2025 GUA Price Prediction: Expert Analysis and Market Outlook for Guanaco Token

Introduction: GUA's Market Position and Investment Value

SUPERFORTUNE (GUA) is an AI-powered prediction market engine incubated by Manta Labs that blends Chinese metaphysics with crypto markets to identify price patterns. As of December 23, 2025, GUA has achieved a market capitalization of $138,200,000 with a circulating supply of 45,000,000 tokens, currently trading at $0.1382. This innovative asset has demonstrated remarkable growth, with a 30-day price surge of 238%, showcasing strong market momentum and investor interest in its unique value proposition.

This comprehensive analysis examines GUA's price trajectory through 2025-2030, integrating historical price patterns, market dynamics, ecosystem developments, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for stakeholders seeking exposure to this emerging prediction market platform.

I. GUA Price History Review and Market Status

GUA Current Market Conditions

SUPERFORTUNE (GUA), incubated by Manta Labs, is an AI-powered prediction market engine that integrates Chinese metaphysics with cryptocurrency market analysis to identify price patterns. As of December 23, 2025, GUA is trading at $0.1382, reflecting a 24-hour decline of 6.33% and a 1-hour decrease of 7.21%.

Price Performance Metrics:

- Current Price: $0.1382

- 24-Hour High/Low: $0.15495 / $0.12994

- All-Time High: $0.25962 (December 21, 2025)

- All-Time Low: $0.05 (November 28, 2025)

- 24-Hour Trading Volume: $1,845,602.30

- Market Capitalization: $6,218,999.99

- Fully Diluted Valuation: $138,200,000.00

Token Supply Information:

- Circulating Supply: 45,000,000 GUA (4.5% of total supply)

- Total Supply: 1,000,000,000 GUA

- Holder Count: 13,477

- Market Dominance: 0.0042%

Recent Price Trends:

- 7-Day Change: +3.59%

- 30-Day Change: +238.01%

- 1-Year Change: +238.01%

GUA demonstrates significant volatility within a short timeframe. The token experienced substantial gains over the 30-day period but has faced recent selling pressure in the last 24 hours. With a circulating supply representing only 4.5% of the total token supply, future price dynamics may be influenced by token release schedules.

View current GUA market price

GUA Market Sentiment Index

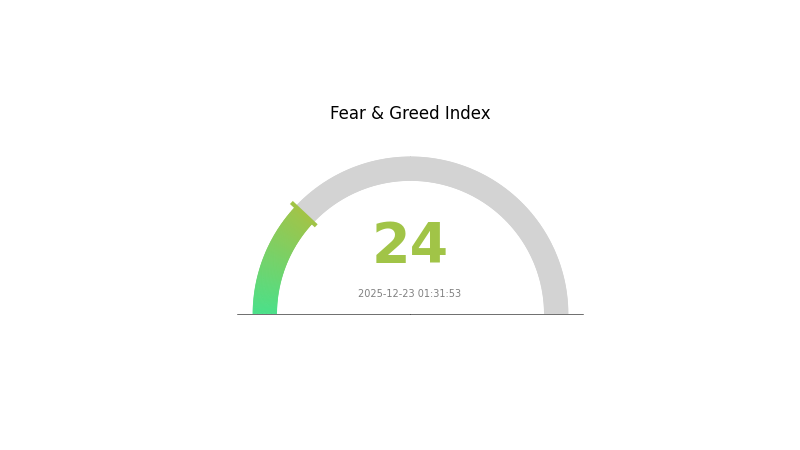

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This indicates significant market pessimism and investor anxiety. During such periods, altcoins typically face heightened selling pressure. However, extreme fear often presents contrarian opportunities for long-term investors. Market participants should exercise caution with leverage trading while considering accumulation strategies for quality assets. Gate.com provides real-time sentiment analysis tools to help traders navigate these volatile market conditions and make informed decisions.

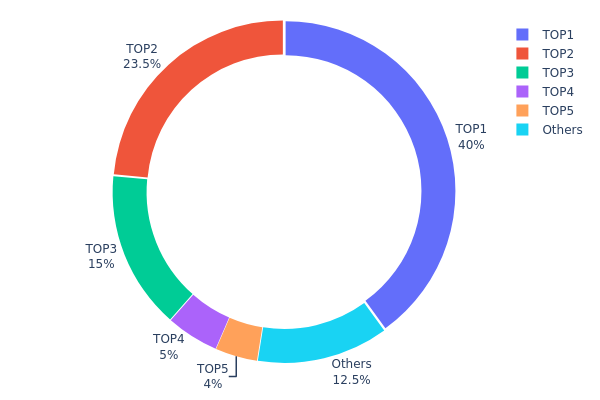

GUA Holdings Distribution

The address holdings distribution chart illustrates the concentration of GUA tokens across different wallet addresses on the blockchain. This metric is essential for assessing the decentralization level of the token, identifying potential liquidity concentration risks, and evaluating the market structure stability. By analyzing the top holders and their proportional stake in the total supply, investors and analysts can gauge the vulnerability of the asset to price manipulation and market volatility triggered by large-scale token movements.

