2025 GMEE Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: GMEE's Market Position and Investment Value

GAMEE (GMEE), as a highly engaging gaming platform, has been connecting players and game creators since its inception in 2021. As of 2025, GMEE's market capitalization has reached $3,564,458, with a circulating supply of approximately 1,364,124,981 tokens, and a price hovering around $0.002613. This asset, known as the "gaming rewards token," is playing an increasingly crucial role in the field of blockchain gaming and user engagement.

This article will comprehensively analyze GMEE's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. GMEE Price History Review and Current Market Status

GMEE Historical Price Evolution

- 2021: Initial launch, price reached all-time high of $0.714328 on May 14

- 2021: Market downturn, price dropped to all-time low of $0.00060225 on July 19

- 2022-2024: Fluctuations within a lower price range

GMEE Current Market Situation

As of October 13, 2025, GMEE is trading at $0.002613. The token has experienced a significant 13.76% increase in the last 24 hours, with a trading volume of $36,954.35. However, GMEE has seen a 27.27% decrease over the past week, indicating short-term volatility. The 30-day performance shows a notable 44.89% increase, suggesting growing interest in recent weeks. Despite these recent gains, GMEE is still down 77.14% compared to one year ago, reflecting the broader challenges in the cryptocurrency market.

GMEE's current market capitalization stands at $3,564,458.58, with a circulating supply of 1,364,124,981 GMEE tokens. The fully diluted market cap is $8,309,340, based on the maximum supply of 3,180,000,000 GMEE. The token's circulating supply represents 42.9% of the total supply, indicating potential for future token releases.

Click to view current GMEE market price

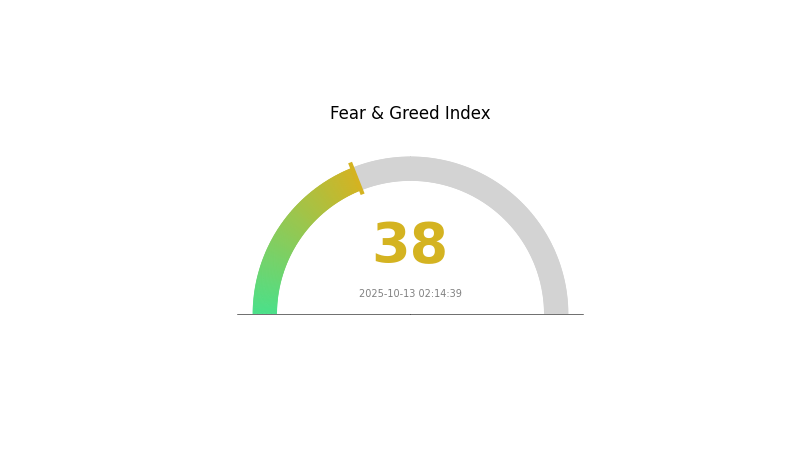

GMEE Market Sentiment Indicator

2025-10-13 Fear and Greed Index: 38 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious, with the Fear and Greed Index at 38, indicating a state of fear. This suggests investors are acting conservatively, potentially creating buying opportunities for contrarian traders. However, it's crucial to remember that market sentiment can shift rapidly. As always, conduct thorough research and consider your risk tolerance before making any investment decisions. Gate.com offers a range of tools to help you navigate these market conditions effectively.

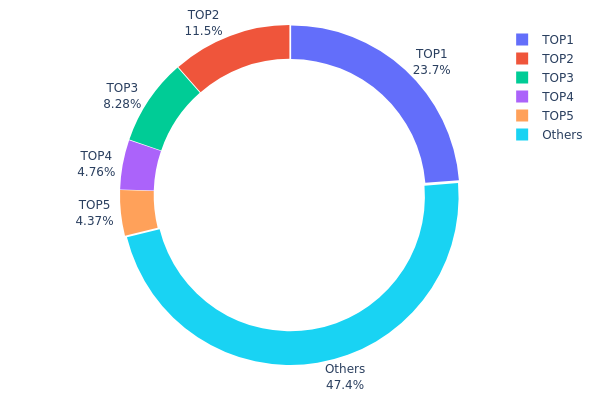

GMEE Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of GMEE tokens among different addresses. Analysis of this data reveals a relatively high concentration of tokens in the top addresses. The top holder possesses 23.71% of the total supply, while the top five addresses collectively control 52.58% of all GMEE tokens.

This level of concentration raises concerns about potential market manipulation and price volatility. With over half of the tokens held by just five addresses, there's a risk that large-scale buying or selling actions by these major holders could significantly impact GMEE's market price. Moreover, this concentration may affect the token's liquidity and overall market stability.

Despite these concerns, it's worth noting that 47.42% of GMEE tokens are distributed among other addresses, indicating some level of decentralization. However, the current distribution suggests a need for increased token dispersion to enhance market resilience and reduce manipulation risks. This concentration pattern reflects a relatively nascent market structure for GMEE, with room for improvement in terms of wider distribution and enhanced on-chain stability.

