2025 GMMT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: GMMT's Market Position and Investment Value

Giant Mammoth (GMMT) is a blockchain infrastructure project designed to extend and reuse existing modules while enabling developers and node operators to establish and run customized blockchains with internal value systems. Launched in 2023, the project has focused on providing greater flexibility and decentralization through improved architecture and security infrastructure. As of December 2025, GMMT has achieved a market capitalization of approximately $5.65 million, with a circulating supply of approximately 1.71 billion tokens and a current price hovering around $0.003299.

This innovative blockchain solution is increasingly playing a critical role in enabling customized blockchain development for enterprise users and decentralized applications. The platform's emphasis on modularity and smart contract architecture positions it as a notable infrastructure provider in the blockchain ecosystem.

This article will comprehensively analyze GMMT's price trajectory and market dynamics, incorporating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and actionable investment strategies for informed decision-making in the digital asset market.

Giant Mammoth (GMMT) Market Analysis Report

I. GMMT Price History Review and Current Market Status

GMMT Historical Price Movement Trajectory

- July 2023: All-time high (ATH) reached at $3.6909, marking the peak of the project's valuation cycle.

- December 2025: All-time low (ATL) hit at $0.002151 on December 17, 2025, representing a significant correction of approximately 94.17% from the ATH over a 2.5-year period.

GMMT Current Market Performance

As of December 23, 2025, GMMT is trading at $0.003299, with a 24-hour trading volume of $19,269.67. The token has experienced recent short-term volatility, declining 0.54% in the past hour and 1.43% over the last 24 hours. However, the 7-day performance shows notable strength with a 44.56% increase from the previous week, indicating potential recovery momentum. The one-month performance reflects a decline of 5.79%, while the year-to-date performance demonstrates a substantial loss of 70.66%.

GMMT currently ranks 1,460 in market capitalization rankings. The fully diluted market capitalization stands at approximately $6.89 million, with a circulating market cap of $5.65 million. The circulating supply comprises 1,713,747,017 tokens out of a total supply of 2,089,177,235 tokens, with a maximum supply cap of 5,000,000,000 tokens. The circulating tokens represent 34.27% of the maximum supply, indicating that approximately 65.73% of tokens remain in reserve.

The market sentiment currently reflects "Extreme Fear" conditions, with GMMT trading across 6 different exchanges. Market dominance remains minimal at 0.00021%, reflecting the token's relatively small position within the broader cryptocurrency market landscape.

Visit GMMT Market Price on Gate.com to view current trading information.

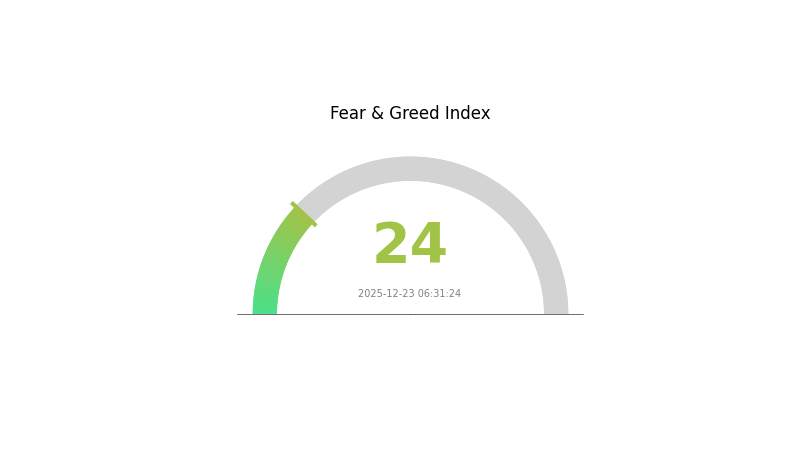

GMMT Market Sentiment Index

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 24. This indicates heightened market anxiety and pessimistic sentiment among investors. Such extreme fear levels often signal potential capitulation, where panic selling reaches peak levels. Historically, extreme fear periods have presented buying opportunities for contrarian investors with strong risk tolerance. However, caution remains essential as markets may continue declining before stabilizing. Traders should exercise prudent risk management and avoid making impulsive decisions during such volatile periods. Monitor key support levels and maintain proper portfolio diversification on Gate.com.

GMMT Address Distribution Analysis

The address holding distribution chart illustrates the concentration of GMMT tokens across different wallet addresses on the blockchain. This metric serves as a critical indicator of token ownership structure, revealing how evenly or unevenly assets are distributed among holders. By analyzing the top addresses and their respective shareholding percentages, we can assess the level of decentralization and identify potential concentration risks within the network.

Currently, the available data does not display specific address holdings and percentages, which limits our ability to provide a detailed concentration assessment. However, a robust decentralized ecosystem typically exhibits a relatively dispersed holding pattern, where no single or small group of addresses controls an excessive proportion of total supply. If GMMT demonstrates a well-distributed ownership structure across numerous addresses with relatively balanced holdings, this would indicate healthy decentralization and reduced susceptibility to market manipulation by large stakeholders.

