2025 FST Price Prediction: Expert Analysis and Market Outlook for Fastswap Token

Introduction: FST's Market Position and Investment Value

FreeStyle Classic Token (FST) represents a unique intersection of cultural expression and blockchain technology, positioning itself as a Web3-native platform where street culture, memes, and community ownership converge. As a BEP-20 token, FST has emerged as a community-driven cultural ecosystem that extends the legacy of FreeStyle Classic into the decentralized space.

As of December 22, 2025, FST maintains a market capitalization of approximately $8.69 million with a fully diluted valuation of $39.51 million. The token has a circulating supply of 220 million FST out of a total supply of 1 billion, with the current trading price hovering around $0.03951. This cultural and community-focused asset is establishing itself within the broader Web3 landscape by emphasizing participant co-creation and decentralized community governance.

This article provides a comprehensive analysis of FST's price dynamics and market trajectory through 2030, integrating historical price patterns, market supply-demand fundamentals, ecosystem development initiatives, and macroeconomic factors. The analysis aims to equip investors with data-driven price forecasts and actionable investment strategies tailored to FST's unique positioning in the cultural token segment.

FreeStyle Classic Token (FST) Market Analysis Report

I. FST Price History Review and Current Market Status

FST Historical Price Evolution

Based on the available data, FreeStyle Classic Token (FST) has experienced significant price volatility since its launch:

- September 20, 2025: FST reached its all-time high of $0.177, marking the peak of market enthusiasm for the project.

- August 25, 2025: FST hit its all-time low of $0.0252, representing a substantial correction from previous highs.

- December 22, 2025 (Current): FST is trading at $0.03951, reflecting a decline of 41.019% over the one-year period.

FST Current Market Conditions

As of December 22, 2025, FreeStyle Classic Token exhibits the following market characteristics:

Price Performance:

- Current Price: $0.03951

- 24-Hour Change: -0.95%

- 7-Day Change: -14.96%

- 30-Day Change: -19.15%

- 1-Year Change: -41.019%

- 24-Hour Price Range: $0.03938 to $0.03997

Market Capitalization & Supply Metrics:

- Market Capitalization: $8,692,200.00

- Fully Diluted Valuation (FDV): $39,510,000.00

- Market Cap to FDV Ratio: 22%

- Circulating Supply: 220,000,000 FST (22% of total supply)

- Total Supply: 1,000,000,000 FST

- Market Dominance: 0.0012%

Trading Activity:

- 24-Hour Trading Volume: $12,124.47

- Active Holders: 11,100

- Exchange Listings: 5 exchanges

- Market Ranking: #1,247

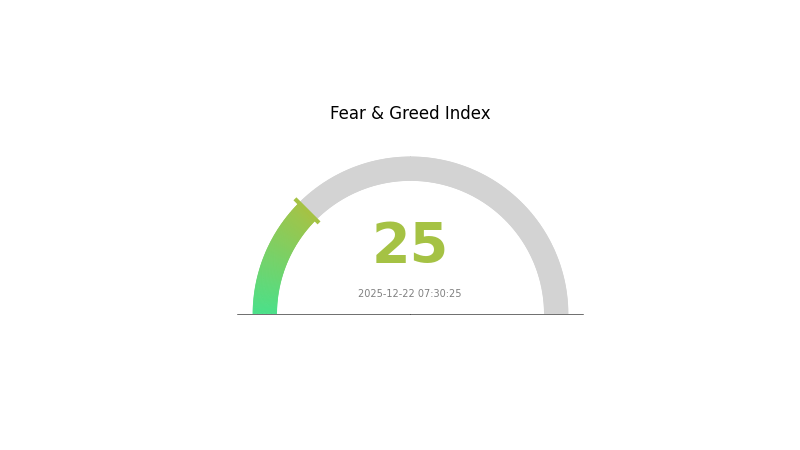

Market Sentiment: Current market sentiment reflects extreme fear (VIX: 25), indicating heightened volatility and risk aversion across crypto markets.

Access current FST market price

FST Market Sentiment Indicator

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the FST index dropping to 25. This severe sentiment indicates heightened panic among investors, likely driven by significant market volatility or bearish news. During such periods, opportunities often emerge for contrarian investors. However, extreme fear also signals potential downside risks. On Gate.com, you can track real-time market sentiment data and make informed trading decisions. Monitor key support levels closely and consider risk management strategies when the market enters extreme fear zones.

