2025 GOATED Price Prediction: Analyzing the Future Value of the Rising Cryptocurrency Star

Introduction: GOATED's Market Position and Investment Value

GOAT Network (GOATED), as a Bitcoin-native ZK Rollup, has made significant strides since its inception. As of 2025, GOATED's market capitalization has reached $5,230,336, with a circulating supply of approximately 96,696,918 tokens, and a price hovering around $0.05409. This asset, often referred to as the "BTCFi yield generator," is playing an increasingly crucial role in delivering sustainable, native BTC yield.

This article will provide a comprehensive analysis of GOATED's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. GOATED Price History Review and Current Market Status

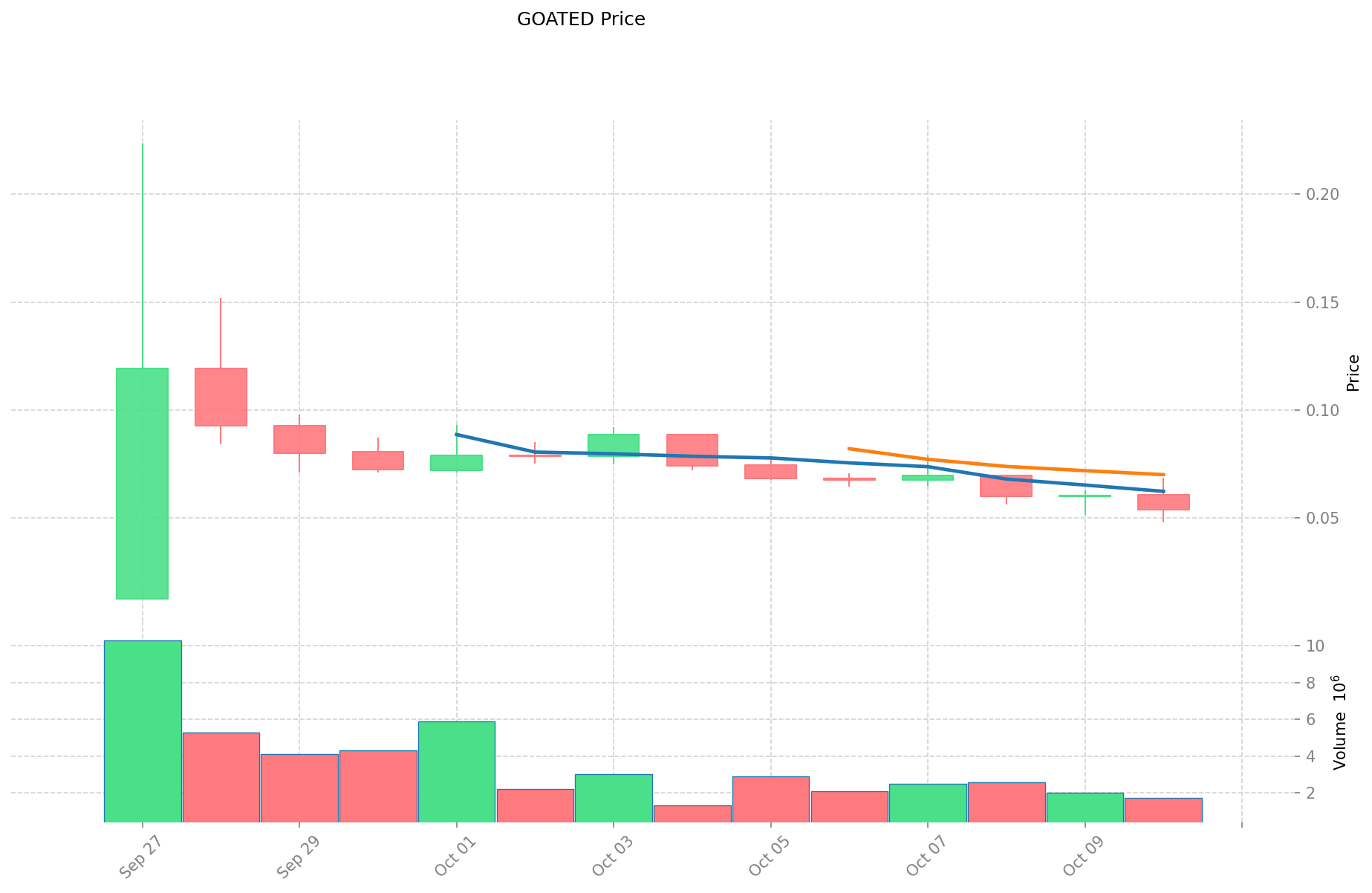

GOATED Historical Price Evolution

- 2025: Project launch, price reached an all-time high of $0.22367 on September 27

- 2025: Market correction, price dropped to an all-time low of $0.01251 on September 27