The distribution pattern significantly influences market dynamics and price stability. Highly concentrated holdings among few addresses pose elevated risks of sudden selling pressure, price volatility, and potential market manipulation, as large holders possess substantial influence over supply and demand dynamics. Conversely, a more distributed address structure strengthens the network's resilience and fosters more organic price discovery through genuine market participation. Monitoring this distribution metric remains essential for evaluating GMMT's long-term sustainability and on-chain structural stability.

Check the current GMMT Address Distribution on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing GMMT's Future Price

Market Sentiment and Liquidity Dynamics

-

Market Sentiment Impact: Investor confidence and sentiment directly influence GMMT price movements. Positive market perception regarding widespread adoption or significant technical breakthroughs can drive price appreciation, while negative sentiment may trigger corrections.

-

Trading Volume and Liquidity: Trading volume plays a critical role in price discovery. Higher liquidity in trading pools results in lower slippage and reduced price volatility, while lower liquidity can amplify price fluctuations during transactions.

-

Liquidity Pool Changes: The addition or withdrawal of liquidity from trading pools directly affects price stability. Larger pools contribute to lower slippage and more stable pricing, whereas smaller pools are susceptible to greater price volatility from individual trades.

III. 2025-2030 GMMT Price Forecast

2025 Outlook

- Conservative Forecast: $0.00238 - $0.00292

- Neutral Forecast: $0.00330

- Bullish Forecast: $0.00366 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Forecast:

- 2026: $0.00292 - $0.00386

- 2027: $0.00352 - $0.00426

- 2028: $0.00361 - $0.00587

- Key Catalysts: Project milestone achievements, ecosystem expansion, market sentiment recovery, and potential adoption acceleration

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00339 - $0.00688 (assumes moderate adoption growth and stable market conditions through 2029)

- Bullish Scenario: $0.00443 - $0.00673 (contingent on significant network development and increased institutional interest by 2030)

- Transformative Scenario: $0.00673+ (predicated on breakthrough ecosystem achievements, mass adoption milestones, and favorable macroeconomic environment)

- 2025-12-23: GMMT trading activity continuing on major platforms including Gate.com, reflecting market participant confidence in the long-term value proposition

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00366 | 0.0033 | 0.00238 | 0 |

| 2026 | 0.00386 | 0.00348 | 0.00292 | 5 |

| 2027 | 0.00426 | 0.00367 | 0.00352 | 11 |

| 2028 | 0.00587 | 0.00397 | 0.00361 | 20 |

| 2029 | 0.00688 | 0.00492 | 0.00339 | 49 |

| 2030 | 0.00673 | 0.0059 | 0.00443 | 78 |

Giant Mammoth (GMMT) Professional Investment Strategy and Risk Management Report

IV. GMMT Professional Investment Strategy and Risk Management

GMMT Investment Methodology

(1) Long-term Hold Strategy

- Suitable for investors: Those with a 1-3 year investment horizon seeking exposure to blockchain infrastructure innovations

- Operational recommendations:

- Accumulate positions during price corrections, particularly when GMMT trades below $0.003

- Establish dollar-cost averaging (DCA) plans to reduce timing risk given the current 70.66% yearly decline

- Hold through market cycles to benefit from potential protocol upgrades and ecosystem expansion

- Monitor on-chain development milestones and network adoption metrics

(2) Active Trading Strategy

- Technical analysis tools:

- Support and Resistance Levels: Use the 7-day high of $0.003457 and 24-hour low of $0.003269 as dynamic reference points

- Volatility Indicators: Track the 44.56% 7-day surge against the -5.79% 30-day decline to identify momentum shifts

- Swing trading key points:

- Entry opportunities: Position when 24-hour volume exceeds $20,000 USDT, indicating stronger market interest

- Exit management: Consider taking profits at resistance levels above $0.0035, or when 1-hour momentum indicators show divergence

GMMT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% maximum portfolio allocation

- Moderate investors: 2-5% portfolio allocation

- Aggressive investors: 5-10% maximum portfolio allocation

(2) Risk Hedging Solutions

- Portfolio diversification: Balance GMMT holdings with established layer-1 and layer-2 blockchain assets to reduce concentration risk

- Position sizing: Implement strict stop-loss orders at 15-20% below entry price to protect capital during adverse market movements

(3) Secure Storage Solution

- Exchange custody: For active traders, maintain holdings on Gate.com with two-factor authentication (2FA) and IP whitelisting enabled

- Non-custodial management: For long-term holders, utilize the Gate Web3 wallet for self-custody with hardware wallet backup for significant positions

- Security best practices: Never share private keys, enable withdrawal address whitelist, and perform regular security audits of connected applications