GUA exhibits significant concentration risk in its current holder distribution. The top three addresses collectively control 78.5% of the total token supply, with the largest holder commanding 40% alone. This extreme concentration in the upper tier holders represents a notable departure from optimal decentralization standards. The fourth and fifth addresses contribute an additional 9% combined, leaving only 12.5% distributed among remaining holders. Such concentration patterns indicate that GUA's token distribution remains heavily weighted toward a small number of wallets, which poses inherent structural vulnerabilities to the asset's market dynamics.

The concentrated distribution architecture of GUA creates meaningful implications for market structure and price stability. With such a substantial portion of tokens held by a limited number of addresses, the potential for coordinated selling pressure or sudden price movements increases materially. Large holders possess disproportionate influence over on-chain activity and market sentiment, while the fragmented distribution among other participants limits organic price discovery mechanisms. This structural composition suggests that GUA's current market environment remains susceptible to volatility shocks driven by the actions of top-tier holders, reflecting a market characterized by relatively low decentralization and elevated concentration-related risks.

Click to view current GUA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9751...05f2df | 400000.00K | 40.00% |

| 2 | 0xe86f...e7957c | 235000.00K | 23.50% |

| 3 | 0x5769...fd06cf | 150000.00K | 15.00% |

| 4 | 0x9740...a00176 | 50000.00K | 5.00% |

| 5 | 0x8ce7...9af25b | 40000.00K | 4.00% |

| - | Others | 125000.00K | 12.5% |

II. Core Factors Affecting GUA's Future Price

Supply Mechanism

-

Token Unlock Schedule and Dilution: The token unlocking plan represents a key pressure factor on GUA's price. As scheduled unlocks occur, increased token supply in the market can lead to downward price pressure if market demand fails to match the new supply volume.

-

Airdrop and Listing Selling Pressure: Early airdrop recipients typically seek immediate profit-taking upon token listing. Historical data indicates that airdrop-driven capital flows are frequently associated with sharp price declines in early stages when demand cannot match the influx of new sellers in the market.

Risk Disclaimer: This analysis is provided for informational purposes only and does not constitute investment advice. Cryptocurrency markets carry substantial risk. Users should conduct their own research and consider their individual financial circumstances before making investment decisions. Trading on Gate.com or any cryptocurrency exchange involves significant risk of loss. Past performance does not guarantee future results.

III. 2025-2030 GUA Price Forecast

2025 Outlook

- Conservative Forecast: $0.1215 - $0.1396

- Base Case Forecast: $0.1396 - $0.1800

- Optimistic Forecast: $0.1800 - $0.2066 (requires strengthened ecosystem adoption and positive market sentiment)

2026-2027 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with increasing institutional interest and ecosystem expansion

- Price Range Predictions:

- 2026: $0.1437 - $0.2424 (25% upside potential)

- 2027: $0.1246 - $0.2555 (50% upside potential)

- Key Catalysts: Enhanced protocol functionality, increased DeFi integration via Gate.com and other trading platforms, growing community engagement, and positive macroeconomic conditions

2028-2030 Long-term Outlook

- Base Scenario: $0.1344 - $0.2478 (assumes steady adoption and stable market conditions through 2028)

- Optimistic Scenario: $0.1918 - $0.2973 (assumes accelerated mainstream adoption, successful partnerships, and positive regulatory developments by 2029)

- Transformative Scenario: $0.1987 - $0.3303 (assumes breakthrough technological upgrades, significant institutional adoption, and substantial ecosystem growth by 2030)

- 2030-12-31: GUA projected at $0.3303 at maximum (94% cumulative gain from current levels, reflecting sustained positive trajectory)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.20662 | 0.13961 | 0.12146 | 1 |

| 2026 | 0.24236 | 0.17312 | 0.14369 | 25 |

| 2027 | 0.25552 | 0.20774 | 0.12464 | 50 |

| 2028 | 0.24784 | 0.23163 | 0.13435 | 67 |

| 2029 | 0.29727 | 0.23974 | 0.19179 | 73 |

| 2030 | 0.33026 | 0.26851 | 0.19869 | 94 |

SUPERFORTUNE (GUA) Professional Investment Strategy Report

IV. GUA Professional Investment Strategy and Risk Management

GUA Investment Methodology

(1) Long-term Holding Strategy

-

Suitable Investors: Risk-tolerant investors with a 6-12 month investment horizon, believers in AI-driven prediction market technology, and those seeking exposure to novel crypto applications blending traditional metaphysics with blockchain technology.