- 2025: Recent volatility, price fluctuating between $0.04813 and $0.0688 in the past 24 hours

GOATED Current Market Situation

As of October 11, 2025, GOATED is trading at $0.05409, experiencing a 13.4% decrease in the last 24 hours. The token's market capitalization stands at $5,230,336, ranking it at 1697 in the global cryptocurrency market. GOATED has seen significant price movements recently, with a 1-hour gain of 1.25% but substantial losses over longer periods: -38.51% in the past week and -73.11% over the last month. The trading volume in the past 24 hours is $121,071, indicating active market participation. The current price is 75.81% below its all-time high and 332.37% above its all-time low, both recorded on September 27, 2025. With a circulating supply of 96,696,918 GOATED tokens out of a total supply of 1 billion, the market is showing signs of high volatility and uncertainty.

Click to view the current GOATED market price

GOATED Market Sentiment Indicator

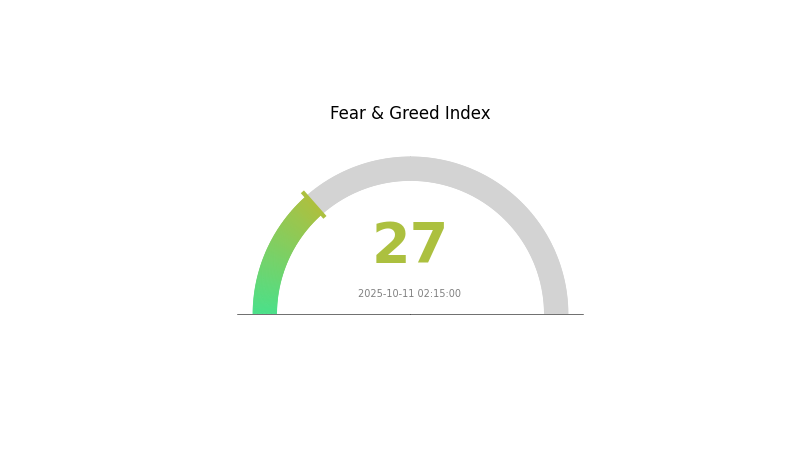

2025-10-11 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone, with the Fear and Greed Index at 27. This indicates a cautious atmosphere among investors. During such periods, some may view it as an opportunity to accumulate, adhering to the adage "be greedy when others are fearful." However, it's crucial to conduct thorough research and manage risks wisely. Stay informed about market trends and always make decisions based on your own analysis and risk tolerance.

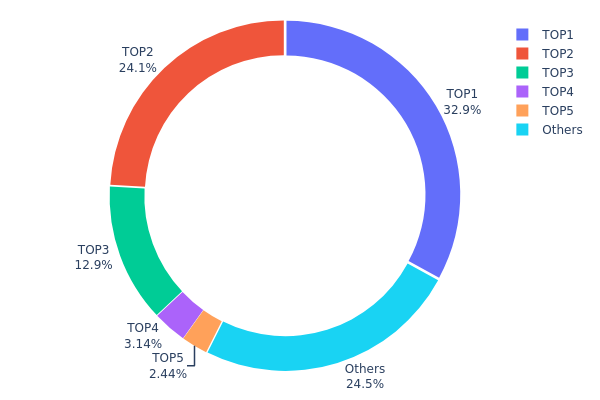

GOATED Holdings Distribution

The address holdings distribution for GOATED reveals a highly concentrated ownership structure. The top five addresses collectively hold 75.5% of the total supply, with the largest holder controlling a substantial 32.93%. This concentration is further emphasized by the second and third largest holders, who possess 24.12% and 12.87% respectively.

Such a centralized distribution raises concerns about market stability and potential price manipulation. With over two-thirds of the supply controlled by just three addresses, there's a significant risk of market volatility should any of these major holders decide to liquidate their positions. This concentration also challenges the principle of decentralization, which is often valued in cryptocurrency projects.

From a market structure perspective, this distribution suggests that GOATED's on-chain stability is potentially fragile. The high concentration in a few addresses could lead to sudden and dramatic price movements, impacting liquidity and overall market dynamics. Investors and traders should be aware of these structural characteristics when considering their positions in GOATED.

Click to view the current GOATED Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x73d8...4946db | 12764.55K | 32.93% |

| 2 | 0xc744...b118e7 | 9352.40K | 24.12% |

| 3 | 0x0422...1e1571 | 4990.63K | 12.87% |

| 4 | 0xb05b...d15109 | 1217.99K | 3.14% |

| 5 | 0x0d07...b492fe | 947.51K | 2.44% |

| - | Others | 9486.40K | 24.5% |

II. Key Factors Affecting GOATED's Future Price

Supply Mechanism

- Circulating Supply: GOATED has a circulating supply of approximately 104 million tokens.

