2025 MDT Price Prediction: Expert Analysis and Market Outlook for Measurable Data Token

Introduction: MDT's Market Position and Investment Value

MeasurableDataToken (MDT) functions as a decentralized communication unit within a blockchain-based big data value economic ecosystem, connecting users, data purchasers, and data suppliers. Since its inception in 2017, MDT has established itself as a quantifiable asset for data value exchange. As of 2025, MDT's market capitalization stands at approximately $13.58 million, with a circulating supply of around 606.32 million tokens, currently trading at $0.013578 per token. This asset is instrumental in creating a fair and transparent data trading environment by incentivizing users to share anonymous data while providing efficient consumption solutions for data buyers.

This article will comprehensively analyze MDT's price trajectory from 2025 through 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors.

MeasurableDataToken (MDT) Market Analysis Report

I. MDT Price History Review and Current Market Status

MDT Historical Price Evolution

MDT was launched on January 2, 2018, with an initial publication price of $0.14. The token has experienced significant volatility over its lifecycle:

-

2021: MDT reached its all-time high (ATH) of $0.168053 on December 26, 2021, marking the peak of market enthusiasm during the broader cryptocurrency bull market.

-

2018: The token experienced its all-time low (ATL) of $0.00173261 on December 18, 2018, reflecting the market downturn during that period.

-

2018-2025: Over the seven-year period, MDT has declined approximately 75.94% from its peak, indicating sustained pressure on the token's valuation through successive market cycles.

MDT Current Market Status

As of December 22, 2025, MDT is trading at $0.013578, reflecting a modest 0.09% increase over the past hour. However, the token shows weakness across longer timeframes, with a 24-hour decline of 1.41% and a more pronounced 7-day decrease of 10.53%. On a monthly basis, MDT has gained 2.55%, suggesting some recovery momentum, though the one-year performance remains deeply negative at -75.94%.

The 24-hour trading volume stands at $17,416.61, with a market capitalization of approximately $8.23 million. The token's fully diluted valuation (FDV) is $13.578 million, based on an unlimited maximum supply and a circulating supply of approximately 606.32 million tokens (representing 60.63% of the total 1 billion token supply). MDT currently ranks at position 1278 by market capitalization, with a market dominance of just 0.0041%. The token is listed on 18 exchanges and has 30,316 token holders, indicating a relatively distributed but modest holder base.

Click to view current MDT market price

MDT Market Sentiment Index

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index reading at 25. This indicates heightened pessimism among investors and significant market uncertainty. During periods of extreme fear, asset prices often reach attractive levels for long-term investors. However, caution is advised, as further market volatility may occur. Monitor key support levels closely and consider dollar-cost averaging strategies. Risk management remains crucial during such turbulent market conditions. For real-time market analysis and sentiment tracking, visit Gate.com's market sentiment dashboard.

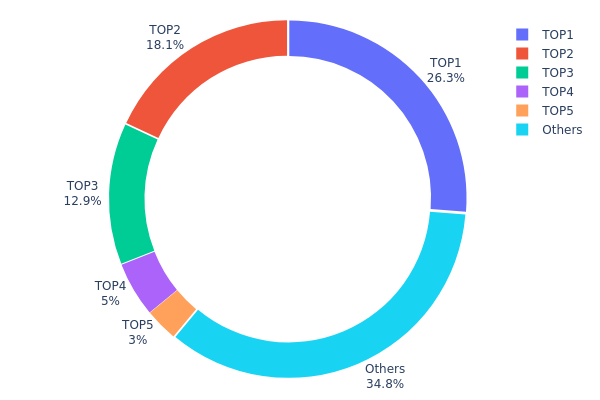

MDT Holdings Distribution

The address holdings distribution represents the concentration of MDT tokens across the blockchain, providing critical insights into token ownership patterns and potential market risks. By analyzing the top holders and their proportional stake in the total supply, this metric reveals the degree of decentralization and the vulnerability of the token to large-scale liquidation events or coordinated market movements.

MDT exhibits a notably concentrated holder structure, with the top five addresses controlling approximately 65.19% of the total token supply. The largest holder alone commands 26.25% of all MDT tokens, while the second-largest holder maintains an 18.09% stake. This level of concentration among a small number of addresses raises concerns about the token's susceptibility to market manipulation and the potential for sudden price volatility. The cumulative dominance of the top three holders at 57.19% indicates that decision-making by a limited number of entities could significantly influence market dynamics and token liquidity.