-

Operation Recommendations:

- Accumulate GUA during market pullbacks when prices fall below the 30-day moving average, particularly following short-term sell-offs like the current -6.33% 24-hour decline.

- Establish a dollar-cost averaging (DCA) plan by investing fixed amounts weekly or monthly to reduce timing risk and average entry prices.

- Hold positions through market volatility cycles, as the token has demonstrated 238% growth over 30 days and 1 year, indicating strong underlying demand.

-

Storage Solution:

- For significant holdings exceeding $5,000 USD equivalent, utilize Gate.com Web3 Wallet for secure self-custody with full control over private keys while maintaining accessibility for staking or governance participation opportunities.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Averages (MA): Use the 7-day, 14-day, and 30-day moving averages to identify trend direction; buy signals emerge when short-term MAs cross above longer-term MAs, with current price of $0.1382 positioned below recent highs of $0.25962.

- Relative Strength Index (RSI): Monitor RSI levels at 14-period intervals; oversold conditions (RSI below 30) present buying opportunities, while overbought conditions (RSI above 70) may indicate profit-taking zones.

- Volume Analysis: Confirm price movements with trading volume; the current 24-hour volume of $1,845,602 provides reasonable liquidity across 11 trading venues for position entry and exit.

-

Wave Trading Key Points:

- Capitalize on the demonstrated volatility pattern: the token reached an all-time high of $0.25962 on December 21st, 2025, then declined to current levels, creating swing trading opportunities between support ($0.12994) and resistance ($0.15495) levels.

- Execute 2-5 day swing trades around predictable market cycles; the 7-day positive return of +3.59% suggests emerging recovery momentum after recent short-term weakness.

- Maintain strict position sizing with 2-3% stop-losses below established support levels to protect against unexpected negative developments.

GUA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total crypto portfolio allocation, positioning GUA as a high-risk/high-reward satellite position rather than a core holding.

- Active Investors: 3-5% of total crypto portfolio allocation, maintaining sufficient exposure to capture upside potential while respecting overall portfolio risk constraints.

- Professional Investors: 5-10% of total crypto portfolio allocation with defined rebalancing triggers and hedging mechanisms across related blockchain technology positions.

(2) Risk Hedging Solutions

- Stablecoin Reserves: Maintain 15-20% of intended GUA allocation in USDT or USDC stablecoins on Gate.com, enabling rapid repositioning during market dislocations without additional slippage.

- Inverse Position Strategy: Utilize inverse tokens or short positions on correlated high-risk crypto assets to offset directional exposure during periods of elevated market uncertainty or negative macro sentiment.

(3) Security Storage Solutions

- Hot Wallet Approach: Use Gate.com Web3 Wallet for active trading amounts (5-10% of holdings) requiring frequent transactions, with multi-signature verification enabled for enhanced security protocols.

- Cold Storage Approach: For 90% of holdings exceeding 6-month holding intentions, transfer GUA tokens to self-managed secure storage addresses with multi-signature authorization requirements and time-locked withdrawal features.

- Security Precautions: Never share private keys or seed phrases; enable two-factor authentication on all Gate.com accounts; verify contract addresses before transfers (GUA contract: 0xa5c8e1513b6a08334b479fe4d71f1253259469be on BSC); conduct small test transfers before moving significant amounts.

V. GUA Potential Risks and Challenges

GUA Market Risks

-

Extreme Volatility Exposure: With 24-hour price swings between $0.12994 and $0.15495, and historical movements from $0.05 to $0.25962, GUA demonstrates extraordinary volatility typical of early-stage speculative tokens, creating substantial drawdown risk for unprepared investors.

-

Liquidity Concentration Risk: The token trades on 11 exchanges with relatively modest 24-hour volume of $1.8M against a market cap of $6.2M, indicating potential illiquidity during panic selling scenarios and wider bid-ask spreads on smaller venues.

-

Market Cap Sustainability Questions: The fully diluted valuation of $138.2M against only 4.5% circulating supply suggests significant dilution risk as vesting schedules unlock additional GUA tokens, potentially exerting downward price pressure.

GUA Regulatory Risks

-

Prediction Market Regulatory Uncertainty: As an AI-driven prediction market engine, GUA operates in jurisdictions with evolving regulatory frameworks around forecasting markets, derivatives trading, and decentralized platforms, creating potential compliance challenges.

-

Gambling Classification Risk: The integration of metaphysical elements with market prediction may trigger regulatory scrutiny in certain jurisdictions classifying such activities as gambling rather than legitimate financial services.

-

Jurisdictional Restrictions: Specific countries and regions may restrict or prohibit participation in prediction markets or AI-driven trading applications, limiting addressable market expansion.