- Current Impact: The large circulating supply may cause price volatility, potentially deterring conservative investors.

Macroeconomic Environment

- Monetary Policy Impact: Interest rate decisions by central banks, particularly the Federal Reserve, can significantly influence the cryptocurrency market, including GOATED.

Technical Development and Ecosystem Building

-

Market Psychology: FOMO (Fear of Missing Out) plays a significant role in GOATED's price movements. As prices rise, more investors join, potentially creating a self-reinforcing cycle of price increases.

-

AI Integration: AI models are being used to analyze market trends, but their limitations in predicting extreme market fluctuations should be noted.

-

Ecosystem Activity: The overall activity and development of the GOATED ecosystem can impact token demand and price stability.

III. GOATED Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.05016 - $0.05394

- Neutral prediction: $0.05394 - $0.05529

- Optimistic prediction: $0.05529 - $0.05664 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.04079 - $0.08098

- 2028: $0.03877 - $0.08458

- Key catalysts: Increased adoption and market expansion

2029-2030 Long-term Outlook

- Base scenario: $0.07753 - $0.0849 (assuming steady market growth)

- Optimistic scenario: $0.09227 - $0.11292 (assuming strong market performance)

- Transformative scenario: $0.11292 - $0.13000 (assuming breakthrough developments)

- 2030-12-31: GOATED $0.11292 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05664 | 0.05394 | 0.05016 | 0 |

| 2026 | 0.06469 | 0.05529 | 0.03925 | 2 |

| 2027 | 0.08098 | 0.05999 | 0.04079 | 10 |

| 2028 | 0.08458 | 0.07049 | 0.03877 | 30 |

| 2029 | 0.09227 | 0.07753 | 0.04807 | 43 |

| 2030 | 0.11292 | 0.0849 | 0.06452 | 56 |

IV. Professional Investment Strategies and Risk Management for GOATED

GOATED Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Bitcoin enthusiasts and believers in BTCFi

- Operation suggestions:

- Accumulate GOATED tokens during market dips

- Stake tokens in the GOAT Network ecosystem for additional yield

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Bitcoin price movements as they may influence GOATED

- Pay attention to new product launches and partnerships within the GOAT Network

GOATED Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Balance GOATED with other BTCFi and Layer 2 projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet for active trading

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for GOATED

GOATED Market Risks

- Volatility: High price fluctuations common in newer crypto projects

- Liquidity: Potential challenges in large-volume trades

- Competition: Emerging BTCFi projects may impact market share

GOATED Regulatory Risks

- Uncertain regulations: Evolving crypto regulations may affect BTCFi projects

- Cross-border compliance: Varying international regulatory standards

- Tax implications: Unclear tax treatment of BTCFi yields in some jurisdictions

GOATED Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the protocol

- Scalability challenges: Possible network congestion during high demand

- Interoperability issues: Compatibility with future Bitcoin upgrades

VI. Conclusion and Action Recommendations

GOATED Investment Value Assessment

GOATED presents a unique value proposition in the BTCFi space with its innovative ZK Rollup technology and yield generation mechanisms. However, it faces short-term risks due to market volatility and regulatory uncertainties.

GOATED Investment Recommendations

✅ Beginners: Start with small positions and focus on learning about BTCFi ✅ Experienced investors: Consider allocating a portion of their Bitcoin portfolio to GOATED for diversification ✅ Institutional investors: Conduct thorough due diligence and consider GOATED as part of a broader BTCFi strategy

GOATED Trading Participation Methods

- Spot trading: Purchase GOATED tokens on Gate.com

- Yield farming: Participate in GOAT Network's yield-generating products

- Staking: Lock up GOATED tokens to earn additional rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is the goat coin worth in 2025?

Based on current predictions, the GOAT coin is expected to be worth around $0.080513188 per token in 2025. This represents the average forecast value.

Is goat a good coin to invest in?

Yes, GOAT is a promising investment. Its innovative features and growing adoption make it a potentially lucrative option in the crypto market.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, with a forecast peak of $122,937. Chainlink follows with a peak prediction of $59.67.

What is the maximum price prediction for goat?

The maximum price prediction for GOAT is $0.000280, expected to be reached by 2029 based on current market analysis and forecasts for the next decade.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

5 ways to get Bitcoin for free in 2025: Newbie Guide

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

What is PUSH: A Comprehensive Guide to Understanding Push Technology and Its Applications in Modern Digital Communication

What is NEURO: A Comprehensive Guide to Understanding Neural Networks and Brain-Inspired Computing Technologies

What is PAI: A Comprehensive Guide to Platform for Artificial Intelligence and Its Applications in Modern Technology

What is HTM: A Comprehensive Guide to Hierarchical Temporal Memory and Its Applications in Machine Learning

Comprehensive Guide to APR and APY in Cryptocurrency