The remaining 34.81% of tokens distributed across other addresses demonstrates a fragmented secondary market structure. While this residual distribution suggests some degree of decentralization among smaller holders, it is substantially outweighed by the concentration at the top. The asymmetrical distribution pattern creates an inherent imbalance in market power, where coordinated actions by major holders could exert disproportionate influence over price discovery and market sentiment. This structural characteristic reflects a relatively early-stage or centralized token distribution model, typical of projects where significant allocations were reserved for founding teams, strategic investors, or development treasuries.

Click to view current MDT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 262564.60K | 26.25% |

| 2 | 0xa145...70c5b3 | 181000.00K | 18.09% |

| 3 | 0x4f4d...8f0ca4 | 128597.48K | 12.85% |

| 4 | 0x5a52...70efcb | 50000.00K | 5.00% |

| 5 | 0x2eb0...45ae2a | 30000.00K | 3.00% |

| - | Others | 347837.92K | 34.81% |

II. Core Factors Influencing MDT's Future Price

Data Value Metrics

-

Data Freshness (Time): The timeliness of data directly impacts its valuation. Fresh data commands higher market value compared to outdated information in MDT's decentralized data economy ecosystem.

-

Data Dimension (Data Specification): The granularity and comprehensiveness of datasets affect their pricing. Multi-dimensional data with richer specifications typically yields greater value in the platform's data monetization market.

Regulatory Compliance and Market Maturity

-

Regulatory Environment: Europe's push for transparent data access has created structural opportunities for MDT. However, regulatory compliance remains a critical constraint. Policy changes across jurisdictions could directly impact MDT's valuation, as governments maintain varying attitudes toward digital currencies.

-

Market Liquidity: Liquidity presents a key challenge for MDT as a lower market cap token. Insufficient liquidity causes even moderate sell orders to trigger sharp price declines, amplifying volatility for both short-term traders and long-term holders.

Market Sentiment and Derivative Indicators

-

Funding Rate Dynamics: MDT's derivative market recently turned negative, signaling dominant short positions. This indicates professional traders expect further price depreciation. The token has experienced a 74.21% decline over the past year, with recent 24-hour losses of 2.8%.

-

Options Market Growth: MDT's options market achieved a historic milestone with open interest reaching 500,000 contracts, reflecting increased demand for hedging and speculation. This suggests growing institutional recognition of MDT's decentralized data economy ecosystem, though negative funding rates reveal prevailing bearish sentiment.

-

Market Volatility: Broader crypto market turbulence, including over $1 billion in liquidations within 24 hours, has increased pressure on smaller market cap assets like MDT. Current market sentiment reflects extreme panic conditions among participants.

III. 2025-2030 MDT Price Forecast

2025 Outlook

- Conservative Forecast: $0.00991 - $0.01358

- Neutral Forecast: $0.01358 - $0.01969

- Optimistic Forecast: $0.01969 (requires sustained market sentiment and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Gradual recovery and accumulation phase with increasing institutional interest in the project fundamentals

- Price Range Predictions:

- 2026: $0.01297 - $0.02179 (22% potential upside)

- 2027: $0.01306 - $0.02344 (41% potential upside)

- Key Catalysts: Platform expansion, strategic partnerships, ecosystem growth initiatives, and improved market liquidity on platforms such as Gate.com

2028-2030 Long-term Outlook

- Base Case: $0.01152 - $0.03028 (assumes moderate adoption and steady ecosystem development by 2028)

- Optimistic Scenario: $0.01806 - $0.03561 (90% upside by 2029, contingent on accelerated mainstream adoption and strengthened tokenomics)

- Transformative Scenario: $0.01842 - $0.04391 (126% upside by 2030, requires breakthrough technological advancements and significant market capitalization expansion)

Note: These forecasts are based on historical trends and market analysis. Actual price movements may vary significantly based on regulatory changes, macroeconomic conditions, and project-specific developments.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01969 | 0.01358 | 0.00991 | 0 |

| 2026 | 0.02179 | 0.01663 | 0.01297 | 22 |

| 2027 | 0.02344 | 0.01921 | 0.01306 | 41 |

| 2028 | 0.03028 | 0.02132 | 0.01152 | 57 |

| 2029 | 0.03561 | 0.0258 | 0.01806 | 90 |

| 2030 | 0.04391 | 0.03071 | 0.01842 | 126 |

MDT (Measurable Data Token) Professional Investment Strategy and Risk Analysis Report

IV. MDT Professional Investment Strategy and Risk Management

MDT Investment Methodology

(1) Long-Term Holding Strategy

-

Target Investors: Value-focused investors with long-term conviction in decentralized data economy models, believing in the fundamental utility of data tokenization platforms.