GUA Technology Risks

-

Smart Contract Vulnerability: All GUA tokens operate on BEP-20 standard (BSC blockchain); potential vulnerabilities in the smart contract code could enable token theft, freezing, or unintended minting, particularly relevant given the nascent development stage.

-

AI Model Accuracy Uncertainty: The core value proposition depends on the accuracy of AI-driven price pattern identification; if algorithmic predictions perform poorly relative to random chance, the utility of fortune reports and lucky charms diminishes substantially.

-

Platform Dependency Risk: As a Manta Labs incubation project, GUA's long-term viability depends on continuous platform development, maintenance, and user acquisition; project abandonment or pivot scenarios could render tokens worthless.

VI. Conclusion and Action Recommendations

GUA Investment Value Assessment

SUPERFORTUNE (GUA) represents a high-risk, speculative investment opportunity combining emerging technologies (AI prediction markets) with novel market positioning (Chinese metaphysics integration). The 238% growth over recent periods demonstrates significant speculative demand, yet the token's extreme volatility, modest liquidity, and unproven product-market fit create substantial downside exposure. The 4.5% circulating supply ratio indicates major dilution ahead. GUA functions optimally within diversified crypto portfolios as a satellite position capturing early-stage adoption upside rather than as a core holding. Success depends critically on the SUPERFORTUNE platform achieving meaningful user adoption and demonstrating AI prediction capabilities superior to market alternatives.

GUA Investment Recommendations

✅ Beginners: Start with minimal allocations (0.5-1% of crypto portfolio) through Gate.com after thorough research; use dollar-cost averaging over 2-3 months; store on Gate.com Web3 Wallet; implement strict 15-20% stop-losses.

✅ Experienced Investors: Consider 2-5% portfolio allocation with active swing trading strategies around identified support/resistance levels; utilize technical analysis to time entries during oversold conditions; maintain hedging positions in stablecoins.

✅ Institutional Investors: Conduct detailed due diligence on Manta Labs team credentials and development roadmap; negotiate directly with project for large allocations; structure positions with time-weighted vesting schedules and governance participation rights.

GUA Trading Participation Methods

-

Gate.com Spot Trading: Execute buy/sell orders directly on Gate.com's spot market using USDT or other trading pairs; monitor real-time order books and price charts; utilize limit orders to avoid slippage during low-liquidity periods.

-

Gate.com Web3 Integration: Transfer purchased GUA tokens to Gate.com Web3 Wallet for enhanced security; maintain backup seed phrases in secure locations; enable advanced security features for large holdings.

-

Multi-Exchange Strategy: Distribute positions across multiple exchanges where GUA trades (among 11 venues) to reduce single-point-of-failure risk and capture potential arbitrage opportunities between price discrepancies.

Cryptocurrency investment carries extreme risk. This report does not constitute financial advice. Investors should make decisions based on personal risk tolerance and conduct thorough due diligence. Consult qualified financial advisors before committing capital. Never invest funds you cannot afford to lose completely.

FAQ

What is GUA and what is its current price?

GUA is a cryptocurrency token with a current price of $0.000007. It has maintained stable value recently with minimal price movement in the last 24 hours.

What factors could affect GUA's price in the future?

GUA's price is influenced by market sentiment, whale activity and large transactions, regulatory developments, overall cryptocurrency market trends, trading volume and liquidity, and adoption rates.

Can GUA reach $1 or higher in the next few years?

Yes, GUA has strong potential to reach $1 in the coming years. With increasing adoption and market momentum, analysts project significant growth trajectory. Current market conditions and development roadmap suggest this milestone is achievable within the next few years.

What is the total supply and market cap of GUA token?

The total supply of GUA token is 964.99 million. The market cap is $3.8K as of December 21, 2025.

2025 SKAI Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 HAHA Price Prediction: Analyzing Future Trends and Market Potential for the Emerging Cryptocurrency

2025 CGPTPrice Prediction: Market Analysis and Future Trends for ChatGPT Subscription Models

2025 CAMP Price Prediction: Bullish Trends and Key Factors Driving Growth in the Cryptocurrency Market

2025 LAI Price Prediction: Bullish Outlook as AI Integration Accelerates Adoption

2025 GIZA Price Prediction: Analyzing Market Trends and Future Prospects for this Emerging Cryptocurrency

How to Withdraw Funds from Hotbit After the Platform Shutdown

AI Predicts the 10 Cryptos Poised for Growth in 2025 | Expert Insights

What is SMTX: A Comprehensive Guide to Surface Mount Technology X and Its Applications in Modern Electronics Manufacturing

What is SOIL: Understanding the Foundation of Earth's Ecosystems and Agricultural Productivity

What is KONET: A Comprehensive Guide to Korea's National Optical Network Infrastructure