2025 GUN Price Prediction: Expert Analysis and Market Forecast for Gamer Gun Token

Introduction: GUN's Market Position and Investment Value

Gunz (GUN) is a utility token powering a AAA game studio's blockchain ecosystem and its flagship battle royale shooter game, "Off The Grid." As of December 2025, GUN has established itself with a market capitalization of $118.2 million and a circulating supply of 604.5 million tokens, with prices currently hovering around $0.01182. This digital asset is emerging as a bridge between blockchain technology and competitive gaming entertainment.

This article will comprehensively analyze GUN's price trajectory through 2030, integrating historical patterns, market supply dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and actionable investment strategies.

GUN (Gunz) Market Analysis Report

I. GUN Price History Review and Current Market Status

GUN Historical Price Evolution

Based on the available data, GUN has experienced significant price volatility since its launch:

- March 31, 2025: GUN reached its all-time high (ATH) of $0.12845, marking the peak of its initial market enthusiasm.

- October 10, 2025: GUN declined to its all-time low (ATL) of $0.00696, representing a substantial correction from the peak.

- December 23, 2025 (Current): GUN is trading at $0.01182, recovering slightly from the ATL but still trading significantly below its historical highs.

The price trajectory reveals a bear market phase spanning from March to October 2025, followed by a modest recovery phase into December.

GUN Current Market Status

Price Metrics:

- Current Price: $0.01182

- 24-Hour Range: $0.01155 - $0.01221

- Market Capitalization: $7,145,190.00

- Fully Diluted Valuation (FDV): $118,200,000.00

- 24-Hour Trading Volume: $219,799.35

- Market Cap to FDV Ratio: 6.05%

Performance Indicators:

- 1-Hour Change: -0.84%

- 24-Hour Change: +0.33%

- 7-Day Change: -49.72%

- 30-Day Change: -4.21%

- 1-Year Change: -87.79%

Supply Metrics:

- Circulating Supply: 604,500,000 GUN (6.045% of total supply)

- Total Supply: 10,000,000,000 GUN

- Market Dominance: 0.0036%

GUN is currently ranked #1345 by market capitalization. The token exhibits significant negative pressure over medium to long-term timeframes, with pronounced weakness observed over the 7-day and 1-year periods. The modest 24-hour recovery suggests potential short-term stabilization, though the broader downtrend remains evident. The relatively low circulating supply ratio indicates substantial future dilution potential as more tokens enter circulation.

Click to view current GUN market price

GUN Market Sentiment Index

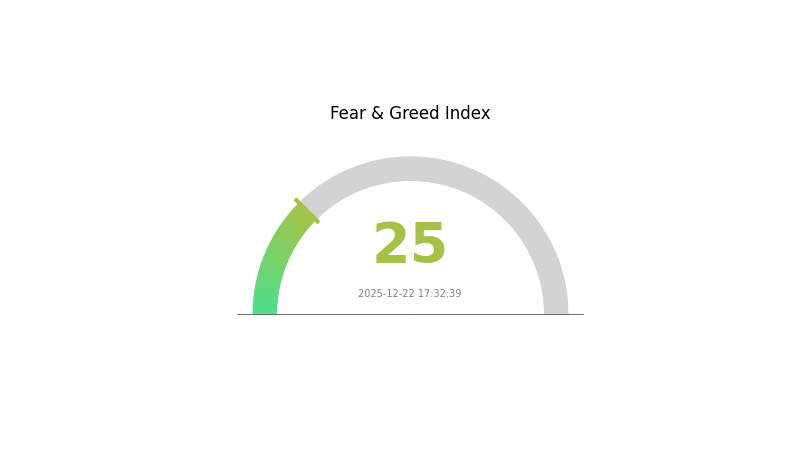

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 25. This indicates significant market pessimism and heightened investor anxiety. During such periods, market volatility typically intensifies as traders react cautiously to price movements. Long-term investors often view extreme fear as a potential buying opportunity, while risk-averse participants may prefer to wait for market stabilization. Monitor Gate.com's market data tools for real-time sentiment analysis and make informed trading decisions based on comprehensive market indicators.

GUN Holdings Distribution

The address holdings distribution represents a critical on-chain metric that illustrates how GUN tokens are allocated across different wallet addresses. This distribution pattern serves as a fundamental indicator of token concentration risk, market decentralization, and potential price manipulation vulnerabilities. By analyzing the concentration of holdings among top addresses, researchers can assess the overall health of the token's ecosystem and gauge the level of power consolidation within the network.

Unfortunately, the provided dataset contains no address holdings information, as the table appears to be empty. Without specific data on top holder addresses and their respective token quantities, a comprehensive analysis of GUN's concentration metrics cannot be conducted at this time. To properly evaluate whether the token exhibits excessive concentration, assess the distribution of voting power among key stakeholders, or determine the resilience of the market structure against potential coordinated selling pressures, complete holdings data would be required.

