol dependency: FIDA's value is intrinsically linked to Serum protocol adoption and Solana network stability; technical failures or protocol vulnerabilities could severely impact token value

- Ecosystem competition: Other data analytics and trading platforms on Solana may reduce demand for Bonfida's services and API usage

- Scaling challenges: Increased network congestion on Solana could degrade platform performance and user experience for Bonfida services

VI. Conclusion and Action Recommendations

FIDA Investment Value Assessment

FIDA operates within the Solana ecosystem as a protocol token for the Bonfida platform, which serves as a frontend for Serum DEX and provides data analytics services. While the project demonstrates potential utility through reported 25% weekly API demand growth from major market makers, the token's investment profile remains highly speculative. The dramatic decline from $59.61 to $0.0376 represents a 99.94% drawdown from historical highs, indicating significant market repricing. Current market dynamics suggest FIDA is in recovery phase, though validation of fundamental demand growth is essential before significant capital allocation.

FIDA Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of trading portfolio) focused on learning the Solana ecosystem; consider dollar-cost averaging small amounts monthly rather than lump-sum purchases to manage timing risk

✅ Experienced investors: Implement core-satellite strategy with 3-5% portfolio weight; use technical analysis to identify accumulation zones around key support levels while maintaining strict stop-losses at -15% to -20% from entry

✅ Institutional investors: Conduct thorough due diligence on Bonfida API usage metrics and Serum protocol adoption trends before allocating capital; consider exposure only as tactical allocation within diversified Solana ecosystem positions

FIDA Trading Participation Methods

- Exchange trading: Access FIDA through Gate.com's spot trading markets with competitive fees and high liquidity

- API integration: Qualified market makers and traders can directly access real-time FIDA data through Bonfida API for automated trading strategies

- Community participation: Engage with the Bonfida community forum at https://forum.bonfida.org/ to stay informed on protocol developments and ecosystem initiatives

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. All investors must carefully evaluate their own risk tolerance and financial situation before participating. Always consult with qualified financial advisors before making investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

What is the all time high of FIDA coin?

The all-time high of FIDA coin is $59.61, reached on November 3, 2021. The price has declined significantly since then, currently down over 99% from its peak.

What will FET be worth in 2025?

FET is expected to reach between $0.84 and $1.00 in 2025. Based on expert analysis and market trends, this represents significant growth from current levels as adoption of Artificial Superintelligence Alliance expands.

What is Fida crypto?

Fida crypto, or Bonfida (FIDA), is a Solana-based project providing decentralized identity solutions and developer tools. The FIDA token enables governance and transactions within the Bonfida ecosystem, enhancing privacy and security for digital identities.

Which coin price prediction 2030?

FIDA price predictions for 2030 remain highly speculative. Based on current market trends and adoption growth, FIDA could potentially reach $0.50-$2.00 depending on ecosystem development and market conditions. However, crypto volatility means actual prices may differ significantly from projections.

2025 JUP Price Prediction: Analyzing Market Trends and Potential Growth Factors for Jupiter's Native Token

2025 DBR Price Prediction: Expert Analysis and Market Forecast for Digital Blockchain Reserve Token

2025 WET Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Will Crypto Recover in 2025?

2025 DYDX Price Prediction: Evaluating Growth Potential and Market Factors for the Leading Derivatives Exchange Token

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

Discover Jupiter Airdrop Qualification Criteria

Guide to Redeeming a Crypto Red Packet Safely

Is OLAXBT (AIO) a good investment?: A Comprehensive Analysis of Features, Risks, and Potential Returns for 2024

Is Clearpool (CPOOL) a good investment?: A Comprehensive Analysis of Risk, Returns, and Market Potential

Is Moca Coin (MOCA) a good investment?: A comprehensive analysis of price potential, market trends, and risk factors in 2024