V. GMMT Potential Risks and Challenges

GMMT Market Risk

- High volatility exposure: GMMT exhibits extreme price fluctuations with a 70.66% yearly decline, exposing investors to substantial downside risk

- Liquidity constraints: With 24-hour volume of only $19,269.67 USD across 6 exchanges, trading depth may be insufficient for large position exits

- Market cap concentration: At rank #1460 with $5.65 million market capitalization, GMMT remains highly susceptible to whale manipulation and sudden capital flight

GMMT Regulatory Risk

- Blockchain infrastructure compliance: As a customizable blockchain platform, GMMT faces evolving regulatory scrutiny regarding its smart contract architecture and value system protocols

- Jurisdiction-specific challenges: Different countries may impose varying requirements on chain-running infrastructure provided by Giant Mammoth, affecting adoption and platform utility

- Securities classification uncertainty: Regulatory authorities worldwide are still determining appropriate frameworks for blockchain infrastructure tokens, creating potential legal exposure

GMMT Technical Risk

- Smart contract audit requirements: The emphasis on easily modifiable contracts increases the attack surface and requires continuous security validation and third-party audits

- Network adoption dependencies: The project's success hinges on developer and node operator adoption for customized blockchain deployment, with limited current ecosystem evidence

- Protocol upgrade management: Frequent architectural modifications to improve security and flexibility introduce regression risks and potential breaking changes

VI. Conclusion and Action Recommendations

GMMT Investment Value Assessment

Giant Mammoth Chain represents an infrastructure-focused blockchain project emphasizing customizable chain deployment and enhanced smart contract flexibility. However, the token exhibits significant challenges including a 70.66% annual decline, modest trading liquidity, and concentrated market capitalization. The project's long-term viability depends critically on ecosystem adoption by developers and enterprise clients seeking customized blockchain solutions. Current market conditions suggest GMMT remains speculative and suitable only for risk-tolerant investors conducting thorough technical and fundamental due diligence.

GMMT Investment Recommendations

✅ Newcomers: Begin with minimal allocation (0.5-1% of portfolio) through Gate.com, focus on understanding the customizable blockchain use case, and avoid leverage or margin trading given volatility levels.

✅ Experienced investors: Implement a structured DCA strategy over 3-6 months, set clear profit-taking targets at 50-100% gains from entry, and maintain strict stop-loss discipline at 20% below average entry price.

✅ Institutional investors: Conduct comprehensive technical audits of the Giant Mammoth Chain architecture, evaluate real-world enterprise adoption pipelines, and structure positions with hedging instruments to manage tail risks.

GMMT Trading Participation Methods

- Direct spot trading: Purchase GMMT directly on Gate.com using stablecoins (USDT, USDC) for immediate exposure with no leverage risk

- Limit order strategies: Place buy orders below current market price to accumulate during temporary selling pressure and reduce average acquisition cost

- Portfolio rebalancing: Periodically adjust GMMT holdings to maintain target allocation percentages as the asset's market capitalization and volatility evolve

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What is the Giant Mammoth coin?

Giant Mammoth (GMMT) is a cryptocurrency focused on delivering scalable, accessible, and sustainable blockchain solutions. It provides advanced features designed to enhance user experience and blockchain functionality.

How much is a Giant Mammoth coin worth?

As of December 23, 2025, a Giant Mammoth coin is worth approximately $0.0034 USD. The price has increased 0.60% in the last 24 hours, with a current market cap of $5.

Will the Giant Mammoth coin rise again?

Giant Mammoth coin is predicted to experience significant decline rather than rise. Market analysis suggests the price may drop substantially in the coming period. Current trends indicate bearish momentum, with forecasts showing potential downward pressure on the coin's value.

What are the risks associated with investing in GMMT?

GMMT investment carries market volatility risks, potential capital loss, and regulatory uncertainty. Token value fluctuates based on adoption and market conditions. Conduct thorough research before participating.

What factors should I consider when predicting GMMT price movements?

Consider project announcements, technological developments, market sentiment, trading volume, and broader cryptocurrency market trends. Monitor ecosystem updates and adoption metrics for more accurate GMMT price predictions.

Crypto Crash or Just a Correction?

Pi to PHP: Current Exchange Rate and Conversion Guide (2025)

2025 KSM Price Prediction: Analyzing Market Trends and Future Growth Potential of Kusama Network

2025 DCR Price Prediction: Analyzing Decred's Future Potential Amid Evolving Market Dynamics

EXT Price Meaning: What It Is and How to Understand It

2025 RVNPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Ravencoin

Onekey Card to End Services by January 2024: What You Need to Know

2025 GOATED Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

2025 RZTO Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 NAKA Price Prediction: Expert Analysis and Market Forecast for Nakamoto (NAKA) Token

2025 CLV Price Prediction: Expert Analysis and Market Forecast for Chainlink's Native Token