When such data becomes available, the analysis would examine critical factors including the percentage of total supply held by the top addresses, the number of addresses required to accumulate a supermajority of tokens, and the velocity of token transfers among major holders. These metrics collectively provide insight into the degree of decentralization, the potential for whale-driven price volatility, and the structural stability of GUN's market ecosystem.

For current GUN holdings distribution data, visit GUN Holdings Distribution on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|

Core Factors Affecting GUN's Future Price

Supply Mechanism

- New Skin Releases: PUBG's introduction of new weapon skins will alter market supply and demand dynamics. New cosmetic items attract player attention and may trigger price fluctuations in existing skins.

- Historical Trends: Previous new skin launches have demonstrated the pattern of supply changes impacting price movements in the GUN ecosystem.

- Current Impact: Upcoming supply changes are expected to create trading opportunities as market participants adjust positions in response to revised supply expectations.

Macro Economic Environment

- Monetary Policy Impact: Changes in monetary policy and interest rate expectations influence overall investment attractiveness in digital assets. Periods of monetary easing tend to increase risk appetite for alternative assets.

- Risk-Off Attributes: In inflationary environments, GUN demonstrates characteristics of a hedging instrument, positioning itself similarly to "digital commodities" with intrinsic value protection properties.

- Geopolitical Uncertainty: International tensions and geopolitical developments increase demand for alternative assets, potentially benefiting GUN as investors seek portfolio diversification away from traditional markets.

Three、2025-2030 GUN Price Forecast

2025 Outlook

- Conservative Forecast: $0.00961 - $0.01186

- Base Case Forecast: $0.01186

- Optimistic Forecast: $0.01494 (requiring sustained market sentiment and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Phase Expectation: Gradual consolidation with modest growth trajectory, characterized by incremental price appreciation and stabilizing market dynamics.

- Price Range Predictions:

- 2026: $0.01032 - $0.01394 (13% potential upside)

- 2027: $0.01025 - $0.01777 (15% potential upside)

- Key Catalysts: Ecosystem expansion, increased adoption rates, strategic partnerships, and strengthening fundamentals within the GUN token ecosystem.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.01226 - $0.01981 (32% appreciation by 2028; assuming steady market conditions and moderate adoption growth)

- Optimistic Scenario: $0.01208 - $0.02380 (50% appreciation by 2029; assuming accelerated ecosystem development and market expansion)

- Transformative Scenario: $0.01226 - $0.02203 (75% appreciation by 2030; assuming breakthrough institutional adoption, significant technological innovations, and mainstream integration)

Note: Price forecasts should be monitored regularly through Gate.com and verified against evolving market conditions. These predictions represent analytical assessments based on historical data and should not constitute investment advice.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01494 | 0.01186 | 0.00961 | 0 |

| 2026 | 0.01394 | 0.0134 | 0.01032 | 13 |

| 2027 | 0.01777 | 0.01367 | 0.01025 | 15 |

| 2028 | 0.01981 | 0.01572 | 0.01226 | 32 |

| 2029 | 0.0238 | 0.01776 | 0.01208 | 50 |

| 2030 | 0.02203 | 0.02078 | 0.01226 | 75 |

GUN (Gunz) Professional Investment Strategy and Risk Management Report

IV. GUN Professional Investment Strategy and Risk Management

GUN Investment Methodology

(1) Long-term Holding Strategy

- Suitable investors: Believers in blockchain gaming ecosystem development and Gunzilla Games' long-term vision

- Operational recommendations:

- Establish a core position during market weakness, particularly when prices approach the support level of $0.00696

- Hold through market cycles, focusing on game development milestones and blockchain adoption metrics

- Reinvest any gains from favorable price movements to compound returns over extended periods

(2) Active Trading Strategy

- Technical analysis tools:

- Support and Resistance Levels: Monitor key price zones at $0.01155 (24H low), $0.01182 (current price), and $0.01221 (24H high) for entry and exit signals

- Volume Analysis: Track the 24-hour trading volume of approximately $219,799 to identify momentum shifts and confirm trend reversals

- Wave operation key points:

- Execute buy positions when price approaches historical support levels with increasing trading volume

- Take profit targets near resistance levels, particularly around the 24-hour high of $0.01221

GUN Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% maximum portfolio allocation

- Active investors: 3-7% portfolio allocation

- Professional investors: Up to 10% portfolio allocation for diversified crypto portfolios

(2) Risk Hedging Solutions

- Dollar-cost averaging (DCA): Deploy capital incrementally over multiple weeks or months to reduce timing risk and average entry prices

- Position sizing: Maintain strict position limits relative to overall portfolio size to limit downside exposure