-

Operational Recommendations:

- Accumulate during market downturns when MDT trades significantly below its historical average, leveraging dollar-cost averaging to reduce average entry prices.

- Hold positions through market cycles, focusing on the platform's ecosystem development and adoption metrics rather than short-term price volatility.

- Reinvest any transaction rewards or platform incentives to compound holdings over extended periods.

-

Storage Solutions:

- Utilize Gate Web3 wallet for secure self-custody with direct access to platform features and rewards.

- Maintain private key backups in secure, offline locations for enhanced security.

- Consider cold storage for portions exceeding amounts needed for regular transactions.

(2) Active Trading Strategy

-

Technical Analysis Framework:

- Support and Resistance Levels: Monitor key historical price points (recent high of $0.013803 and low of $0.013016 in 24-hour period) to identify optimal entry and exit positions.

- Volume Analysis: Track the 24-hour trading volume of approximately $17,416.61 to assess liquidity and potential price movement significance.

-

Swing Trading Considerations:

- Capitalize on the 7-day downtrend of -10.53% by identifying potential reversal points and oversold conditions.

- Monitor 1-hour price changes (+0.09%) for short-term momentum trading opportunities, while remaining cognizant of wider timeframe trends.

MDT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total cryptocurrency portfolio allocation to MDT, emphasizing capital preservation over growth.

- Active Investors: 3-7% of total cryptocurrency portfolio allocation, allowing moderate exposure to platform development and ecosystem growth.

- Professional/Institutional Investors: 5-15% allocation with diversified entry strategies and sophisticated hedging mechanisms in place.

(2) Risk Mitigation Strategies

- Portfolio Diversification: Combine MDT holdings with other data economy tokens and blockchain assets to reduce concentration risk and correlations.

- Position Sizing: Establish stop-loss orders at 15-20% below entry price to limit downside exposure during adverse market movements.

(3) Secure Storage Solutions

-

Web3 Wallet Recommendation: Gate Web3 Wallet provides integrated security features with direct access to blockchain ecosystems, enabling secure self-custody while maintaining flexibility for active trading or participation in platform rewards.

-

Hot Wallet Strategy: Maintain only transaction-required amounts in exchange wallets on Gate.com; transfer remaining holdings to personal custody immediately after acquisition.

-

Critical Security Measures:

- Implement two-factor authentication on all exchange and wallet accounts.

- Never share private keys, seed phrases, or recovery information with third parties.

- Verify all transaction details before confirming, particularly wallet addresses and transfer amounts.

- Utilize hardware-backed security features when available through Gate Web3 Wallet.

V. MDT Potential Risks and Challenges

Market Risk Factors

-

Extreme Price Volatility: MDT exhibits substantial price fluctuations, trading down -75.94% over the past year from approximately $0.0554 to current $0.0136, demonstrating significant downside risk potential.

-

Low Liquidity Concerns: With 24-hour trading volume of only $17,416.61 and a market cap of $8.23 million, MDT faces liquidity constraints that could result in slippage during large trades and difficulty executing positions at desired prices.

-

Limited Market Adoption: Current market ranking of 1,278 among cryptocurrencies, combined with relatively low trading volume, suggests limited mainstream adoption and potentially restricted growth ceiling compared to established blockchain projects.

Regulatory Risk Considerations

-

Data Privacy Regulations: Evolving global data protection laws (GDPR, CCPA, and emerging regulations) may conflict with or restrict MDT's decentralized data marketplace operations, potentially impacting platform viability.

-

Token Classification Uncertainty: Regulatory bodies may reclassify MDT from utility token to security token status in various jurisdictions, triggering compliance complications and exchange listing restrictions.

-

Jurisdictional Restrictions: Different countries maintain varying approaches to data trading and blockchain technology; MDT may face operational restrictions or market access limitations in key regulatory regions.

Technical and Operational Risks

-

Platform Dependency: MDT's value is fundamentally tied to the adoption and success of the Measurable Data Token ecosystem; failure of platform development or user adoption could substantially diminish token utility.

-

Smart Contract Vulnerabilities: As an ERC-20 token on Ethereum, MDT remains subject to potential smart contract bugs, exploits, or unforeseen technical issues that could compromise token functionality or security.

-

Competition from Established Platforms: Alternative data economy solutions and larger blockchain projects may offer superior features, liquidity, or institutional support, potentially diverting users and reducing MDT's competitive positioning.