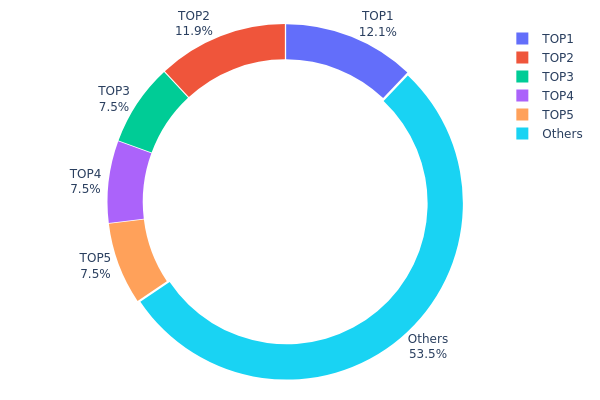

FST Holdings Distribution

The address holdings distribution map illustrates the concentration of FST token ownership across the blockchain network, revealing how token supply is allocated among individual addresses. This metric serves as a critical indicator of decentralization, market structure stability, and potential vulnerability to coordinated price movements or market manipulation.

FST's current holdings distribution demonstrates moderate concentration characteristics. The top five addresses collectively control 46.48% of the token supply, with the largest holder possessing 12.07% and the second-largest holding 11.91%. While these figures indicate meaningful concentration among major stakeholders, the remaining 53.52% dispersed among other addresses suggests a relatively distributed ownership structure. Notably, the third through fifth largest holders each maintain identical positions of 7.50%, which may warrant further investigation regarding their operational relationships or strategic alignment.

The existing distribution pattern presents a balanced risk profile for market dynamics. The absence of extreme concentration—where a single entity controls an overwhelming majority—mitigates acute manipulation risks inherent in highly centralized token structures. However, the concentration of nearly half the supply among five addresses does create potential for coordinated actions that could influence price discovery and market volatility during periods of reduced liquidity. The substantial "Others" category reinforces that FST maintains a decentralized foundation, though continued monitoring of address accumulation patterns remains essential to assess whether concentration trends intensify or diffuse over time.

Click to view current FST holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa5a8...ab05b7 | 120713.66K | 12.07% |

| 2 | 0x7a24...c724bd | 119166.67K | 11.91% |

| 3 | 0xef18...546db3 | 75000.00K | 7.50% |

| 4 | 0x63e7...f7478f | 75000.00K | 7.50% |

| 5 | 0x6eea...83e985 | 75000.00K | 7.50% |

| - | Others | 535119.67K | 53.52% |

II. Core Factors Influencing FST's Future Price

Macroeconomic Environment

-

Federal Reserve Policy Impact: The monetary policy stance of major central banks, particularly the U.S. Federal Reserve, plays a significant role in shaping market dynamics. Recent expectations suggest potential rate adjustments throughout 2024-2025, which can influence liquidity conditions and overall market sentiment for digital assets. A more accommodative policy environment may provide tailwinds for risk assets, while tightening cycles could create headwinds.

-

Inflation Hedge Characteristics: Inflation remains a key factor affecting emerging market cycles, with current data significantly above target levels. Digital assets like FST may benefit in inflationary environments as investors seek alternative stores of value, though this relationship is complex and varies with broader economic conditions and growth momentum.

-

Geopolitical Factors: Rising geopolitical uncertainties, including regional conflicts and policy uncertainty, can create market volatility. These macro risks may influence capital flows and investor sentiment, potentially impacting trading volumes and price discovery mechanisms for tokens traded on platforms like Gate.com.

Market Dynamics and Trading Mechanisms

-

Trading Volume and Market Demand: FST's future price movement is primarily influenced by market demand and trading volumes. Fluctuations in transaction activity directly affect price discovery and liquidity conditions.

-

High-Frequency Trading Impact: High-frequency trading strategies have become increasingly prevalent in financial markets, including cryptocurrency venues. These algorithms can amplify market movements and create rapid price adjustments based on information flows. The speed and frequency of automated trading can contribute to both increased market efficiency and potential volatility spikes, similar to historical phenomena observed in traditional securities markets.