Click to view the current GMEE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7e9b...effa30 | 754000.00K | 23.71% |

| 2 | 0x8a34...dc6779 | 364617.11K | 11.46% |

| 3 | 0x6aad...23418b | 263358.35K | 8.28% |

| 4 | 0x0d07...b492fe | 151464.38K | 4.76% |

| 5 | 0xee8a...e5a8ab | 139031.84K | 4.37% |

| - | Others | 1507528.32K | 47.42% |

II. Key Factors Affecting GMEE's Future Price

Market Sentiment

- Investor Confidence: Investor sentiment and confidence directly impact GMEE/UZS price trends.

- Current Impact: Market uncertainty may lead to increased volatility in GMEE prices.

Macroeconomic Environment

- Global Economic Conditions: The overall global economic situation influences GMEE's price.

- Regulatory Environment: Changes in cryptocurrency regulations can significantly affect GMEE's value.

Technological Development and Ecosystem Building

- Technological Advancements: Progress within the GMEE ecosystem and broader blockchain technology can impact its price.

- Market Demand: The overall demand for GMEE and its use cases within its ecosystem play a crucial role in price determination.

III. GMEE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00157 - $0.00220

- Neutral prediction: $0.00220 - $0.00261

- Optimistic prediction: $0.00261 - $0.0029 (requires favorable market conditions)

2026-2027 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00251 - $0.00372

- 2027: $0.00204 - $0.00333

- Key catalysts: Increased adoption and positive market sentiment

2028-2030 Long-term Outlook

- Base scenario: $0.00328 - $0.00362 (assuming steady market growth)

- Optimistic scenario: $0.00362 - $0.00540 (assuming strong market performance)

- Transformative scenario: $0.00540+ (extremely favorable market conditions)

- 2030-12-31: GMEE $0.00540 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0029 | 0.00261 | 0.00157 | 0 |

| 2026 | 0.00372 | 0.00275 | 0.00251 | 5 |

| 2027 | 0.00333 | 0.00324 | 0.00204 | 23 |

| 2028 | 0.00365 | 0.00328 | 0.0022 | 25 |

| 2029 | 0.00378 | 0.00347 | 0.00253 | 32 |

| 2030 | 0.0054 | 0.00362 | 0.00333 | 38 |

IV. GMEE Professional Investment Strategies and Risk Management

GMEE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term horizon

- Operation suggestions:

- Accumulate GMEE tokens during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Identify overbought and oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to manage downside risk

- Take partial profits on significant price increases

GMEE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple gaming tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for GMEE

GMEE Market Risks

- High volatility: Gaming tokens can experience significant price swings

- Competition: Increasing number of gaming-related cryptocurrencies

- Market sentiment: Susceptible to overall crypto market trends

GMEE Regulatory Risks

- Uncertain regulations: Potential for stricter oversight of gaming tokens

- Cross-border compliance: Varying regulations across different jurisdictions

- Tax implications: Evolving tax treatment of gaming-related cryptocurrencies

GMEE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: Possible network congestion during high demand

- Interoperability issues: Compatibility with different blockchain networks

VI. Conclusion and Action Recommendations

GMEE Investment Value Assessment

GMEE presents a high-risk, high-reward opportunity in the growing blockchain gaming sector. Long-term potential exists, but short-term volatility and regulatory uncertainties pose significant risks.

GMEE Investment Recommendations

✅ Beginners: Allocate only a small portion of portfolio, focus on learning

✅ Experienced investors: Consider a balanced approach with strict risk management

✅ Institutional investors: Conduct thorough due diligence and monitor regulatory developments

GMEE Trading Participation Methods

- Spot trading: Buy and sell GMEE tokens on Gate.com

- Staking: Participate in staking programs if available

- Gaming participation: Engage with GAMEE platform to earn tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for Gamee airdrop?

The Gamee airdrop price is predicted to reach $0.005599 by 2030, with a range of $0.004311 to $0.005599.

What is GMEE crypto used for?

GMEE is used to access features in Arc8, such as buying League and Premium Passes. It serves as the in-game currency for these features.

What meme coin will explode in 2025 price prediction?

Shiba Inu is predicted to explode in price in 2025, driven by strong community support and viral trends. Its popularity remains high due to sustained interest and market dynamics.

What is Gamee listing price?

Gamee's current listing price is $0.00368, reflecting a 2.19% increase in the last 24 hours. This price is significantly below its all-time high of $0.775 reached on April 7, 2021.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

6 Best Bitcoin ATMs With Low Fees and High Privacy in Recent Years

Small Cap ETFs: Definition and How They Work

Top 11 Leading Exchanges for Traders

What is GAI: A Comprehensive Guide to Generative AI and Its Transformative Impact on Modern Technology

What is mobile mining and can you make money with it