VI. Conclusion and Action Recommendations

MDT Investment Value Assessment

MDT represents a speculative opportunity within the decentralized data economy sector, with a unique positioning as a tokenized incentive mechanism for anonymous data sharing. The current market valuation of $8.23 million reflects significant downside from historical peaks, presenting potential accumulation opportunities for long-term believers in data tokenization models. However, the 75.94% year-over-year decline, low trading liquidity, and unproven mainstream platform adoption indicate substantial risk factors. The token's future value trajectory depends critically on successful ecosystem development, regulatory clarity, and achieving meaningful user adoption in data marketplace operations.

Investment Recommendations by Investor Profile

✅ Beginners: Allocate a minimal, non-critical position (0.5-1.5% of crypto portfolio) through Gate.com as a speculative bet on data economy tokenization. Focus on educational understanding of the platform's value proposition before increasing exposure. Set strict position sizing limits and maintain diversified holdings.

✅ Experienced Investors: Implement a structured dollar-cost averaging approach across market cycles, targeting 3-5% portfolio allocation at favorable price levels. Utilize technical analysis to identify accumulation zones during extended downtrends. Actively monitor platform development metrics, partnership announcements, and regulatory developments affecting data privacy frameworks.

✅ Institutional Investors: Execute diversified entry strategies across multiple price points, combining direct holdings with derivative positions for yield generation. Establish comprehensive risk management protocols including position limits, stop-loss mechanisms, and portfolio correlation analysis. Maintain active engagement with project governance and ecosystem participants to inform investment thesis evolution.

MDT Trading Participation Methods

-

Spot Trading on Gate.com: Purchase MDT directly using fiat currency or other cryptocurrency pairs, maintaining control over acquired tokens through Gate Web3 Wallet for enhanced security and autonomy.

-

Market Order Execution: Utilize immediate liquidity for position establishment or liquidation, accepting market prices to ensure transaction completion given potential liquidity constraints.

-

Limit Order Strategies: Set specific price targets for accumulation or distribution, enabling patient capital deployment at optimal entry points without forced execution at unfavorable prices.

Cryptocurrency investment carries extreme risk and volatility. This report is provided for informational purposes only and does not constitute investment advice, financial recommendation, or solicitation to buy or sell MDT or any other digital asset. Investors must conduct independent research, assess their individual risk tolerance, and consult qualified financial advisors before making investment decisions. Never invest capital exceeding amounts you can afford to lose completely. Regulatory environments remain uncertain and subject to rapid change, potentially materially affecting token valuations and utility.

FAQ

Does MDT crypto have a future?

Yes, MDT has promising potential. With growing adoption in data tokenization and decentralized markets, MDT's utility and value proposition continue to strengthen. Market expansion and technological advancements support long-term growth prospects.

What is MDT's long-term outlook?

MDT demonstrates strong long-term potential with robust ecosystem development and growing adoption in decentralized finance. Driven by continuous innovation and expanding market penetration, MDT is positioned for sustained growth and value appreciation in the Web3 space.

What factors influence MDT cryptocurrency price movements?

MDT price movements are influenced by market demand and supply dynamics, trading volume, overall crypto market sentiment, regulatory developments, technological updates, macroeconomic factors, and investor behavior shifts.

How does MDT compare to other cryptocurrencies in the same category?

MDT holds a market cap of $90.6 million, ranking #1727 on CoinGecko. With 610 million circulating tokens and recent 12.70% decline, it underperforms similar Ethereum ecosystem cryptocurrencies. MDT's 24-hour trading volume reaches $1.3 million, positioning it competitively within its category.

What is the historical price performance of MDT and what are the price predictions for 2025?

MDT has experienced price fluctuations throughout its history. Based on current analysis, MDT's average price for 2025 is estimated around $0.01. Historical performance shows volatility typical of emerging digital assets in the crypto market.

Where to Find Alpha in the 2025 Crypto Spot Market

why is crypto crashing and will it recover ?

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

Pi to GBP: Price and Prediction

2025 CHZ Price Prediction: Will Chiliz Soar to New Heights in the Crypto Sports Market?

2025 BRETTPrice Prediction: Analyzing Future Market Trends, Challenges, and Growth Potential

Top Privacy Coins for Investment with High Growth Potential in 2025

Beginner's Guide to Cryptocurrency ETFs

Step-by-Step Guide to Buying Blocktix (TIX)

2025 CUDIS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 SHDW Price Prediction: Expert Analysis and Market Forecast for Shadow Token's Growth Potential