Three、2025-2030 FST Price Forecast

2025 Outlook

- Conservative Prediction: $0.03603 - $0.03959

- Neutral Prediction: $0.03959

- Optimistic Prediction: $0.05186 (requires market sentiment improvement and increased adoption)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery phase with consolidation, followed by accelerated growth momentum as ecosystem development progresses

- Price Range Prediction:

- 2026: $0.03384 - $0.06539

- 2027: $0.05056 - $0.08278

- 2028: $0.03666 - $0.07194

- Key Catalysts: Enhanced protocol functionality, expanded partnership ecosystem, increased institutional participation, and improved market liquidity on platforms like Gate.com

2029-2030 Long-term Outlook

- Base Scenario: $0.07055 - $0.09031 (assuming steady ecosystem growth and moderate adoption)

- Optimistic Scenario: $0.06209 - $0.11662 (assumes accelerated user growth and successful feature implementations)

- Transformation Scenario: Above $0.11662 (assumes breakthrough in mainstream adoption and significant technological advancements)

- December 22, 2025: FST trades at $0.03959 (current market equilibrium phase)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05186 | 0.03959 | 0.03603 | 0 |

| 2026 | 0.06539 | 0.04573 | 0.03384 | 15 |

| 2027 | 0.08278 | 0.05556 | 0.05056 | 40 |

| 2028 | 0.07194 | 0.06917 | 0.03666 | 75 |

| 2029 | 0.09031 | 0.07055 | 0.06209 | 78 |

| 2030 | 0.11662 | 0.08043 | 0.07802 | 103 |

FreeStyle Classic Token (FST) Investment Analysis Report

IV. FST Professional Investment Strategy and Risk Management

FST Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Community-focused participants who believe in cultural tokenization and Web3 cultural ecosystems

- Operational Recommendations:

- Accumulate FST during market dips, particularly when prices fall below $0.035

- Hold tokens through market cycles to benefit from potential community growth and cultural adoption

- Participate in community governance and cultural initiatives to maximize engagement value

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price levels at $0.0252 (all-time low from August 25, 2025) and $0.177 (all-time high from September 20, 2025)

- Volume Analysis: Track 24-hour trading volume (currently $12,124.47) to identify breakout opportunities and market sentiment shifts

- Wave Trading Key Points:

- Enter positions during negative momentum phases (current 7-day decline of -14.96%)

- Exit or take profits during recovery rallies above the 24-hour high of $0.03997

- Monitor hourly price action for short-term trading opportunities

FST Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of cryptocurrency portfolio allocation

- Active Investors: 3-7% of cryptocurrency portfolio allocation

- Professional Investors: 5-10% of cryptocurrency portfolio allocation

(2) Risk Hedging Solutions

- Diversification Strategy: Combine FST holdings with other established cryptocurrencies to reduce concentration risk

- Position Sizing: Limit individual FST position size to prevent significant portfolio impact from price volatility

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for frequent trading and community participation

- Cold Storage Approach: Transfer large FST holdings to secure cold storage for long-term protection

- Security Precautions: Enable multi-factor authentication, never share private keys, verify contract addresses before transactions (FST contract: 0xfa35e2250e376c23955247383dc32c79082e7fcc on BSC)

V. FST Potential Risks and Challenges

FST Market Risks

- Price Volatility: FST has experienced significant price fluctuations with a -41.019% decline over the past year, indicating high volatility and unpredictable market movements

- Limited Liquidity: With 24-hour volume of only $12,124.47 and presence on only 5 exchanges, FST faces liquidity constraints that may impact entry and exit ability

- Market Capitalization Concentration: The $8.69 million market cap represents a relatively small position in the crypto market with 0.0012% dominance, making it vulnerable to market manipulation

FST Regulatory Risks

- Emerging Regulatory Framework: Cultural tokens and Web3 community projects operate in an evolving regulatory environment with unclear compliance requirements

- Jurisdiction Uncertainties: Different countries may impose varying regulations on tokens tied to cultural movements and community ownership models

- Compliance Evolution: Future regulatory changes could impact FST's operational status or community participation mechanisms

FST Technical Risks

- BEP-20 Smart Contract Risk: As a BSC-based token, FST depends on Binance Smart Chain infrastructure stability and security