(3) Secure Storage Solutions

- Hot wallet option: Gate.com Web3 Wallet for frequent trading and active management

- Cold storage approach: Transfer significant holdings to offline storage solutions for long-term security

- Security considerations: Enable two-factor authentication on all exchange accounts, use strong passwords, and never share private keys or seed phrases with third parties

V. GUN Potential Risks and Challenges

GUN Market Risks

- Significant price volatility: GUN has experienced -87.79% decline over one year and -49.72% over seven days, indicating extreme volatility unsuitable for risk-averse investors

- Low liquidity relative to market cap: With only $219,799 in 24-hour volume against $7.14 million market cap, the token faces potential liquidity challenges during large trades

- Market sentiment challenges: The token demonstrates relatively weak market positioning at rank 1,345, suggesting limited mainstream adoption and investor interest

GUN Regulatory Risks

- Evolving gaming and blockchain regulations: Governments worldwide continue developing regulatory frameworks for gaming tokens and blockchain projects, which could impact GUN's utility and value

- Cross-jurisdictional compliance: As a gaming-focused blockchain project operating globally, Gunzilla Games must navigate varying regulatory requirements across different countries

- Classification uncertainty: Regulatory classification of GUN as either a utility token or security token remains subject to future regulatory determinations

GUN Technical Risks

- Blockchain scalability: The GUNZ blockchain must demonstrate ability to handle significant transaction volumes as the "Off The Grid" game scales

- Smart contract vulnerabilities: Like all blockchain projects, potential security exploits or bugs in smart contracts could negatively impact token value

- Game adoption risk: The flagship "Off The Grid" battle royale shooter must achieve meaningful player adoption and retention to drive token utility and demand

VI. Conclusion and Action Recommendations

GUN Investment Value Assessment

GUN represents a speculative investment opportunity centered on Gunzilla Games' ability to establish a successful AAA gaming title with integrated blockchain technology. The token's substantial price decline (-87.79% annually) reflects market skepticism regarding near-term success, though long-term value depends entirely on "Off The Grid" achieving significant player adoption and ecosystem growth. Current market metrics indicate limited institutional interest and liquidity, presenting both risk and opportunity for patient, well-capitalized investors willing to endure significant volatility.

GUN Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of portfolio) through Gate.com, focusing exclusively on capital you can afford to lose entirely, and consider dollar-cost averaging over 2-3 months to reduce entry risk

✅ Experienced investors: Allocate 3-5% to GUN with active monitoring of game development milestones, player adoption metrics, and blockchain network activity; implement clear stop-loss orders at 20-30% below entry points

✅ Institutional investors: Conduct comprehensive due diligence on Gunzilla Games' development team, technical architecture, and competitive positioning before considering positions up to 10% allocation; monitor regulatory developments affecting gaming tokens

GUN Trading Participation Methods

- Direct trading on Gate.com: Access GUN trading pairs and execute spot trades through the Gate.com platform with competitive fees

- Price monitoring: Use Gate.com's real-time price alerts and technical analysis tools to track GUN movements and identify optimal entry/exit opportunities

- Community engagement: Follow official channels (@GunzillaGames and @GUNbyGUNZ on X) for development updates, game release announcements, and ecosystem news that may impact token value

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on their personal risk tolerance and consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

How high will Gunz go?

Gunz is forecasted to reach approximately $0.01875 by 2027 based on current market trends and technical analysis. Long-term growth potential depends on ecosystem development and adoption.

How much is a gun coin worth in 2026?

Based on current market analysis, GUN coin is predicted to range between $0.00780 and $0.0217 in 2026, with the maximum estimated value at $0.0217.

How much is a gunz coin worth today?

As of today, Gunz (GUN) is trading at approximately $0.01179, with a 24-hour trading volume of $6,796,858. The price has declined by 1.16% in the last 24 hours.

2025 GMEE Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 ORBR Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 RON Price Prediction: Analyzing Growth Potential in the Play-to-Earn Gaming Ecosystem

2025 ZENT Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Cryptocurrency Landscape

2025 UDSPrice Prediction: Analyzing Market Trends and Key Factors Influencing Future Valuations

2025 UNA Price Prediction: Bullish Trends and Key Factors Shaping the Token's Future Value

Is Social Master & Branch (SMB) a good investment?: A Comprehensive Analysis of Risks, Returns, and Market Potential

Is GoPlus Security (GPS) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Growth Prospects

Is Kadena (KDA) a good investment?: A comprehensive analysis of potential returns, risks, and market outlook for 2024

Is Rarible (RARI) a good investment?: A Comprehensive Analysis of the NFT Marketplace Token's Potential and Risks in 2024

TIMECHRONO vs RUNE: A Comprehensive Comparison of Two Powerful Time Management and Blockchain Platforms