- Token Distribution Concerns: With 22% of total supply in circulation (220 million of 1 billion tokens), significant future dilution is possible

- Limited Development Infrastructure: Lack of published whitepaper or visible technical development resources raises questions about ongoing development and security audits

VI. Conclusion and Action Recommendations

FST Investment Value Assessment

FreeStyle Classic Token represents an experimental intersection of cultural expression and blockchain technology. While the project's positioning within the Web3 cultural ecosystem offers unique engagement value for community participants, the token faces significant market challenges including limited liquidity, low market capitalization, and substantial price volatility. The project's current focus on cultural and meme-driven community participation may appeal to engaged users but presents concentrated investment risk for portfolio investors. Long-term viability depends on sustained community growth, expanding exchange listings, and successful cultural adoption in the Web3 space.

FST Investment Recommendations

✅ Beginners: Start with minimal allocation (under 1% of crypto portfolio), participate in community activities to understand project dynamics before increasing exposure, and use Gate.com for secure trading

✅ Experienced Investors: Implement dollar-cost averaging during downtrends, actively monitor community sentiment across social channels (@FreeStyle_Web3 on Twitter), and set strict stop-loss orders at 10-15% below entry points

✅ Institutional Investors: Conduct comprehensive due diligence on project governance and tokenomics, evaluate community metrics and holder concentration, and consider FST only as a small alternative allocation with clear exit strategies

FST Trading and Participation Methods

- Gate.com Trading: Execute spot trading through Gate.com's platform for direct FST purchases and sales

- Community Participation: Engage with the FreeStyle Classic community ecosystem through cultural content creation and social participation

- Long-term Positioning: Accumulate FST during extended downtrends while the project develops infrastructure and expands its cultural footprint

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. Consultation with professional financial advisors is strongly recommended. Never invest more than you can afford to lose.

FAQ

What is the historical price trend of FST? What factors influence its price movements?

FST price movements are driven by supply and demand dynamics, market sentiment, and investor activity. Historical price trends show complex fluctuations influenced by ecosystem developments, trading volume, and broader cryptocurrency market conditions.

How to predict FST price? What are the common technical analysis methods?

Common technical analysis methods include moving averages and RSI(Relative Strength Index). By analyzing historical price data and trading volume, traders can identify market trends and potential buy/sell signals to predict FST's future price movements.

What could FST's future price reach? What are the risks of investing in FST?

FST's future price may potentially rebound to $0.01-$0.05 range depending on market adoption and ecosystem growth. Investment risks include market volatility, liquidity fluctuations, and regulatory uncertainties inherent in crypto assets.

FST与其他加密货币相比,价格潜力如何?

FST currently trades at low levels with significant recovery potential. As an emerging asset with relatively low market cap, it offers higher upside compared to established cryptocurrencies. Early adopters may benefit from substantial price appreciation as adoption grows.

What are the main fundamental factors affecting FST price?

FST price is primarily influenced by supply mechanisms, institutional adoption, technological advancements, ecosystem development, and macroeconomic conditions. These factors directly drive market demand and investor confidence in the token.

2025 XLM Price Prediction: Stellar Lumens' Potential Growth Trajectory in a Maturing Crypto Ecosystem

2025 1INCH Price Prediction: Analyzing Growth Potential and Market Trends for the DeFi Aggregator Token

2025 FTT Price Prediction: Analyzing Market Trends and Potential Growth Factors in the Digital Asset Ecosystem

2025 TURBO Price Prediction: Analyzing Market Trends and Future Valuation Prospects in the Evolving Cryptocurrency Ecosystem

2025 AWE Price Prediction: Comprehensive Analysis of Market Trends and Future Growth Potential

2025 XCNPrice Prediction: Will XCN Token Reach New Heights in the Post-Halving Bull Market?

What is PROPC: A Comprehensive Guide to Process-Oriented Programming and Control Structures

What is KRL: A Comprehensive Guide to the KUKA Robot Language and Its Applications in Industrial Automation

What is ALU: Understanding the Arithmetic Logic Unit and Its Role in Computer Processing

What is HEMI: A Comprehensive Guide to Chrysler's Revolutionary Engine Technology

What is GALFAN: A Revolutionary Coating Technology for Enhanced Corrosion Protection and Durability